United States Automotive Battery Market Size, Share, Trends and Forecast by Battery Type, Drive Type, Vehicle Type, and Region, 2025-2033

United States Automotive Battery Market Size and Share:

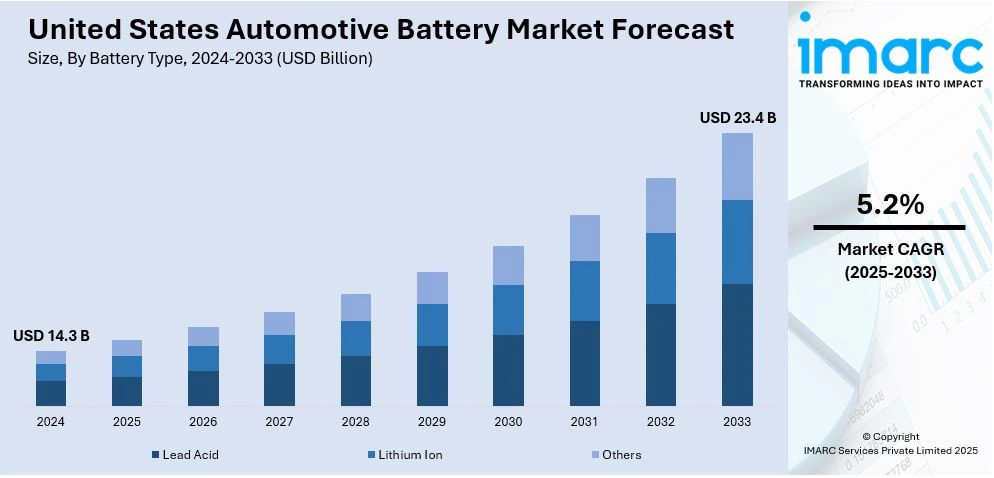

The United States automotive battery market size was valued at USD 14.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.4 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. The market is experiencing significant growth mainly driven by the rise in electric vehicle adoption and advancements in battery technologies. The rising government incentives, along with expanding EV infrastructure and rising consumer demand for sustainable transportation are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.3 Billion |

| Market Forecast in 2033 | USD 23.4 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

The market is mainly driven by the widespread adoption of electric vehicle across the United States. As automakers expand their EV lineups and consumers increasingly prioritize sustainable transportation the demand for high-performance batteries has skyrocketed. In the second quarter of 2024, sales of electric and hybrid vehicles in the United States increased to 18.7% climbing from 17.8% in the first quarter as reported by the US Energy Information Administration. Hybrid vehicle sales experienced a significant boost of 30.7% reaching 9.6% while battery electric vehicles (BEVs) accounted for 7.1% of the market. Additionally, advancements in battery technology such as improved energy density and faster charging capabilities make EVs more practical and convenient for everyday use.

Another key driver is the push for innovation and cost reduction in battery production. Economies of scale and investments in research and development are lowering the costs of lithium-ion and alternative battery technologies making them more accessible to a broader market. For instance, in August 2024, Chemours inaugurated its Battery Innovation Center in Newark, Delaware aiming to enhance electric vehicle battery performance and sustainability. This advanced facility supports the development and testing of innovative battery technologies promoting collaboration to create cost-effective lithium-ion batteries thus contributing to the clean energy transition in the automotive sector. Supply chain enhancements and the securing of critical raw materials also play a crucial role in supporting market growth. Furthermore, the rise of connected and smart vehicles which rely on advanced battery systems for various functionalities, is expanding the applications and boosting the overall demand in the automotive battery sector.

United States Automotive Battery Market Trends:

Government policies and Incentives

Favorable government regulations and policies play a crucial role in facilitating the adoption of EVs and increasing battery production in the United States. Federal and state-level incentives such as tax credits, rebates, and grants make EVs more affordable for clients and persuade companies to spend in battery technologies. Additionally, subsidies for battery manufacturing facilities help create jobs and promote domestic production. For instance, in September 2024, the Biden-Harris administration announced over $3 billion to enhance domestic battery manufacturing across 14 states aiming to create 12,000 jobs. Simultaneously, the implementation of stricter emissions regulations compels automakers to transition from traditional internal combustion engines to electric powertrains. These regulations not only reduce greenhouse gas emissions but also drive innovation in cleaner, more efficient battery solutions fostering a sustainable automotive future.

Rising EV Adoption

The surge in electric vehicle adoption in the United States is significantly driven by the rising consumer demand for electric and hybrid models which in turn boosts battery sales. Consumers are increasingly prioritizing sustainability, lower operating costs, and advanced technology features offered by EVs. According to industry reports, the United States electric vehicle sales surpassed Europe for the first time reaching 3,44,000 units in Q3 2024. Major automakers are committing to comprehensive electrification strategies pledging substantial investments in EV development and expanding their electric lineups. This commitment includes launching a diverse range of models to cater to different market segments and investing in innovative battery technologies.

Shift Towards Solid-State Batteries

The automotive industry in the United States is increasingly shifting toward solid-state batteries driven by intensive research and development aimed at enhancing safety and performance. Unlike traditional batteries that use liquid electrolytes solid-state batteries employ solid materials significantly reducing the risk of leaks and thermal runaway incidents. This improvement not only boosts safety but also allows for higher energy density but also enables EVs to attain longer ranges on a single charge. Additionally, solid-state technology minimizes reliance on volatile liquid electrolytes enhancing battery longevity and reliability. For instance, in October 2024, Stellantis and Factorial announced partnership to advance the electric vehicle technology by introducing solid-state batteries in a new Dodge Charger Daytona fleet set to launch by the year 2026. This collaboration aims to enhance performance and affordability in EVs with Factorial's high energy density batteries marking a significant stride towards mass production and sustainable transport. These advancements make solid-state batteries a promising cornerstone for the future of electric mobility thereby supporting broader EV adoption and innovation.

United States Automotive Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States automotive battery market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on battery type, drive type, and vehicle type.

Analysis by Battery Type:

- Lead Acid

- Lithium Ion

- Others

Lead acid batteries dominate the United States automotive battery market due to their cost-effectiveness and widespread application in conventional vehicles. Known for reliability and durability they are extensively used in starting, lighting and ignition (SLI) systems. These batteries are also recyclable making them environmentally friendly. Despite their heavier weight and limited energy density lead acid batteries remain a preferred choice for standard vehicles and backup power solutions sustaining their relevance in the evolving automotive landscape.

Lithium ion batteries are rapidly gaining traction in the United States automotive battery market driven by their superior energy density and lightweight design. These batteries are integral to the growth of electric vehicles and hybrid models supporting longer driving ranges and faster charging. Their efficiency and ability to sustain multiple charge cycles make them ideal for modern automotive demands. Although higher in cost advancements in technology are reducing prices boosting their adoption in an increasingly electrified market.

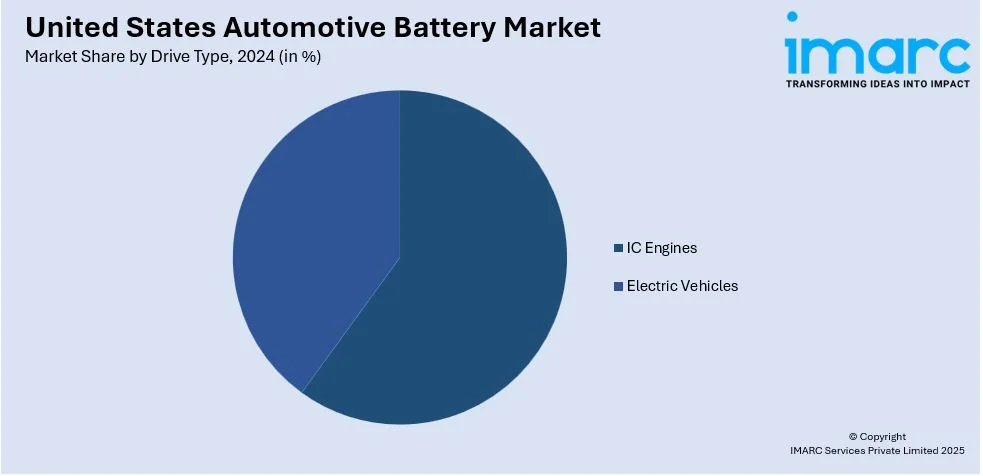

Analysis by Drive Type:

- IC Engines

- Electric Vehicles

Batteries for IC engines hold a substantial share in the United States automotive battery market supporting traditional gasoline and diesel-powered vehicles. These batteries primarily serve starting, lighting, and ignition functions. Lead acid batteries dominate this segment due to their affordability and proven performance. As IC engine vehicles remain a significant part of the automotive landscape demand for reliable battery solutions continues though growth is slowing as the market shifts toward electric and hybrid alternatives.

Electric engine batteries are transforming the United States automotive battery market driven by the rapid adoption of electric vehicles and hybrids. Lithium-ion batteries dominate this segment offering high energy density and efficiency for extended driving ranges. With government incentives and consumer demand for cleaner transportation, this segment is experiencing significant growth. Technological advancements are enhancing battery performance and reducing costs making electric engine batteries a cornerstone of the future automotive industry in the United States.

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

- Others

The passenger vehicle segment drives significant demand in the United States automotive battery market as these vehicles dominate the country’s roads. Batteries for passenger cars primarily lead acid and lithium ion power essential functions and meet energy needs for advanced features like infotainment and safety systems. As electric and hybrid models gain popularity among consumers the demand for high-performance batteries is increasing positioning this segment as a critical driver for advancements in battery technology and market growth.

Commercial vehicles contribute robustly to the United States automotive battery market relying on durable batteries for heavy duty operations. This segment includes trucks, buses, and other utility vehicles that demand high-performance batteries to power larger engines and auxiliary systems. Lead acid batteries dominate due to their cost-effectiveness while the adoption of lithium ion batteries is growing for electric and hybrid models. Rising emphasis on electrification in logistics and public transport further enhances growth prospects for this segment.

The electric vehicle segment is reshaping the United States automotive battery market with lithium ion batteries leading the charge. EV batteries are crucial for supporting long-range capabilities and fast charging meeting growing consumer and regulatory demands for sustainable transportation. Increasing government incentives and investments in charging infrastructure are accelerating EV adoption driving substantial growth in this segment. Advancements in battery technology are reducing costs and enhancing performance solidifying EV batteries as a pivotal component of the automotive industry’s future.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is a prominent market for automotive batteries in the United States driven by a high concentration of passenger vehicles and the need for reliable battery replacements due to harsh winters. Lead acid batteries dominate this region for conventional vehicle applications, particularly in starting, lighting, and ignition systems. Urban centers such as New York and Boston are also experiencing rising demand for lithium-ion batteries as electric vehicles gain traction. This region’s focus on sustainability and the adoption of advanced automotive technologies positions it as a significant contributor to the growth of the United States automotive battery market.

The Midwest automotive battery market benefits from the region’s strong manufacturing and agricultural sectors which heavily rely on commercial vehicles. Lead acid batteries remain the preferred choice due to their affordability and durability in supporting heavy-duty applications. However, the gradual increase in hybrid and electric vehicle adoption is driving demand for lithium-ion batteries. The region’s diverse vehicle fleet encompassing passenger cars and trucks ensures a steady demand for both traditional and advanced battery solutions. Additionally, its varied climate necessitates robust batteries that perform efficiently in extreme weather conditions further bolstering the market growth potential.

The South is a thriving market for automotive batteries supported by a substantial population of passenger and commercial vehicles. Warm climates in this region create a demand for durable batteries capable of withstanding high temperatures. Lead acid batteries dominate the conventional vehicle market while lithium-ion batteries are gaining popularity with the increasing adoption of electric vehicles in states like Texas and Florida. The mix of urban centers and rural areas in the South generates a diverse customer base driving steady growth across conventional and electric vehicle segments. Expanding EV infrastructure further strengthens the region's market prospects.

The West region leads the United States automotive battery market, particularly in electric vehicle adoption driven by government incentives and strong EV infrastructure. California’s commitment to clean energy and sustainability accelerates demand for lithium-ion batteries. While lead acid batteries remain relevant for conventional vehicles, especially in rural areas the region's emphasis on electrification propels innovation in advanced battery technologies. States in the West are also hubs for technological advancements fostering research and development in solid-state and other next-generation batteries. This region’s progressive policies and focus on clean mobility solidify its role as a major market for automotive batteries.

Competitive Landscape:

The automotive battery market in the United States is highly competitive consisting of both well-established manufacturers and new innovative companies working to improve battery performance and affordability. Key players in the market are concentrating on advancing technologies such as increased energy density, quicker charging times and longer battery life spans to satisfy the rising demand for electric vehicles. For instance, in October 2024, Tesla announced its plans to introduce four new variants of its proprietary 4680 batteries mainly intended for vehicles like cyber trucks and upcoming robo taxis. Forming strategic partnerships with automakers and investing heavily in large-scale production facilities are essential strategies for capturing the market share. Ongoing research and development foster innovation while efforts to cut production costs and enhance scalability help companies effectively adapt to fast-paced growth and changing needs of the electric vehicle market.

Latest News and Developments:

- In August 2024, Samsung SDI and General Motors finalize the $3.5 billion joint venture to build an electric vehicle battery plant in New Carlisle, Indiana. The facility will create over 1600 jobs and will initially produce 27 GWh of batteries to ramp up to 36 GWh by the year 2027.

- In December 2023, Stellantis and Ample announced their partnership to introduce a modular battery-swapping technology allowing electric vehicles to quickly replace depleted batteries in under five minutes. The initial program will launch in Madrid with Fiat 500e vehicles addressing charging time and range anxiety while promoting sustainable mobility solutions.

United States Automotive Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Battery Types Covered | Lead Acid, Lithium Ion, Others |

| Drive Types Covered | IC Engines, Electric Vehicles |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States automotive battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States automotive battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States automotive battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An automotive battery powers the electrical systems and ignition of vehicles. It provides energy for starting, lighting, and ignition (SLI) in traditional vehicles and supports propulsion in electric and hybrid models. Automotive batteries are vital for efficient vehicle operation and advanced features like infotainment and safety systems.

The United States automotive battery market was valued at USD 14.3 Billion in 2024.

IMARC estimates the United States automotive battery market to exhibit a CAGR of 5.2% during 2025-2033.

The market is driven by increasing electric vehicle adoption, advancements in battery technology, government incentives, and expanding EV infrastructure. Enhanced energy density, faster charging capabilities, and cost reduction in production are also contributing significantly to the market's growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)