United States Beer Market Report by Product Type (Standard Lager, Premium Lager, Specialty Beer, and Others), Packaging (Glass, PET Bottle, Metal Can, and Others), Production (Macro-Brewery, Micro-Brewery, and Others), Alcohol Content (High, Low, Alcohol-Free), Flavor (Flavored, Unflavored), Distribution Channel (Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, and Others), and Region 2026-2034

United States Beer Market Size, Share & Trends

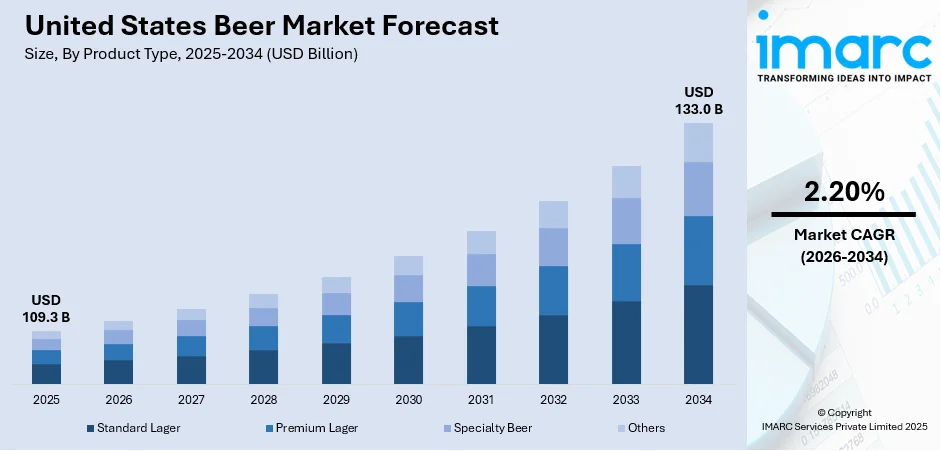

The United States beer market size reached USD 109.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 133.0 Billion by 2034, exhibiting a growth rate (CAGR) of 2.20% during 2026-2034. The changing consumer preferences towards craft and flavored beers, increasing disposable incomes, expanding young population, rising popularity of beer among women, and the proliferation of microbreweries and brewpubs are boosting the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 109.3 Billion |

|

Market Forecast in 2034

|

USD 133.0 Billion |

|

Market Growth Rate 2026-2034

|

2.20% |

Access the full market insights report Request Sample

United States Beer Market Analysis:

- Major Market Drivers: Changing consumer preferences towards craft and flavored beers, driven by a desire for authenticity and diverse flavor experiences represents the key factor driving the market growth. Besides this, increasing disposable incomes, allowing consumers to spend more on premium and specialty beer offerings combined with the rising popularity of beer among women is fostering market expansion.

- Key Market Trends: The rise of craft beer is boosting market growth, with small, independent breweries focusing on quality, flavor, and brewing techniques. Moreover, changing consumer preferences towards flavored beers, low-alcohol options, and premium offerings are other United States beer market trends propelling the industry forward. Additionally, increasing health consciousness driving demand for lighter, healthier beer options, as well as transparency and sustainability in production processes, is aiding the market growth.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: Intense competition among major breweries and craft producers combined with regulatory challenges and continuously changing consumer preferences is impeding market growth. On the other hand, opportunities for breweries to capitalize on the growing demand for premium, craft, and healthier beer options, as well as leveraging technological advancements in brewing techniques and distribution channels are bolstering market expansion.

To get more information on this market Request Sample

United States Beer Market Trends:

Rise of craft beer

Craft beer, characterized by its small-scale production, innovative flavors, and emphasis on quality and authenticity, has experienced exponential growth in recent years. Consumers are drawn to craft beer for its diverse range of styles, unique ingredients, and artisanal production methods, which offer a departure from mass-produced mainstream beers. Craft beer's retail dollar sales grew by 3%, reaching $28.9 billion, and now constitute 24.7% of the expanded $117 billion U.S. beer market. Craft beer's association with local culture and community, with many craft breweries prioritizing sourcing ingredients locally and engaging with their customer base through taprooms and events is contributing to the United States beer market outlook.

Popularity of low and no-alcohol beer

Low and no-alcohol beers offer consumers the opportunity to enjoy the taste and social aspects of beer without the associated intoxicating effects. This preference is more common among younger customers who place a high value on mindfulness, exercise, and moderation. Brewers are responding to this demand by innovating with brewing techniques and ingredients to create flavorful and satisfying low and no-alcohol beer options that rival their alcoholic counterparts. Between August 2021 and August 2022, total dollar sales of non-alcoholic drinks in the country reached $395 million, marking a year-over-year growth of +20.6%. This evident surge in demand for low and no-alcohol beers is bolstering the United States beer market size.

Expansion of online sales channels

E-commerce platforms and direct-to-consumer (D2C) sales channels have become increasingly popular for beer producers to reach consumers, particularly in the wake of the COVID-19 pandemic. According to the data, online beer sales surged to US$4.2 million in 2020 with e-commerce penetration increasing tenfold within three months during the pandemic. Along with this, online sales offer convenience, choice, and accessibility, allowing consumers to explore a wide variety of beer options from the comfort of their homes. Moreover, IWSR reported beverage alcohol e-commerce sales to hit US$42 billion globally by 2025, a 66% surge. U.S. online alcohol sales, now at US$6.1 billion, soared 131% since 2019. Thus, online sales channels are influencing the United States beer market growth.

United States Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, packaging, production, alcohol content, flavor, and distribution channel.

Breakup by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Standard lager accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes standard lager, premium lager, specialty beer, and others. According to the report, standard lager represented the largest segment.

Standard lagers’ mild flavor profile and easy drinkability, make it a popular choice for casual beer drinkers and large-scale events. Due to its affordable price, standard lager is accessible to a wide range of consumers. Moreover, with major beer companies heavily investing in the marketing and distribution of standard lager brands to solidify their position and visibility in the industry, the market is contributing to the market growth. Apart from this, the combination of broad appeal, affordability, accessibility, and marketing efforts has enabled standard lager to maintain its popularity in United States beer market share.

Breakup by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Glass holds the largest share of the industry

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes glass, PET bottle, metal can, and others. According to the report, glass accounted for the largest market share.

Glass packaging holds the largest share due to excellent protection against external factors such as light and oxygen, which can degrade the quality of beer over time. This keeps the beer's flavor freshness intact and guarantees that customers will have a great drinking experience. Additionally, through its transparent look, customers can see the beer's color and clarity, which may influence the consumer's purchasing decision. Furthermore, glass is recyclable and widely accepted by recycling programs, making it an environmentally friendly packaging option that resonates with consumers concerned about sustainability. Its versatility in accommodating various beer styles and branding options also contributes to its popularity among breweries.

Breakup by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Macro-brewery represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the production. This includes macro-brewery, micro-brewery, and others. According to the report, macro-brewery represented the largest segment.

Macro-breweries’ economies of scale, allowing them to produce beer in large quantities at lower costs compared to smaller breweries are impelling the market growth. Macro breweries attract customers who are on a tight budget by offering their products at affordable prices. As they have substantial marketing budgets and wide-ranging distribution networks, macro-breweries are able to reach a sizable audience and uphold strong brand visibility. Moreover, macro-breweries often produce well-known brands that have a loyal customer base, propelling the United States beer market revenue. While craft breweries have gained popularity in recent years, the sheer size and resources of macro-breweries allow them to maintain their dominance in the industry.

Breakup by Alcohol Content:

- High

- Low

- Alcohol-Free

High alcohol beer exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the alcohol content have also been provided in the report. This includes high, low, and alcohol-free. According to the report, high alcohol beer accounted for the largest market share.

High-alcohol beer has shown clear supremacy as it caters to a niche segment of consumers who seek a stronger and more intense drinking experience. This niche includes enthusiasts of craft beer styles such as imperial stouts, barleywines, and double IPAs, which typically have higher alcohol content. In line with this, high-alcohol beers often command higher prices, contributing to their appeal among consumers seeking premium and specialty products. Furthermore, the craft beer movement has popularized experimentation with higher alcohol content, leading to an increase in the availability and variety of high-alcohol beer options. While standard lagers still hold a significant market share, the growing consumer interest in craft beer and premium offerings has propelled high-alcohol beer to dominance in its niche segment, reflecting evolving tastes and preferences in the market.

Breakup by Flavor:

- Flavored

- Unflavored

Unflavored is the largest segment in the market

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes flavored and unflavored. According to the report, unflavored represented the largest segment.

The unflavored segment accounts for the largest market share owing to a wide range of consumers with their classic and familiar taste profiles. These beers are often perceived as versatile and suitable for various occasions, making them a staple choice for many beer drinkers. Additionally, unflavored beers are commonly produced by macro-breweries, which benefit from extensive distribution networks and brand recognition, allowing them to maintain a dominant position in the market. While flavored beers have gained popularity in recent years, particularly among craft breweries, the sheer volume of unflavored beer consumption continues to outweigh that of flavored varieties.

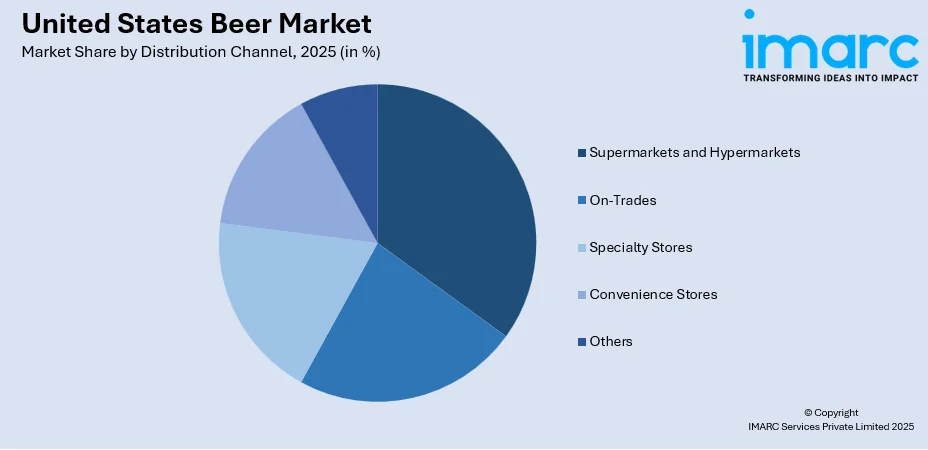

Breakup by Distribution Channel:

To get detailed segment analysis of this market Request Sample

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Supermarkets and hypermarkets are the predominant market segment

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

Supermarkets and hypermarkets stand as the predominant market segment due to the wide selection of beer brands and varieties, catering to the diverse preferences of consumers. The convenience of one-stop shopping attracts customers seeking convenience and variety in their beer purchases. Additionally, supermarkets and hypermarkets often leverage promotions, discounts, and bulk purchasing options to attract customers, further solidifying their dominance in the market. Moreover, these large retail chains benefit from extensive advertising and marketing efforts, enhancing brand visibility and consumer awareness of available beer options. While specialty beer stores and liquor stores cater to niche markets, the sheer size, accessibility, and promotional strategies of supermarkets and hypermarkets position them as the leading distribution channels for beer in the U.S. market.

Breakup by Region:

- Northeast

- Midwest

- South

- West

West leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the country, which include Northeast, Midwest, South, and West. According to the report, West was the largest market for beer in the United States.

The United States beer market forecast indicates the West region's dominance due to the vibrant beer cultures in Portland, San Diego, and Denver, fostering a strong demand for craft and specialty beers. Additionally, the West boasts a large population with a high concentration of young, affluent consumers who are willing to experiment with different beer styles and brands. Furthermore, the region's favorable climate and geography support the growth of ingredients used in beer production, such as hops and barley, contributing to the proliferation of local breweries and artisanal beer offerings. Moreover, the West's progressive regulatory environment and consumer preferences for sustainability and organic products align well with the values often associated with craft beer, further driving its market dominance in the region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- In the U.S. beer market, competition is fierce among a variety of players, reflecting diverse consumer preferences and a dynamic industry landscape. Macro-breweries dominate the market with their well-established brands, extensive distribution networks, and significant marketing budgets. These companies compete not only with each other but also with smaller regional breweries and craft beer producers. The craft beer movement, fueled by consumer demand for unique flavors and local products, has seen explosive growth, leading to a proliferation of independent breweries across the country. These craft breweries often focus on quality, innovation, and community engagement to differentiate themselves in the market. Additionally, changing consumer preferences, including a shift towards premium and specialty beers, further intensify competition as breweries vie for market share by offering diverse product portfolios and engaging marketing strategies.

United States Beer Market News:

- In August 2023, Edinburgh-based brewery Innis & Gunn launched its latest creation, 12 Moons Lager. Bottled during the full moon, it matured for a year in just 75 bottles. With 5.8% alcohol content, this unpasteurized, bottle-conditioned lager joins Innis & Gunn's 2023 limited-edition collection as its fourth offering.

United States Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packagings Covered | Glass, PET Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Contents Covered | High, Low, Alcohol-Free |

| Flavors Covered | Flavored, Unflavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States beer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States beer market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States beer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States beer market was valued at USD 109.3 Billion in 2025.

We expect the United States beer market to exhibit a CAGR of 2.20% during 2026-2034.

The rising demand for premium craft beer, along with the introduction of beer variants in exotic and tropical flavors, is primarily driving the United States beer market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of beer across the nation.

Based on the product type, the United States beer market has been divided into standard lager, premium lager, specialty beer, and others. Among these, standard lager currently exhibits a clear dominance in the market.

Based on the packaging, the United States beer market can be categorized into glass, PET bottle, metal can, and others. Currently, glass holds the largest market share.

Based on the production, the United States beer market has been segregated into macro-brewery, micro-brewery, and others. Among these, macro-brewery currently accounts for the majority of the total market share.

Based on the alcohol content, the United States beer market can be bifurcated into high, low, and alcohol-free. Currently, high exhibits a clear dominance in the market.

Based on the flavor, the United States beer market has been segmented into flavored and unflavored, where unflavored currently holds the largest market share.

Based on the distribution channel, the United States beer market can be divided into supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others. Currently, supermarkets and hypermarkets exhibit a clear dominance in the market.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where West currently dominates the United States beer market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)