United States Frozen Pizza Market Size, Share, Trends and Forecast by Crust Type, Size, Product Type, Topping, Distribution, and Region, 2025-2033

United States Frozen Pizza Market Size and Share:

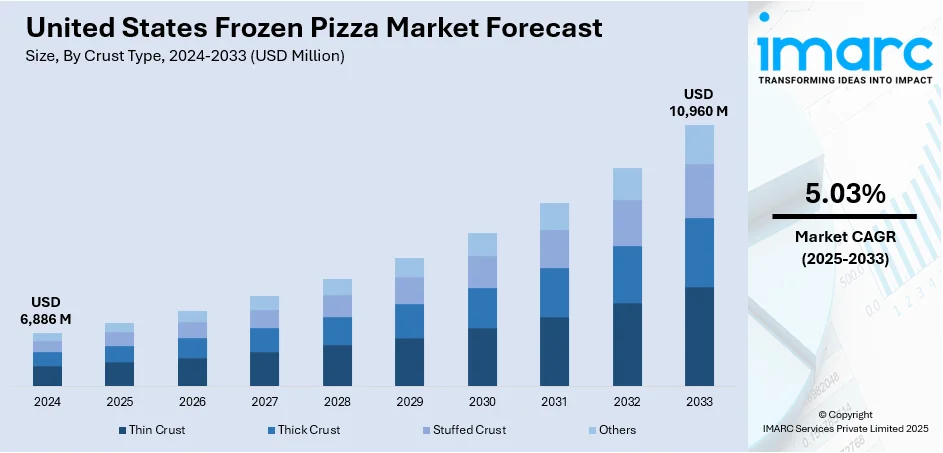

The United States frozen pizza market size was valued at USD 6,886 Million in 2024. Looking forward, the market is expected to reach USD 10,960 Million by 2033, exhibiting a CAGR of 5.03% during 2025-2033. Midwest currently dominates the market, holding a significant market share in 2024. The market is driven by consumer demand for convenient, ready-to-eat meals that align with busy lifestyles. Innovations in crust types, toppings, and healthier options are attracting diverse demographics. Strong retail distribution and brand competition continue to shape the evolving landscape of the United States frozen pizza market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6,886 Million |

|

Market Forecast in 2033

|

USD 10,960 Million |

| Market Growth Rate 2025-2033 | 5.03% |

The market in the US is growing steadily, driven by multiple consumer, economic, and industry-level factors. Rising demand for convenient meal solutions is a primary driver, as busy lifestyles leave consumers with less time for cooking. Frozen pizza offers a quick, affordable, and satisfying option that fits easily into modern routines. Amid inflationary pressures, consumers are also shifting toward cost-effective alternatives to dining out, making frozen pizza an attractive value proposition for families and individuals alike. For instance, in February 2025, DiGiorno joined forces with Hidden Valley Ranch to elevate the classic combination of pizza and ranch from a simple pairing to a full-blown culinary experience. Embracing the widespread love for this iconic duo, the two brands have introduced a pair of bold, ranch-infused frozen pizzas that reimagine the fan-favorite flavor mashup in an entirely new way.

To get more information on this market, Request Sample

The United States frozen pizza market growth is also driven by product innovation, which has elevated the category, with brands introducing a wide range of flavors, crust types, and dietary options such as gluten-free, keto-friendly, and plant-based varieties. These innovations cater to evolving health-conscious and diverse taste preferences. Premium offerings that mimic restaurant-quality experiences further appeal to consumers seeking indulgence at home. For instance, in May 2025, Caulipower, recognized for its gluten-free pizzas made with cauliflower-based crusts, expanded its product range with a new frozen variety. This latest creation, dill pickle pizza, features a cauliflower-infused dough topped with white béchamel sauce, mozzarella cheese, dill pickle brine, roasted garlic, and a finishing touch of dill garnish.

United States Frozen Pizza Market Trends:

Rising Workforce and Shifting Lifestyle Preferences

The increasing pace of life, driven by demanding work schedules, is significantly influencing food choices across the United States. As people seek convenient meal options, the demand for ready-to-eat (RTE) products like frozen pizza continues to climb. According to the National Bureau of Economic Research (NBER), the US labor force is expected to expand by 16.2% between 2020 and 2060, adding approximately 25.2 million workers. This growth reflects a broader trend of time-constrained consumers leaning toward convenient food solutions. Moreover, 52% of Americans now prioritize convenience more than before, with Millennials (57%) and Gen Z (61%) leading this shift. Around 23% of US consumers even identify as “convenience seekers,” reinforcing the frozen pizza market’s upward trajectory.

Rise in Product Innovation and Health-Focused Offerings

Manufacturers in the frozen pizza sector are actively diversifying their offerings to align with evolving dietary needs and preferences. Health-conscious consumers are increasingly opting for products with minimal artificial preservatives, reduced fat, and zero trans fats. According to the United States frozen pizza market trends, this has led to the introduction of whole wheat and multigrain crusts, along with gluten-free and dairy-free options tailored for lactose-intolerant individuals. These innovations not only broaden the appeal of frozen pizzas but also reflect a proactive response to rising consumer awareness around nutrition and allergen sensitivity. By combining convenience with better-for-you attributes, brands are capturing new customer segments and boosting retention in an increasingly health-aware food environment. For instance, in May 2023, South Korea’s leading food conglomerate, CJ CheilJedang Corp., established the world’s largest frozen pizza manufacturing facility in the United States as part of its strategic effort to surpass Nestlé and gain a dominant position in the American frozen pizza market.

Growing Fast Food Affinity Among Younger Generations

The expanding popularity of fast food, particularly among younger consumers, is playing a pivotal role in creating a positive United States frozen pizza market outlook. Millennials and Gen Z, who prioritize affordability, speed, and variety in their meals, are key contributors to this trend. According to industry research, 42% of Americans aged 18–34 consume fast food multiple times per week, compared to only 13% among those 55 and older. Frozen pizza, offering a familiar and flexible alternative to dining out, fits seamlessly into their lifestyle. Additionally, increased disposable incomes and a growing openness to experimenting with new flavors and formats are encouraging trial and repeat purchases. These behavioral shifts are shaping the competitive landscape and sustaining momentum in the market across the US.

United States Frozen Pizza Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States frozen pizza market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on crust type, size, product type, topping, and distribution.

Analysis by Crust Type:

- Thin Crust

- Thick Crust

- Stuffed Crust

- Others

Stuffed crust holds the largest share in the market due to its strong appeal among consumers seeking indulgent, flavorful meal options. This variety offers a unique twist on traditional pizza by incorporating cheese or other fillings into the crust, enhancing the overall taste and texture experience. Its popularity is further driven by its association with comfort food and its ability to offer added value in frozen formats. Many leading brands have expanded their stuffed crust offerings with new flavors, premium ingredients, and promotional tie-ins, increasing consumer interest and repeat purchases. The combination of indulgence, variety, and familiarity makes stuffed crust a standout choice in the frozen aisle, contributing to its dominant position in the US market.

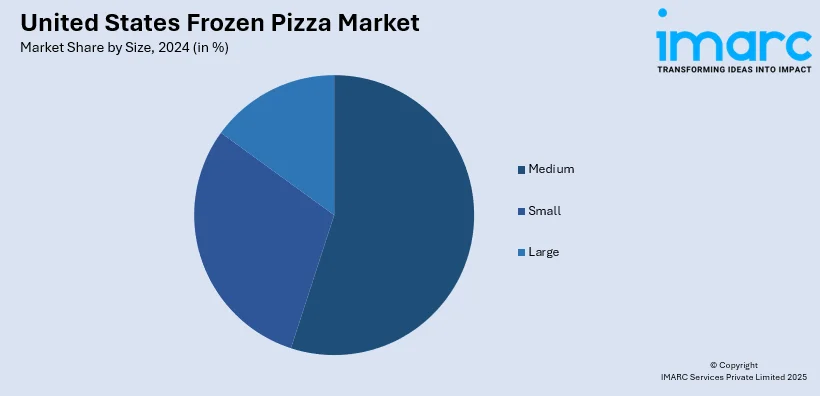

Analysis by Size:

- Small

- Medium

- Large

Medium-sized frozen pizzas stand as the largest component in 2024, holding 55.0% of the market due to their ideal balance of portion size, affordability, and versatility. They cater well to small families, couples, or individuals looking for multiple servings without the bulk or waste of larger formats. Medium pizzas are also more conveniently stored in standard freezers and cooked in most household ovens, making them a practical choice for everyday consumption. Their price point typically falls within an affordable range, appealing to budget-conscious consumers seeking value without compromising on variety or taste. With wide availability across major retail channels and numerous flavor options, medium-sized frozen pizzas continu

Analysis by Product Type:

- Regular Frozen Pizza

- Premium Frozen Pizza

- Gourmet Frozen Pizza

Regular frozen pizza stands as the largest component in 2024, holding 63.6% of the market due to its widespread appeal, familiarity, and consistent availability. This classic style caters to the preferences of a broad consumer base, offering a balanced combination of crust, sauce, cheese, and toppings that align with traditional pizza expectations. According to the United States frozen pizza market forecast, regular frozen pizzas are typically priced competitively, making them an affordable meal solution for families and individuals alike. Their straightforward preparation and portion size also add to their convenience, especially for quick dinners or casual gatherings. With major brands heavily investing in this category through varied flavors, improved quality, and promotional offers, regular frozen pizza continues to dominate shelf space and consumer purchases, maintaining its leading position in the US market.

Analysis by Topping:

- Cheese

- Meat

- Fruits and Vegetables

- Others

Meat leads the market with 54.7% of market share in 2024 due to strong consumer preference for hearty, protein-rich options that deliver both flavor and satiety. Varieties like pepperoni, sausage, bacon, and meat lovers’ combinations are widely popular across age groups and are often viewed as more indulgent and satisfying. These offerings align with mainstream American taste preferences and are commonly featured in promotional deals and multipacks, driving higher purchase volumes. Additionally, meat-based frozen pizzas are heavily marketed by leading brands, reinforcing their presence in supermarkets and convenience stores. The combination of rich flavor, wide availability, and perceived value makes meat pizzas a dominant choice, securing their leading position in the US frozen pizza market.

Analysis by Distribution:

- Food Chain Services

- Modern Trade

- Departmental Stores

- Online Stores

- Others

Food chain service holds the largest share in the United States frozen pizza market because consumers strongly associate branded restaurant flavors with quality, trust, and consistency. Well-known food chains leverage their established reputation and loyal customer base to market frozen versions of their popular menu items, creating instant recognition and confidence at the retail level. These branded frozen pizzas replicate restaurant-style taste and presentation, offering a premium experience at home. Additionally, strategic partnerships with major retailers ensure prominent shelf placement and frequent promotional campaigns, boosting sales. As consumers seek convenient yet familiar meal options, food chain-affiliated frozen pizzas meet this demand effectively, making them a preferred choice and securing their dominant position in the US frozen pizza market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Midwest region significantly drives the United States frozen pizza market demand due to a mix of cultural habits, convenience needs, and climate conditions. Historically, the Midwest is considered the birthplace of frozen pizza, with deep roots in its food culture and family dining traditions. The region’s cold winters increase demand for easy-to-prepare, comfort foods like frozen pizza, which can be stored in bulk and cooked quickly at home. Additionally, large households and rural communities, where restaurant access may be limited, prefer frozen options for affordability and accessibility. Strong regional brands and deep supermarket penetration also support sales. This combination of tradition, practicality, and environmental factors makes the Midwest a stronghold for frozen pizza consumption in the United States.

Competitive Landscape:

The frozen pizza market in the US is highly competitive, dominated by major players such as Nestlé (DiGiorno, California Pizza Kitchen), Schwan’s Company (Tony’s, Red Baron), and General Mills (Totino’s). These brands compete on product variety, taste innovation, and pricing. Emerging players and private-label brands from retailers like Walmart and Costco are gaining traction by offering affordable alternatives with improved quality. Brand loyalty, aggressive marketing, and retail partnerships play key roles in shelf positioning. Additionally, foodservice brands like Pizza Hut and Uno Pizzeria are expanding into retail frozen segments, intensifying competition. With growing consumer demand for premium, gluten-free, and plant-based options, companies are investing in product innovation to capture shifting preferences and maintain their edge in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the United States frozen pizza market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Nestlé launched DiGiorno Wood Fired Style Crust Pizza, its first major frozen pizza innovation in a decade. Targeting the USD 54 Billion U.S. pizza market, the USD 6.49 product offers premium, restaurant-style options in four varieties, aiming to regain market share and meet rising consumer demand for elevated at-home meals.

- May 2025: Wegmans launched Amore Roman-style frozen pizzas, becoming the first U.S. grocer to offer this Italian-made crust. The line features four flavors and DIY crust packs, expanding the Amore private label inspired by its Rochester restaurant. Wegmans operates 112 East Coast stores and ranks No. 39 on PG's 2024 list.

- May 2025: RAGÚ launched a new frozen pizza line in collaboration with Palermo Villa, Inc., featuring four varieties topped with RAGÚ-inspired sauces. Priced at USD 4.99–USD 6.99, the pizzas reflect RAGÚ’s Italian heritage and expand its offerings into the freezer aisle at select U.S. retailers nationwide.

- May 2025: Palermo Villa and Kellanova launched Cheez-It Frozen Pizza, featuring a 12-inch Cheez-It-flavored crust in three varieties. Priced at USD 6.99–USD 9.99, the pizzas blend iconic Cheez-It taste with classic toppings and are available at major U.S. retailers, with broader rollout planned by August.

- January 2025: MBC Companies acquired Nardone Brothers Baking Co., expanding into the USD 23.6 Billion frozen pizza market. The move extends MBC’s reach beyond breakfast into all-day dining, adds a third production facility, and strengthens its presence in K-12, private label, and foodservice channels through complementary products and cross-selling opportunities.

- September 2024: Brynwood Partners IX L.P. acquired Miracapo Pizza Company, a frozen pizza contract manufacturer with three Chicagoland facilities totaling 175,000 sq. ft. and 385 employees. The deal expands Brynwood’s presence in the pizza sector and brings its total manufacturing footprint to 19 facilities and USD 3 Billion in sales.

United States Frozen Pizza Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crust Types Covered | Thin Crust, Thick Crust, Stuffed Crust, Others |

| Sizes Covered | Small, Medium, Large |

| Product Types Covered | Regular Frozen Pizza, Premium Frozen Pizza, Gourmet Frozen Pizza |

| Toppings Covered | Cheese, Meat, Fruits and Vegetables, Others |

| Distributions Covered | Food Chain Services, Modern Trade, Departmental Stores, Online Stores, Others |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States frozen pizza market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States frozen pizza market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States frozen pizza industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The frozen pizza market in the United States was valued at USD 6,886 Million in 2024.

The United States frozen pizza market is projected to exhibit a CAGR of 5.03% during 2025-2033, reaching a value of USD 10,960 Million by 2033.

The United States frozen pizza market is driven by growing demand for convenient, affordable meal solutions, increased product variety, and improvements in quality and flavor. Rising adoption among busy households, expanded retail distribution, and innovation in health-conscious and premium offerings further fuel market growth.

Midwest currently dominates the chitosan market due to cultural traditions, rural accessibility, and tight-knit family habits. Cold winters boost demand for comforting, easy-to-store meals, while affordability and widespread supermarket availability drive consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)