U.S. Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033

U.S. Food Packaging Market Size and Share:

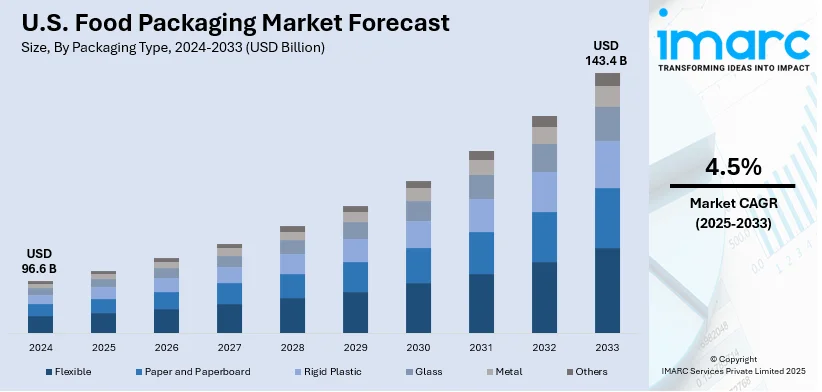

The U.S. food packaging market size was valued at USD 96.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 143.4 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. The market is growing fast as a result of the increasing demand for convenience food, rapid technological advancements, significant growth in e-commerce, heightened sustainability concerns, and elevating health awareness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 96.6 Billion |

|

Market Forecast in 2033

|

USD 143.4 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

The fast-paced lifestyle of American consumers has increased the demand for convenience foods, including ready-to-eat (RTE) meals, frozen foods, and snack items. According to the latest data, the country's convenience store sales reached $860 billion in 2023. On the other hand, foodservice sales, including prepared food, commissary, and hot and cold beverages, made up 26.9%. Manufacturers are shifting focus to packages that products have freshness, ensure food safety, and extend the shelf life. Packaging innovations in resealable pouches and single-serve containers and microwaveable packaging appeal to ease of use and portability. Furthermore, consumers rising demand for packaging that should keep pace with their on-the-go lifestyles without compromising quality, is supporting the market growth.

Some of the major trends steering the U.S. food packaging market are the rapid technological innovations in food packaging that have transformed the industry. These trends assist in enhancing food preservation and improving the consumer experience. Techniques such as modified atmosphere packaging (MAP) and vacuum packaging help maintain product freshness by controlling oxygen and moisture levels. Moreover, the Americas MAP is expected to grow to USD 7.79 billion by 2026. Additionally, smart packaging technologies, such as temperature sensors and freshness indicators, provide real-time monitoring of food conditions, ensuring safety and quality throughout the supply chain. With the rise in demand for high-tech solutions, packaging companies are heavily investing in research and development (R&D) to create intelligent, durable, and cost-effective materials.

U.S. Food Packaging Market Trends:

E-Commerce and Online Food Delivery Growth

The rapid growth of e-commerce and online food delivery services drastically raises the demand for specialized food packaging. As per the latest report, the US online food delivery industry would grow at an annual rate of 9.8% and reach $68.6 billion by 2032. This demand for more durable, leak-proof, and thermally insulated packaging rapidly increased with grocery and prepared meal orders made online, which in turn is acting as a growth-inducing factor. Packaging has become fundamental in ensuring that food products reach consumers in optimized condition and most importantly, maintaining freshness, quality, and safety levels during delivery. Another driving factor has been due to increased home deliveries which require packaging that is light, easy to dispose of, and user-friendly. Companies are increasingly coming up with designs for packaging that meet the requirements of being attractive to enhance brand recognition.

Sustainability and Environmental Concerns

The growing concerns for environmental issues have led a major shift toward sustainable packaging solutions in the food industry. For example, in April 2023, the US Environmental Protection Agency (EPA) unveiled its National Strategy to Prevent Plastic Pollution that aims to completely stop allowing plastic waste to enter the environment by 2040. Consumers are opposing the use of traditional plastic packaging, and manufacturers are responding with biodegradable, compostable, and recyclable materials. With the popularity of bio-based plastics, plant-based packaging, and innovations such as edible films, the environmental impact of food packaging continues to decline. The implementation of stricter policies in the U.S., regulatory bodies are focusing on reducing plastic waste, which further pushes companies toward sustainable practices. Companies are not only focusing on reducing packaging waste but also investing in closed-loop recycling systems to promote a circular economy.

Health and Safety Awareness

Today, with health-conscious consumers emphasizing more on the safety and hygiene of food, high-quality packaging has emerged as a critical aspect of food production and distribution. Proper packaging ensures that food remains contamination-free, prevents nutrient loss, and stays fresh. This trend has led the modern packaging industry to use innovative materials and designs that guarantee airtight seals and tamper-evident closures. Manufacturers are also using antimicrobial coatings and advanced barrier materials to prevent the growth of bacteria and other pathogens. The health and safety emphasis has also promoted the use of transparent packaging wherein consumers can visually inspect the product before purchase.

U.S. Food Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. food packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on packaging type, and application.

Analysis by Packaging Type:

- Flexible

- Paper and Paperboard

- Rigid Plastic

- Glass

- Metal

- Others

Food packaging market has a very flexible and cost-effective packaging segment known as flexible packaging. The materials used include plastic films, pouches, and wraps, all of which are light in weight yet rigorous, easy to customize, and versatile. This type of packaging is widely used for snacks, frozen foods, and ready-to-eat (RTE) meals due to its ability to conform to any shape or size and at the same time, the amazing barrier properties capable of resisting moisture, oxygen, and contaminants.

Paper and paperboard packaging are gaining acceptance because of their environmentally friendly features and biodegradable nature. They are used for bakery products, cereals, and fast food products, for both appearance and functionality. This segment finds favor with environmentally sensitive consumers who opt for plastic-alternative packaging. Innovations in materials used for paperboards have also improved their utility for a variety of food products, making them water-resistant and greaseproof.

Rigid plastics offer a durable and versatile type of packaging suitable for bottling beverages, dairy products, and shelf-stable foods. It includes containers, bottles, and trays, offering excellent protection against physical damage while retaining the freshness quality of food. Being transparent and light, rigid plastics appeal to consumers and manufacturers alike. It is also non-destructible when used in tamper-evident design for added security purposes in packaged foods.

Glass packaging is often used for premium F&B products due to its high aesthetic value and excellent barrier properties. The type is commonly used for sauces, baby food, and beverages like juices and wines. It does not react chemically and, thus, provides integrity to the product, so long shelf life products are best suited with it. Although it's heavier than most other materials and certainly less cost-effective, its recyclability and perceivable sustainability let it have a competitive advantage.

The metal packaging, or cans and tins, provides a sure and protective capability for long-term food storage. Canned goods, beverages, and ready-to-eat meals are packaged with this particular type of packaging in view of its hermetic seal that helps preserve the freshness and quality of foods for quite some time. The strength, recyclability, and ability to withstand extreme temperatures during processing and storage make aluminum and steel the preferred metals in canning.

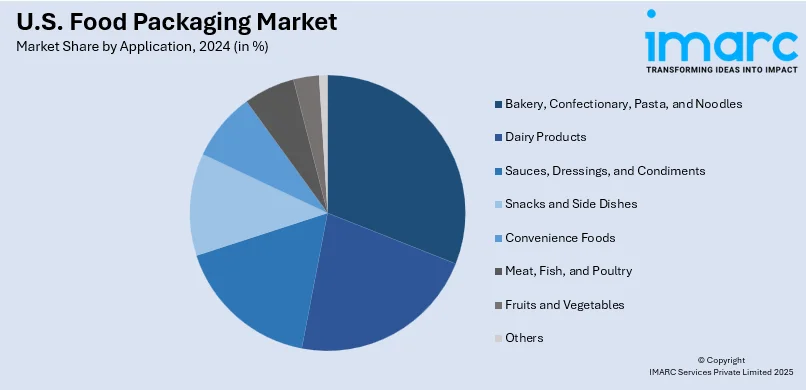

Analysis by Application:

- Bakery, Confectionary, Pasta, and Noodles

- Dairy Products

- Sauces, Dressings, and Condiments

- Snacks and Side Dishes

- Convenience Foods

- Meat, Fish, and Poultry

- Fruits and Vegetables

- Others

The bakery, confectionery, pasta, and noodle packaging emphasizes on freshness, texture, and flavor. Flexible packaging, such as pouches or films, are basically moisture-sensitive material that reduces moisture to preserve the freshness of pastries and chocolates. The rigid plastic or paperboard for packaging of pasta and noodles ensures that it is durable and stackable. The provision of transparent windows and resealable mechanisms makes it more convenient for the customer to open it again after consumption while designs emphasizing the eco-friendliness are becoming trendy.

Dairy packaging is essential to ensure that milk, cheese, yogurt, and butter have a prolonged shelf life and hygiene. Rigid plastic containers, flexible pouches, rigid tubes, and flexible tubes are used quite often because they offer enhanced protection against contamination and also help to maintain their temperature stability. Transparent designs help the consumers evaluate their product's quality while innovations like single-serve packs are ideal for on-the-go consumption.

In sauces, dressings, and condiments require leakage-proof and tough packaging to withstand transportation and storage. Flexible pouches with spouts and rigid glass jars are highly in demand as they are convenient to use and an excellent aesthetic product. Additionally, squeeze bottles and portion-controlled packs cater to the growing demand for user-friendly designs. Barrier properties assist in preventing oxidation, flavor and consistency of the product.

Snacks and side dishes segments depend on packaging that supports portability and fresh preservation. The choices for this category depend predominantly on flexible materials, such as resealable pouches and single-serve packs, which are primarily developed according to the on-the-go snacking habits. Prominent designs and transparent windows for easy visualization are another important aspect in order to attract consumers. The segment also focuses on barrier-related properties to avoid moisture and air penetration.

Convenience foods require packaging that manages to fit in durability, portability, and microwave compatibility. Ready-to-eat (RTE) meals and frozen foods come frequently packed in trays or pouches or cartons that are built to withstand freezing and reheating processes. Convenience is a significant consideration, with advances such as easy-peel lids, resealable pouches, and compartmentalized trays becoming popular.

Packaging of meat, fish, and poultry is centered on freshness, safety, and shelf life. Vacuum sealing and modified atmosphere packaging (MAP) are extensively used to minimize bacterial growth and extend the life of a product. In rigid plastic trays and flexible films, raw and processed meat are packaged with superior barrier properties. Moreover, various transparent designs enable clear product inspection which enhances usage.

The packaging for fruits and vegetables aims to preserve freshness and reduce spoilage. Flexible films, breathable plastic bags, and clamshell containers are popular choices for their ability to regulate moisture and prevent physical damage. Innovations like ethylene-absorbing films help extend the shelf life of fresh produce. Transparent packaging provides visibility, ensuring consumers can assess product quality before purchase.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeastern U.S. market for food packaging is boosted by urbanization, high population density, and an intense need for convenience meals. The region's cities support a thriving food service sector which largely depends on effective and environmentally conscious packaging solutions. The use of recyclable and biodegradable packaging materials has grown as a result of the region's emphasis on sustainability. The need for high-end, environmentally friendly packaging designs is further heightened by the regions's high concentration of specialized food items and organic marketplaces.

The Midwest's position as a center for agriculture helps the food packaging industry, that concentrates heavily on packaging alternatives for processed, meat, poultry, and dairy products. The region's vast food production and processing facilities prioritize industrial and bulk packaging in addition to retail-ready options. Plastics, both rigid and flexible, are used frequently to keep perishable commodities secure and fresh. Packaging strategies in this area are being influenced steadily by sustainability initiatives as local manufacturers use eco-friendly materials to satisfy the demands of consumers.

A combination of established and new trends is driving the food packaging business in the South. The substantial demand for packing fruits, vegetables, and seafood is boosted by the region's substantial agricultural base. Furthermore, the demand for adaptable, practical, and affordable packaging solutions has risen due to the expanding population and a booming food service industry. The region's cities are experiencing a hike in demand for creative and environmentally friendly packaging to maintain pace with the growing demand for fast-food and ready-to-eat foods.

Innovation in the food packaging industry is largely driven by the Western region. The demand for sustainable and biodegradable packaging materials has risen as a result of the region's focus on eco-friendly and health-conscious lifestyles. The West, being a center for plant-based and organic foods, prioritizes focus on high-end packaging alternatives that reflect the caliber of the products. The region's tech-driven culture encourages the use of innovative and advanced packaging methods. Furthermore, the region's expanding e-commerce industry has driven up demand for robust and aesthetically appealing packaging for meal delivery and grocery delivery services.

Competitive Landscape:

Leading companies in the U.S. food packaging market are focusing on innovation, sustainability, and consumer-centric solutions to maintain their competitive edge. They are heavily investing in research and development (R&D) to create packaging that extends shelf life, enhances product safety, and caters to convenience trends. Sustainability is a primary focus, with major players adopting eco-friendly practices such as using biodegradable materials, improving recyclability, and reducing packaging waste. Companies are also leveraging smart packaging technologies, including sensors and freshness indicators, to meet the growing demand for transparency and safety. Additionally, partnerships and acquisitions are on the rise as companies seek to expand their capabilities and market reach.

The report provides a comprehensive analysis of the competitive landscape in the U.S. food packaging market with detailed profiles of all major companies, including:

- Amcor plc.

- Berry Global Inc.

- Sonoco Products Company

- Huhtamäki Oyj.

- Winpak Ltd.

- DS Smith PLC

- Sealed Air

Latest News and Developments:

- In April 2024, American Packaging Corporation announced the launch of another RE™ “Design for Recycle” flexible packaging technology targeted at pet food products ranging from small pouches for pet treats to large bags for pet kibble.

- In January 2024, Sealed Air announced its plan to launch CRYOVAC® brand compostable overwrap tray in the International Product & Processing Expo (IPPE), which is held in Atlanta US. This tray is made from biobased and food-contact grade resin and is capable of handling variety of conditions across the food value chain.

U.S. Food Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Flexible, Paper and Paperboard, Rigid Plastic, Glass, Metal, Others |

| Applications Covered | Bakery, Confectionary, Pasta, and Noodles, Dairy Products, Sauces, Dressings, and Condiments, Snacks and Side Dishes, Convenience Foods, Meat, Fish, and Poultry, Fruits and Vegetables, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Amcor plc., Berry Global Inc., Sonoco Products Company, Huhtamäki Oyj., Winpak Ltd., DS Smith PLC, Sealed Air, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. food packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. food packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. food packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

U.S. food packaging encompasses the materials and methods used to enclose and protect food products throughout the supply chain, from production and distribution to retail and consumption. Its primary functions include preserving food quality, ensuring safety, extending shelf life, and providing essential information to consumers.

The U.S. food packaging market was valued at USD 96.6 Billion in 2024.

IMARC estimates the U.S. food packaging market to exhibit a CAGR of 4.5% during 2025-2033.

The market is growing fast as a result of the increasing demand for convenience food, rapid technological advancements, significant growth in e-commerce, heightened sustainability concerns, and elevating health awareness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)