United States Cellulose Acetate Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

United States Cellulose Acetate Market Size and Share:

The United States cellulose acetate market size was valued at USD 1.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.77 Billion by 2033, exhibiting a CAGR of 4.90% from 2025-2033. Northeast currently dominated the market owing to the increasing demand for sustainable materials, rapid advancements in manufacturing technologies, rising health consciousness, stricter environmental regulations, and the expansion of industries such as fashion, eyewear, and medical devices, with a strong emphasis on biodegradability, recycling, and eco-friendly alternatives to traditional plastics are major factors bolstering the United States cellulose acetate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2033 | USD 2.77 Billion |

| Market Growth Rate (2025-2033) | 4.90% |

United States Cellulose Acetate Market Analysis:

- Major Drivers: Surging demand for biodegradable and environmentally friendly materials in various industries, especially as substitutes for traditional plastics. Government policies favoring sustainable materials, improvements in production processes due to technological developments, and heightened health awareness fueling demand in medical devices and cigarette filters are the major drivers stimulating the United States cellulose acetate market growth.

- Key Market Trends: Increased focus on sustainability in fashion and textiles, improvement in manufacturing technology, and lowering of production costs, as well as circular economy efforts to recycle cellulose acetate products. Trends in the United States cellulose acetate market show high demand for renewable wood pulp-based materials over petroleum-based synthetic materials in various applications.

- Challenges: The U.S. cellulose acetate industry is confronted with increasing competition from bio-based and synthetic alternatives, fluctuating raw material prices, and strict environmental regulations. Declining demand from traditional cigarette filter applications adds pressure to the market while elevated production costs and supply chain disruptions further constrain expansion, necessitating companies to innovate and diversify use.

- Opportunities: According to the United States cellulose acetate market analysis, the major opportunities are in growing demand for sustainable packaging, fabrics, and bioplastics, spurred by environmentally friendly consumers and policy support. Biodegradable film innovation, medical uses, and specialty fiber applications enhance market growth. Increased emphasis on lowering plastic waste places cellulose acetate as a broad, renewable option in emerging green technologies and businesses.

The demand for biodegradable and eco-friendly materials, such as cellulose acetate, has risen significantly in the U.S., particularly within industries seeking alternatives to plastic. A report estimates that around 11 million metric tons of plastic are released into the ocean annually. To counter this, cellulose acetate is being increasingly adopted as a biodegradable alternative to single-use plastics, especially in packaging and fashion industries. By January 2023, the percentage of consumers requesting sustainable packaging solutions had risen to 81%. As a result, brands such as Patagonia and L’Oréal are also incorporating more cellulose-based packaging in their products as part of their sustainability goals. The market for green packaging in the country is projected to grow by 4.3% annually from 2024 and 2032, further boosting the United States cellulose acetate market demand.

To get more information on this market, Request Sample

The fashion industry in the U.S. is experiencing a notable transition towards the use of more sustainable materials. Specifically, cellulose acetate fibers are becoming popular in the U.S. due to their sustainable, high-performance qualities. Known for its use in acetate-based fabrics like acetate silk, which is soft and luxurious to the touch, this material has been increasingly favored by textile manufacturers. The growth of the fashion and textile industry in the U.S. has led to a rise in the demand for high-quality synthetic fibers that can mimic natural silk. The textile market in the country is projected to reach USD 277.4 billion by 2033, with a compound annual growth rate (CAGR) of 4.1% from 2025 to 2033. Cellulose acetate, being both a high-performing and environmentally safer alternative, fits this need. Unlike other synthetics like polyester, which are derived from petroleum-based resources, cellulose acetate is made from renewable wood pulp, making it more appealing to both manufacturers and consumers looking for greener alternatives. Moreover, as fashion brands and designers are becoming more conscious of their environmental footprint, cellulose acetate offers a way to maintain luxurious, durable, and stylish products without contributing heavily to plastic pollution.

United States Cellulose Acetate Market Trends:

Rising Health Consciousness and Demand for Non-Toxic Alternatives

With more people becoming conscious of their health, the demand for products that are less toxic and non-hazardous to human life is also expanding. This especially affects the requirement of cellulose acetate in items such as cigarette filters and medical devices. Cellulose acetate-based cigarette filters have been used by the industry as a standard product since time immemorial. Their proven ability to reduce tar and nicotine levels portrays them as a safe and healthier cigarette, as opposed to unfiltered cigarettes. With the current growth rate of the cigarette market reaching staggering US$ 81.2 billion by 2032, the need for cellulose acetate will also rise. On the medical side, cellulose acetate's non-toxic and hypoallergenic properties have made it the preferred material for surgical and medical applications like wound dressings, catheters, and other biomedical devices. Concerns about the health risks related to synthetic chemicals and plastic products are on the rise, so the use of cellulose acetate is favored, as it is considered safer and more inert with the human body.

Advancements in Manufacturing Technology

The continuous development in product manufacturing and processing technologies has also been one of the primary drivers of the United States cellulose acetate market growth. Current innovations in cellulose acetate manufacturing have made it more economical and energy-efficient to manufacture the material. With this, more industries and manufacturers can access it. New processing techniques, including more environmentally friendly solvents in production, have decreased the environmental impact of cellulose acetate production. Such advancements make the material even more attractive to industries looking for sustainable and cost-effective alternatives to traditional plastics. In addition, technological advancements in recycling cellulose acetate products, such as used filters and textiles, open up circular economy opportunities that are further increasing the demand for the material in the U.S. market.

Government Regulations and Environmental Policies

Current regulation and policies against plastic waste through sustainability have given a boost to the United States cellulose acetate market share. The United States government in coordination with federal, state, and local has come up with stringent environmental legislation targeting single-used plastics and wastes. Such strict regulatory policies encourage corporations to look at biodegradable cellulose as an alternative where cellulose-based materials can also deteriorate naturally to not leave harsh residues. Bans on plastics related to single-used products such as bags or polystyrene, and requirements on recyclability materials, among others are promoting industries to use bioplastic products. For instance, through the adoption of the "National Strategy to Prevent Plastic Pollution: Part Three of a Series on Building a Circular Economy for All," the U.S. administration aims to eliminate the release of plastic waste from both land and sea-based sources into the environment by 2040. The U.S. government has also provided incentives for companies that adopt sustainable production practices, making cellulose acetate a more attractive option.

United States Cellulose Acetate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States cellulose acetate market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application.

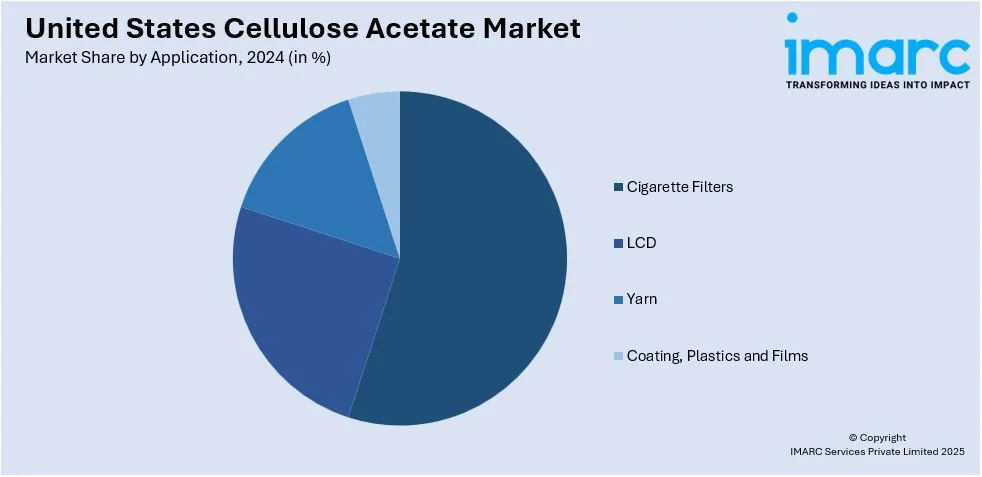

Analysis by Application:

- Cigarette Filters

- LCD

- Yarn

- Coating, Plastics and Films

As per the United States cellulose acetate market forecast, in 2024, cigarette filters dominate the market because cellulose acetate is the material of choice in these filters due to its ability to efficiently minimize the intake of nicotine and hazardous tar while preserving structural integrity. Demand for filters remains high despite a decline in smoking rates because of continuous tobacco consumption in the global arena, a drive towards effective health legislations, and increasing air quality and public health awareness. As a result, the cellulose acetate filter market is expected to be buoyant because it derives momentum from regulatory requirements as well as due to growing demand for eco-friendly tobacco products with more sustainable, biodegradable filter materials being developed.

Regional Analysis:

- Northeast

- Midwest

- South

- West

According to the United States cellulose acetate market outlook, the northeast region holds the largest market share in 2024. This is because of its well-established manufacturing and industrial infrastructure. Major cities like New York, Boston, and Philadelphia are located in this region, which benefits from strong demand across several sectors, including fashion, medical, and consumer goods. A majority of companies that focus on sustainability are located in the Northeast, which adds to its wide range of usage of biodegradable materials such as cellulose acetate. In 2023, the Northeast accounted for considerable consumption of the product mainly due to its robust industrial base, innovation in manufacturing technology, and increasing consumer demand for eco-friendly products. With increasing stringency of regulations, the focus on sustainable production practices of the Northeast continues to strengthen it as the market leader in cellulose acetate.

Competitive Landscape:

According to the recent United States cellulose acetate market trends, the major players in the market are continuously increasing their production capacity, innovating in green manufacturing practices, and enhancing the product portfolio in accordance with the environmental requirements. Companies are also focusing on investing in cutting-edge production technologies that reduce energy use and lower the environmental impact of cellulose acetate production. Some have been focused on developing biodegradable and recyclable cellulose acetate for various applications like cigarette filters and textiles. Meanwhile, others are innovating in the development of high-quality, non-toxic cellulose acetate for medical applications, such as surgical sutures and wound dressings, which is the health-conscious, eco-friendly trend. The leading firms are also enhancing their position in the tobacco industry by improving the efficiency and sustainability of their cellulose acetate filters. The United States cellulose acetate companies are also working in collaboration with the recycling organizations that help improve the recovery and reuse of cellulose acetate products in pursuit of closing a loop in the circular economy.

The report provides a comprehensive analysis of the competitive landscape in the United States cellulose acetate market with detailed profiles of all major companies.

Recent News and Developments:

- In March 2025, DAICEL CORPORATION launched BELLOCEA® BS7, an eco-friendly cosmetic texture improver made from cellulose acetate. Designed to replace microplastic microbeads, BS7 offers both high biodegradability and a smooth, soft feel. Biodegrading in soil, compost, and marine environments, it meets European standards. With the EU set to ban microbeads in cosmetics by 2035, BELLOCEA® BS7 provides a sustainable, biodegradable solution for global cosmetic manufacturers.

- In October 2024, Eastman and UPM Specialty Papers revealed that they have collaborated to develop an innovative biopolymer-coated paper packaging solution. They used Eastman’s biobased and compostable Solus that are made from cellulose acetate and UPM’s BioPBS polymer. This packaging solution is specifically designed for food applications that require grease and oxygen barriers.

- In April 2024, Eastman collaborated with circular solutions provider, Debrand, with an aim to repurpose textile waste into innovative fibers. Eastman plans to apply its molecular technology to recycle 5,000 pounds of pre- and post-consumer garment waste collected by Debrand, transforming it into cellulose acetate fiber for its brand.

United States Cellulose Acetate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Cigarette Filters, LCD, Yarn, Coating, Plastics and Films |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States cellulose acetate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States cellulose acetate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States cellulose acetate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States cellulose acetate market was valued at USD 1.73 Billion in 2024.

The growth of the U.S. cellulose acetate market is driven by increasing demand for sustainable and biodegradable materials, advancements in production technologies, stricter environmental regulations, the rise of eco-conscious consumer behavior, and expanding applications in industries such as fashion, medical devices, and tobacco products, particularly in cigarette filters.

IMARC estimates the United States cellulose acetate market to exhibit a CAGR of 4.90% during 2025-2033.

Cigarette filters accounted the largest market share by application, owing to cellulose acetate’s effectiveness in reducing the inhalation of harmful tar and nicotine while maintaining structural integrity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)