United States Electronic Toll Collection Market Size, Share, Trends and Forecast by Technology, System, Subsystem, Offering, Toll Charging, Application, and Region, 2026-2034

United States Electronic Toll Collection Market Size and Share:

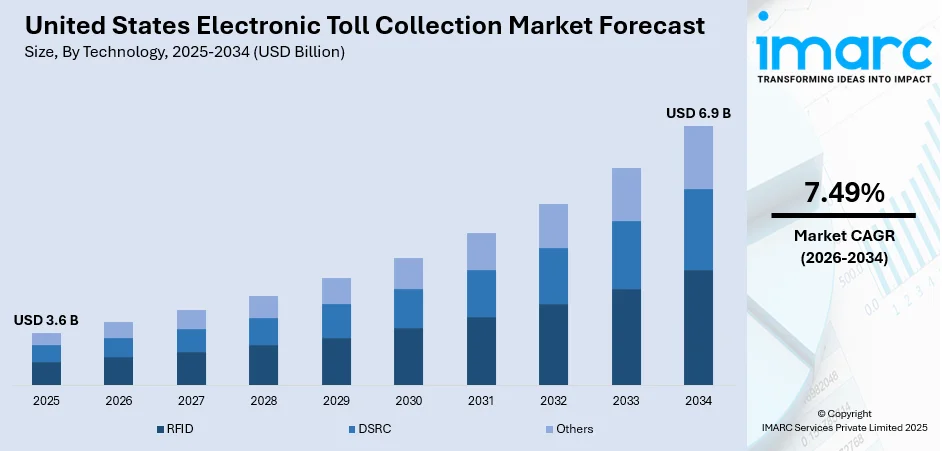

The United States electronic toll collection market size was valued at USD 3.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2034, exhibiting a CAGR of 7.49% during 2026-2034. South currently dominates the market in 2025. The market is growing due to increasing highway congestion, rising vehicle registrations, and the push for cashless toll systems. In addition, infrastructure modernization and system interoperability continue to support United States electronic toll collection market share across long-distance freight corridors and commuter routes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.6 Billion |

|

Market Forecast in 2034

|

USD 6.9 Billion |

| Market Growth Rate 2026-2034 | 7.49% |

Access the full market insights report Request Sample

As electronic tolling becomes the standard across US highways, agencies are looking beyond just system upgrades. They are now focusing on how to utilize existing toll-related infrastructure more effectively. Besides this, with the transition away from physical toll booths, several large networks now face the challenge of underused spaces where toll plazas once operated. These areas, often located on high-traffic corridors, represent valuable real estate that can be transformed to support mobility or community services. One growing trend is to convert these former toll zones into safety rest areas, electric vehicle (EV) charging stations, or transportation hubs.

To get more information on this market Request Sample

Nationwide tolling operations are increasingly focused on expanding interoperability, simplifying travel for both private users and commercial fleets. The need for a seamless tolling system is more pressing than ever with Millions of vehicles crossing state lines each day. Agencies across the country are collaborating to unify toll tag systems and simplify the process of multi-state travel. This development enables drivers to use a single account across multiple networks, reducing administrative burdens and improving customer satisfaction. Interoperability also encourages more drivers to adopt ETC services, boosting enrollment and usage. In recent years, systems like E-ZPass have made significant progress, now working across 35 agencies in 20 states. By early 2025, over 59 Million E-ZPass devices were in use, demonstrating consistent growth in user acceptance. The ease of integration and simplified toll processing not only benefits end users but also improves operational efficiency for toll operators. These efforts mark a shift toward unified national tolling frameworks, creating an environment where ETC systems can operate without borders.

United States Electronic Toll Collection Market Trends:

User-centric Digital Tools Expanding

The United States electronic toll collection market growth is increasingly shaped by digital platforms that simplify user interaction, support account management, and improve access to tolling information. Agencies are investing in web-based services to meet the expectations of a tech-savvy driving population seeking clarity, control, and convenience. In this environment, centralized platforms are becoming more critical to ensuring drivers can easily understand toll policies, account settings, and discount eligibility. In August 2024, the California Toll Operators Committee launched a redesigned FasTrak.org website, focusing on making statewide toll information easier to find, including rental car tolling, frequently asked questions, and a map of over 870 lane miles. The streamlined interface and mobile-first design enhanced the site’s accessibility and usability, providing drivers with faster responses and more relevant content tailored to each region. This development reflects a broader market trend toward unified tolling ecosystems, where users can manage accounts across multiple jurisdictions through a single portal. The impact is a measurable increase in account registrations and toll tag usage, especially in regions with mixed facility operators. By enhancing online customer service, agencies are increasing the adoption of electronic tolling systems and reducing their reliance on manual support or in-person assistance.

Infrastructure Overhaul Favoring Gantry Systems

As aging toll plazas become costlier to maintain and less compatible with modern traffic demands, agencies across the US are accelerating the transition to gantry-based, barrier-free toll systems. The focus has shifted toward efficiency, safety, and long-term operational savings, with gantries supporting open-road tolling and advanced vehicle recognition technologies. These systems also reduce stop-and-go traffic and eliminate the need for physical tollbooth staffing, lowering annual maintenance and personnel expenses. In January 2025, the Pennsylvania Turnpike activated Open Road Tolling (ORT) in its eastern corridor, replacing traditional toll plazas with gantries and implementing a new classification system based on axle count and vehicle height using Automated Vehicle Classification (AVC). This marked a shift toward performance-based tolling operations that align with national standards. The change improved vehicle throughput, reduced emissions at entry and exit points, and enhanced billing accuracy. Similar infrastructure upgrades are now in planning or execution phases across multiple states. The ORT model not only addresses the rising demand for faster, uninterrupted travel but also supports future integrations with smart traffic systems, helping tolling authorities respond to evolving mobility needs while controlling long-term operational costs.

Growing Traffic Volumes Boosting ETC Demand

The consistent rise in vehicle ownership across the United States is contributing to increased congestion on highways, especially at traditional toll plazas. In May 2025, new vehicle registrations rose by 2.2% year-over-year, with over 1.5 Million vehicles added that month alone. Annual car sales also exceeded 16.6 Million, reflecting a 3.05% growth rate. This surge, along with the country’s well-established transportation and freight networks, is prompting transportation agencies to adopt faster and more efficient toll-collection methods. Electronic toll collection (ETC) systems provide real-time toll processing, facilitating smoother traffic flow, reduced delays, and lower carbon emissions. They are also being used for security applications, such as tracking stolen vehicles and monitoring speed violations. Additionally, toll revenues are increasingly being earmarked for highway and road upgrades. The widespread use of systems like E-ZPass—now accepted by over 35 agencies across 20 states demonstrates the growing acceptance of ETC in both personal and commercial vehicle segments. With over 59 Million E-ZPass devices in active use and continuous growth in circulation, ETC adoption is gaining momentum, especially as the country moves toward more integrated and technology-driven traffic management solutions.

United States Electronic Toll Collection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States electronic toll collection market, along with forecasts at the regional levels from 2026-2034. The market has been categorized based on technology, system, subsystem, offering, toll charging, and application.

Analysis by Technology:

- RFID

- DSRC

- Others

As per the electronic toll collection market outlook, in 2025, the RFID segment led the market, accounting for 55.4% of the total market share driven by the widespread use of passive tags across major toll networks. RFID tags became a preferred solution because they required no onboard power, worked in all weather, and were low-cost to issue and maintain. Toll authorities deployed RFID-enabled gantries on interstates, bridges, and tunnels to improve vehicle flow and reduce delays. Agencies favored RFID over GPS or ANPR in areas with high traffic density, as it reduced read errors and minimized enforcement overhead. The ability to integrate RFID tags with fleet management systems also appealed to logistics operators. Mass adoption was further supported by state-led initiatives promoting cashless tolling on high-volume corridors.

Analysis by System:

- Transponder - or Tag-Based Toll Collection Systems

- Other Toll Collection Systems

In 2025, the transponder - or tag-based toll collection systems segment led the electronic toll collection market, accounting for 69.8% of the total market share, driven by the legacy adoption, system reliability, and cross-state compatibility. E-ZPass, SunPass, and similar networks remained dominant as drivers prioritized trusted and interoperable solutions. These systems enabled toll collection without requiring vehicle stops, thereby improving traffic throughput and reducing congestion. States introduced toll discounts for tag users, further incentivizing the adoption of these tags. Transponders were widely used on both urban express lanes and interstate highways, handling Millions of vehicles daily. Freight operators and commercial fleets relied on tag systems for trip tracking and efficient billing. With strong public familiarity, clear signage, and seamless integration with toll authorities’ back-office platforms, tag-based tolling remained the backbone of electronic tolling infrastructure nationwide.

Analysis by Subsystem:

- Automated Vehicle Identification

- Automated Vehicle Classification

- Violation Enforcement System

- Transaction Processing

In 2025, the automated vehicle classification segment led the electronic toll collection market, accounting for 45.0% of the total market share. As accurate tolling based on axle count and vehicle class became increasingly essential. Toll operators deployed AVC systems on highways, express lanes, and tunnels to automatically distinguish between passenger vehicles, trailers, and commercial trucks. These systems enabled variable toll rates based on size or weight without slowing traffic. AVC technology—ranging from laser profilers to machine vision cameras—ensured compliance and minimized fraudulent under classification. State agencies used AVC to enforce regulations and improve revenue accuracy. The increasing demand for multi-lane free-flow systems further supported AVC installations. High throughput, reduced manual errors, and enhanced enforcement capabilities drove the widespread adoption of AVC across public and private toll networks.

Analysis by Offering:

- Hardware

- Back Office and Other Services

In 2025, the hardware segment led the electronic toll collection market, accounting for 60.4% of the total market share, due to extensive deployments of tolling infrastructure. State and local agencies ramped up investments in gantries, RFID readers, lane controllers, sensors, and license plate recognition systems. Hardware upgrades accompanied the shift to cashless tolling, especially on major highways and managed lanes. Agencies prioritized robust, all-weather systems with minimal downtime and long service lives. Equipment was installed on bridges, tunnels, and expressways as legacy booths were phased out. Growth in commercial vehicle traffic also necessitated the installation of additional AVC sensors and enforcement cameras. Federal funding under infrastructure programs supported large-scale hardware rollouts. The physical footprint of ETC systems expanded significantly as more routes adopted real-time, automated tolling.

Analysis by Toll Charging:

- Distance Based

- Point Based

- Time Based

- Perimeter Based

In 2025, the distance based led the electronic toll collection market, driven by the growing interest in usage-based road pricing. Declining fuel tax revenues and growing electric vehicle (EV) adoption prompted policymakers to explore fairer alternatives tied to miles driven. Pilot programs in Oregon, Utah, and Virginia used GPS, OBD-II devices, and RFID systems to track vehicle distance and calculate charges accordingly. These systems enabled personalized billing and transparent accounting, appealing to both drivers and agencies. Urban planners also used distance pricing to manage congestion by charging more in high-traffic zones. By linking toll charges to actual road use, states improved equity and resource allocation. Support from federal grant programs helped fund the integration of technology and system trials in multiple states.

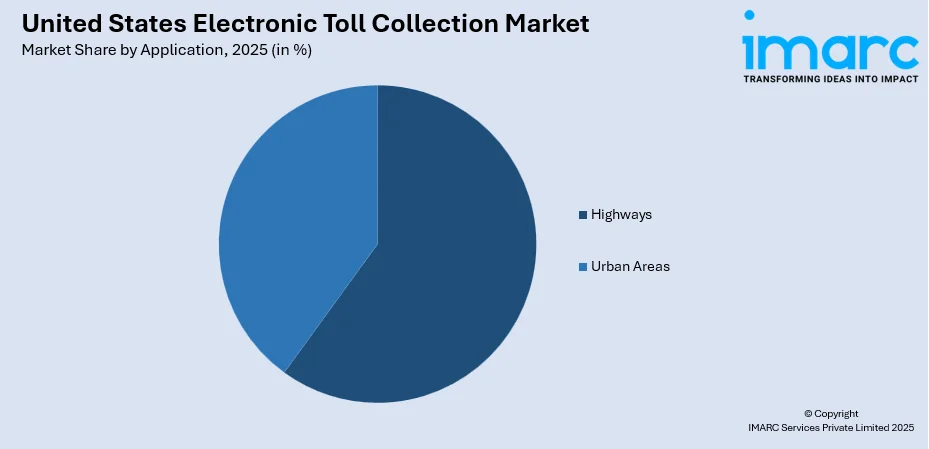

Analysis by Application:

To get detailed segment analysis of this market Request Sample

- Highways

- Urban Areas

Based on the electronic toll collection market forecast, in 2025 the highways led the market, accounting for 63.2% of the total market share, driven by the increasing interstate travel and heavy freight movement. States prioritized ETC expansion along major corridors, such as I-95, I-10, and I-70, to reduce bottlenecks and manual tolling delays. Highways offered stable, high-volume traffic flow, making them ideal candidates for full electronic conversion. Agencies deployed RFID gantries, AVC systems, and real-time monitoring hardware to support efficient tolling operations. Open-road tolling replaced legacy booths, reducing congestion and emissions. The rise of express lanes with dynamic pricing also increased tolling revenue. Highway tolls became a key funding source for maintenance, lane expansions, and bridge improvements under federal and state infrastructure programs.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, the South led the electronic toll collection market, driven by the rapid infrastructure growth, population migration, and the development of new toll corridors. States like Texas, Florida, and Georgia invested heavily in express lanes, all-electronic tolling systems, and public-private toll roads. These regions benefited from warm climates that reduced maintenance costs and allowed year-round system deployment. Fast-growing metro areas, such as Dallas, Miami, and Atlanta, experienced higher traffic demand, prompting the expansion of ETC coverage. Interoperability between state systems and large-scale RFID rollouts supported regional travel without cash. Freight traffic from southern ports and distribution hubs further boosted toll volumes. Strong policy support and public acceptance helped make the South the most active tolling region in the nation.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- January 2025: New York City implemented congestion pricing, becoming the first US city to do so. Utilizing electronic tolling, the USD 9 peak-hour fee aimed to reduce traffic, improve air quality, and fund transit upgrades. Similar systems in London, Singapore, and Milan showed reduced emissions and enhanced transportation efficiency.

- January 2025: TransCore launched its Infinity tolling system on the West Virginia Turnpike, introducing toll-by-plate payment and upgraded E-ZPass infrastructure. The deployment enhanced processing speeds and convenience, following the 2024 launch of TransCore’s Integrity back-office system, which improved account management and streamlined toll payment for Turnpike drivers.

- January 2025: Bay City began tolling both the Independence and Liberty Bridges using an electronic toll system with scanners and no on-site collectors. Residents with transponders accessed the bridges for free, while non-residents faced tolls up to USD 11.50. The move aimed to fund essential bridge repairs through user-based fees.

- January 2025: The Transportation Corridor Agencies issued an RFI to repurpose 10 former toll plazas on SR 73, 133, 241, and 261 after shifting to All Electronic Tolling. This initiative supported ETC growth by reallocating underused assets to enhance mobility and community value.

United States Electronic Toll Collection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | RFID, DSRC, Others |

| Systems Covered | Transponder - or Tag-Based Toll Collection Systems, Other Toll Collection Systems |

| Subsystems Covered | Automated Vehicle Identification, Automated Vehicle Classification, Violation Enforcement System, Transaction Processing |

| Offerings Covered | Hardware, Back Office and Other Services |

| Toll Charging Covered | Distance Based, Point Based, Time Based, Perimeter Based |

| Applications Covered | Highways, Urban Areas |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States electronic toll collection market from 2020-2034.

- The United States electronic toll collection market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States electronic toll collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States electronic toll collection market was valued at USD 3.6 Billion in 2025.

The United States electronic toll collection market is projected to exhibit a CAGR of 7.49% during 2026-2034, reaching a value of USD 6.9 Billion by 2034.

The electronic toll collection market is driven by rising traffic volumes, increasing vehicle registrations, and the shift toward cashless toll systems. Technological advancements, government initiatives to improve road infrastructure, and growing demand for faster, more efficient toll collection processes further support market expansion.

In 2025, South dominated the electronic toll collection market accounting for 46.5% of the total market share, driven by rapid urbanization, infrastructure expansion, and increasing adoption of electronic toll systems across high-traffic corridors. Additionally, a robust logistics sector and government incentives fueled this growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)