United States Beverage Packaging Market Size, Share, Trends and Forecast by Material, Product, Application, and Region, 2025-2033

United States Beverage Packaging Market Size and Share:

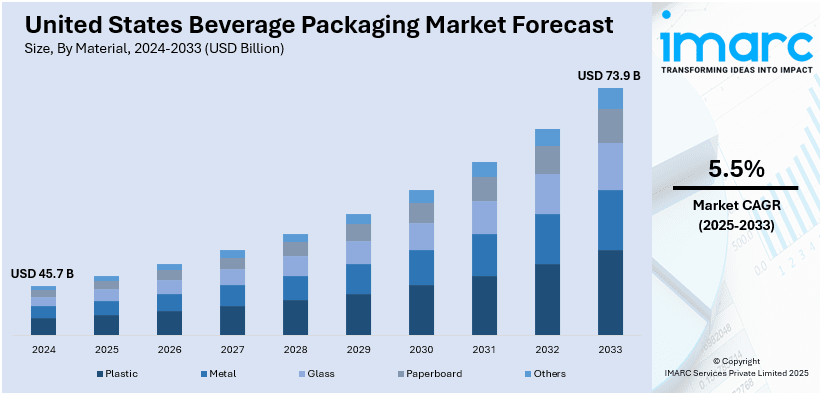

The United States beverage packaging market size was valued at USD 45.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 73.9 Billion by 2033, exhibiting a CAGR of 5.5% from 2025-2033. The US market is driven by the growing consumption of functional beverages, including improved waters, probiotic drinks, plant-based milk, and vitamin-infused juices, along with the rising demand for PET bottles due to its portability and ease of use during travel or exercise.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.7 Billion |

| Market Forecast in 2033 | USD 73.9 Billion |

| Market Growth Rate (2025-2033) | 5.5% |

Every day, the public is showing more concern about the negative impact that single-use plastics have on the environment. Thus, glass, aluminum, and other biodegradable plastics are considered most sought after for packaging nowadays. Corporations also are worried about maintaining their business because people are loyal to more sustainable brands. Moreover, aluminum is quite recyclable, does not lose quality and that is the reason why it is commonly used for bottles of beer, sodas and energy drinks. Glass, another material that is very recyclable, is also becoming popular for bottles of premium drinks owing to its quality and sustainability attributes. In order to cut down the use of virgin plastics and complete the recycle loop, beverage industry producers are using recycled plastics for the containers. As per the IMARC Group’s report, the United States green packaging market is expected to reach US$ 104.3 Billion by 2032.

The growth of functional and natural ready to drink (RTD) beverages which include fortified fruit juices enhanced with vitamins, minerals, or antioxidants is driven by the increasing emphasis of consumers on their well-being. This creates a demand for packages that preserve original flavor of fruit juices and their nutrients while encouraging the application of advanced packaging technologies like aseptic and vacuum sealed containers. Additionally, the fruit juice market requires good packaging that is more transparent because it displays the natural appearance of the juice while promoting its premium image. The IMARC Group’s report shows that the United States fruit juice market is expected to reach USD 77.5 Billion by 2033.

United States Beverage Packaging Market Trends:

Health and wellness trends

As customers look for drinks with extra health advantages, functional beverages including improved waters, probiotic drinks, plant-based milk, and vitamin-infused juices are becoming more popular. These goods need to be packaged to protect delicate components like vitamins or probiotics, which is why aseptic packaging and other cutting-edge materials and technologies are being used. Consumers who are concerned about their health are eager to learn about what they eat. Transparent packaging materials, such glass or clear PET bottles, increase appeal and confidence by letting customers see the goods. Clean and simple labeling on packaging designs highlights natural ingredients and offers comprehensive nutritional data, which is consistent with wellness-focused branding. Single-serve or portion-controlled packaging is in greater demand as a result of the growing emphasis on controlling sugar and calorie intake. The content published on the website of the IMARC Group’s report shows that the United States health and wellness market size is projected to exhibit a growth rate (CAGR) of 6.02% during 2024-2032.

Growing consumption of energy drinks

Active people and busy professionals looking for on-the-go energy alternatives are big fans of energy drinks. Lightweight packaging and single-serve cans that can be conveniently carried around are perfect for water bottles and small cans of energy drinks. Aluminum cans are best for such packaging needs because of their capability to protect the taste and fizziness of drinks. At the same time, as more customers seek eco-friendly options, the recyclability of aluminum makes it an attractive choice. Attractive packing design is an advantage for energy drinks sellers, especially targeting the younger generations like the millennials and generation Z. These combinations create shelf space for the products and offer products benefits over competitors in a market which is overcrowded. According to the IMARC Group’s report, the United States energy drinks market is expected to reach US$ 20.4 Billion by 2032.

E-commerce growth

Online beverages must be packaged to survive the stresses of transportation, such as possible knocks, temperature fluctuations, and extended storage. To maintain product integrity, this is prompting advancements in multi-layered packaging, shock-resistant materials, and leak-proof designs. The desire for specialized, small packaging that fits neatly into regular delivery boxes is being driven by the popularity of beverage subscription services, such as those for coffee, functional drinks, and bottled water. Convenience-focused packaging choices, including multi-pack or pre-portioned pouches, are also much sought after. Customers that care about the environment anticipate that e-commerce packaging should reflect their values. To cut waste and improve sustainability, beverage companies are implementing recyclable materials like rPET, biodegradable alternatives, and simple secondary packaging. The IMARC Group’s report predicted that United States e-commerce market is expected to reach US$ 2,083.97 Billion by 2032.

United States Beverage Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States beverage packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, product, and application.

Analysis by Material:

- Plastic

- Metal

- Glass

- Paperboard

- Others

Affordable, lightweight, and easy to design, plastic still holds the largest market share in the United States. Enhancements in recyclable and biodegradable polymers, particularly rPET, are aiding in resolving environmental concerns and encouraging the continuous utilization of plastic, especially for water, soft drinks, and functional beverages.

Owing to its durability, recyclability, and flavor-preserving properties, metal, most commonly seen in metal cans, is widely used in carbonated drinks, energy drinks, and craft beverages. Both the regular and premium beverage markets are experiencing an increase in demand due to its sleek and contemporary appearance and high consumer acceptance.

Glass is a popular choice for alcoholic beverages, juices, and high-end goods because of its superior barrier qualities, premium appearance, and environmentally beneficial nature. Glass packaging appeals to people who are concerned about their health and the environment since it is perceived as sustainable and high-quality, even though it is more expensive and heavier.

Because paperboard is lightweight, biodegradable, and suitable for aseptic packaging, it is frequently used for milk, juices, and plant-based beverages. Paperboard cartons are becoming more popular due to consumer preferences for sustainable packaging, particularly in eco-friendly and organic product lines.

Analysis by Product:

- Bottles

- Cans

- Pouches

- Cartons

- Others

Because they are versatile and consumers want resealable options, bottles, made of materials like plastic, glass, and metal, dominate the beverage packaging market. They are frequently used for water, juices, soft drinks, and alcoholic beverages, and there is a developing market for environment friendly alternatives like lightweight glass and rPET.

Owing to their longevity, capacity to be recycled, and ability to preserve product freshness, cans are a popular choice for carbonated drinks, energy drinks, and alcoholic beverages. Aluminum cans' eco-friendly appeal and stylish, portable shape are leading to their widespread use in a variety of beverage categories.

On account of their cost-effectiveness, lightweight form, and versatility, pouches are becoming more popular in the United States beverage market. They are perfect for juices, sports drinks, and children's drinks. Consumer requirements for sustainability and convenience are met by their resealable characteristics and lower material consumption.

Often composed of paperboard, cartons are prized for their aseptic and environmentally beneficial packaging properties and are used for goods like milk, plant-based drinks, and juices. Brands that care about the environment and present a sustainable image are increasingly choosing cartons.

Analysis by Application:

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Carbonated Drinks

- Bottled Water

- Milk

- Fruit and Vegetable Juices

- Energy Drinks

- Plant-Based Drinks

- Others

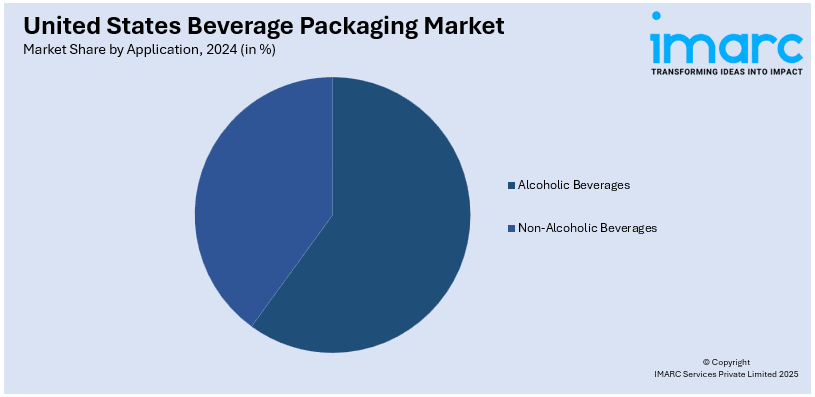

The demand for high-end packaging options, such as glass bottles, aluminum cans, and pouches, for ready-to-drink (RTD) cocktails is driven by alcoholic beverages, such as beer, wine, and spirits. Innovations like recyclable aluminum cans and lightweight glass bottles are increasing due to the emphasis on sustainability and aesthetics in an effort to appeal to people who care about the environment.

With a variety of material and design specifications, non-alcoholic beverages, which include water, soft drinks, juices, energy drinks, and functional drinks, dominate the beverage packaging market in the United States. Consumer desires for everyday beverages that are more convenient and sustainable are being met by innovations in lightweight polymers, resealable cans, and environment friendly cartons.

Analysis by Regional:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

To meet the ever-evolving demands of consumers and regulations, key players in the United States beverage packaging industry are focused on incorporating sustainability, new technologies, and product personalization. Companies are introducing lightweight aluminum products, biodegradable alternatives, and recycled polymers (rPET) to reduce their ecological footprint. Innovative technology like smart packaging with QR codes and NFC tags is also helping improve customers’ interaction with products and transparency of the information provided. Businesses are also shifting their emphasis towards personalization to include unique shapes and photographs and images on packaging as per various consumer segments. The major companies within the country are also concentrating on mergers and acquisitions (M&A) and partnerships for growth. For instance, in July 2024, Suzano announced the acquisition of industrial assets from Pactiv Evergreen in the United States. The acquisition is for US$110 million and comprises two mills in Pine Bluff, Arkansas, and Waynesville, North Carolina, which produce liquid packaging board and cupstock.

The report provides a comprehensive analysis of the competitive landscape in the United States beverage packaging market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: The Coca-Cola Company launched 100% recycled polyethylene terephthalate (rPET) 20-oz bottles for Coca-Cola Trademark goods in the United States. The company is focusing on reducing energy use and carbon emissions through this initiative.

United States Beverage Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Metal, Glass, Paperboard, Others |

| Products Covered | Bottles, Cans, Pouches, Cartons, Others |

| Applications Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States beverage packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States beverage packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States beverage packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Beverage packaging refers to the materials and designs used to encase and protect beverages for storage, transportation, and consumption. It includes bottles, cans, pouches, and cartons made from materials like plastic, metal, glass, and paperboard. It also ensures product safety, extends shelf life, and enhances branding, catering to consumer preferences for convenience, sustainability, and aesthetic appeal.

The United States beverage packaging market was valued at USD 45.7 Billion in 2024.

IMARC estimates the United States beverage packaging market to exhibit a CAGR of 5.50% during 2025-2033.

The growth of the beverage packaging industry can be attributed to rising consumption of energy drinks, juices, ready to drink (RTD) products, advances in packaging technology, e-commerce growth, and need for sustainable packaging solutions. Increased health consciousness among individuals, coupled with an emergence of smart packaging materials and technologies, resulting in a growing appreciation for premium products thus reinforcing the market growth initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)