United States Chitosan Market Size, Share, Trends and Forecast by Grade, Source, Application, and Region, 2026-2034

United States Chitosan Market Size and Share:

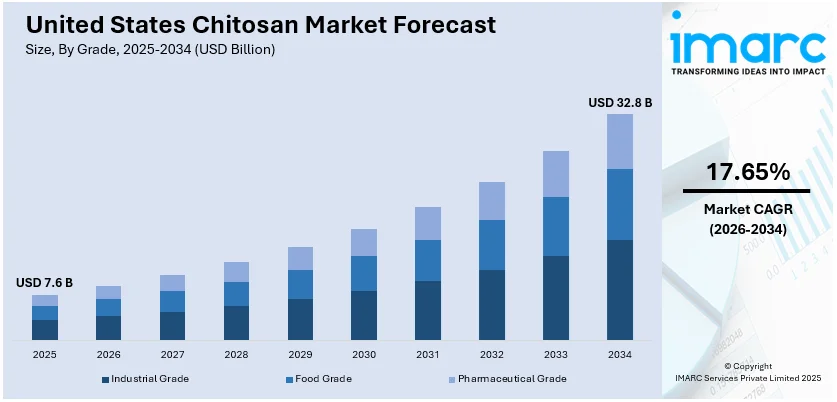

The United States chitosan market size was valued at USD 7.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 32.8 Billion by 2034, exhibiting a CAGR of 17.65% during 2026-2034. South currently dominates the market, holding a significant market share in 2025. The market is expanding due to rising demand in pharmaceuticals, cosmetics, and water treatment applications. Increasing focus on sustainable, bio-based products and advancements in biotechnology are further fueling growth. These factors collectively contribute to the growing prominence of the United States chitosan market share across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.6 Billion |

| Market Forecast in 2034 | USD 32.8 Billion |

| Market Growth Rate (2026-2034) | 17.65% |

One of the primary drivers of the market is the increasing demand for sustainable and biodegradable materials, particularly in water treatment applications. Chitosan, derived from shrimp shells and other natural sources, is widely used as an eco-friendly flocculant to remove heavy metals and organic contaminants in municipal and industrial wastewater systems. This aligns with stringent environmental regulations and the country’s growing focus on green infrastructure. Additionally, rising consumer preference for clean-label and natural ingredients is boosting chitosan use in functional foods, dietary supplements, and biodegradable food packaging. The agricultural sector is also adopting chitosan-based biopesticides and seed coatings as part of sustainable farming practices, which is driving the United States chitosan market growth.

To get more information on this market Request Sample

In the healthcare and pharmaceutical sectors, chitosan is gaining traction in drug delivery, wound care, and tissue engineering due to its biocompatibility and antimicrobial properties. For instance, a recent Deloitte Center for Health Solutions survey reveals that nearly 60% of leaders now view the industry's future positively, up from 52% the previous year. This growing confidence is further reflected in expectations around financial performance: 69% of respondents foresee revenue growth in 2025, while 71% anticipate enhanced profitability. These findings suggest a shift toward a more hopeful industry outlook, signaling renewed momentum and strategic focus heading into the new year. Ongoing research and development (R&D) and regulatory support are fueling the development of advanced formulations, such as nano-chitosan.

United States Chitosan Market Trends:

Expanding Industrial Applications and Corporate Investment

The chitosan market in the US is gaining momentum due to its versatile applications in industries prioritizing sustainable materials. Sourced from crustacean shells such as shrimp, crabs, and lobsters, chitosan is biodegradable, non-toxic, and biocompatible, making it suitable for water treatment, textiles, packaging, and chemical alternatives. In 2025, Milliken & Company invested in Tidal Vision, a chitosan-focused technology firm with over 200 employees and operations in five US states. This investment aims to accelerate the use of biodegradable chemistries and develop high-performance, eco-friendly material solutions. Such partnerships reflect the rising demand for bio-based products and underscore chitosan’s role as a foundational ingredient in building greener, more responsible industrial ecosystems across the US.

Rising Demand in Healthcare and Biomedical Fields

Chitosan is playing a transformative role in the US healthcare sector due to its strong antimicrobial, wound-healing, and biocompatible properties, which are creating a positive United States chitosan market outlook. It is increasingly used in wound dressings, drug delivery systems, and tissue engineering applications. With approximately 4.5% of the US population affected by chronic wounds, chitosan’s effectiveness in promoting healing and reducing infection makes it a highly valuable material in advanced medical treatments. As the healthcare industry shifts toward natural and regenerative solutions, chitosan’s safe, bioactive profile is attracting significant research and commercial interest. Ongoing clinical studies and FDA attention are helping position chitosan as a next-generation biomedical material, supporting its expansion across hospitals, pharmaceutical companies, and health technology platforms.

Agricultural and Nutraceutical Momentum Boosting Growth

Chitosan is witnessing increased use in agriculture and dietary supplement segments, driven by sustainability trends and consumer health awareness. In farming, chitosan-based biopesticides and plant growth enhancers support natural resistance against pathogens, promoting crop health while reducing reliance on chemical treatments. According to the United States chitosan market trends, this aligns with regulatory pressure and organic farming practices. In the nutraceutical space, chitosan’s fat-binding ability has led to its inclusion in weight loss supplements and digestive health products. Its clean-label appeal, non-toxic nature, and functionality cater to the growing demand for plant-based and eco-friendly ingredients. As environmental consciousness continues to influence both agriculture and nutrition, chitosan’s multifunctionality is positioning it as a key growth driver across these rapidly evolving sectors. For instance, in June 2024, DPH Biologicals partnered with Belgium's KitoZyme to launch ChitoNox FC, the first fungal chitosan seed treatment biocontrol for U.S. growers. Sustainably sourced and EPA-registered, it offers protection against nematodes and diseases, enhances plant defenses, and promotes growth. Commercial availability begins with the 2025 crop season.

United States Chitosan Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States chitosan market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on grade, source, and application.

Analysis by Grade:

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Industrial grade stands as the largest component in 2025, holding 49.6% of the market due to its broad applicability, cost-effectiveness, and scalability across high-demand sectors. It is widely used in water and wastewater treatment as a natural flocculant for removing heavy metals, oils, and suspended solids, making it valuable for municipal, agricultural, and industrial applications. Additionally, its role in cosmetics, textiles, and agriculture, including as a seed coating and biodegradable pesticide carrier, further strengthens demand. Unlike pharmaceutical or food-grade variants, industrial-grade chitosan requires less processing, making it more affordable for large-scale use. Its versatility, combined with growing environmental regulations and the push for sustainable materials, ensures continued dominance of industrial-grade chitosan in the United States chitosan market.

Analysis by Source:

- Shrimp

- Crab

- Squid

- Krill

- Others

Shrimp leads the market with around 57.7% of market share in 2025 due to its abundance, high chitin content, and cost-effective sourcing. As a major byproduct of the seafood industry, shrimp shells offer a sustainable and readily available raw material for chitosan extraction. The well-established processing infrastructure and efficient supply chains further support large-scale production. Compared to other sources like crab or fungi, shrimp-derived chitosan provides consistent quality and higher yield, making it more economically viable for industrial, pharmaceutical, and agricultural applications. Additionally, the use of shrimp waste aligns with environmental goals by reducing seafood industry waste. According to the United States chitosan market forecast, this combination of availability, efficiency, and sustainability ensures shrimp remains the dominant source in the market.

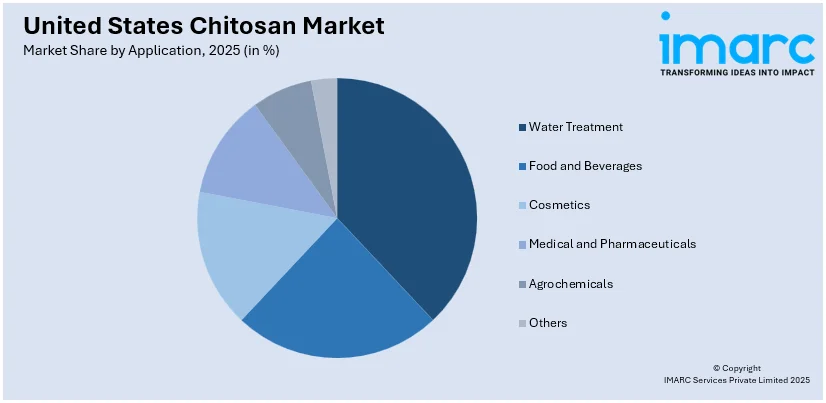

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Water Treatment

- Food and Beverages

- Cosmetics

- Medical and Pharmaceuticals

- Agrochemicals

- Others

Water treatment leads the market with 23.8% of market share in 2025 due to the polymer’s exceptional ability to act as a natural, biodegradable flocculant. Chitosan effectively removes heavy metals, oils, suspended solids, and other pollutants from wastewater, making it ideal for municipal, industrial, and agricultural applications. Its eco-friendly profile offers a safer alternative to conventional synthetic chemicals, aligning with tightening environmental regulations and growing sustainability goals across the U.S. Additionally, chitosan’s non-toxic and renewable nature makes it suitable for sensitive ecosystems, such as those involved in drinking water purification and aquaculture. With increasing demand for cleaner water, stricter discharge standards, and emphasis on green technologies, chitosan's role in water treatment continues to dominate the United States chitosan market demand.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The South US chitosan market is witnessing strong growth driven by rising environmental and industrial demand for sustainable solutions. Municipalities and industrial facilities are increasingly adopting chitosan in wastewater treatment due to its natural, biodegradable properties that effectively remove heavy metals and organic pollutants. In the healthcare sector, the region’s growing investment in medical innovation is boosting the use of chitosan in wound care, drug delivery, and tissue engineering. Additionally, the expanding food processing and packaging industries across the South are fueling demand for chitosan-based edible coatings and biodegradable films. With rising consumer preference for eco-friendly and clean-label products, along with favorable research and regulatory environments, the Southern U.S. is becoming a significant contributor to overall chitosan market development.

Competitive Landscape:

The United States chitosan market features a competitive landscape marked by both established players and emerging innovators. Key companies, such as Primex, KitoZyme, Heppe Medical Chitosan, and Advanced Biopolymers are actively expanding their product portfolios to serve sectors including pharmaceuticals, water treatment, cosmetics, and food. Strategic collaborations, research partnerships, and research and development (R&D) investments are common, aimed at improving chitosan purity, bioavailability, and application versatility. Several firms are exploring advanced technologies such as nano-chitosan and fermentation-based production to meet clean-label and sustainability demands. Regulatory compliance, particularly with FDA standards, plays a crucial role in market entry. Overall, competition centers around innovation, customization, and sustainability, with companies striving to secure a larger share of the evolving United States chitosan market.

The report provides a comprehensive analysis of the competitive landscape in the United States chitosan market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Organisan Corporation launched Stimul-8, a chitosan-based biostimulant, in Canada. Approved under CFIA Reg #2525157S, Stimul-8 enhances plant health, yield, and stress resistance. Designed for regenerative agriculture, it supports commercial farms, turf care, and personal lawns with eco-friendly, non-toxic technology promoting sustainable farming practices.

- April 2025: BC3 Technologies received a U.S. patent for SEAL Hemostatic Wound Spray, the first FDA-cleared aerosolized chitosan product for rapid bleeding control. Compact and easy to use, SEAL is now deployed by EMS, military, and first responders globally, including battlefield use and Maryland trauma protocols.

- February 2025: Tidal Vision closed a USD 140 Million Series B funding round to expand globally. The biotechnology company will build new facilities in Europe, Texas, and Ohio, boosting production and R&D of its chitosan-based solutions for industries like water treatment, agriculture, and materials, supporting environmental and commercial innovation.

- February 2025: MUSC's Burn Center and Zucker Institute partnered with Chitozan Health to develop advanced chitosan-based burn and wound gels. Designed to reduce infection and accelerate healing, the gels utilize patented Glucosil technology. Market launch is expected in 2026, with research beginning in spring 2025.

- August 2024: Dyson launched its Chitosan-powered wet line hair styling products, marking its entry into beauty formulations. Derived from oyster mushrooms, the sustainable chitosan offers flexible, long-lasting hold without stiffness. The range includes pre-style creams and post-style serums designed to complement Dyson tools and enhance styling with minimal waste.

United States Chitosan Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Grades Covered | Industrial Grade, Food Grade, Pharmaceutical Grade |

| Sources Covered | Shrimp, Crab, Squid, Krill, Others |

| Applications Covered | Water Treatment, Food and Beverages, Cosmetics, Medical and Pharmaceuticals, Agrochemicals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States chitosan market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States chitosan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States chitosan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chitosan market in the United States was valued at USD 7.6 Billion in 2025.

The United States chitosan market is projected to exhibit a CAGR of 17.65% during 2026-2034, reaching a value of USD 32.8 Billion by 2034.

The key drivers of the US chitosan market encompass growing demand for biodegradable, eco-friendly biopolymers across industries; widespread adoption in water treatment as a natural flocculant; expanding pharmaceutical and biomedical applications; uptake in sustainable food preservation and packaging; and rising usage in cosmetics and agriculture.

South currently dominates the chitosan market due to growing demand for eco-friendly water treatment solutions, rising adoption in pharmaceutical applications like wound care and drug delivery, and expanding use in sustainable agriculture and food packaging, supported by regional focus on environmental compliance and clean-label consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)