United States Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End Use, and Region, 2026-2034

United States Furniture Market Summary:

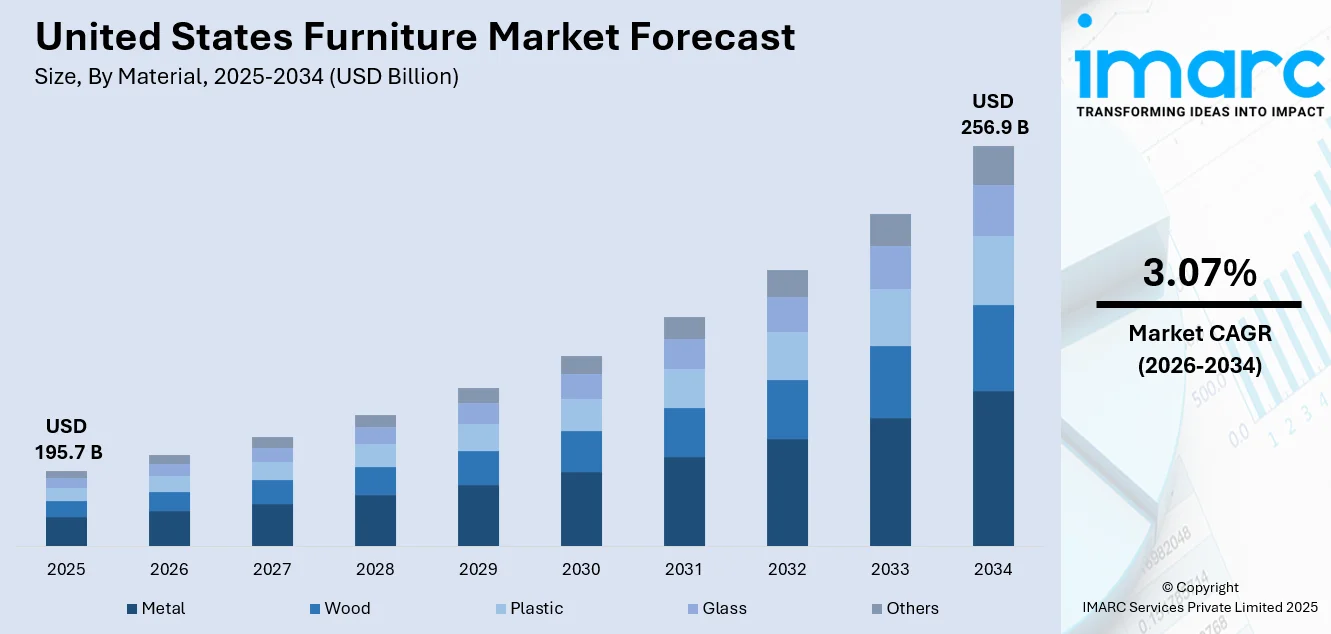

The United States furniture market size was valued at USD 195.7 Billion in 2025 and is projected to reach USD 256.9 Billion by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

The United States furniture market is currently experiencing stable expansion on account of the evolving consumer preferences toward sustainable and multifunctional designs. Increasing residential construction activities, urbanization trends, and the proliferation of e-commerce platforms are reshaping the industry landscape. Growing demand for eco-friendly materials and personalized home furnishing solutions continues to fuel market development across residential and commercial applications nationwide.

Key Takeaways and Insights:

- By Material: Wood dominates the market with a share of 39% in 2025, owing to its timeless aesthetic appeal, natural durability, and versatility across residential and commercial applications. Consumer preference for sustainable and eco-friendly materials further reinforces wood's position.

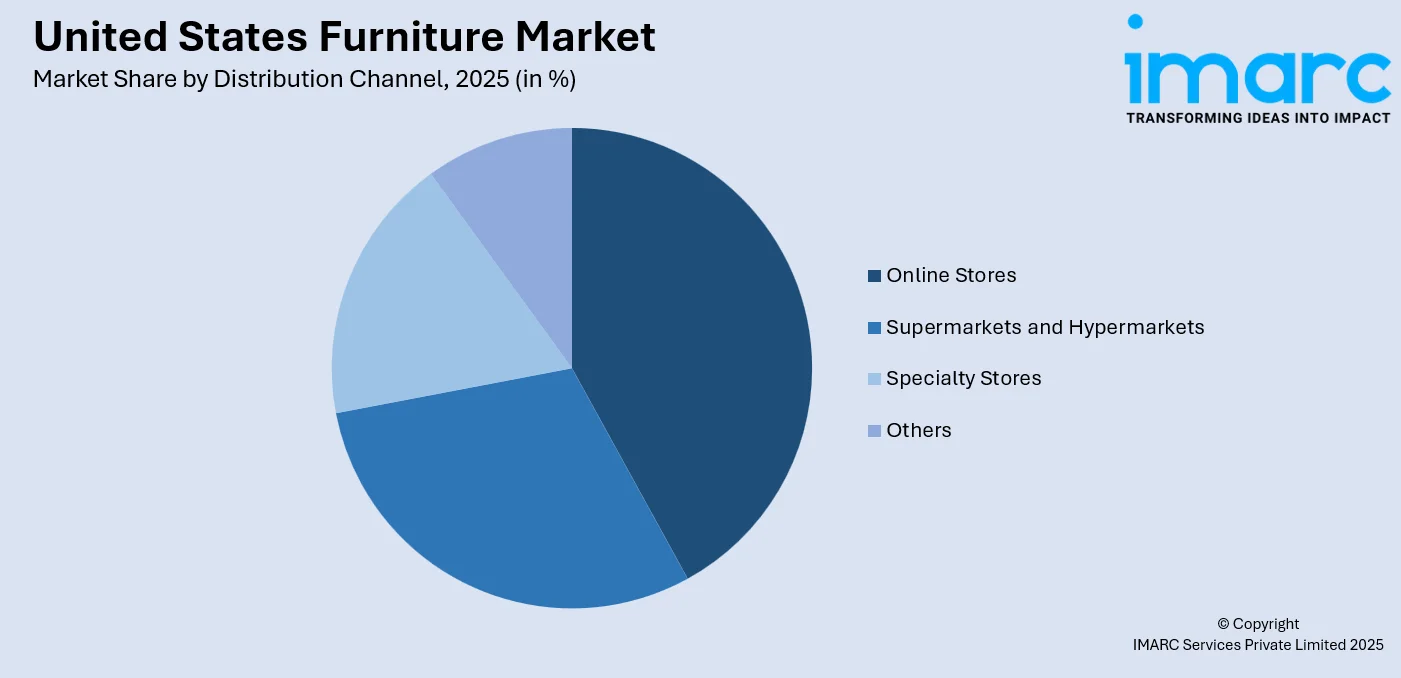

- By Distribution Channel: Online stores lead the market with a share of 41% in 2025. This dominance is driven by the convenience of virtual showrooms, extensive product selections, competitive pricing, and enhanced delivery options that cater to digitally savvy consumers.

- By End Use: Residential exhibits a clear dominance in the market with 68% share in 2025, reflecting strong consumer investment in home furnishings driven by housing construction growth, remodeling activities, and increasing prioritization of comfortable living spaces.

- By Region: South is the largest region with 35% share in 2025, driven by rapid population growth in states like Texas and Florida, expanding residential construction, favorable business conditions, and escalating need emerging from residential as well as hospitality sectors.

- Key Players: Key players drive the United States furniture market by expanding manufacturing capabilities, investing in sustainable production methods, and strengthening omnichannel distribution networks. Their focus on product innovation, technological integration, and strategic partnerships enhances market accessibility and consumer engagement nationwide.

To get more information on this market Request Sample

Various variables, which point out the changing lifestyle preferences and evolving consumer behaviors in the country, are influencing the furniture industry in the United States. With rising disposable income, people are able to spend on premium home furnishings, which not only serve the purpose but also add to the aesthetic appeal. Home furnishings for living rooms, bedrooms, and storage areas remain in high-demand in both urban and suburban areas, thanks to the rising number of home construction and renovation activities. The use of eco-friendly materials, such as reclaimed wood, old metal, and natural materials, has been adopted by furniture manufacturers in response to the shifting consumer behavior, which gives high priority to sustainability. Customized, space-saving, and technology-integrated furniture designs remain highly sought after by the growing population of millennials and Gen Z, who prefer to purchase their first home. Moreover, the requirement for home office furniture, which balances ergonomic use and modernism, has risen with the rise in the hybrid working lifestyle.

United States Furniture Market Trends:

Accelerating Adoption of Sustainable and Eco-Friendly Materials

Environmental awareness is radically changing how furniture is made and purchased in the US. Products made from recycled materials, renewable resources, and sustainably produced parts that reduce environmental effect over the course of their lifecycle are becoming more and more popular among consumers. In response, producers are incorporating low-emission production methods like recovered wood, bamboo, recycled metals, and organic textiles into their product lines. Environmentally conscious shoppers now consider certifications like Forest Stewardship Council and Greenguard authentication while making purchases.

Rising Demand for Multifunctional and Space-Saving Furniture

Urbanization and evolving living patterns are driving substantial demand for furniture that maximizes utility within compact spaces. Consumers in metropolitan areas increasingly favor modular designs, convertible pieces, and multifunctional furniture that serves multiple purposes without compromising aesthetic appeal. Storage-integrated beds, expandable dining tables, and transformable seating solutions address the practical requirements of modern households. This trend reflects broader shifts toward efficient space utilization and adaptable living environments that accommodate diverse lifestyle needs and changing household configurations.

Integration of Smart Technology in Home Furnishings

Technological innovation is transforming traditional furniture into connected components of the modern smart home ecosystem. Furniture manufacturers are incorporating features including built-in wireless charging stations, integrated lighting systems, voice-controlled adjustments, and sensor-equipped ergonomic capabilities. Height-adjustable desks with programmable settings and sofas with embedded entertainment systems exemplify this convergence of comfort and connectivity. Consumer appetite for technology-enhanced living spaces continues driving innovation as manufacturers explore artificial intelligence applications for personalized furniture recommendations.

Market Outlook 2026-2034:

The United States furniture market demonstrates promising growth prospects as consumer spending patterns and lifestyle preferences continue evolving favorably. Rising homeownership rates among millennials, sustained remodeling activities, and expanding e-commerce accessibility position the industry for continued expansion. The market generated a revenue of USD 195.7 Billion in 2025 and is projected to reach a revenue of USD 256.9 Billion by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034. Innovation in sustainable manufacturing, smart furniture integration, and personalized design solutions will drive competitive differentiation. The residential segment's dominance is expected to persist, supported by robust housing construction and renovation activities. Furthermore, omnichannel retail strategies combining physical showrooms with digital platforms will enhance consumer accessibility and purchasing convenience across all market segments.

United States Furniture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material |

Wood |

39% |

|

Distribution Channel |

Online Stores |

41% |

|

End Use |

Residential |

68% |

|

Region |

South |

35% |

Material Insights:

- Metal

- Wood

- Plastic

- Glass

- Others

Wood dominates with a market share of 39% of the total United States furniture market in 2025.

Wood furniture maintains its dominant market position owing to its timeless aesthetic appeal, natural durability, and exceptional versatility across diverse furniture applications. Consumers continue demonstrating strong preference for wooden pieces that complement both traditional and contemporary interior design styles. The material's inherent warmth and character create inviting living environments that resonate with homeowners seeking authenticity in their furnishing choices. According to the 2025 Wood Furniture Scorecard released by the Sustainable Furnishings Council and National Wildlife Federation, Forest Stewardship Council certification remains strongly correlated with top-performing furniture retailers, with leading brands like Room & Board achieving 95% to 98% sustainably sourced wood in their product lines.

The enduring popularity of wood furniture reflects deeper consumer connections to natural materials and craftsmanship traditions. Hardwood species including oak, maple, and walnut command premium positioning for their exceptional longevity and distinctive grain patterns. The bedroom furniture category represents a significant application area, with consumers investing in quality wood bed frames, dressers, and nightstands. In recent developments, manufacturers have launched innovative wooden and metal space-saving desks and beds specifically designed for urban homeowners seeking stylish solutions that blend traditional wood craftsmanship with contemporary functional requirements.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Online stores lead with a share of 41% of the total United States furniture market in 2025.

Online furniture retail's unparalleled ease, wide range of products, and aggressive pricing tactics have completely changed how consumers make purchases. Customers can use digital platforms to browse large catalogs, compare brand specs, and use augmented reality capabilities to see products in their locations. The removal of geographical restrictions allows retailers to provide larger inventories without being restricted by physical showrooms, increasing market reach. Consumer trust in buying furniture online has increased dramatically, and digital-native generations are especially at ease using mobile applications and e-commerce platforms to complete expensive purchases.

Traditional obstacles to online furniture purchases, such as delivery dependability and white-glove installation services, have been addressed by the development of logistics skills. By enabling precise product evaluation prior to commitment, advanced visualization technologies such as virtual room planners and three-dimensional product renderings decrease buy hesitancy. With significant online sales that demonstrate consumers' acceptance of digital shopping advantages, the US continues to lead the world in furniture e-commerce. Large retailers have improved their digital infrastructures with personalized suggestion engines and shopping guides driven by artificial intelligence, which make difficult furniture purchases easier for customers looking for carefully chosen options.

End Use Insights:

- Residential

- Commercial

Residential exhibits a clear dominance with 68% share of the total United States furniture market in 2025.

The residential furniture segment's commanding market position reflects Americans' substantial investment in creating comfortable, aesthetically pleasing home environments. Rising homeownership rates and sustained renovation activities drive consistent demand for living room, bedroom, dining, and home office furnishings. Consumer preferences have evolved toward pieces that combine functionality with design sophistication, reflecting homes' expanded roles as multipurpose spaces for work, entertainment, and relaxation. The United States housing market reported approximately one point four seven Million housing starts in recent periods, indicating strong pace of new residential developments and corresponding increased need for home furnishings.

Millennial and Generation Z consumers are emerging as primary drivers of residential furniture demand as they enter peak home-buying years and establish households. These demographics demonstrate particular interest in sustainable materials, customizable configurations, and technology-integrated designs that align with their lifestyle values. The National Association of Home Builders reported that single-family permits nationwide reached 981,911 in 2024, representing a 6.7% increase year-over-year, with single-family construction demonstrating resilience despite elevated mortgage rates. The home office furniture category has gained permanent significance as remote and hybrid work arrangements persist across professional sectors. Storage solutions including wardrobes, cabinets, and modular shelving systems address practical organization needs while contributing aesthetic value to residential interiors across diverse architectural styles and living situations.

Regional Insights:

- Northeast

- Midwest

- South

- West

South represents the leading segment with 35% share of the total United States furniture market in 2025.

The Southern region dominates the United States furniture market owing to rapid population growth, expanding residential construction, and favorable business conditions attracting corporate relocations and workforce migration. States including Texas, Florida, and Georgia represent key demand centers where robust real estate development and strong hospitality sectors sustain consistent furniture purchasing activity throughout the year. Urban expansion in major metropolitan areas like Houston, Dallas, Atlanta, and Miami creates continuous demand across residential and commercial furniture categories, while suburban communities drive substantial investment in home furnishing solutions.

Consumer preferences in the Southern region span diverse design aesthetics from traditional and rustic farmhouse styles to sleek contemporary modern designs reflecting the area's rich cultural diversity and evolving demographic composition. The region's comparatively lower cost of living and business-friendly regulatory environment have attracted significant furniture manufacturing investments, strengthening local supply chains and distribution capabilities while reducing transportation costs. Florida's booming tourism industry and expanding retirement communities create additional demand for both indoor residential furniture and weather-resistant outdoor furnishings specifically engineered for the warm, humid regional climate conditions.

Market Dynamics:

Growth Drivers:

Why is the United States Furniture Market Growing?

Expanding Residential Construction and Remodeling Activities

The flourishing residential construction sector represents a primary catalyst for furniture market expansion as new housing developments create immediate demand for complete home furnishing solutions. Single-family home construction, apartment complexes, and condominium developments each generate distinct furniture requirements ranging from basic essentials to premium customized pieces. Homeowners embarking on renovation projects similarly drive furniture replacement cycles as updated interiors necessitate complementary furnishings that align with contemporary design preferences. The remodeling industry's resilience reflects Americans' ongoing commitment to improving existing properties rather than relocating, creating sustained furniture purchasing opportunities. Kitchen and bathroom renovations frequently extend into adjacent living spaces, prompting coordinated furniture updates across multiple rooms. Seasonal renovation patterns influence furniture demand fluctuations, with spring and summer months typically demonstrating elevated activity levels. Government housing incentives and mortgage accessibility variations further influence construction pace and consequent furniture demand across different market periods.

E-Commerce Proliferation and Digital Retail Innovation

Digital commerce transformation has fundamentally expanded furniture market accessibility by eliminating traditional geographic and temporal purchasing constraints. Online platforms enable consumers to browse, compare, and purchase furniture products continuously without physical store visitation requirements. Advanced visualization technologies including augmented reality applications, three-dimensional product rendering, and virtual room planning tools address traditional online furniture purchasing barriers by enabling accurate product assessment before commitment. Mobile commerce growth has further accelerated market expansion as consumers increasingly complete purchases through smartphone applications during commutes, breaks, and leisure periods. Social media platforms have emerged as influential discovery channels where consumers encounter furniture inspiration and complete purchases directly within integrated shopping features. Logistics innovations including white-glove delivery, scheduled installation services, and streamlined return processes have strengthened consumer confidence in high-value online furniture transactions. The competitive dynamics between digital-native retailers and traditional stores adopting omnichannel strategies benefit consumers through enhanced service offerings and pricing transparency.

Growing Consumer Preference for Sustainable and Eco-Friendly Products

Environmental consciousness among American consumers has intensified significantly, transforming sustainability from niche preference into mainstream purchasing criterion. Consumers increasingly scrutinize furniture material sourcing, manufacturing processes, and product lifecycle environmental impacts when making purchasing decisions. Manufacturers responding to this shift have expanded sustainable product lines featuring reclaimed wood, recycled metals, organic fabrics, and low-emission finishes that minimize environmental footprint. Certification programs including Forest Stewardship Council, Greenguard, and various eco-labels provide consumers verification of environmental claims, influencing brand selection and premium willingness. Circular economy principles are gaining traction as consumers and manufacturers explore furniture refurbishment, resale, and recycling programs that extend product lifecycles beyond initial ownership. Younger consumer demographics demonstrate particularly strong sustainability preferences, with environmental values influencing not only furniture selection but broader brand loyalty patterns. The convergence of environmental responsibility and quality expectations has elevated sustainable furniture from compromise to aspiration, commanding premium positioning across market segments.

Market Restraints:

What Challenges the United States Furniture Market is Facing?

Elevated Raw Material Costs and Supply Chain Volatility

Furniture manufacturers face persistent challenges from fluctuating raw material costs including lumber, metals, fabrics, and foam components that compress profit margins and complicate pricing strategies. Global supply chain disruptions have intermittently constrained material availability while increasing transportation costs and delivery timelines. These cost pressures often transfer to consumers through higher retail prices, potentially suppressing demand among price-sensitive market segments and delaying discretionary furniture purchases.

Housing Market Uncertainty and Interest Rate Pressures

Fluctuations in mortgage interest rates directly influence housing market activity and consequently furniture demand patterns. Elevated borrowing costs reduce home purchasing affordability, diminishing new household formation rates and associated furniture outfitting requirements. Existing homeowners facing higher refinancing costs may postpone renovation projects that would otherwise generate furniture replacement demand. Economic uncertainty affecting consumer confidence further compounds cautious spending behavior on discretionary home furnishing purchases.

Competition from Secondhand and Rental Furniture Markets

Growing consumer acceptance of pre-owned furniture through resale platforms, thrift stores, and online marketplaces presents competitive pressure on new furniture sales. Younger consumers particularly embrace secondhand purchasing as both economical and environmentally responsible alternative. Furniture rental and subscription services offering flexibility for transient lifestyles further divert potential purchases from traditional retail channels. This expanding secondary market captures budget-conscious consumers who might otherwise purchase new entry-level furniture products.

Competitive Landscape:

The United States furniture market exhibits a fragmented competitive structure characterized by the coexistence of large multinational corporations, established domestic manufacturers, specialty retailers, and emerging direct-to-consumer brands. Market participants compete across multiple dimensions including product quality, design innovation, pricing strategy, distribution reach, and customer service excellence. Established players leverage extensive manufacturing capabilities, brand recognition, and nationwide distribution networks to maintain market positions while investing in digital transformation initiatives. Emerging brands differentiate through sustainable sourcing practices, customization options, and streamlined direct-to-consumer models that eliminate intermediary costs. Strategic acquisitions, retail expansion programs, and partnership arrangements continue reshaping the competitive landscape as companies pursue growth opportunities and operational synergies. Omnichannel retail strategies integrating physical showrooms with robust e-commerce platforms have become competitive necessities as consumer shopping journeys increasingly span multiple touchpoints.

United States Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States furniture market size was valued at USD 195.7 Billion in 2025.

The United States furniture market is expected to grow at a compound annual growth rate of 3.07% from 2026-2034 to reach USD 256.9 Billion by 2034.

Wood dominated the market with a share of 39%, owing to its timeless aesthetic appeal, natural durability, versatility across applications, and growing consumer preference for sustainable materials.

Key factors driving the United States furniture market include expanding residential construction activities, e-commerce proliferation, growing sustainability preferences, rising disposable incomes, and increasing demand for multifunctional designs.

Major challenges include elevated raw material costs, supply chain volatility, housing market uncertainty, interest rate pressures, competition from secondhand markets, and tariff-related import cost increases affecting pricing strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)