United States Decorative Laminates Market Expected to Reach USD 3.0 Billion by 2033 - IMARC Group

United States Decorative Laminates Market Statistics, Outlook and Regional Analysis 2025-2033

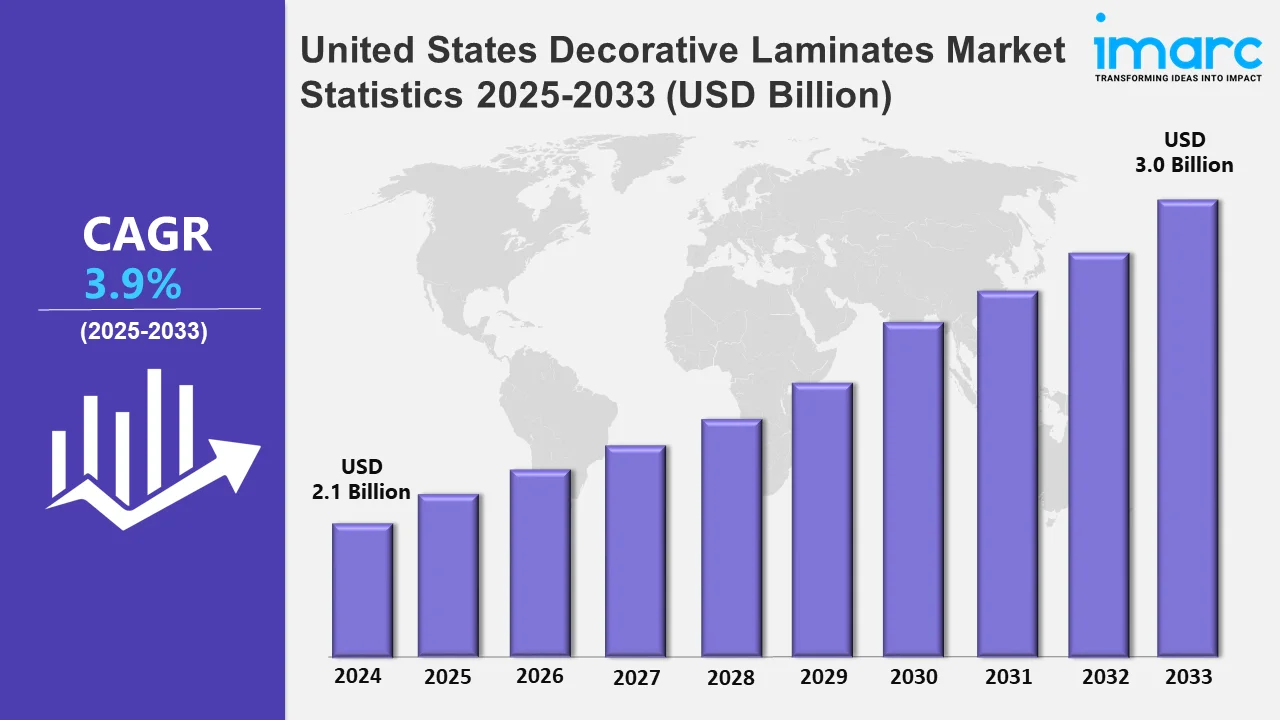

The United States decorative laminates market size was valued at USD 2.1 Billion in 2024, and it is expected to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.9% from 2025 to 2033.

To get more information on this market, Request Sample

The decorative laminates market in the US is largely driven by their increasing demand compared to paint, veneer, and other coatings, owing to their longer shelf-life, improved aesthetic value, durability, and cost-effectiveness. For example, in April 2024, DuPont introduced the DuPont Pyralux ML Series of decorative laminates for printed circuit boards (PCBs). Besides this, the rising incorporation of advanced techniques in the manufacturing and installation of decorative laminates to improve their performance and design is further stimulating the market growth in the US. For instance, in July 2024, AWK unveiled a range of Alveo PVC bathroom wall panels made from decorative high-pressure laminates suitable for utilization in adaptations when fitted onto a structural wall.

Moreover, the emerging trend of renovation and remodeling activities in the residential as well as commercial sectors in the US is catalyzing the decorative laminates market. Furthermore, the expanding furniture industry and the escalating population are boosting the market growth forward. For example, in June 2023, the furniture company Ikea obtained Made4Net, a New Jersey-based supplier of supply chain and warehouse management software for modernizing and future-proofing omnichannel operations. Apart from this, Keding Enterprises Co. dominated high-pressure decorative laminates for the US market.

United States Decorative Laminates Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The inflating disposable incomes of individuals and the rising need for modern construction materials are propelling the market for decorative laminates across the United States.

Northeast Decorative Laminates Market Trends:

The Northeast region in the US, particularly cities like Boston and New York, has a heightened requirement for decorative laminates, owing to the rising focus of the population on aesthetically pleasing and innovative materials in commercial and residential spaces. Moreover, the widespread adoption of ready-to-assemble derivatives and modular construction components positively influences the market growth in the region. For instance, in May 2024, Floor & Decor, the top high-growth merchant specifying in hard-surface flooring for landholders and professionals, opened its first-ever store in New York City.

Midwest Decorative Laminates Market Trends:

The market in the Midwest is mainly bolstered by the increasing interest of consumers in contemporary and traditional designs. Furthermore, ongoing innovations in laminate production like developing eco-friendly processes and materials, also propel the market expansion in this region. For example, in August 2024, Octopus Product Ltd., the decorative surfacing brand of high-pressure laminates, was acquired by Wilsonart to function as part of Chicago-based Laminart, the provider of boutique interior surfacing materials.

South Decorative Laminates Market Trends:

The Southern region of the US has been experiencing an increase in decorative laminates demand, mainly across cities like Houston, Atlanta, and Miami, owing to the modernization and rapid development. Besides this, key players in the region are forming alliances with retailers, architects, and designers to expand their network, further fueling the market growth. For instance, in April 2023, Floor & Decor inaugurated its tenth area store in the Atlanta market.

West Decorative Laminates Market Trends:

The market in the West region of the US, mainly in states like Nevada, California, and Washington, is booming due to the increasing trend of sustainable manufacturing and the integration of digital tools in laminate production. Moreover, companies like Innovative Laminate Works, Arvinyl Laminates LP, American Laminates, etc., are leveraging new technologies to meet the consumer demand for advanced products.

Top Companies Leading in the United States Decorative Laminates Industry

There are several companies encompassing the decorative laminates market in the US. In August 2024, Wilsonart, a world-leading engineered surfaces company, acquired Octopus Product, Ltd., a pioneering decorative surfacing brand of high-pressure laminate (HPL), decorative metals, and wood panels. Moreover, in July 2023, Ethnicraft, a Belgium-based dealer of high-end furniture, invested about USD 18 Million in a construction venture in the US.

United States Decorative Laminates Market Segmentation Coverage

- Based on product type, the market has been segmented into high-pressure laminates and low-pressure laminates. High-pressure laminates are highly durable materials that are impact and scratch-resistant. Low-pressure laminates, also recognized as melamine, refer to thinner and less sturdy materials.

- Based on the application, the market has been categorized into furniture and cabinets, flooring, wall panels, and others. Decorative laminates are largely used in furniture like cabinets, chairs, tables, etc., to improve their appearance. In flooring for bedrooms, living areas, kitchens, etc., these materials are utilized due to their high resilience and design flexibility. Decorative laminates are used in wall panels to create accent walls and paneling to add color and texture to interiors.

- Based on end use, the market has been divided into non-residential, residential, and transportation. The non-residential applications contain the use of decorative laminates in office and retail spaces, cafes, restaurants, healthcare facilities, etc. In residential places like kitchens, bedrooms, bathrooms, wardrobes, etc., these materials are utilized to enhance their appearance. Lastly, decorative laminates are used in transportation to provide durability and enhanced finish to surfaces.

- Based on texture, the market has been separated into matte/suede and glossy. Matt laminate has a smooth and non-reflective texture, while the suede laminate has a smooth feel that imitates the suede fabric. Moreover, glossy laminate has a reflective and easy-to-clean surface.

- Based on the pricing, the market has been split into mass and premium. Mass pricing caters to the broader market with affordably priced laminates, while the premium-priced laminates are adopted by high-end residential projects and luxury commercial spaces.

- Based on the sector, the market has been allocated into organized and unorganized. The organized sector comprises registered and well-established companies. In contrast, smaller businesses with unstructured operations, functioning on a smaller scale, come under the unorganized sector.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 3.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | High Pressure Laminates, Low Pressure Laminates |

| Applications Covered | Furniture and Cabinets, Flooring, Wall Panels, Others |

| End Uses Covered | Non-Residential, Residential, Transportation |

| Textures Covered | Matte/Suede, Glossy |

| Pricings Covered | Mass, Premium |

| Sectors Covered | Organised, Unorganised |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Decorative Laminates Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)