United States E-Cigarette Market Size, Share, Trends and Forecast by Product, Flavor, Mode of Operation, Distribution Channel, and Region, 2026-2034

United States E-Cigarette Market Overview:

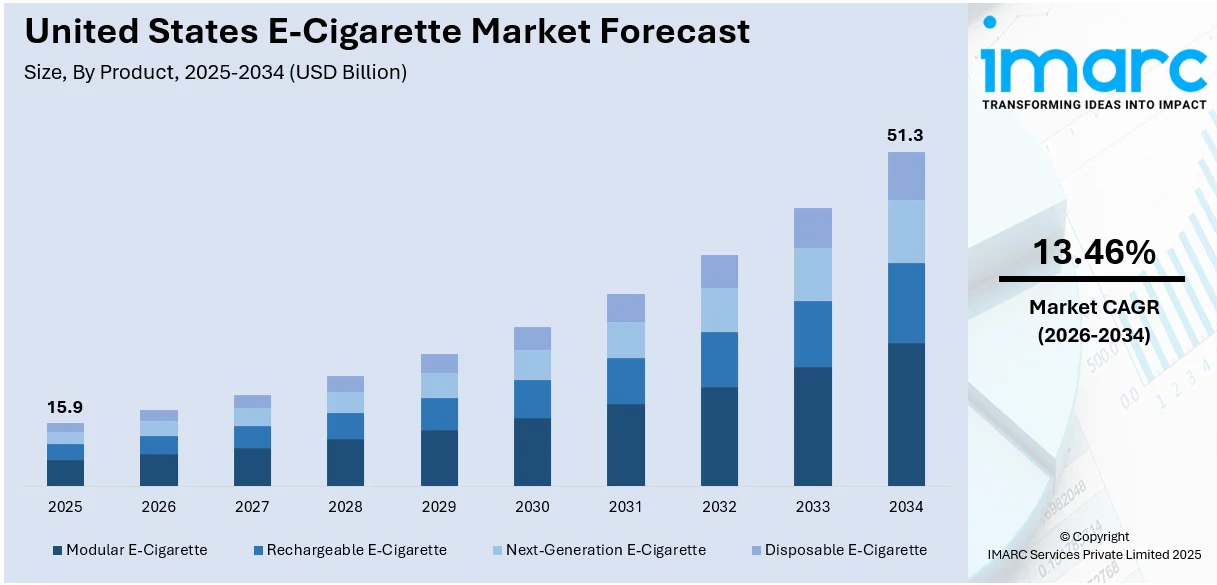

The United States e-cigarette market size reached USD 15.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 51.3 Billion by 2034, exhibiting a growth rate (CAGR) of 13.46% during 2026-2034. The market includes growing health consciousness, as consumers are looking for smoking alternatives viewed as less risky. Advances in device technology, e.g., pod systems and disposables, provide convenience and simplicity and appeal to both new and frequent consumers. Further, changing government regulations, e.g., flavor bans and taxations, determine the availability of products and prices and impact consumer purchasing decisions. All of these drive market demand, product development, and competitive actions among retailers and manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 15.9 Billion |

|

Market Forecast in 2034

|

USD 51.3 Billion |

| Market Growth Rate 2026-2034 | 13.46% |

The growing societal acceptability of e-cigarettes in the United States is significantly driving market expansion. As societal norms around smoking evolve, vaping is being viewed more and more as a contemporary and socially preferred activity than old-fashioned cigarette smoking. This shift is partly fueled by the unobtrusive design and lower smell of e-cigarettes, which render them more convenient in the private sphere as well as in public space. Moreover, social media platforms and exposure to culture have promoted wider demographic participation, especially among urban young people and professionals in the workplace. This social change is also facilitated by developing regulatory schemes that distinguish vaping from smoking in public places. With the increasingly common usage of e-cigarettes, new consumers are more likely to be motivated to use vaping products as lifestyle options instead of addiction alternatives. For instance, in September 2024, Synergy Life Science introduced Nebi®, an e-cigarette with a water base in Atlanta, utilizing ultrasonic vaporization technology to provide safe vapor without heating or traditional e-liquids. Consequently, the market enjoys a consistent stream of clients driven more by social fashion and self-expression than by smoking cessation alone.

To get more information on this market Request Sample

A major driver of the United States e-cigarette market growth is online and direct-to-consumer sales channels. As retail becomes increasingly digital, e-cigarette organizations are using e-commerce platforms to expand their reach across the nation. For example, in June 2025, HorizonTech introduced its 100K disposable vape in America, providing up to 100,000 puffs in Regular Mode and 60,000 in Boost Mode, with 40ml e-liquid and 12 fruit or mint flavors. Moreover, the shift to digital retail enables greater convenience, broader product variety, and price transparency that resonate with technology-oriented consumers looking for tailored vaping solutions. Online channels also allow for anonymous buying, which is especially appealing for those who are switching from conventional smoking or making their first attempt at e-cigarettes. Subscription models and sponsored online marketing campaigns also allow businesses to establish deep consumer relationships and brand loyalty. These tactics offer consumers a consistent product delivery, freshness on new flavors, and offers that drive purchase frequency and product involvement. The capacity to provide educational content and evaluations continues to boost consumer confidence and satisfaction. With more American consumers turning to digital channels for lifestyle products, e-cigarette sales growth through online platforms continues to drive market momentum.

United States E-Cigarette Market Trends:

Health Consciousness & Smoking Cessation

A major driver of the U.S. e-cigarette market is growing consumer interest in health and wellness. As awareness rises regarding the harmful effects of traditional tobacco smoking, many individuals are turning to e-cigarettes as an alternative that is widely perceived to be less damaging. For some, vaping is seen as a tool to reduce or quit smoking entirely, offering the familiarity of nicotine without combustion byproducts like tar. The marketing of vaping products as "smoking alternatives" reinforces this perception, attracting former smokers seeking harm reduction and wellness-oriented users alike. This shift in public mindset has expanded the customer base from only smokers to a broader group interested in managing health risks. The connection between vaping and perceived lower health impacts continues to sustain market demand and drive product innovation aimed at supporting this lifestyle shift.

Technological Innovation & Convenience (Pods/Disposables)

Innovation in product design and user convenience plays a key role in driving the U.S. e-cigarette market. Modern vaping devices have become more compact, sleek, and easy to use, especially with the rise of pod systems and disposables. These devices appeal to consumers because they require minimal setup—no messy refills, complicated maintenance, or battery replacements. Pods offer the flexibility of flavor changes, while disposables provide grab-and-go ease for casual or on-the-go use. Additionally, technological upgrades like adjustable settings, longer battery life, and enhanced vapor production continue to attract both newcomers and long-time users seeking a personalized experience. The emphasis on design simplicity, combined with performance and variety, encourages repeat purchases and broadens the market beyond experienced vapers to curious first-timers and tech enthusiasts. As a result, innovation remains central to keeping consumer interest high.

Regulatory & Tax Structures Driving Market Dynamics

Regulations and tax policies greatly influence the U.S. e-cigarette market. Federal regulators have imposed stringent rules on product approvals, marketing strategies, and flavor options, which determine which brands and categories of products end up in the hands of consumers. The restrictions have narrowed the number of flavors available in the marketplace, driving consumer trends and compelling companies to adjust their product lines. Simultaneously, tariffs and import duties affect production prices and supply chains, leading some producers to move production or change prices. Vaping product taxes at the state level also influence retail prices and consumer purchase decisions, so price affordability is an important factor for many purchasers. These intricate and changing rules impose challenges as well as opportunities for businesses, influencing competition and how products are distributed and marketed. In such an environment, companies need to be compliant and flexible to thrive and develop in the market.

United States E-Cigarette Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States e-cigarette market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, flavor, mode of operation, and distribution channel.

Analysis by Product:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

Next-generation e-cigarettes commanded the highest product share in the United States e-cigarette market outlook in 2025, capturing about 38.3% of overall revenue. These products are popular because of their cutting-edge tech, adjustable features, and consistency of nicotine delivery. In contrast to first-generation cig-a-likes or basic vape pens, next-generation products tend to come with sub-ohm functionality, adjustable voltage or wattage options, and tank refill capabilities, giving users more control over vapor output and throat strike. This category also enjoys robust interest from advanced users who want performance-based products. With consumers increasingly valuing the longevity of devices, flavor strength, and overall satisfaction, next-gen e-cigarettes are rapidly gaining popularity among both recreational and transitioning smokers. Their suitability for various types of e-liquids and enhanced battery life have helped them gain widespread acceptance as well. With continuous product improvement and increased consumer interest in customized vaping experiences, this category is likely to remain at the top in the foreseeable years.

Analysis by Flavor:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

Tobacco flavor was the number one flavor category in the U.S. e-cigarette market in 2025, accounting for 32.2% of the share. This is powered mainly by consumers making the switch from traditional tobacco cigarette smoking and craving a known taste in their transition to vaping. Tobacco-flavored e-cigarettes are a friendly and less sudden option, particularly for older adults familiar with the sensory experience of traditional cigarettes. In spite of increased demand for fruit and dessert flavors, tobacco is the most accepted among older demographics as well as among those seeking to quit smoking. Tobacco flavor is also usually preferred in regulatory environments where flavored nicotine products are restricted. Continued presence of this traditional profile, coupled with its compatibility with harm-reduction efforts, has maintained its elevated market share. Manufacturers often enhance their tobacco flavor products with natural extracts and modern formulation processes to enhance authenticity and attractiveness. Consequently, tobacco is a staple of product lines in the e-cig market.

Analysis by Mode of Operation:

- Automatic E-Cigarette

- Manual E-Cigarette

Automatic e-cigarettes held a very high share United States e-cigarette market forecast in 2025 because of their ease of use and sleek design. These devices switch on when inhaled, obviating the requirement for manual settings or buttons, making them especially appealing to new users and casual smokers. The ease-of-use increases accessibility and convenience, which aids in broader consumer adoption. Designing often like common cigarettes in function and shape, automatic e-cigarettes are more familiar for transitioning smokers, promoting acceptance among older populations and new users. The rise in disposable vape products—the majority of which use automatic mode—has further tightened the grip of this mode. With growing demand for low-maintenance, inconspicuous vaping solutions, automatic devices remain attractive to customers who are looking for efficiency without compromising on enjoyment. The reliable delivery of vapor and user-friendly products place automatic e-cigarettes into the default solution category for the majority of consumers, facilitating their sustained leadership position in retail and online channels across the U.S. marketplace.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Specialist E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

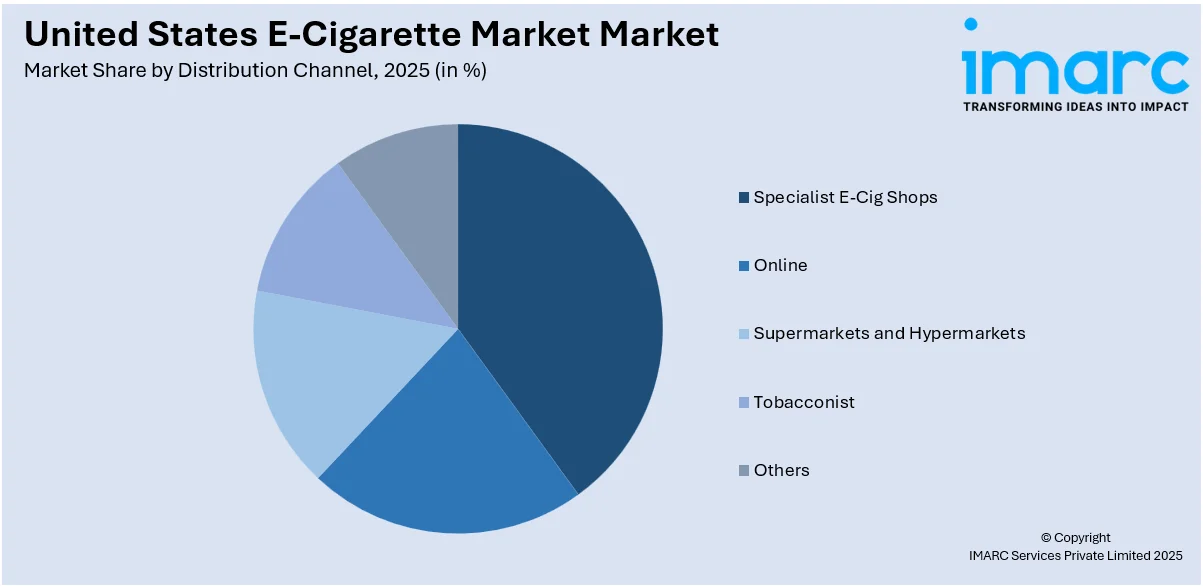

Specialist e-cigarette stores commanded a dominant 37.6% value share of the United States e-cigarette distribution market in 2025 and were the key drivers of product adoption and consumer awareness. These specialty vape stores provide a broad range of products, e-liquids, and accessories, appealing to new and experienced customers. The interactive, advisory sales style in vape stores assists consumers in making decisions based on characteristics such as taste, nicotine concentration, and device operation. Product knowledge and tailored advice lead to greater customer satisfaction and loyalty, while enabling brands to present premium and innovative offerings more effectively. In addition, specialty retailers typically offer product testing and maintenance services, setting them apart from convenience stores or web sites. Their capacity to quickly respond to regulatory evolution and carry compliant inventory has also made them relevant. With the maturation of the e-cigarette marketplace, these specialty retailers continue to play a crucial role in maintaining product awareness, building consumer confidence, and promoting consistent sales throughout a broad range of user segments.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The United States Northeast region experiences steady growth in the e-cigarette industry, thanks to urban population hubs, heightened health consciousness, and ease of access via specialist vape stores. Consumer demand for harm-reduction products remains on the increase. State-level regulation differences, especially in regions such as Massachusetts and New York, dictate product availability, promotional efforts, and retailing tactics within the region.

The Midwest region of the United States mirrors increasing consumer use of e-cigarettes, especially in urban areas where smoking levels are generally high. Ease of use and affordability drive purchasing, particularly among adult consumers looking for alternatives to traditional cigarettes. Growing availability in convenience stores and vape shops sustains expansion. Sensitization and use remain low in rural areas, sustaining uneven regional growth patterns in the overall market environment.

The South dominates the U.S. e-cigarette market, fueled by strong consumer desire, extensive retail availability, and cultural receptiveness to vaping as a smoking substitute. States throughout the region display robust adoption, especially among adults who are migrating from conventional cigarettes. Flavored popularity and convenience store sales growth further cement regional leadership, positioning the South as a significant driver of national market growth.

The West is a dynamic market influenced by United States e-cigarette market trends in early adoption, technology-based consumers, and strong health consciousness. Demand is high in California, Washington, and Colorado markets, particularly for sophisticated devices and low-nicotine products. Regulatory attention, such as flavor prohibitions and marketing restrictions, governs product lines, with resultant innovation in product formulations and targeted retailer approaches throughout the region.

Competitive Landscape:

The United States e-cigarette industry is marked by the high competition between mature players and new brands competing for consumers' loyalty via innovation, pricing, and brand image. Players are distinguishing their products through product design, battery life, vapor yield, and user experience improvements. Premium positioning is prevalent in rechargeable and refillable devices, whereas affordability and convenience are highlighted in the disposable category, which has recorded high growth. Market players are also investing in stylish packaging, flavor diversity, and sophisticated nicotine delivery systems to target unique consumer niches. Point of retail is still an important element, with brands establishing shelf presence within convenience stores, gas stations, and vape specialty stores, with others operating mainly through online channels. Marketing tactics tend to involve influencer relations and educational content to create trust and target young adult consumers. As consumer tastes keep changing, success in the market depends on how well one can achieve consistent quality, regulation compliance, and innovative design in a saturated market.

The report provides a comprehensive analysis of the competitive landscape in the United States e-cigarette market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2025, The FDA and U.S. Customs and Border Protection (CBP) seized nearly two million units of unauthorized e-cigarettes worth $33.8 million during a joint operation in Chicago. These products, mainly from China, were mislabeled to avoid detection. Brands like Snoopy Smoke and Raz were among those confiscated. This action reflects ongoing federal efforts to block illegal e-cigarette imports and prevent unauthorized products from reaching U.S. consumers, especially youth.

- In June 2024, The U.S. Justice Department and FDA launched a new task force to crack down on the sale and distribution of illegal e-cigarettes, focusing on protecting youth from unauthorized vaping products. This follows the FDA’s issuance of over 1,100 warning letters to companies violating regulations on new tobacco products, including e-cigarettes. The initiative aims to strengthen enforcement against flavored and unapproved devices that continue to appear in the market despite prior regulatory actions.

- In February 2024, The UPMC Comprehensive Lung Center launched a dedicated Vaping Clinic to address rising concerns over vaping-related lung injuries. The clinic focuses on evaluating lung health and treating symptoms such as coughing, shortness of breath, and recurrent infections among e-cigarette users. Stemming from past EVALI outbreaks and ongoing research on harmful vape components, the clinic aims to educate patients and provide specialized care for those affected by vaping-induced respiratory issues.

United States E-Cigarette Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Mode of Operations Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Specialist E-Cig Shops, Online, Supermarkets and Hypermarkets,Tobacconist, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States e-cigarette market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States e-cigarette market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States e-cigarette market comprises devices that vaporize liquid nicotine solutions, offering an alternative to traditional smoking. It includes products like vape pens, pod systems, and disposables. Driven by demand for smoking cessation tools and flavored options, the market faces evolving regulations, health concerns, and technological innovations.

The United States E-Cigarette market was valued at USD 15.9 Billion in 2025.

The United States e-cigarette market is projected to exhibit a CAGR of 13.46% during 2026-2034, reaching a value of USD 51.3 Billion by 2034.

Key factors driving the U.S. e-cigarette market include rising health awareness, demand for smoking alternatives, and technological innovations in vaping devices. Convenient, user-friendly designs like pods and disposables attract consumers. Additionally, changing regulations, flavor preferences, and shifting consumer perceptions toward harm reduction significantly influence market growth and product development.

Next-generation e-cigarettes account for the largest share of the United States e-cigarette market at around 38.3%. Their popularity is driven by advanced features, customizable options, and perceptions of reduced harm compared to traditional smoking. These factors make them appealing to a wide range of consumers, especially younger adult users.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)