United States Business Jet Market Size, Share, Trends and Forecast by Type, Business Model, Range, Point of Sale, and Region, 2025-2033

United States Business Jet Market Size and Share:

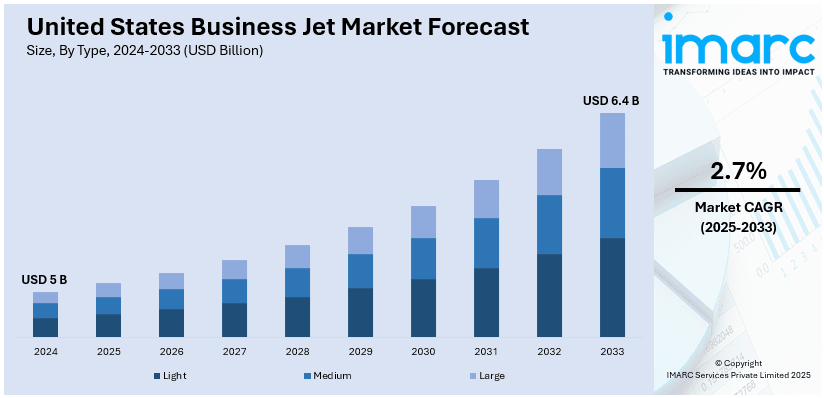

The United States business jet market size was valued at USD 5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 2.7% from 2025-2033. The market is experiencing growth driven by increased demand for private air travel, rising corporate investments in modernized fleets, and a shift toward safer, flexible, and more efficient travel options to meet evolving customer needs and optimize business operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate (2025-2033) | 2.7% |

The United States business jet market is driven by an increasing demand for private air travel, particularly among high-net-worth individuals (HNWIs) and corporate executives seeking greater flexibility, convenience, and privacy. This trend is boosted by the desire for time savings, which is a significant factor for busy professionals who value efficiency. Additionally, technological advancements in business jets, such as improved fuel efficiency, enhanced safety features, and modern amenities, are encouraging more individuals and companies to invest in private aircraft. For instance, in October 2024, Textron Aviation introduced the Cessna Citation CJ4 Gen3 at NBAA-BACE in Las Vegas, naming Ryan Samples as its launch customer. Featuring Garmin G3000 PRIME avionics, Emergency Autoland, and Autothrottles, the aircraft showcases cutting-edge technology and is set to enter service in 2026. Furthermore, the expanding number of ultra-high-net-worth individuals (UHNWIs) in the U.S. also plays a crucial role in driving demand for business jets, as these individuals prefer private travel for both business and leisure purposes.

Moreover, the rising global business activities and the growing need for faster, more secure travel solutions are key factors in the expansion of the U.S. business jet market. Corporations are intensely investing in their own fleets to reduce dependency on commercial airlines and offer executives tailored flight schedules. Additionally, the desire for corporate fleet modernization, with newer, highly efficient aircraft offering lower operational costs and improved performance, is accelerating demand. Further driving the market's expansion has been the ongoing growth of the charter flight sector and easier access to fractional ownership plans. The U.S. business jet industry is moving towards lower priced, safe, and convenient air travel options, which is reflected in these aspects taken together.

United States Business Jet Market Trends:

Demand for Private Travel and Corporate Efficiency

The growing preference for private travel is one of the leading trends propelling the U.S. business jet market. The rising numbers of HNWIs and corporate executives seeking more flexibility in their schedules, private jets provide the perfect solution for convenient, time-efficient, and secure travel. Business owners and senior managers increasingly value the ability to optimize their time, ensuring they can maintain productive work schedules while traveling. Additionally, private air travel offers more privacy, avoiding long waits at airports and eliminating the hassle of commercial travel. This trend is further strengthened by the rise of on-demand charter services, where businesses and individuals can hire jets without the full ownership burden, offering flexibility and convenience.

Corporate Fleet Modernization

Fleet modernization is another key trend driving the U.S. business jet market. Companies are intensely replacing older jets with newer, more fuel-efficient, and environmentally friendly models. These modern jets not only reduce operational costs but also meet evolving regulatory standards regarding emissions and noise. The integration of advanced technology, newer business jets come equipped with state-of-the-art avionics, enhancing flight safety and comfort. As per the sources, in October 2024, Wheels Up announced a fleet modernization strategy, transitioning to Embraer Phenom 300 and Bombardier Challenger 300 series aircraft. The plan includes acquiring GrandView Aviation’s Phenom fleet, selling Citation X jets, and enhancing customer experience with advanced Gogo Galileo HDX WiFi. Moreover, the corporate fleet upgrades are driven by the need to ensure that business jets remain competitive in terms of performance, operational efficiency, and passenger experience. The companies are placing a higher value on sustainable and high-performing equipment, the demand for modern business jets continues to amplify, benefiting both large corporations and small businesses looking to optimize travel.

Technological Advancements and Cost Efficiency

Technological innovation is transforming the U.S. business jet market, making private air travel more accessible and cost-efficient. Advances in aircraft design, materials, and propulsion systems have made jets lighter and more fuel-efficient, reducing operating costs. According to the sources, in October 2024, The ACJ TwoTwenty redefined business aviation with ultimate comfort, advanced technology, and sustainability. Offering 73 m² of cabin space across six customizable zones, it combines fly-by-wire innovation, superior connectivity, and unmatched range of 5,650 nautical miles for intercontinental flights. These improvements are particularly attractive to businesses seeking to optimize their travel budgets while still maintaining the advantages of private air travel. Moreover, the introduction of newer engines and flight management systems has made business jets safer and more efficient. The development of hybrid and electric aircraft also promises to further reduce environmental impact, making private aviation more sustainable in the long run. As technological advancements continue, business jets are becoming more affordable and appealing to a broader range of corporate clients, ensuring sustained market growth.

United States Business Jet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States business jet market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, business model, range, and point of sale.

Analysis by Type:

- Light

- Medium

- Large

Light business jets provide affordable travel options for small parties and are built for short- to medium-distance flights. These aircraft are appropriate for regional business travel which offer a comfortable and effective substitute for commercial flights. They can usually carry 4–8 passengers. Their rapid turnaround time and price make them popular with entrepreneurs and small businesses.

Medium business jets have a wider range for medium-haul flights and can accommodate a bigger group of passengers, usually 7-9. The cost, range, and comfort of these jets are balanced. They are preferred by business leaders who often travel between large cities due to their raised passenger amenities and higher fuel economy. They frequently have onboard amenities and chairs can be fully reclined.

The largest business jets carry as many as 18 people and are designed for the long haul. Such planes offer large cabins, fitted with state-of-the-art amenities such as private sleeping quarters, conference rooms, and fully functional kitchens. For long-distance travel, it is the most private, comfortable, and convenient choice for wealthy individuals and major businesses.

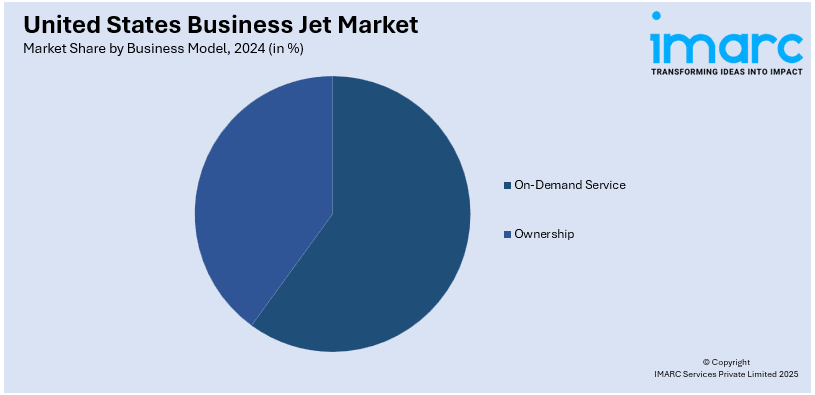

Analysis by Business Model:

- On-Demand Service

- Air Taxis

- Branded Charters

- Jet-Card Programs

- Ownership

- Fractional Ownership

- Full Ownership

Air taxis offer rapid, short-distance travel, enabling urban commuters to bypass traffic congestion with cost-effective, point-to-point service. They provide flexibility and efficiency for travelers needing quick transportation, making them a vital solution in urban mobility.

Branded charters cater to luxury and corporate travelers with bespoke flight services. Offering tailored experiences, these charters ensure privacy, customization, and comfort, appealing to clients seeking premium, hassle-free air travel for business or leisure.

Jet-card programs provide pre-paid flight access without ownership, offering flexibility in aircraft selection and usage. Members benefit from convenience, freedom from long-term commitments, and operational simplicity, attracting clients seeking accessible and adaptable private aviation options.

Fractional ownership enables shared jet ownership, reducing acquisition costs while retaining access to private aviation. Ideal for individuals or firms requiring flexible air travel, it blends affordability with significant operational and scheduling advantages.

Full ownership offers exclusive jet control, ensuring complete scheduling freedom and tailored travel. Suited for high-frequency flyers or corporations, it delivers privacy, convenience, and luxury, meeting the demands of unrestricted private air travel.

Analysis by Range:

- < 3,000 NM

- 3,000 - 5,000 NM

- > 5000 NM

Aircraft with a range of less than 3,000 nautical miles are typically used for short to medium domestic flights. These jets are highly efficient for regional business travel, offering quick access to nearby cities and providing cost-effective solutions for companies with frequent, short-distance travel needs. Their compact size and affordability make them popular for regional operations.

Jets within the 3,000 to 5,000 nautical miles range are ideal for longer domestic and transcontinental flights. These aircraft are favored for business trips across the United States and international travel to nearby regions. Offering a balance of size, range, and operational cost, they are well-suited for companies with global outreach and frequent international operations.

Business jets with a range exceeding 5,000 nautical miles are designed for long-haul international travel, providing nonstop connectivity between major global hubs. These aircraft are equipped with luxurious amenities and are typically used by high-net-worth individuals and large corporations for global mobility. They combine comfort, speed, and efficiency, offering significant time-saving advantages.

Analysis by Point of Sale:

- OEM

- Aftermarket

The OEM segment in the business jet market includes direct manufacturing and sales of new aircraft. The OEMs offer jets with state-of-the-art technology, performance capabilities, and customization options. Aircraft sold through this channel cater to corporate fleets, private owners, and charter services, offering long-term value through innovation and advanced safety features.

The aftermarket segment involves replacement parts, maintenance services, and upgrades for business jets in existence. As the age of these aircraft increases, it is highly important to have access to the right aftermarket services in order to maintain optimal performance levels adhering to the safety regulations in force. This segment contributes to business jet operational efficiency and life expectancy, catering to owners and operators with customized solutions for avionics, engines, and cabin amenities.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States is a significant hub for business jet activity, driven by high levels of corporate headquarters, financial institutions, and tech startups. This region sees strong demand for private aviation services, with proximity to major airports like New York City’s Teterboro enhancing its appeal.

The Midwest, with its strong industrial base and large agricultural sector, drives a steady demand for business jets, especially among manufacturers and agricultural conglomerates. Cities like Chicago, Detroit, and Minneapolis are key centers for aviation, with corporate fleets and frequent private air travel being essential for business operations.

The South region benefits from a mix of economic drivers, including energy, tech, and healthcare industries, with states like Texas and Florida being hotspots for business aviation. The region’s favorable climate and growing urban centers, such as Houston and Miami, contribute to a rise in both private jet ownership and on-demand services.

The West, particularly California, is a leader in the United States business jet market due to its large concentration of tech giants, entertainment industries, and affluent individuals. With key cities like Los Angeles and San Francisco driving demand, the region has seen significant growth in private jet travel, both for corporate and leisure purposes.

Competitive Landscape:

The competitive landscape of the U.S. business jet market is shaped by established OEMs like Gulfstream, Bombardier, and Dassault, alongside innovative service providers. OEMs focus on technological advancements and sustainability, introducing fuel-efficient and long-range jets to meet evolving customer preferences. Service providers diversify their offerings through jet cards, fractional ownership, and branded charters, targeting convenience-oriented clients. Emerging players leverage digital platforms for on-demand services, appealing to tech-savvy users. Collaboration with aviation service companies for aftermarket support enhances brand loyalty. Market consolidation through partnerships and acquisitions is also a key trend, creating synergies and expanding geographical presence. Strong competition encourages innovation, with industry leaders striving to maintain their positions in a dynamic market influenced by shifting customer demands and regulatory advancements.

The report provides a comprehensive analysis of the competitive landscape in the United States business jet market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Gulfstream's G700 redefines luxury and sustainability in business jets, featuring a master suite, chef-friendly galley, and advanced Rolls-Royce Pearl 700 engines. With a range of 14,353 km and a speed of Mach 0.935, the $45.9 billion business jet market is poised for growth. Deliveries start in 2026, reflecting strong demand.

- Textron Aviation debuted the CJ4 Gen3, CJ3 Gen3, and M2 Gen3 business jets, the next generation of Cessna Citation aircraft, during NBAA-BACE in Las Vegas in October 2024.. Featuring Garmin Emergency Autoland and advanced G3000 PRIME avionics, these jets promise enhanced safety and efficiency with improved connectivity, and lower operating costs.

United States Business Jet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Large |

| Business Models Covered |

|

| Ranges Covered | < 3,000 NM, 3,000 - 5,000 NM, > 5000 NM |

| Point of Sales Covered | OEM, Aftermarket |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States business jet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States business jet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States business jet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A business jet is a small, private aircraft intended for the swift and comfortable transportation of high-level passengers, such as entrepreneurs or executives. Business jets are commonly used for corporate travel, providing flexibility and time savings by avoiding commercial airport delays. These jets are equipped with luxury amenities, such as conference rooms, fully stocked kitchens, and reclining seats, making them ideal for executive functions, client meetings, and long-distance travel.

The United States business jet market was valued at USD 5 Billion in 2024.

IMARC estimates the United States business jet market to exhibit a CAGR of 2.7% during 2025-2033.

Key factors driving the United States business jet market include rising demand for private air travel among executives, increasing corporate fleet investments, growing preference for flexible travel solutions, enhanced operational efficiency, expanding fractional ownership programs, and technological advancements in aircraft design for fuel efficiency, sustainability, and superior passenger comfort.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)