United States Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2026-2034

United States Foreign Exchange Market Size and Share:

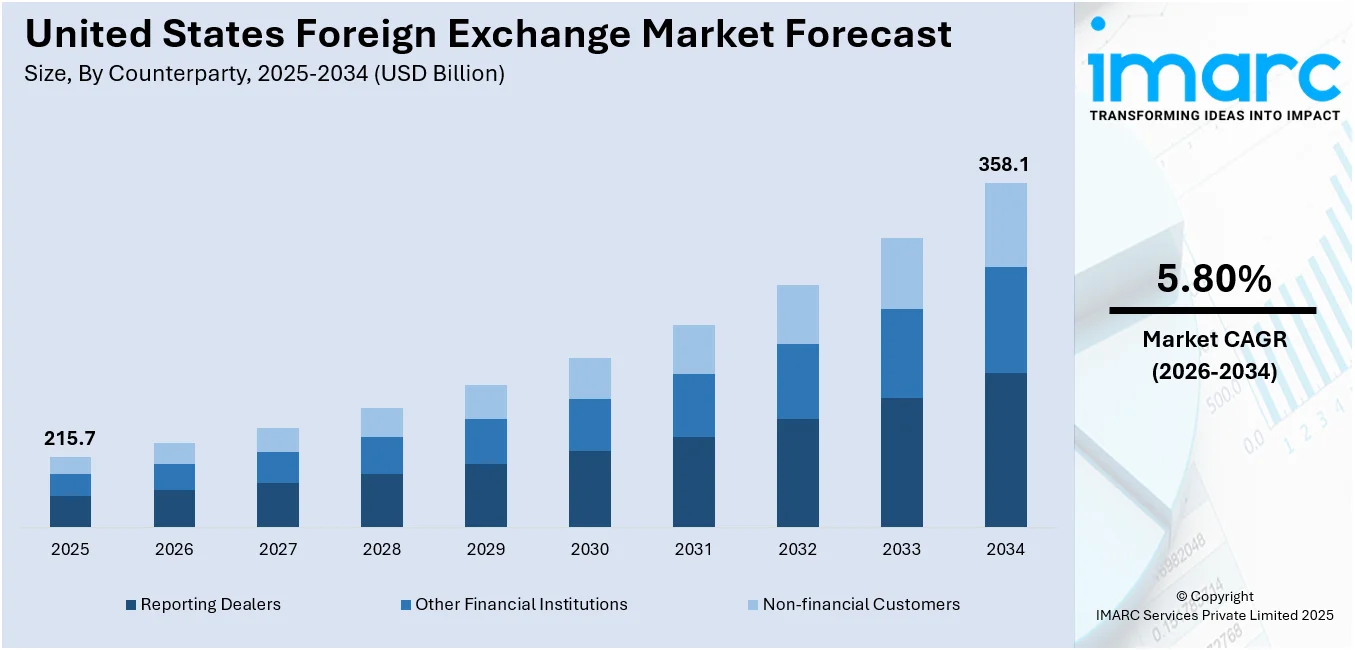

The United States foreign exchange market size was valued at USD 215.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 358.1 Billion by 2034, exhibiting a CAGR of 5.80% from 2026-2034. Interest rate differentials, economic data, Federal Reserve policies, geopolitical stability, trade balances, and market sentiment are driving the market for foreign exchange in the United States. Strong economic performance and safe-haven demand for the U.S. dollar attract global investors. Inflation trends, foreign investments, and government debt levels significantly influence currency movements, which contributes significantly to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 215.7 Billion |

| Market Forecast in 2034 | USD 358.1 Billion |

| Market Growth Rate (2026-2034) | 5.80% |

The foreign exchange market in the United States is driven by a variety of economic, financial, and geopolitical factors. The most important of these is monetary policy as determined by the Federal Reserve. Decisions on interest rates, quantitative easing, or tightening have an impact on the dollar's attractiveness to foreign investors. Higher interest rates tend to strengthen the dollar as they provide better returns on U.S. assets. As per the Federal Reserve Board, in 2024, most central banks significantly tightened monetary policy as inflation accelerated worldwide. Although the COVID pandemic had an impact on global supply chains and labor markets, which increased inflation uniformly across economies, domestic factors were responsible for some significant differences in the timing and degree of monetary policy responses. Against this backdrop, exchange rates registered notable movements and many commentators highlighted the relative stance of monetary policy as the main driver. In line with this, economic indicators such as GDP growth, unemployment rates, and inflation also play a pivotal role. Strong economic performance signals a robust investment climate, thus increasing the demand for the U.S. dollar.

To get more information on this market Request Sample

The U.S. trade balance, therefore, affects foreign exchange. As a trade deficit, importing more than exporting, can increase dollar supply in the global markets, putting a downward pressure on it. However, the presence of the dollar as the world's reserve currency often negates this effect, keeping its strength intact even with deficits. For example, in November 2024, The U.S. Census Bureau and the U.S. Bureau of Economic Analysis reported that the goods and services deficit was $84.4 billion in September, which increased $13.6 billion from August at $70.8 billion. The September exports were $267.9 billion, $3.2 billion less than in August. Imports of goods and services were $352.3 billion, $10.3 billion more than August imports. Moreover, the U.S. dollar serves as a safe-haven asset because of geopolitical stability amidst uncertainty around the world. Political or economic crises in other regions have led to increased demand for dollars as investors look for refuge.

United States Foreign Exchange Market Trends:

Federal Reserve Monetary Policy

The Federal Reserve's interest rates and monetary policy decisions have a significant impact on the US dollar. Higher interest rates tend to make U.S. assets more attractive to investors, thereby increasing the demand for the dollar. Conversely, rate cuts or dovish policies can weaken it. Actions such as quantitative easing or tightening, along with statements from the Fed, do influence global perceptions of the dollar's strength, which does drive foreign exchange movements. As recently as November 2024, the Federal Reserve decreased its target federal funds interest rate by 0.25% to a target range of 4.50% to 4.75% during its regularly scheduled two-day meeting. Following the 0.50% decrease during the previous meeting, economists and investors had forecast the incremental lower shift in rates, while interest-rate markets were factoring in 0.75% to 1.00% of extra cuts by year's end in 2025.

Economic Performance

The dollar's strength is determined by the key indicators such as GDP growth, employment rates, and inflation. A strong economy attracts foreign investment, thereby increasing the demand for the dollar. Conversely, weak economic data or signs of a slowdown reduce its appeal. Stability in the U.S. markets further reinforces the dollar's global role, even during trade imbalances or external pressures. For example, in November 2024, the U.S. consumer spending rose a bit more than expected in October, which suggests the economy maintained most of its solid growth pace at the start of the fourth quarter but the drive in recent months appears to have lost steam on inflation. The failure to quell inflation back to 2% of the Fed's target, coupled with the threat of higher imports tariffs from the incoming Trump regime, may limit the room left for interest rate cuts by America's central bank next year.

Geopolitical Stability and Safe-Haven Demand

The U.S. dollar often appreciates in times of geopolitical uncertainty, as it is a safe-haven asset. Global crises, wars, or financial instability drive investors to the relative safety of the dollar. This status, coupled with the fact that the U.S. is the world's largest economy, ensures the strong demand for the currency in times of uncertainty. For example, at the 2024 BRICS Summit, it was pointed out that almost 95% of trade between Russia and China is now conducted in Rubles and Yuan, bypassing the dollar. Industry reports suggest that the USD is the world's reserve currency held by most central banks and institutions as part of their foreign exchange reserves. The dominant economic position of the US and its widely used currency in foreign trade make the USD a preferred safe haven.

United States Foreign Exchange Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States foreign exchange market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on counterparty and type.

Analysis by Counterparty:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Reporting dealers, such as large banks and market makers, hold the largest share in the U.S. foreign exchange market due to their role as primary intermediaries in currency trading. They facilitate transactions for clients, manage liquidity, and offer bid-ask spreads. These dealers dominate because of their significant trading volumes, access to vast resources, and the ability to execute large trades quickly and efficiently.

Other financial institutions, including investment funds, hedge funds, and insurance companies, hold a significant share due to their substantial foreign exchange operations. These institutions engage in currency trading for portfolio diversification, hedging purposes, and speculative investments. Their extensive participation is driven by their large capital bases and the need for efficient currency risk management across international markets.

Non-financial customers, such as multinational corporations, hold a significant share in the FX market primarily for hedging currency risks related to global trade. Companies with international operations use foreign exchange markets to mitigate risks from fluctuations in exchange rates, protect profits, and secure favorable pricing for cross-border transactions. Their participation is driven by operational needs rather than speculative motives, leading to frequent currency transactions.

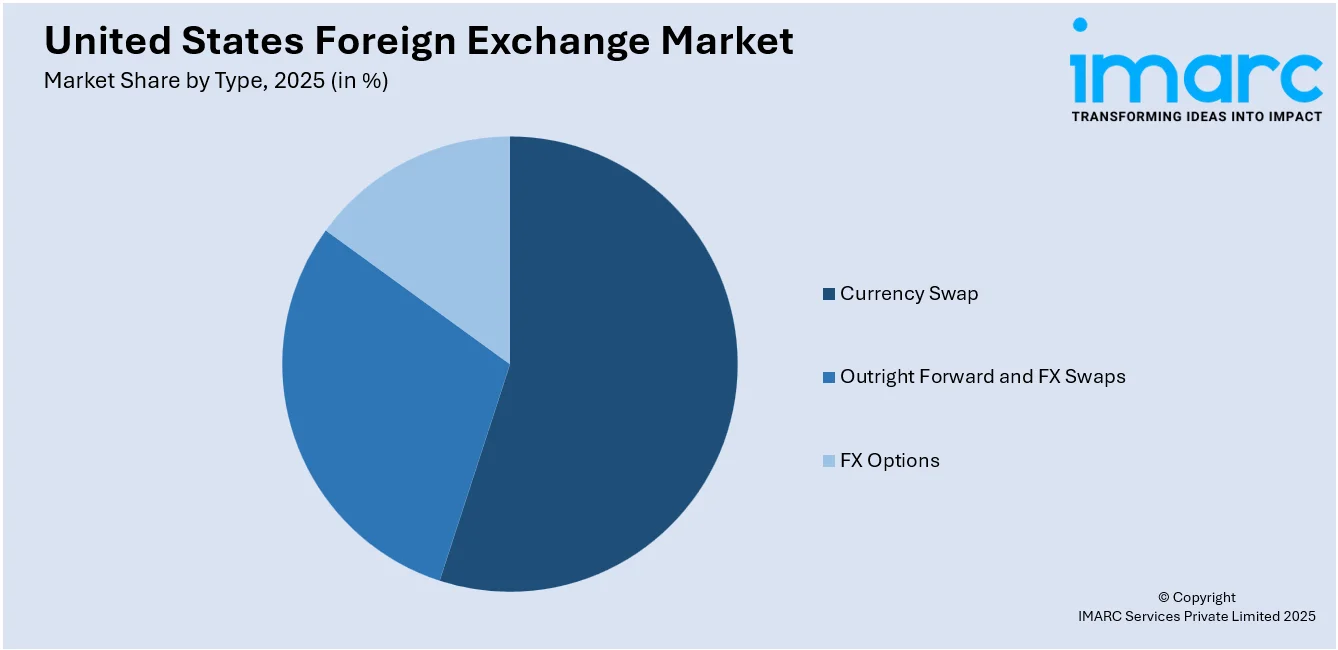

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Currency swaps are widely used by multinational corporations and financial institutions to manage long-term foreign exchange risk and interest rate exposure. They allow parties to exchange principal and interest payments in different currencies, supporting global trade and investment.

Outright forwards and FX swaps dominate due to their flexibility in managing short- and medium-term currency risk. These instruments allow hedging against future exchange rate fluctuations, making them essential for corporates and financial institutions.

FX options hold a significant share as they offer the right, but not the obligation, to trade currencies at a specific rate. This flexibility makes them valuable for hedging against unpredictable currency movements, attracting both speculators and risk-averse entities.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is a financial hub, home to major banking institutions, stock exchanges, and global trade networks. Economic activities such as finance, technology, and international trade influence the FX market here. The region’s proximity to global financial centers like New York contributes to large volumes of currency trading, driven by investments, multinational corporations, and foreign exchange transactions linked to finance, banking, and cross-border trade.

In the Midwest, manufacturing and agriculture play a critical role. Strong export activities in industries like automobiles, machinery, and farming drive currency demand. As businesses in this region trade internationally, they engage in the foreign exchange market for hedging and currency transactions. Exchange rate fluctuations directly impact profitability, particularly for exporters, making this region sensitive to trade balances and the need for effective currency management.

The South is known for its energy production, particularly oil and gas, alongside industries like agriculture and aerospace. These sectors contribute to foreign exchange demand, especially due to the region’s export activities. The South’s reliance on global markets for energy and agricultural products means that currency fluctuations have a direct impact on trade, prices, and investments, influencing exchange rate dynamics in this region.

The West is a key region for technology and entertainment industries, along with significant trade activities in ports like Los Angeles. International business operations, especially in tech, drive demand for foreign currencies for imports, exports, and investments. The region's focus on innovation and cross-border collaboration, along with high levels of foreign investment, results in substantial participation in the FX market.

Competitive Landscape:

The highly competitive foreign exchange market of the United States is governed by global banks, financial institutions, and trading platforms. Major market players like JPMorgan Chase, Citibank, and Goldman Sachs ensure liquidity in the market. This has been transformed by fintech and electronic trading platforms like EBS and CME Group that provide algorithmic and high-frequency trading. While small regional banks often provide localized facilities, it is the large global corporates and hedge funds that contribute to high trading volumes, mainly to hedge and speculating purposes. Regulation by agencies such as the Commodity Futures Trading Commission (CFTC) guarantees market stability. The dynamic interplay of traditional institutions and technology fosters continuous innovation and intense competition.

Latest News and Developments:

- In July 2024, Citi announced the launch of its annual CitiFX Vendor Review, which provides the broadest view of FX vendors and a comprehensive analysis of the FX landscape for the benefit of clients and FX providers. The review highlights where strategic venue and vendor partners can improve based on client needs and work towards a gold standard of best practice, operational governance, and clear benchmarks.

-

In October 2024, ION, a global leader in trading and workflow automation software, high-value analytics and insights, and strategic consulting to financial institutions, central banks, governments, and corporate organizations, announces it has connected to the FMX Futures Exchange (the “Exchange”), which opened on 23 September 2024. With this connectivity, clients can now trade on the newly launched Exchange through ION’s execution and post-trade product suite.

United States Foreign Exchange Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States foreign exchange market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States foreign exchange market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Foreign exchange (Forex or FX) refers to the global market where currencies are traded. It facilitates currency conversion for international trade, investment, and travel. Participants include banks, corporations, governments, and individuals. Exchange rates fluctuate based on economic conditions, geopolitical events, and market demand, making forex highly dynamic and liquid.

The United States foreign exchange market was valued at USD 215.7 Billion in 2025.

IMARC estimates the United States foreign exchange market to exhibit a CAGR of 5.80% during 2026-2034.

The key factors driving the market are Federal Reserve policies, economic performance, and geopolitical stability. Interest rate changes, inflation, and employment data influence currency demand. Trade balances, capital flows, and market sentiment also play key roles, while the U.S. dollar’s safe-haven status attracts global investors during uncertainty.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)