United States Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

United States Edtech Market Size and Share:

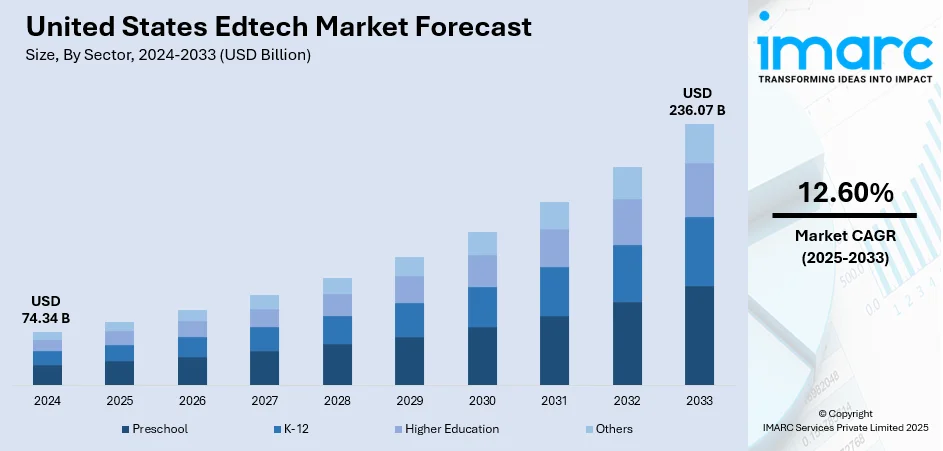

The United States Edtech market size was valued at USD 74.34 Billion in 2024. The market is projected to reach USD 236.07 Billion by 2033, exhibiting a CAGR of 12.60% from 2025-2033. The market is driven by increasing adoption of digital learning technologies, personalized learning, and workforce development solutions. As demand for flexible, accessible, and career-focused learning increases, the market is growing across K–12, higher education, and corporate learning. AI innovation, analytics, and immersive tech are defining the competitive landscape. Public and private investments are strong, further driving market growth and scalability. These dynamics are a major contributor to the growing United States Edtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 74.34 Billion |

|

Market Forecast in 2033

|

USD 236.07 Billion |

| Market Growth Rate 2025-2033 | 12.60% |

The United States edtech market is heavily influenced by the growing use of digital learning tools in K–12 and higher education. Schools and universities nationwide are embracing learning management systems, adaptive assessment platforms, and interactive content to enhance educational outcomes and student interaction. This trend is compounded by increasing need for differentiated learning experiences that accommodate different learning styles and learning paces. Online platforms that have analytics and progress-tracking features enable teachers to gain insights into student performance and provide intervention in a timely manner. Teachers are also aided by technology-enabled resources like curriculum planning software, virtual classrooms, and collaborative spaces which streamline teaching and administrative tasks. For instance, in April 2025, Kira Learning introduced an entirely AI-native K–12 platform, combining lesson planning, grading, and real-time tutoring to simplify teaching and make education at scale more personalized across classrooms. Moreover, this broad recognition of learning technology is also promoted by federal and state programs that seek to advance learning infrastructures. Consequently, the industry is experiencing ongoing investment in innovation, which contributes to increased accessibility of content and enhanced academic effectiveness in diverse learning environments in the United States.

To get more information on this market, Request Sample

Another important factor favoring the United States Edtech market outlook is an increased focus on workforce development and ongoing learning. With the quickening pace of industry transformation because of automation, artificial intelligence, and evolving job requirements, learners are looking for flexible, tech-enabled learning solutions to reskill and upskill. Edtech platforms that provide micro-credentials, online certifications, and career-oriented training have become key drivers of lifelong learning and career progression. Corporate training initiatives also now depend more and more on scalable, interactive edtech offerings that can be tailored to meet particular business requirements. For example, in March 2025, zSpace acquired BlocksCAD to enhance its AR/VR learning environment with 3D modeling software, adding depth to project-based STEM education with immersive, interactive design and coding experiences. Furthermore, the success of hybrid and remote work models has made the demand for open digital learning spaces that facilitate professional training beyond the conventional classroom model all the more pressing. Initiatives supported by the government to close digital skill divides and enable neglected groups further emphasize the expansion of adult learning and vocational technology platforms. This intersection of technological capacity and labor market demand is hastening the creation and implementation of new edtech products designed specifically for adult learners nationwide.

United States Edtech Market Trends:

Rise in Online and Personalized Learning Platforms

The United States Edtech market growth is seeing vast momentum because of the increasing demand for online and custom learning solutions. Educators and students are increasingly adopting digital platforms for regular learning activities, a sign of change in education culture. With vast connectivity and devices available everywhere, learning can no longer be limited to traditional classrooms. Rather, digital platforms provide flexible, accessible, and self-paced learning, meeting all kinds of student demands. Technologies like machine learning and artificial intelligence are instrumental by facilitating adaptive learning pathways, instant feedback, and interactive materials. All these have contributed to increased engagement levels among students and better learning performance. The use of AI applications by teachers in supporting lesson planning, monitoring performance, and personalized learning experiences indicates the direction toward data-informed education. Overall, the growing convergence of online and AI-driven solutions is transforming the conventional models of education, rendering learning more efficient and personalized, and pushing the market towards growth.

Upskilling and Workforce Readiness Demand

Heightened focus on employability and career flexibility is driving the market growth as per United States Edtech market analysis. With industries changing fast with automation and technological upsets, there is an increased requirement for employees to reskill and upskill periodically. EdTech solutions are bridging this gap by providing modular courses, micro-credentials, and certificate courses keeping pace with the prevailing industry needs. Students of all ages are looking to online platforms for adaptive, career-oriented learning that enables both short-term employment preparedness and long-term skills development. Corporate training initiatives are also adapting EdTech solutions in order to enable scalable, individualized learning for staff members. The movement toward distributed workspaces only fuels this trend further, as workers demand virtual learning environments that enable learning beyond the classroom. This intersection of technological need and labor market demand is increasing the utility and use of EdTech as a driver of workforce change and economic resilience.

Infrastructure Expansion and Government Support

The continued growth of digital infrastructure and pro-active government initiatives are crucial drivers of the United States Edtech market trends. Increased access to high-speed internet and mobile technology allows urban and rural students to access digital learning platforms. Government programs that promote bridging the digital divide, including investment in fiber networks and school connectivity, are laying the groundwork for inclusive learning. For instance, such investments as the USD 90 million Tennessee March 2025 fiber expansion project emphasize initiatives toward infrastructure modernization to advance education and innovation. Further, state and federal initiatives supporting technology integration in classrooms, teacher training, and digital curriculum design are driving wider EdTech uptake. These efforts not only enhance learning access and quality of education but also facilitate inclusive learning opportunities. While infrastructure becomes stronger and more inclusive, EdTech players are in a better place to scale their products, thus fueling market expansion and social impact.

United States Edtech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States Edtech market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector, type, deployment mode, and end user.

Analysis by Sector:

- Preschool

- K-12

- Higher Education

- Others

In 2024, the segment of K–12 education represented about 46.4% of the United States edtech market and thus is the largest contributor by sector. The general adoption of digital tools into elementary and secondary classrooms is largely altering how teachers teach and how students learn. Increasingly, schools are employing curriculum management platforms, digital testing tools, and interactive learning modules customized to varying student needs. This is also supported by national and state initiatives that facilitate digital equity and infrastructure improvement funding. Additionally, the transition to blended learning and remote teaching models has rendered edtech essential to the maintenance of continuity and quality of education. The advancement of tablets, laptops, smartboards, and topic-related software has grown the digital shift both in urban and rural areas. As development goes on and digital literacy is the key to student achievement, the K–12 market is likely to remain a strong force in market growth.

Analysis by Type:

- Hardware

- Software

- Content

Hardware accounted for around 41.7% of the United States edtech market by type in 2024, highlighting its important position in digital education infrastructure. Laptops, tablets, interactive whiteboards, and projectors are at the center of content delivery in digital classrooms for K–12 and higher education schools. Schools have made significant investments in 1:1 device initiatives, providing one device per student for individual learning. Growing focus on technology-supported learning spaces and off-campus education models is also fueling demand for solid and scalable hardware solutions. Hardware is more than just student-facing equipment; educators and administrators also gain from classroom management applications, audio-visual aids, and backend server infrastructure that enable smooth learning experiences. Additionally, hardware investments come with software packages as well, allowing for long-term use and ecosystem integration. As the spotlight on digital readiness becomes more pronounced, particularly in under-resourced schools, hardware remains an integral part of the shifting educational technology environment in America.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

On-premises deployment remains an indispensable part of the United States edtech industry, particularly in institutions focused on data control, infrastructure security, and customizability. Although solutions in the cloud are on the rise, on-premises systems are still widely used by numerous schools and universities for implementing local learning management systems (LMS), content delivery systems, and administrative tools. The model is widely in use in districts that have existing IT capabilities or data policy requirements that require localized server environments. On-premises installation gives educational institutions the ability to customize system configurations to suit their specific operational requirements and reduce third-party data dependencies. Furthermore, some forms of edtech hardware and software, e.g., assessment tools or classroom interaction systems, are tailored for on-premises deployment. Where the scalability and cost-effectiveness of cloud paradigms are leading the way, the on-premises market still retains validity, especially where infrastructure investments are already in place or compliance requirements favor in-house data governance and control.

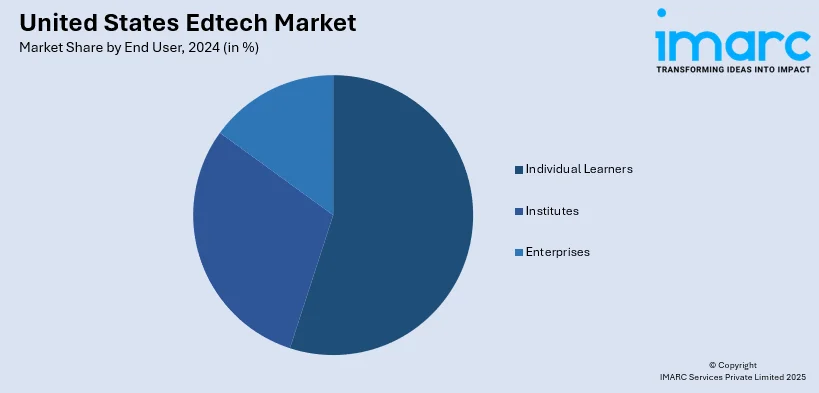

Analysis by End User:

- Individual Learners

- Institutes

- Enterprises

Individual learners constituting students, educators, lifelong learners, and business professionals are a crucial end-user segment within the United States edtech industry. They fuel demand for open, individualized, and self-directed learning platforms beyond conventional education settings. As online certifications gain popularity, language apps, tutoring sites, and skill-centric microlearning, individuals are more in charge of their learning process. Educators also use edtech for tools such as lesson planning, classroom gamification software, and professional development training. Further, working adults who reskill or upskill to change career paths depend greatly on on-demand learning sites and credentialing systems. Mobile accessibility, cost-effectiveness, and ease of use drive adoption among all demographics. Social learning and peer-to-peer platform influence is also increasing, particularly in non-traditional educational environments. As digital literacy increases and learning is increasingly decentralized, the individual end-user marketplace will be responsible for playing a major role in determining the future course of educational technology adoption throughout the United States.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region reflects robust EdTech uptake fueled by dense student populations, highly reputed educational institutions, and high state investments in digital education. AI-based individualized learning is led by urban regions, while public-private partnerships spearhead K–12 and higher learning innovation, rendering the region a focal point for education technology research and deployment.

The Midwest is enriched by increased virtual classroom and remote learning technology demand, especially in rural regions. Broadband expansion investments and school modernization initiatives by states fuel EdTech implementation. Institutions of higher education across the region are rapidly embracing learning management systems and career-readiness platforms to promote student engagement and workforce alignment.

The South is witnessing EdTech expansion at a rapid pace because of the growth in digital infrastructure, growing acceptance in K–12 education, and government-initiated programs. Texas and Florida are at the forefront in developing virtual schools, AI-based tutoring, and customized curriculum. Economic development initiatives and investments in teacher professional development further sustain the region's digital learning environment.

The West is at the forefront of EdTech innovation with robust global startup ecosystems, led by California. Classroom high-tech integration, the extensive use of mobile learning applications, and investment in AI-based platforms fuel growth. Public school districts and state universities are among the first adopters of immersive technologies like AR/VR, driving substantial regional market growth and experimentation.

Competitive Landscape:

The United States edtech market's competitive environment is marked by a wide variety of mature players, new startups, and scholarly institutions that provide proprietary platforms. Firms compete within several segments such as K–12 learning solutions, higher education platforms, test preparation, professional training, and corporate learning tools. The industry is characterized by continuous innovation, with the major differentiators being content quality, user interface, personalization options, and integration features. Open-source platforms and freemium models are also starting to make an impact, allowing greater access and making competition more severe. Strategic alliances with educational institutions, governments, and content developers further strengthen market positioning. Investment activity within the sector also continues to be strong, underpinning acquisitions, mergers, and niche technology development like AI-based tutoring and immersive learning through AR/VR. As the United States EdTech market forecast anticipates substantial growth, amplifying demand for hybrid and lifelong learning will lead to heightened competitive intensity, with participants emphasizing scalability, engagement metrics, and data-driven results to remain relevant.

The report provides a comprehensive analysis of the competitive landscape in the United States Edtech market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Chilean EdTech platform School In One entered the U.S. with a USD 500,000 pre-seed investment and more than 850 schools on board. Currently operating in Florida, the platform provides connected learning, communication, and performance tools with the aim to transform education through AI features and real-time school management functions.

- April 2025: Edtech firm Seesaw, based in the U.S., acquired Jordan-based Little Thinking Minds, a leading provider of Arabic literacy solutions. The acquisition strengthens Seesaw's international reach, especially in the MENA region, and enables multilingual and culturally sensitive learning tools, with a possible launch of an Arabic-language platform in 2026.

- February 2025: NBA All-Star Pascal Siakam and DMZ launched the Siakam EdTech Engine, a 12-week accelerator program for K-12 EdTech startups in Canada and the U.S. The program includes mentorship, funding, and school board partnership, seeking to promote innovative, inclusive solutions that improve education in under-resourced communities.

- January 2025: Prodigy Learning and Minecraft Education introduced 'AI Ready Skills' to educate students on basic AI topics through learning via games. Provided worldwide, including in US schools, the curriculum includes subjects such as machine learning and ethics in AI, readying students for a future workforce where AI skills are becoming more highly valued than conventional experience.

- December 2024: UK-based Pango Education was acquired by Imagine Learning to complement its AI-powered, customized K-12 solutions. The deal reinforces its Curriculum-Informed AI products, which will benefit 18 million students in U.S. schools through streamlined lesson planning, flexibility for changing standards, and enhanced classroom learning experiences.

- October 2024: Bain Capital purchased PowerSchool for USD 5.6 Billion, making it go private. PowerSchool, with over 60 million students and 18,000 customers worldwide, offers cloud-based K-12 education software. The deal enables further innovation, specifically through generative AI, in U.S. schools and globally.

United States Edtech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Edtech market in the United States was valued at USD 74.34 Billion in 2024.

The United States Edtech market is projected to exhibit a CAGR of 12.60% during 2025-2033, reaching a value of USD 236.07 Billion by 2033.

The primary drivers of the United States edtech market are expanding demand for flexible and customized learning, rising adoption of digital tools in classrooms, and robust emphasis on reskilling the workforce. Government policy support for educational transformation, increasing internet penetration, and the growth of AI and data analytics also improve learning outcomes and driving market growth.

The K–12 education market led in the United States edtech market in 2024 at 46.4%, fueled by universal use of digital learning tools in schools, government-funded initiatives, and increasing demand for personalized, technology-enabled instruction across primary and secondary education institutions throughout the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)