United States Battery Materials Market Size, Share, Trends and Forecast by Type, Battery Type, Application, and Region, 2025-2033

United States Battery Materials Market Overview:

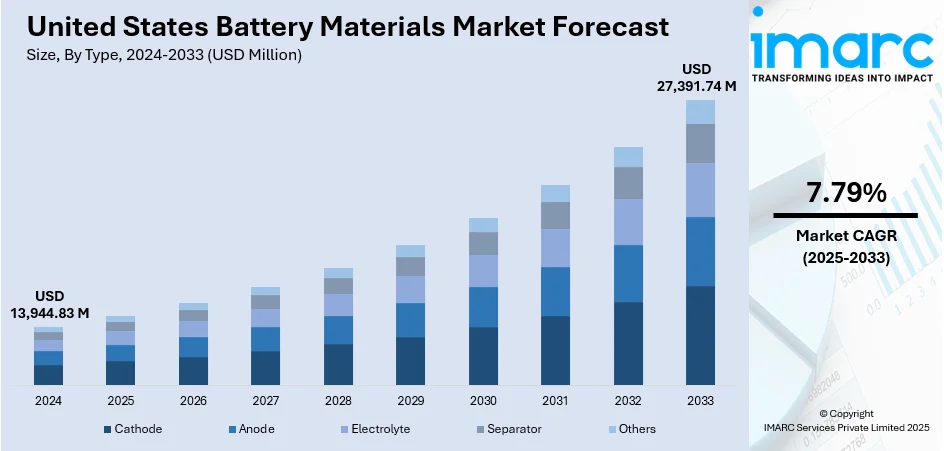

The United States battery materials market size was valued at USD 13,944.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 27,391.74 Million by 2033, exhibiting a CAGR of 7.79% from 2025-2033. South region currently dominates the market driven by the rising use of primary batteries in critical medical devices. Devices such as pacemakers, insulin pumps, hearing aids, and portable diagnostic tools depend on reliable, long-lasting power sources to ensure continuous operation and patient safety. As the demand for advanced, compact, and energy-efficient medical equipment increases, so does the need for high-performance battery materials, supporting United States battery materials market share in the healthcare segment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,944.83 Million |

| Market Forecast in 2033 | USD 27,391.74 Million |

| Market Growth Rate 2025-2033 | 7.79% |

The rapid expansion of the electric vehicle (EV) market in the U.S. is a key driver for battery materials demand. Government incentives, stricter emission norms, and rising consumer interest in sustainable mobility are boosting EV adoption nationwide. As of early 2023, over 2.5 million EVs were on U.S. roads, with EVs projected to account for 40–56% of passenger vehicle sales by 2030. Major automakers are ramping up EV production, significantly increasing the demand for critical battery materials like lithium, cobalt, and nickel. The U.S. government’s push for domestic battery manufacturing, combined with partnerships between automakers and material suppliers, is further strengthening the market. This trend is also encouraging investments across the EV battery value chain, including raw material extraction, processing, and recycling.

To get more information on this market, Request Sample

Rising adoption of renewable energy sources such as solar and wind has created strong demand for grid-scale energy storage systems (ESS). To stabilize power supply and ensure energy availability during variable generation periods, utilities are investing in large lithium-ion battery storage solutions. Government policies like the Inflation Reduction Act offer incentives for ESS installation, further boosting demand for battery materials. Additionally, the growing need for backup power in residential and commercial sectors increases the consumption of critical battery materials. This trend supports the development of a resilient energy infrastructure, promoting United States battery materials market growth across the U.S.

United States Battery Materials Market Trends:

Accelerated On-shoring of Battery Material Supply Chains

A strong emphasis on building domestic battery materials capacity is reshaping the U.S. market, aiming to reduce reliance on foreign sources, especially from Asia. The government is actively promoting local mining, refining, and processing of key minerals such as lithium, nickel, and graphite through supportive policies, funding programs, and public-private partnerships. A notable example is the U.S. Department of Energy’s grant of up to $1.2 billion for North America’s first large-scale synthetic graphite plant in Tennessee, marking a significant step towards self-sufficiency in battery materials. This development is part of a broader national effort to establish facilities for extraction, processing, and recycling across the country. The strategy not only secures the energy supply chain but also stimulates job creation and economic growth, ensuring the U.S. becomes a competitive force in the United States battery materials market outlook.

Advancements in Next-Generation Battery Materials

The U.S. battery materials market is witnessing a strong push toward developing next-generation battery technologies. Researchers and companies are exploring alternatives to conventional lithium-ion batteries, such as solid-state, lithium-sulfur, and sodium-ion chemistries. These emerging materials promise improvements in energy density, charging speed, safety, and cost. For example, silicon-based anodes are being developed to replace graphite, offering the potential for higher battery capacities. Similarly, solid electrolytes are gaining attention for their safety and stability benefits over liquid counterparts. These innovations aim to overcome the limitations of current battery technologies and address the growing needs of electric vehicles, consumer electronics, and grid storage systems. As investments in R&D increase, these advanced materials are expected to drive the next wave of growth in the U.S. battery industry, supporting its technological leadership globally.

Rise of Battery Recycling and Circular Economy Practices

Recycling has emerged as a crucial trend in the U.S. battery materials market to reduce dependence on virgin raw materials such as lithium, cobalt, and nickel. With the growing stockpile of end-of-life batteries from electric vehicles and consumer electronics, recycling presents a valuable opportunity to extract and reuse critical elements. However, despite its potential, only about 5% of lithium-ion batteries are currently recycled in the U.S., compared to nearly 90% for lead-acid batteries, highlighting significant room for growth. Companies are investing in advanced technologies to improve recovery efficiency, while government incentives and regulations are pushing industries toward circular economy practices. This approach not only supports sustainability goals and reduces environmental impacts but also helps lower long-term production costs. The development of a closed-loop recycling system is key to ensuring future supply security and resilience for the battery materials market.

United States Battery Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States Battery Materials market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type, battery type, and application.

Analysis by Type:

- Cathode

- Anode

- Electrolyte

- Separator

- Others

Cathode materials hold the largest share in the U.S. battery materials market, primarily due to their crucial role in determining a battery’s performance, capacity, and lifespan. As the demand for high-energy-density batteries increases—especially in electric vehicles, portable electronics, and energy storage systems—the need for advanced cathode materials like lithium nickel manganese cobalt oxide (NMC) and lithium iron phosphate (LFP) continues to grow. These materials directly influence battery efficiency, safety, and charging speed, making them essential components in next-generation battery technologies. Additionally, continuous research and development focused on enhancing cathode properties, reducing costs, and minimizing reliance on scarce elements further boost their market demand. The expanding EV market and renewable energy storage projects are key drivers supporting cathode material dominance in the battery materials sector.

Analysis by Battery Type:

- Lithium Ion

- Lead Acid

- Others

Lithium-ion batteries dominate the U.S. battery materials market, accounting for the largest share of 44.8%, primarily due to their superior energy density, long cycle life, and efficiency compared to other battery technologies. These batteries are the preferred choice for electric vehicles, consumer electronics, and energy storage systems, driving strong demand across multiple sectors. Their lightweight design, fast charging capabilities, and ability to deliver consistent performance make them ideal for portable and mobile applications. Additionally, advancements in lithium-ion battery technology, such as the development of solid-state versions and improved safety features, are further expanding their use. Supportive government policies promoting EV adoption and renewable energy storage also contribute to the growing reliance on lithium-ion batteries in the U.S. market.

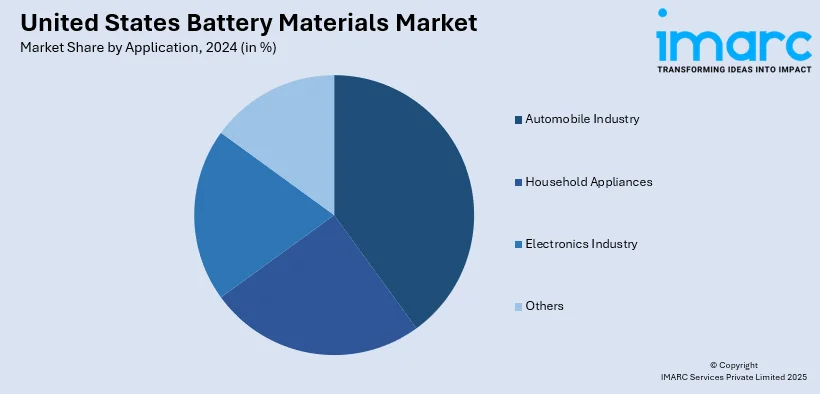

Analysis by Application:

- Automobile Industry

- Household Appliances

- Electronics Industry

- Others

The automotive industry leads the growth of the U.S. battery materials market with a 32.3% share, driven by the rapid shift toward electric vehicles (EVs). Growing consumer demand for cleaner, energy-efficient transportation and supportive government policies, such as tax credits and emissions regulations, are encouraging automakers to accelerate EV production. As a result, the need for high-performance batteries and essential materials like lithium, cobalt, and nickel has surged. Major automotive manufacturers are investing heavily in battery manufacturing and forming partnerships with material suppliers to secure stable, long-term supply chains. Additionally, advancements in battery technology to improve driving range, safety, and charging speed are fueling further demand. This strong focus on electrification is solidifying the automotive sector’s dominance in the battery materials market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Southern region of the United States leads the battery materials market due to its favorable business environment, availability of key raw materials, and strong industrial infrastructure. States in this region offer attractive incentives, tax benefits, and government support to encourage investment in battery manufacturing and material processing facilities. The presence of abundant lithium reserves and other essential minerals also makes the South a strategic hub for battery material extraction and refinement. Additionally, the region benefits from its proximity to major automotive manufacturing centers and emerging electric vehicle production facilities, creating strong demand for battery components. Investments in research, development, and recycling infrastructure further enhance the South’s leadership position, making it a critical contributor to the growth of the U.S. battery materials market.

Competitive Landscape:

The competitive landscape of the U.S. battery materials market is dynamic and rapidly evolving, driven by increasing demand for electric vehicles, renewable energy storage, and portable electronics. Numerous players operate across various stages of the supply chain, including raw material extraction, refining, processing, and recycling. The market is characterized by strategic partnerships, mergers, and collaborations aimed at securing sustainable sources of critical materials and enhancing domestic production capabilities. Innovation in advanced battery chemistries and materials is also intensifying competition, as companies seek to develop safer, more efficient, and cost-effective solutions. Additionally, government policies and incentives are influencing market positioning, encouraging local production and reducing reliance on imports. Overall, competition focuses on technological advancement, supply chain security, and environmental sustainability.

The report provides a comprehensive analysis of the competitive landscape in the United States battery materials market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: US Vanadium LLC and Tyfast Energy Corp. launched a collaborative development project aimed at increasing the local manufacturing of ultra-fine-grain vanadium oxide materials in the United States. This raw material is essential for the production of Tyfast's innovative lithium vanadium oxide (LVO) anode, which is used in high-performance lithium-ion batteries. The partnership seeks to maximize the synthesis of high-purity vanadium oxide powders from post-industrial waste streams at the Arkansas facility of US Vanadium for use in Tyfast's exclusive lithium vanadium oxide (LVO) anode.

- May 2025: Ampcera Inc., a rapidly expanding developer of solid-state battery materials based in California, unveiled the commercial release and first international shipments of Ampcera Inc.'s novel nano sulfide solid electrolyte powders, a revolutionary material intended to facilitate the next generation of high-performance all-solid-state batteries. These powders facilitate the fabrication of ultra-thin solid electrolyte separator layers and better energy-density cathodes and anodes, allowing for exceptional performance and enhanced profitable potential for solid-state battery applications in aerospace, consumer electronics, defense, and electric vehicles.

- April 2025: SES AI Corporation announced the launch of the Molecular Universe MU-0, the company’s software and service platform for newest discovering battery materials driven by AI and physics. With a single, integrated search, the platform enables university researchers and experts in the battery sector to search through a large library of potential small molecules, facilitating expedited research on battery materials.

- April 2025: California-based Lyten declared that it has created the first battery-grade lithium-metal foil in the United States using lithium alloys and lithium-metal that were produced in the United States. Lyten now intends to localize its supply chain for lithium-metal anodes, following the successful achievement of a fully localized supply chain for its sulfur cathode, which will result in a battery with a robust supply chain and no tariffs.

- March 2025: BASF commenced manufacturing Licity anode binders at its facility in the United States, significantly increasing the scope of its production capacity in the country to meet the demands of the quickly changing lithium-ion battery market. With the help of this increased production capacity, BASF is now able to provide its Licity portfolio on a global scale.

United States Battery Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cathode, Anode, Electrolyte, Separator, Others |

| Battery Types Covered | Lithium Ion, Lead Acid, Others |

| Applications Covered | Automobile Industry, Household Appliances, Electronics Industry, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States battery materials market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States battery materials market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States battery materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States battery materials market was valued at USD 13,944.83 Million in 2024

The United States battery materials market is projected to exhibit a CAGR of 7.79% during 2025-2033, reaching a value of USD 27,391.74 Million by 2033

Key factors driving the U.S. battery materials market include the rapid adoption of electric vehicles, expansion of renewable energy storage systems, government incentives for domestic battery production, and advancements in next-generation battery technologies. Additionally, increasing emphasis on recycling and sustainable sourcing of critical materials further boosts market growth and resilience.

South region currently dominates the United States battery materials market due to significant investments, advanced manufacturing facilities, strong supply chains, and growing partnerships with major electric vehicle and energy storage companies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)