United States Flooring Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

United States Flooring Market Overview:

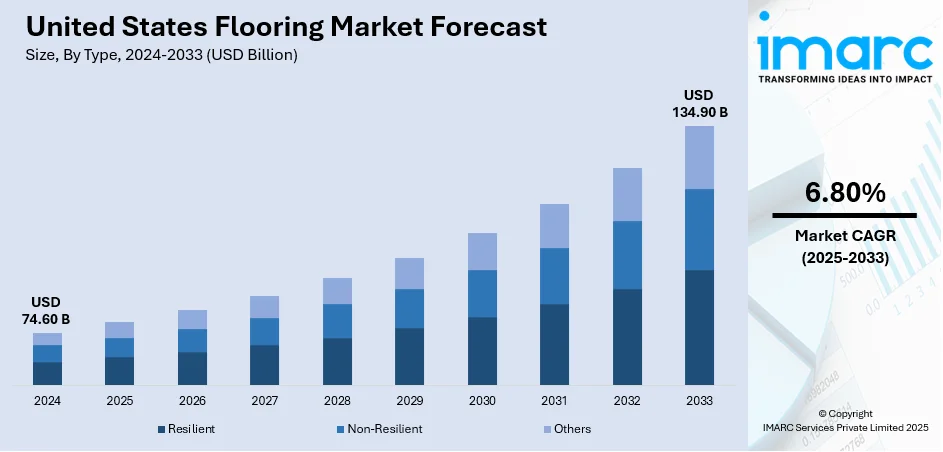

The United States flooring market size was valued at USD 74.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 134.90 Billion by 2033, exhibiting a CAGR of 6.80% from 2025-2033. The market is experiencing steady growth, driven by increased demand in residential and commercial sectors. Rising home renovation activities, technological advancements in flooring materials, and a growing preference for durable and eco-friendly options are contributing to this growth. The demand for resilient flooring types, like vinyl and laminate, is increasing due to their affordability and ease of maintenance. With continued innovation and sustainability efforts, the United States flooring market share is expected to continue expanding across various consumer segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 74.60 Billion |

| Market Forecast in 2033 | USD 134.90 Billion |

| Market Growth Rate 2025-2033 | 6.80% |

One major driver in the United States flooring market is growth in residential remodeling and new construction. According to data published by the US Census Bureau and the US Department of Housing and Urban Development, in May 2025, building permits for privately-owned housing units were issued at an annual rate of 1,393,000. The number of completions increased to 1,526,000, reflecting a rise of 5.4%. Single-family housing starts were recorded at 924,000, while completions reached 1,027,000. As more homeowners invest in upgrades kitchens, bathrooms, and basements in particular there’s a higher demand for flooring that is stylish, durable, and easy to install. Luxury vinyl tile and engineered wood are popular because they offer the appearance of natural materials without the maintenance issues. Builders also tend to favor cost-effective materials that balance aesthetics with durability, especially in multi-family housing.

To get more information on this market, Request Sample

Another factor is changing consumer preferences. People want flooring that is not just attractive but also sustainable and easy to clean. That has increased demand for eco-friendly options like bamboo or reclaimed wood and pushed manufacturers to offer more recycled or low-VOC products. For instance, in July 2024, AHF Products launched Ingenious Plank™, a next-generation hybrid flooring solution that is 100% PVC-free and eco-friendly. Weighing 40% less than traditional options, it features 23 wood visuals and enhances durability with waterproof, scratch-resistant technology. Designed for residential and light commercial spaces, it reflects AHF’s commitment to innovation and sustainability. At the same time, digital tools that let buyers see how a product looks in their space have changed how flooring is sold. Convenience and customization are influencing both product development and retail strategy.

United States Flooring Market Trends:

Rise of Luxury Vinyl and Engineered Products

Luxury vinyl tile (LVT) and engineered wood are taking a bigger share of the US flooring market. LVT offers the look of wood or stone at a lower cost and with better water resistance, making it a strong choice for kitchens, bathrooms, and basements. For instance, in June 2024, Interface, Inc. launched its new Etched & Threaded carpet tile and Earthen Forms™ LVT collections, emphasizing sustainable and innovative design. These modular flooring solutions blend natural textures and patterns, offering diverse options for commercial spaces. Both collections feature eco-friendly materials and are available for viewing at Interface showrooms worldwide. Engineered wood provides the warmth of hardwood but with greater stability and easier installation. Both options suit busy households looking for style and function without the upkeep of traditional materials. Their popularity is rising in both residential remodels and commercial spaces. United States flooring market outlook points to continued growth in these categories.

Growing Demand for Eco-Friendly Options

Sustainability is becoming a key priority for US flooring buyers. Homeowners and builders are choosing materials that are recycled, low in volatile organic compounds (VOCs), and sourced responsibly. Bamboo and cork are popular for their rapid renewability, while reclaimed wood appeals to those looking for character and a lower environmental impact. Certifications and transparency around sourcing and emissions are influencing purchase decisions. This shift is also driving innovation in adhesives and finishes that meet green building standards. For instance, in April 2024, Interface, Inc. has introduced new carpet tile collections, including textured Open Air™ Stria and Open Ended™, along with World Woven™ Two, enhancing commercial interiors with style and durability. Additionally, FLOR's collaboration with designer Trina Turk features vibrant area rugs. All offerings prioritize sustainability and are available in North and South America. With environmental awareness rising, the United States flooring market forecast suggests strong growth in eco-conscious products over the next several years.

Growth of DIY and Easy-Install Products

More homeowners in the US flooring market are choosing do-it-yourself options that save time and avoid hiring professionals. Click-lock planks click securely into place, reducing installation time and effort. Peel-and-stick tiles make it even simpler—just clean the floor, peel the backing, and press it down. These products work well for quick makeovers in bedrooms, kitchens, and rental properties. Many brands offer realistic wood and stone aesthetics with built-in durability. This trend is reshaping project planning, with homeowners feeling empowered to update floors on their own. United States flooring market growth is being driven by this surge in user-friendly flooring solutions.

United States Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States flooring market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Resilient

- Non-Resilient

- Others

Resilient stand as the largest type in 2024, holding 35.8% of the market because of its versatility and performance. It includes materials like vinyl, linoleum, and rubber, which are favored for their water resistance, ease of cleaning, and durability under heavy use. Luxury vinyl tile has become especially popular due to its realistic wood and stone visuals combined with a soft, flexible base. These products are widely used in homes, offices, schools, and healthcare settings. As more consumers and commercial buyers prioritize low-maintenance, cost-effective flooring, resilient types continue to see strong demand and dominate overall market share. The United States flooring market trends show a strong demand for these materials, ensuring their ongoing leadership in the industry.

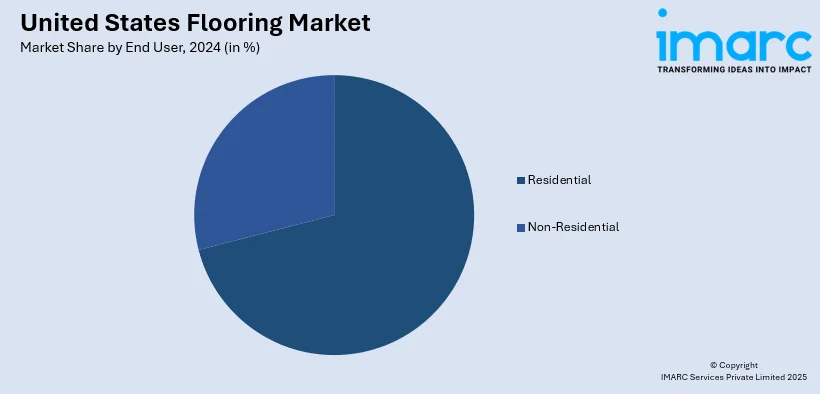

Analysis by End User:

- Residential

- Non-Residential

Residential leads the market with 70.9% of market share in 2024, driven by ongoing home renovations, new housing developments, and shifting consumer preferences. Homeowners are investing more in interior upgrades, especially in kitchens, living rooms, and basements, where stylish and durable flooring is a priority. Materials like luxury vinyl, engineered wood, and laminate are widely chosen for their design appeal and practicality. Single-family homes and apartments both contribute to rising demand, with DIY-friendly options gaining ground. The focus on comfort, aesthetics, and ease of upkeep makes residential spaces a key area of growth, keeping this segment at the forefront of the US flooring market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast flooring market is shaped by older housing stock and frequent remodeling activity. Homeowners often choose hardwood and engineered wood to match traditional interiors. Harsh winters drive demand for moisture-resistant options like vinyl and tile in entryways and basements. Urban areas see more multi-family units, where cost-effective and durable flooring solutions are especially popular.

In the Midwest, changing weather patterns influence flooring preferences. Homeowners look for materials that can handle temperature shifts and moisture, making vinyl, laminate, and carpet common choices. Affordability is a key factor, especially in rural and suburban areas. Engineered wood is also used in modern builds due to its resilience and aesthetic appeal across both new homes and renovations.

The South leads in housing starts, which drives strong demand for flooring. With warm and humid conditions, materials like tile, vinyl, and laminate are popular for their moisture resistance. Open-plan homes often feature wood-look floors in living areas, while cost-sensitive buyers lean toward budget-friendly options. Growth in suburban development fuels consistent market expansion across the region.

The West sees high demand for eco-friendly and stylish flooring options, reflecting regional preferences for sustainability and design. Hardwood, bamboo, and cork are more common here, along with polished concrete in modern homes. Wildfire-prone areas also consider fire-resistant materials. Urban hubs like California drive premium product sales, while mountain and desert zones look for weather-adapted solutions.

Competitive Landscape:

The US flooring market is marked by intense competition across material segments, pricing tiers, and distribution channels. Manufacturers focus on design variety, durability, and fast installation to stand out, while also investing in sustainable and low-emission products. Private labels and imported products add pricing pressure, especially in entry-level ranges. Online platforms and home improvement chains play a growing role in reaching consumers, prompting shifts in marketing and logistics. Innovation in click-lock systems, waterproof surfaces, and realistic textures continues to influence buyer preferences. Competitive advantage increasingly depends on product differentiation, responsive supply chains, and the ability to meet changing residential and commercial needs.

The report provides a comprehensive analysis of the competitive landscape in the United States flooring market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Pennsylvania-based AHF Products unveiled the Armstrong Flooring Kaleido color lab, an online design tool for luxury vinyl tile (LVT) that enables designers to use precise control and vibrant, expressive colors to completely revamp commercial spaces. The Kaleido experience begins with an online design platform that enables designers to view their work in a variety of carefully chosen commercial settings, as well as in their own private spaces.

- May 2025: San Jose Hardwood Floors, a renowned provider of flooring solutions in the Bay Area, launched SJ Floors Wholesale, a new division that will sell premium flooring supplies to the general public directly. These high-quality items, previously available exclusively to professional installers, will now be available to independent contractors, DIY enthusiasts, and homeowners who oversee their own installations.

- May 2025: Illinois-based Taj Flooring unveiled its latest commercial flooring range, the Avian Rigid Core Click. This new collection was created with performance, design flexibility, and American production in mind. It supports TAJ's continuous dedication to sustainability and quality while meeting the needs of contemporary commercial interiors.

- May 2025: SnapLock Industries, an international manufacturer and distributor of premium modular flooring based in Utah, successfully secured its latest U.S. patent, further enhancing its expanding line of exclusive innovations that aim to transform the flooring sector. This recently granted patent covers a sophisticated method and tool for the alignment and assembly of multi-layer floor panels, which will significantly improve manufacturing efficiency and precision while enabling even tighter tolerances and higher-quality products.

- April 2025: Lowe’s Companies, Inc. announced plans for the acquisition of Artisan Design Group (ADG), a prominent supplier of design, distribution, and installation services for interior surface finishes, including flooring, for a transaction value of USD 1.325 billion. This acquisition will significantly broaden Lowe’s Pro product range into another avenue of distribution in the US flooring market.

United States Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-Residential |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States flooring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States flooring market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flooring market in the United States was valued at USD 74.60 Billion in 2024

The United States flooring market is projected to exhibit a CAGR of 6.80% during 2025-2033, reaching a value of USD 134.90 Billion by 2033

The market is experiencing growth due to various factors such as an increase in residential renovations, a rise in new housing construction, a demand for low-maintenance materials, and a preference for eco-friendly products. Additionally, technological innovations in flooring design, the expansion of DIY trends, and greater accessibility through both retail and online distribution channels also play a role in this growth

Resilient flooring holds the largest market share due to its durability, water resistance, and affordability. Products like luxury vinyl tile are widely used in both residential and commercial spaces. Their ease of installation and broad design options make them a preferred choice across multiple applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)