United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034

United States Air Freight Market Size and Share:

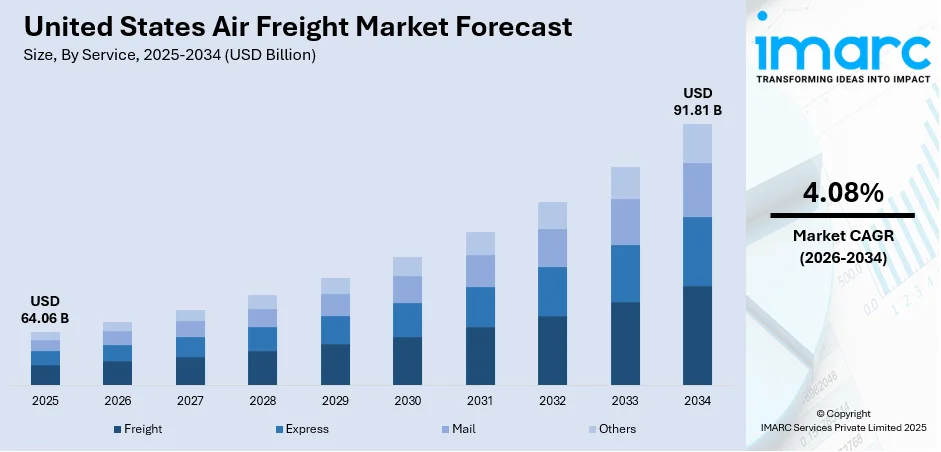

The United States air freight market size was valued at USD 64.06 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 91.81 Billion by 2034, exhibiting a CAGR of 4.08% during 2026-2034. The market is driven by the growing application in the pharmaceutical and medical sectors, and wide availability of fast-shipping solutions. Moreover, the rising adoption of artificial intelligence (AI) and the internet of things (IoT) coupled with growing investments by retail giants in dedicated air cargo services to meet delivery promises represent some of the other major growth-inducing factors driving the United States air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 64.06 Billion |

|

Market Forecast in 2034

|

USD 91.81 Billion |

| Market Growth Rate 2026-2034 | 4.08% |

Access the full market insights report Request Sample

The market for air freight in the United States is expanding rapidly, driven by the explosive growth of e-commerce, which is significantly boosting the demand for fast and reliable shipping solutions. Consumers now expect shorter delivery times, prompting retailers to prioritize air freight services. For instance, in June 2024, Nippon Express (NX) began a new airfreight service from Cincinnati/Northern Kentucky International Airport (CVG) in Kentucky to Chubu Centrair International Airport in Japan to meet demand in neighboring Ohio. Supply chain disruptions, such as ocean freight delays and port congestion, have led businesses to shift toward air transport to maintain inventory flow and meet customer demands efficiently.

To get more information on this market Request Sample

Air freight is essential for transporting high-value and time-sensitive goods, including electronics, pharmaceuticals, and automotive parts, in industries where delays can be extremely costly. The United States air freight market growth is also driven by substantial investments in logistics infrastructure, such as airport cargo facilities and automation technologies, which have improved air freight capacity, tracking, and handling efficiency. These technological enhancements make air transport more attractive to shippers. Additionally, shifting trade policies, including new tariffs and evolving trade agreements, influence logistics strategies and partnerships, often favoring air freight to mitigate risks related to regulatory changes. For instance, in April 2024, Atlantis Transportation Services / ACI Air Cargo, a reputable supplier of cargo handling solutions for airlines and freight forwarders throughout North America, announced a strategic alliance with AGI, a major ramp and cargo warehouse provider in Canada and the United States.

United States Air Freight Market Trends:

E-commerce Expansion

The explosive growth of e-commerce in the United States is a major driver of the air freight market. Consumers increasingly expect fast, often next-day, delivery for online purchases, putting pressure on supply chains to shorten transit times. Air freight offers the quickest method for moving goods over long distances, making it ideal for e-commerce logistics. Retail giants and marketplaces are investing heavily in dedicated air cargo services to meet delivery promises. Additionally, smaller businesses are leveraging air freight to stay competitive. The surge in e-commerce, accelerated by changing consumer behavior and digital transformation, continues to raise demand for efficient, reliable air cargo services, fundamentally reshaping the structure and volume of air freight operations in the U.S. For instance, in June 2024, ECU Worldwide, the worldwide subsidiary of Allcargo Logistics, announced that it had partnered with ShipBob to offer its air and ocean freight services to ShipBob's receiving hubs and fulfillment centers in the US, Europe, Canada, and Australia. With more than 2,400 direct trade channels, door-to-door deliveries, and a network in more than 180 countries, ECU Worldwide will play a significant role in FreightBob, ShipBob's end-to-end managed freight and inventory distribution program.

Supply Chain Disruptions and Demand for Speed

The United States air freight market trend is also fueled by the ongoing global supply chain disruptions. Congestion at major seaports, labor shortages, and geopolitical tensions have made ocean freight less reliable. Companies are increasingly using air freight to bypass bottlenecks and maintain inventory flow, especially for critical and high-margin products. Air cargo offers greater predictability and speed, key advantages in times of uncertainty. Industries such as retail, healthcare, and manufacturing have shifted portions of their supply chain strategies to include more air freight capacity. This rising preference for faster, flexible shipping solutions strengthens air freight’s importance, particularly as businesses seek resilience and continuity amid fluctuating global supply chain conditions. For instance, in October 2024, Pro Carrier revealed a new agreement with the United States that will integrate first-mile and last-mile services to the United Kingdom, Europe, and other countries. Pro Carrier and Forward Transit will collaborate to offer customers a fully integrated and tracked solution under one roof with the new end-to-end service.

Transportation of High-Value and Time-Sensitive Goods

Air freight is the preferred mode of transportation for high-value, sensitive, or perishable goods that require tight control over transit times, further influencing the United States air freight market trend. Sectors like electronics, pharmaceuticals, aerospace, and automotive manufacturing depend heavily on air cargo to ensure quick, safe delivery. For products, such as vaccines, critical machinery parts, or luxury electronics, delays can have enormous financial consequences. Air freight’s speed and security measures, including temperature-controlled environments and rigorous tracking systems, make it indispensable for these industries. The growing value and specialization of goods being shipped across the U.S. economy increase the reliance on air cargo. As industries evolve toward higher-value, precision-driven operations, air freight’s strategic role continues to expand. For instance, in April 2023, the first routes between the United States and China were launched by the cargo airline division of A.P. Moller-Maersk, which is renowned for being a giant in ocean shipping and logistics. The company is providing twice-weekly freighter service between Shenyang Taoxian International Airport and Greenville-Spartanburg International Airport (GSP) in South Carolina, as well as between Chicago Rockford International Airport and Hangzhou.

United States Air Freight Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States air freight market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on service, destination, and end user.

Analysis by Service:

- Freight

- Express

- Others

Freight stands as the largest service in 2025, holding around 39.8% of the market. Freight holds the largest share in the United States air freight market due to its crucial role in transporting high-value, time-sensitive, and large-volume goods. Industries like electronics, pharmaceuticals, automotive, and aerospace rely heavily on air freight for quick, secure delivery of critical parts and products. The growing demand for fast and reliable shipping, especially from e-commerce and global supply chains, further drives air freight's prominence. Air cargo offers speed, security, and efficiency, making it the preferred choice for businesses needing rapid delivery, which solidifies freight's dominant position in the U.S. air freight market.

Analysis by Destination:

- Domestic

- International

Domestic leads the market share with around 62.5% of the United States air freight market size due to the country's well-established infrastructure and high demand for fast, reliable delivery within its borders. With the rise of e-commerce and time-sensitive industries, businesses increasingly rely on domestic air freight to quickly move goods across regions. The proximity of major airports, efficient logistics networks, and shorter delivery distances make domestic air freight a cost-effective and reliable choice. Additionally, industries like healthcare, automotive, and retail require quick replenishment of stock, further driving the demand for domestic air cargo services, ensuring its dominance in the market.

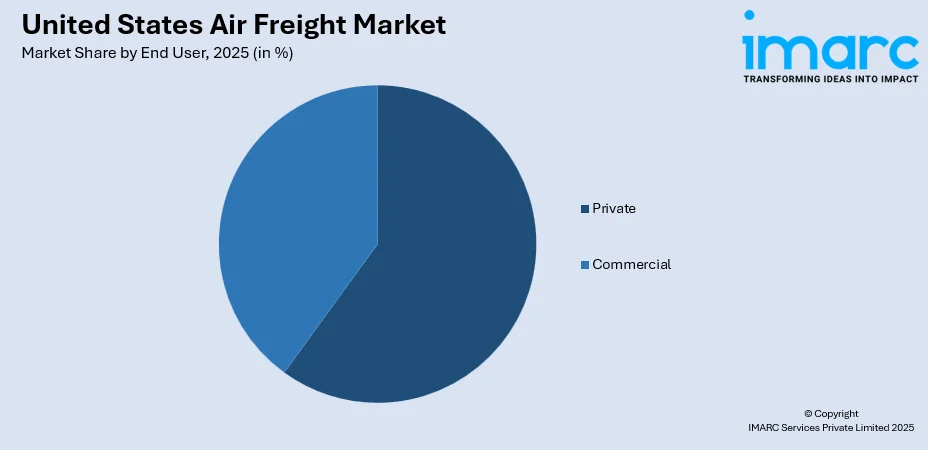

Analysis by End User:

To get detailed segment analysis of this market Request Sample

- Private

- Commercial

Consumer electronics leads the market with around 67.8% of market share in 2025 due to their extensive use in transporting high-volume goods across various industries, including retail, electronics, automotive, and pharmaceuticals. Commercial airlines offer established, reliable networks and infrastructure, allowing for efficient, time-sensitive shipments, which creates a positive impact on the United States air freight market outlook. The demand for rapid delivery of both raw materials and finished products, especially in e-commerce and global supply chains, has driven commercial carriers to expand their freight operations. Additionally, commercial air freight benefits from economies of scale, with airlines able to utilize existing passenger flight routes, making it a cost-effective and widely accessible solution for businesses.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast benefits from a high concentration of major airports like JFK and Newark, facilitating swift air freight movement, thereby fueling the United States air freight market demand. E-commerce growth, particularly in metropolitan areas, fuels demand for rapid delivery. Additionally, industries like pharmaceuticals, technology, and manufacturing depend on quick transportation of high-value goods. The region's infrastructure and proximity to major shipping hubs make it an ideal base for both domestic and international air freight services, supporting efficient and time-sensitive logistics operations.

The Midwest is driven by manufacturing hubs and distribution centers, making it a vital region for air freight. Industries such as automotive, agriculture, and technology rely on air cargo for the rapid transportation of components and finished products. Major airports like Chicago O'Hare and Detroit Metropolitan serve as critical air freight hubs, connecting the region to global markets. The proximity to suppliers and production centers enhances the need for fast logistics, boosting air freight demand in the region.

The South is a key hub for the air freight market due to its rapidly growing e-commerce sector, especially in states like Texas and Florida. Major logistics hubs like Dallas/Fort Worth and Miami International Airport facilitate the movement of goods across the U.S. and globally. The region also supports industries like electronics, healthcare, and aerospace, all of which require fast, efficient shipping for time-sensitive products. Strong infrastructure and favorable business conditions continue to drive air freight growth in the South.

The West Coast, home to major ports like Los Angeles and Seattle, is central to the U.S. air freight market due to its proximity to Asia and the Pacific Rim. E-commerce demand, especially in California, along with industries like tech, entertainment, and agriculture, contributes to strong air freight activity. The region's extensive airport network, including San Francisco and Los Angeles International, supports both domestic and international shipments, making it a critical hub for air cargo services, particularly for high-value goods.

Competitive Landscape:

The air freight market for the United States is highly competitive, with numerous major players dominating the sector. Key carriers like FedEx, UPS, and DHL Express offer comprehensive global air freight services, with extensive networks and infrastructure to support fast deliveries. Additionally, integrated air cargo services provided by traditional airlines such as American Airlines, Delta, and United Airlines contribute significantly to the market. According to the United States air freight market forecast, these companies compete on speed, reliability, cost-efficiency, and technological advancements in tracking and automation. Emerging players and logistics companies, including Amazon Air, are increasingly expanding their air cargo capabilities to capture market share. The market is also influenced by third-party logistics providers (3PLs), like XPO Logistics, which offer end-to-end solutions. Continued investments in infrastructure and technological innovation are vital for companies to stay competitive in this rapidly evolving market.

The report provides a comprehensive analysis of the competitive landscape in the United States air freight market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: CEVA Logistics started a new trans-Pacific air cargo charter service to increase aviation capacity for important trade channels. With three weekly flights between Wuxi, China (WUX) and Chicago, Illinois (ORD), the new service provides its clients with more dependable and consistent air capacity. Industrial equipment, electronics, big cargoes, e-commerce products, and clothing are just a few of the many cargo kinds that this new charter service is intended to handle. Through its CEVA FORPLANET suite, a collection of low-carbon transportation and circular economy solutions targeted at minimizing environmental effect, CEVA is also providing sustainable aviation fuel (SAF) options as part of its dedication to sustainability.

- November 2024: Qantas Freight launched a new United States website, allowing US-based freight forwarders to search and book cargo capacity online. The portal provided access to schedules, rates, and booking options for Qantas and Jetstar services across the US, Australia, and New Zealand. It also enabled users to create route templates, streamlining the booking process.

- October 2024: Amazon officially launched Amazon Air Cargo, expanding its air logistics beyond parcel delivery. It opened its fleet to freight forwarders and businesses, challenging FedEx and UPS. The division, created in 2016, grew to over 100 aircraft with 250 daily flights. A new website was also introduced for businesses to book air cargo shipments directly.

- August 2024: CMA CGM AIR CARGO launched its first transpacific service with a B777-200F, connecting Hong Kong to Chicago on August 25, 2024. This marks a key step in its expansion across North America. Two more B777-200F aircraft will be delivered soon, boosting capacity. The move aligns with CMA CGM Group’s strategy to enhance global logistics solutions.

- May 2024: A.P. Moller - Maersk launched a full-service air freight gateway in Miami to enhance connectivity between the U.S., Asia, and Latin America. The facility, activated in April, strengthens Maersk’s global air freight network. It aims to provide seamless and competitive logistics solutions for Latin American markets. This expansion reinforces Maersk’s commitment to integrated supply chain services.

United States Air Freight Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, and Others |

| Destinations Covered | Destinations Covered |

| End Users Covered | Private, Commercial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States air freight market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States air freight market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States air freight market was valued at USD 64.06 Billion in 2025.

The United States air freight market is projected to exhibit a CAGR of 4.08% during 2026-2034, reaching a value of USD 91.81 Billion by 2034.

The United States air freight market is driven by booming e-commerce demand, rising need for rapid transportation of high-value goods, supply chain disruptions favoring faster shipping options, and advancements in logistics infrastructure. Additionally, changes in trade policies and tariffs influence shipment patterns, making air freight a strategic choice for businesses seeking speed and reliability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)