United States Active Pharmaceutical Ingredients Market Size, Share, Trends and Forecast by Business Mode, Synthesis Type, Drug Type, Application, and Region, 2025-2033

United States Active Pharmaceutical Ingredients Market Size and Share:

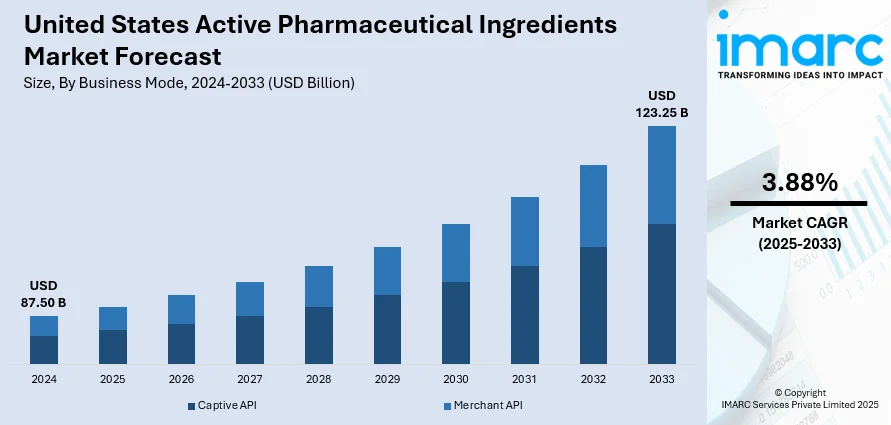

The United States active pharmaceutical ingredients market size was valued at USD 87.50 Billion in 2024. Looking forward, Looking forward, IMARC Group estimates the market to reach USD 123.25 Billion by 2033, exhibiting a CAGR of 3.88% during 2025-2033. The market is experiencing robust growth, propelled by the increasing prevalence of chronic diseases, advancements in biotechnology, and a strong focus on innovative drug development. Government initiatives aimed at bolstering domestic pharmaceutical manufacturing and ensuring supply chain resilience are further enhancing market dynamics. The rising demand for both synthetic and biotech APIs across various therapeutic areas underscores the evolving landscape of the United States active pharmaceutical ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 87.50 Billion |

| Market Forecast in 2033 | USD 123.25 Billion |

| Market Growth Rate 2025-2033 | 3.88% |

The growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and diabetes has led to rising demand for effective pharmaceutical treatments, thereby increasing the need for APIs. The US government initiatives aimed at strengthening domestic drug manufacturing are fueling API production. These efforts include financial incentives, supply chain security measures, and policies to reduce reliance on imports. Such regulatory support encourages local production and investment in advanced manufacturing facilities. For instance, in February 2024, the US Pharmacopeia (USP) and the API Innovation Center (APIIC) have partnered strategically to explore solutions for practical supply chain issues that affect American patients. To increase the robustness of the pharmaceutical supply chain and lessen or avoid drug shortages, numerous governmental and nongovernmental initiatives are being undertaken.

The United States active pharmaceutical ingredients market growth is also driven by the rising demand for generic and biosimilar drugs, driven by patent expirations of major branded medications, which further accelerates API consumption. Generic formulations offer cost-effective treatment options and increase accessibility, benefiting both consumers and manufacturers. For instance, in February 2024, Alembic Pharmaceuticals, a generic medication manufacturer based in Vadodara, intends to introduce five to six new products in the US each quarter. The company introduced 20 new items in the first nine months of the current fiscal year (9MFY24) and 11 new products in the third quarter (Q3FY24). The increasing partnerships between pharmaceutical companies and contract manufacturing organizations (CMOs) enhance production capacity, operational efficiency, and innovation in API development.

United States Active Pharmaceutical Ingredients Market Trends:

Shift Toward Biologics and Specialty APIs

The increasing need to treat chronic illnesses, like autoimmune diseases, cancer, and uncommon genetic issues, is fueling the rise in demand for biologics and specialty active pharmaceutical ingredients (APIs) in the US. An industry analysis revealed that between 2011 and 2022, more than 15 million individuals, constituting 4.6% of the US population, received a diagnosis of at least one autoimmune disorder. Additionally, 34% of these individuals were diagnosed with two or more autoimmune conditions. Unlike conventional small-molecule drugs, biologics are produced from living cells and are much larger and more complex, requiring specialized equipment and advanced production techniques. The need for individualized care and the rising incidence of chronic illnesses are encouraging pharmaceutical companies to concentrate on developing biologic therapies. These medications offer less harmful therapy options that are also more effective. The advancements in the market echo a greater shift towards precision medicine, in which medications are individualized to an individual’s exact needs, resulting in more effective and safer healthcare solutions.

Increasing Demand for Generic Drugs

The cost-effectiveness of generic drugs, when compared to branded medications, has led to their growing significance in the United States. According to an industry report, generic medications have saved the US healthcare system around USD 338 Billion each year, with projected savings over ten years close to USD 2.4 Trillion. According to the United States active pharmaceutical ingredients market forecast, these medications offer more cost-effective treatment alternatives while maintaining the quality and effectiveness of the brand-name drug. The importance of generic drugs lies in the requirement for manufacturers to demonstrate that their products are equally effective and safe as their branded counterparts. Thus, the APIs used in generics must comply with rigorous regulatory standards and be of superior quality. This trend highlights the necessity of maintaining stringent standards in API manufacturing to support the expansion of the generic drug market.

Advancements in Manufacturing Technologies

Technological advancements in the manufacturing of active pharmaceutical ingredients (APIs) are enhancing efficiency, lowering production costs, and ensuring higher quality standards, thereby creating a positive United States active pharmaceutical ingredients market outlook. Continuous manufacturing offers significant cost savings by enabling uninterrupted production processes, thereby enhancing product consistency and minimizing the risks associated with contamination and human error. Furthermore, the implementation of advanced purification methods allows for the more effective refinement of active pharmaceutical ingredients (APIs), ensuring adherence to stringent quality and safety standards. To ensure strict adherence to regulatory guidelines throughout the entire production process, current technological innovations are enabling manufacturers to maintain comprehensive oversight across their production chains. By incorporating these advanced technologies, pharmaceutical companies can consistently produce high-quality active pharmaceutical ingredients (APIs) at a lower cost, thereby offering more affordable and safer medications to patients.

United States Active Pharmaceutical Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States active pharmaceutical ingredients market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on business mode, synthesis type, drug type, and application.

Analysis by Business Mode:

- Captive API

- Merchant API

Captive API stands as the largest business mode in 2024, holding 51.5% of the market due to the emphasis on quality control, supply chain security, and regulatory compliance. Pharmaceutical companies prefer in-house API production to maintain strict oversight over manufacturing standards, reduce dependency on external suppliers, and ensure consistency with FDA requirements. Captive production also offers better protection of intellectual property and formulation secrets, especially for patented or high-value drugs. Additionally, increased focus on domestic manufacturing, driven by supply disruptions and geopolitical risks, has encouraged US drugmakers to invest in captive API facilities, further strengthening their market dominance and operational resilience.

Analysis by Synthesis Type:

- Synthetic

- Biotech

Synthetic API leads the market with 70.7% of market share in 2024 due to their well-established manufacturing processes, cost efficiency, and scalability. These APIs are commonly used in treatments for chronic and widespread conditions such as cardiovascular diseases, diabetes, and infections, driving consistent demand. Synthetic production allows for precise control over chemical structure, facilitating mass production with high purity and stability. Additionally, existing infrastructure and regulatory familiarity with synthetic processes make them more accessible for both branded and generic drug manufacturers. This broad applicability and manufacturing reliability contribute significantly to the dominance of synthetic APIs in the US market.

Analysis by Drug Type:

- Generic

- Branded

Branded leads the market with 53.6% of market share in 2024 due to their association with innovative therapies, high market exclusivity, and premium pricing. These drugs often treat complex or chronic conditions and require proprietary APIs, ensuring long-term demand and higher profit margins. Pharmaceutical corporations have made significant investments in research and development (R&D) to create innovative APIs that are patent-protected and provide branded medications with a competitive advantage. Additionally, strong brand recognition and trust among healthcare providers and patients support sustained usage. Regulatory incentives and favorable reimbursement policies further reinforce the dominance of branded drugs in driving API demand within the US market.

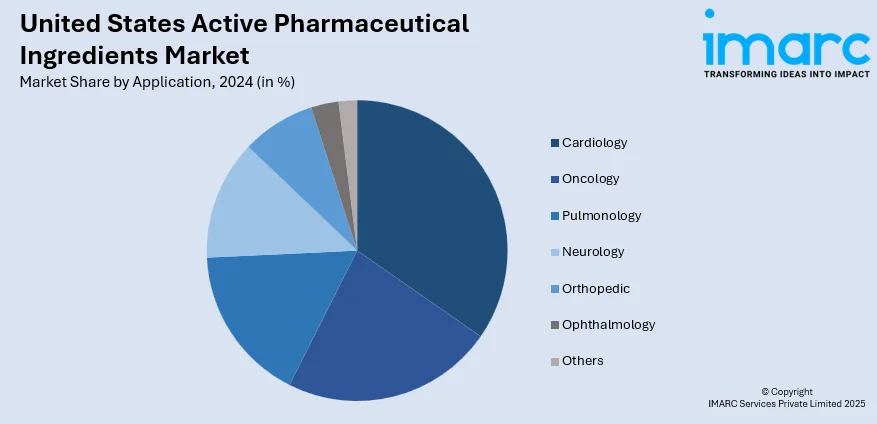

Analysis by Application:

- Cardiology

- Oncology

- Pulmonology

- Neurology

- Orthopedic

- Ophthalmology

- Others

Cardiology leads the market with 21.7% of market share in 2024 due to the high prevalence of cardiovascular diseases, which remain a leading cause of morbidity and mortality nationwide. The aging population, sedentary lifestyles, and rising rates of obesity and hypertension contribute to the growing demand for cardiac medications. APIs used in treatments for conditions like heart failure, arrhythmia, and high blood pressure are consistently required in large volumes. Additionally, many cardiovascular drugs are part of long-term therapy regimens, ensuring stable and recurring API demand. This sustained clinical need secures cardiology’s leading position in the US API market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast drives API demand due to its concentration of major pharmaceutical companies, research institutions, and biotech hubs, especially in states like Massachusetts and New Jersey. A strong clinical trial ecosystem, advanced research and development (R&D) infrastructure, and proximity to regulatory bodies like the FDA foster innovation. The region’s emphasis on specialty and branded drug development increases the need for high-value APIs. Additionally, access to a skilled workforce and academic partnerships supports sustained growth in the API manufacturing sector.

The Midwest's API market is driven by its robust pharmaceutical manufacturing base and centralized logistics infrastructure. States like Illinois and Indiana house several API and formulation production facilities, benefiting from lower operational costs. Public and private investments in health sciences, along with proximity to agricultural feedstocks for chemical synthesis, support synthetic API production. The region also benefits from academic-industry collaborations and a focus on cost-effective generics, which maintain consistent API demand across both branded and generic segments.

In the South, API market growth is fueled by increasing pharmaceutical manufacturing investments, favorable tax environments, and supportive state policies. States like North Carolina and Texas are home to growing biotech and life sciences clusters, attracting contract manufacturing and research organizations. Additionally, the region offers access to a large patient base for clinical research and trials, contributing to increased drug development and API demand. The South’s lower production costs and business-friendly climate enhance its competitiveness in the API space.

The West region’s API market is driven by strong biotechnology innovation, particularly in California, which hosts leading pharma and biopharma companies. High research and development (R&D) investment, venture capital availability, and proximity to top research universities foster advanced API development, especially for biologics and specialty drugs. The region also supports a growing number of startups and CDMOs focused on cutting-edge therapies. Additionally, access to Pacific trade routes facilitates international collaboration and raw material sourcing, strengthening the West’s API supply chain capabilities.

Competitive Landscape:

The United States active pharmaceutical ingredients (API) market is highly competitive, featuring a mix of multinational pharmaceutical giants, domestic manufacturers, and specialized contract development and manufacturing organizations (CDMOs). Key players such as Pfizer, Merck & Co., Teva Pharmaceuticals, and Cambrex dominate through extensive product portfolios and advanced manufacturing capabilities. The market is also influenced by emerging biotech firms investing in novel and high-potency APIs. Strategic collaborations, facility expansions, and compliance with FDA regulations are central to maintaining market position. Increasing focus on domestic production, driven by supply chain concerns and government incentives, is reshaping competition. Additionally, innovations in synthetic and biologic APIs are intensifying rivalry, as companies strive to meet rising demand for high-quality, cost-effective, and scalable API solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States active pharmaceutical ingredients market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: API manufacturer Lupin launched Eslicarbazepine Acetate Tablets in the US, following FDA approval of its ANDA. The tablets, available in 200 mg, 400 mg, 600 mg, and 800 mg, are bioequivalent to Aptiom and are indicated for partial-onset seizures.

- March 2025: Mallinckrodt and Endo announced a definitive agreement to combine into a global, diversified pharmaceuticals company. The merger will create a strong balance sheet, enhance financial flexibility, and focus on growth opportunities. Mallinckrodt's Dublin headquarters will serve as the global base, with the deal expected to close in H2 2025.

- September 2024: Wanbury announced its new API product portfolio for FY24-25, covering therapeutic areas like anti-diabetics, analgesics, and antidepressants. The portfolio includes APIs such as Metformin HCl, Sertraline HCl, and Diphenhydramine HCl, with global demand estimates ranging from 291 MT to 61,400 MT.

- September 2024: ANI Pharmaceuticals completed the acquisition of Alimera Sciences, strengthening its Rare Disease segment with key assets like ILUVIEN and YUTIQ. The deal, valued at USD 5.50 per share, expands ANI's ophthalmology portfolio and its global footprint, adding value to its API offerings and enhancing market reach.

United States Active Pharmaceutical Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Modes Covered | Captive API, Merchant API |

| Synthesis Types Covered | Synthetic, Biotech |

| Drug Types Covered | Generic, Branded |

| Applications Covered | Cardiology, Oncology, Pulmonology, Neurology, Orthopedic, Ophthalmology, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States active pharmaceutical ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States active pharmaceutical ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States Active Pharmaceutical Ingredients active pharmaceutical ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The active pharmaceutical ingredients market in the United States was valued at USD 87.50 Billion in 2024.

The active pharmaceutical ingredients market is projected to exhibit a CAGR of 3.88% during 2025-2033, reaching a value of USD 123.25 Billion by 2033.

Key factors driving the United States active pharmaceutical ingredients market include rising demand for generic and branded drugs, increasing prevalence of chronic diseases, growing investment in pharmaceutical research and development (R&D), and government efforts to boost domestic API manufacturing. Regulatory support and supply chain security concerns also contribute to sustained market growth and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)