United States Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End User, and Region, 2026-2034

United States Gas Turbine Market Size and Share:

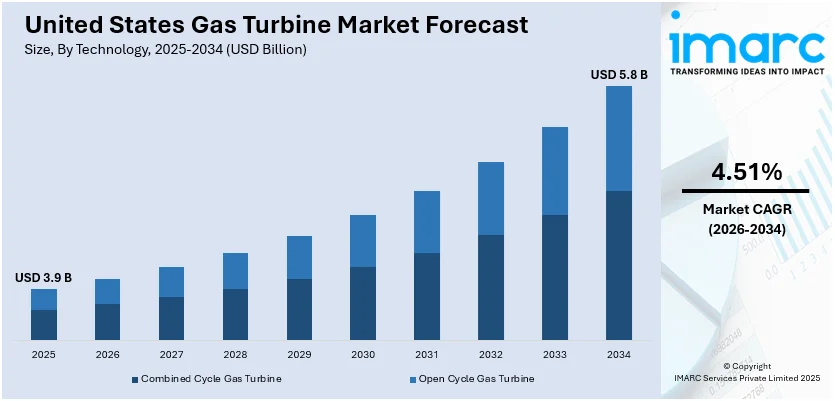

The United States gas turbine market size was valued at USD 3.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.8 Billion by 2034, exhibiting a CAGR of 4.51% from 2026-2034. South dominates the market, holding a significant market share. The market is witnessing significant growth mainly driven by the growing demand for flexible and efficient power generation across industrial and utility sectors. As the country transitions toward cleaner energy sources, gas turbines play a crucial role in balancing renewable power. Continuous advancements in turbine efficiency and emissions control are further strengthening adoption across diverse applications. This momentum reflects the rising importance of the United States gas turbine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.9 Billion |

| Market Forecast in 2034 | USD 5.8 Billion |

| Market Growth Rate (2026-2034) | 4.51% |

The market for gas turbines in the United States is largely influenced by the increasing need for dependable and flexible power generation. As the energy industry shifts towards cleaner alternatives, gas turbines provide an effective solution for managing the inconsistency of renewable energy sources such as solar and wind. Their rapid start-up capabilities and stable operations are crucial for maintaining grid reliability. Additionally, surging industrial activities and the demand for continuous power in sectors like manufacturing, oil and gas, and aviation further drive the gas turbines market demand. For instance, in January 2025, Engine No. 1, Chevron, and GE Vernova formed a partnership to develop up to four gigawatts of power for US data centers using gas turbines. This initiative aims to bolster AI development, create jobs, and ensure energy security, leveraging American natural gas resources and innovative technology. Their adaptability for both large-scale and distributed power generation promotes extensive use.

To get more information on this market Request Sample

Another significant factor contributing to growth is the continuous technological innovation aimed at improving efficiency and lowering emissions. Developments in turbine design, advanced materials, and the ability to integrate various fuels such as blending with hydrogen are making gas turbines more environmentally friendly and economically viable. Furthermore, rising investments in infrastructure upgrades and energy security are prompting the replacement of outdated power equipment with high-performance gas turbines. The US government's commitment to promoting cleaner energy options, along with industry initiatives to enhance energy efficiency, continues to foster United States has turbine market growth. For instance, in December 2024, the Department of Defense allocated USD 253.7 Million to Williams International for the purpose of increasing gas turbine engine production. This initiative is in line with the 2024 National Defense Industrial Strategy, which aims to boost domestic capabilities to address the growing demand for precision strike weapons such as the Harpoon and Tomahawk, while ensuring resilient supply chains and military preparedness. Consequently, gas turbines are becoming an essential component of future-oriented power systems across diverse applications.

United States Gas Turbine Market Trends:

Hydrogen Co-firing and Fuel Diversification

As the United States prioritizes the reduction of carbon emissions and the shift towards cleaner energy sources, gas turbine technology is adapting to incorporate alternative fuels. A prominent trend is the increased use of hydrogen co-firing, which enables gas turbines to run on a mixture of natural gas and hydrogen, leading to a significant decrease in greenhouse gas emissions. For instance, in June 2025, Georgia Power and Mitsubishi Power achieved a significant milestone by completing the largest hydrogen blending test globally, successfully integrating 50% hydrogen in a gas turbine at Plant McDonough-Atkinson. This test led to a 22% reduction in CO2 emissions in comparison to using 100% natural gas, furthering the advancement of cleaner energy technologies in Georgia. Furthermore, the adoption of biofuels and dual-fuel systems improves operational adaptability while promoting sustainability objectives. This movement towards cleaner fuel alternatives complies with environmental regulations and aligns with the nation’s long-term decarbonization strategies. These developments underscore critical United States gas turbine market trends.

Distributed Energy Applications

The increasing need for dependable, decentralized power solutions is driving the adoption of modular gas turbines throughout the United States. These compact and efficient systems are perfectly suited for on-site energy generation in facilities such as manufacturing plants, hospitals, and data centers, guaranteeing consistent operations. Moreover, they are increasingly being incorporated into microgrids and serve as backup power sources in remote or off-grid areas. Their capacity to deliver quick, scalable, and fuel-flexible energy makes them essential for promoting local energy independence and enhancing grid resilience. According to United States gas turbine market forecast, distributed energy applications are anticipated to significantly contribute to future growth.

Retrofitting and Upgrades Enhancing System Efficiency

The aging infrastructure within the US power sector is driving a surge of retrofitting and modernization initiatives involving gas turbine units. Utility providers are allocating resources toward advanced combustion technologies, digital control improvements, and performance optimization methods to increase turbine efficiency and lower emissions. For instance, in May 2025, GE Vernova launched AGP XPAND, an upgrade for its 9E.03 gas turbines, enhancing output by 7% and efficiency by 1%. This upgrade requires no major changes to maintenance and is expected to provide significant fuel savings and increased capacity, benefiting power plants globally. These enhancements prolong the functional lifespan of existing turbines while ensuring compliance with more stringent regulatory requirements. Retrofitting also tends to be more economically viable than full replacements, enabling utilities to boost output with minimal capital investment. This trend is solidifying the standing of established players and strengthening their position in the shifting market landscape, thereby contributing to the overall United States gas turbine market share.

United States Gas Turbine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States gas turbine market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, design type, rated capacity, and end user.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

Combined cycle gas turbine stands as the largest technology in 2025, holding 63.7% of the market due to their higher efficiency and reduced emissions when compared to open cycle systems. These turbines leverage both gas and steam cycles to convert a greater amount of heat into electricity, achieving efficiency rates exceeding 60%. They are particularly well-suited for large-scale electricity generation, especially as utilities strive to align energy demand with environmental objectives. Their capacity to deliver stable, continuous base-load power while supporting intermittent renewable sources makes them a favored option. As there is increasing pressure to upgrade outdated power infrastructure, the uptake of combined cycle systems creates a positive US gas turbine market outlook.

Analysis by Design Type:

- Heavy Duty (Frame) Type

- Aeroderivative Type

Heavy duty (frame) type leads the market with 68.8% of market share in 2025 owing to their high-power output, extended operational lifespan, and adaptability for large-scale electricity generation. These turbines are engineered to function continuously under high-load scenarios, making them ideal for utility and industrial use. Their sturdy design enables seamless integration with combined cycle systems, enhancing overall plant efficiency. Furthermore, innovations in materials and combustion technology have bolstered their fuel flexibility and operational performance. With the increasing need for large-capacity, dependable power especially in base-load and grid-supporting roles the heavy duty type maintains the largest share in the US gas turbine sector.

Analysis by Rated Capacity:

- Above 300 MW

- 120-300 MW

- 40-120 MW

- Less Than 40 MW

Above 300 MW leads the market with 45.1% of market share in 2025 due to their capability to service utility-scale power plants and address high electricity demand. These large-capacity turbines are primarily used in combined cycle setups, providing high efficiency and reliability for base-load generation. Their size makes them particularly suitable for incorporation into national electrical grids, where consistent output and operational stability are critical. The drive to replace aging coal-fired facilities with cleaner, high-capacity gas systems further enhances the prominence of this segment. With the energy sector focusing on sustainable solutions and modernizing the grid, turbines rated above 300 MW continue to attract substantial investment.

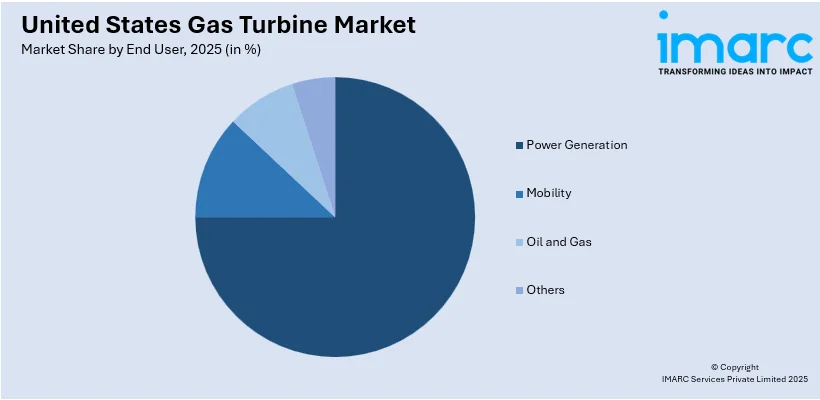

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Power Generation

- Mobility

- Oil and Gas

- Others

Power generation leads the market with 74.4% of market share in 2025, accounting for the majority of gas turbine installations across the United States. The transition toward cleaner energy sources and the necessity for flexible, on-demand power to facilitate renewable energy integration are driving factors. Gas turbines offer rapid start-up times and high efficiency, making them well-suited for supplementing solar and wind energy. Utilities favor gas turbines for applications in base-load, peaking, and backup generation in both centralized and distributed energy frameworks. Their reliability, lower emissions when compared to coal, and responsiveness to grid fluctuations reinforce their critical role in the national energy landscape, ensuring sustained demand from power producers.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Southern region of the United States leads in the gas turbine market due to its concentration of industrial activities, extensive power generation facilities, and a conducive regulatory environment. States such as Texas, Louisiana, and Georgia have substantial energy infrastructure and are heavily reliant on gas-based power for residential and industrial use. The region also enjoys proximity to significant natural gas resources, ensuring a reliable and cost-effective fuel supply. Additionally, the increasing population and energy demand in the South spur ongoing investments in modern gas turbine installations. This regional leadership is anticipated to continue as utilities focus on efficiency and grid reliability amidst rising consumption.

Competitive Landscape:

The landscape of the US gas turbine market is influenced by a combination of global manufacturers and regional companies that prioritize advanced technologies, improved efficiency, and reductions in emissions. Major industry players are allocating resources towards research and development to boost turbine performance, enhance fuel flexibility, and implement digital monitoring systems. Common strategies for maintaining market share and strengthening customer connections include forming strategic partnerships, establishing long-term service agreements, and undertaking modernization initiatives. As the demand for cleaner energy solutions rises, manufacturers are investigating options such as hydrogen co-firing and hybrid energy systems. The market's competitive nature is further heightened by the necessity to comply with stringent environmental regulations, which spurs innovation in low-emission turbine designs. Overall, the market is dynamic, with competition focusing on reliability, lifecycle costs, and adaptability for a variety of power generation uses.

The report provides a comprehensive analysis of the competitive landscape in the United States gas turbine market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Baker Hughes secured a deal from Frontier Infrastructure Holdings to supply 16 NovaLT gas turbines for data center projects in Wyoming and Texas. The turbines supported multi-fuel use, including hydrogen. This followed a broader partnership for CCS and power solutions, addressing growing U.S. energy demand driven by data center expansion.

- March 2025: GE Vernova launched the TM2500 DLE, a 34MW mobile aeroderivative gas turbine offering 39% efficiency without water use. Designed for rapid deployment, it featured low emissions, fast startup, and multi-fuel capability. The compact unit addressed growing needs for decentralized, emergency, and off-grid power with a 30-day commissioning window.

- March 2025: Partners Group acquired Middle River Power and an associated 1.9 GW portfolio of 11 gas power plants in California for $2.2 billion. Middle River integrated on-site battery storage at its plants, forming Hybrid Energy Centers to boost grid reliability and decarbonization. The move supported long-term utility contracts and future expansion.

- January 2025: Shell Energy North America completed the acquisition of RISEC Holdings, gaining a 609 MW combined-cycle gas turbine plant in Rhode Island. The move secured long-term energy offtake and reinforced Shell’s presence in ISO New England. The plant’s efficiency and flexibility supported grid stability amid growing decarbonization-driven power demand.

United States Gas Turbine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States gas turbine market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States gas turbine market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States gas turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gas turbine market in the United States was valued at USD 3.9 Billion in 2025.

The United States gas turbine market is projected to exhibit a CAGR of 4.51% during 2026-2034, reaching a value of USD 5.8 Billion by 2034.

The US gas turbine market is driven by rising energy demand, the shift toward cleaner power generation, and growing reliance on gas-based plants to balance renewable sources. Advancements in turbine technology, grid modernization efforts, and industrial expansion further support long-term market growth.

South holds the largest share in the United States gas turbine market, supported by strong industrial activity, high energy consumption, and proximity to natural gas resources. States in this region also host major utility projects and infrastructure that favor gas-based power generation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)