United States Halloween Decorations Market Size, Share, Trends and Forecast by Type, Type of Costumes, Distribution Channel, and Region, 2025-2033

United States Halloween Decorations Market Size and Share:

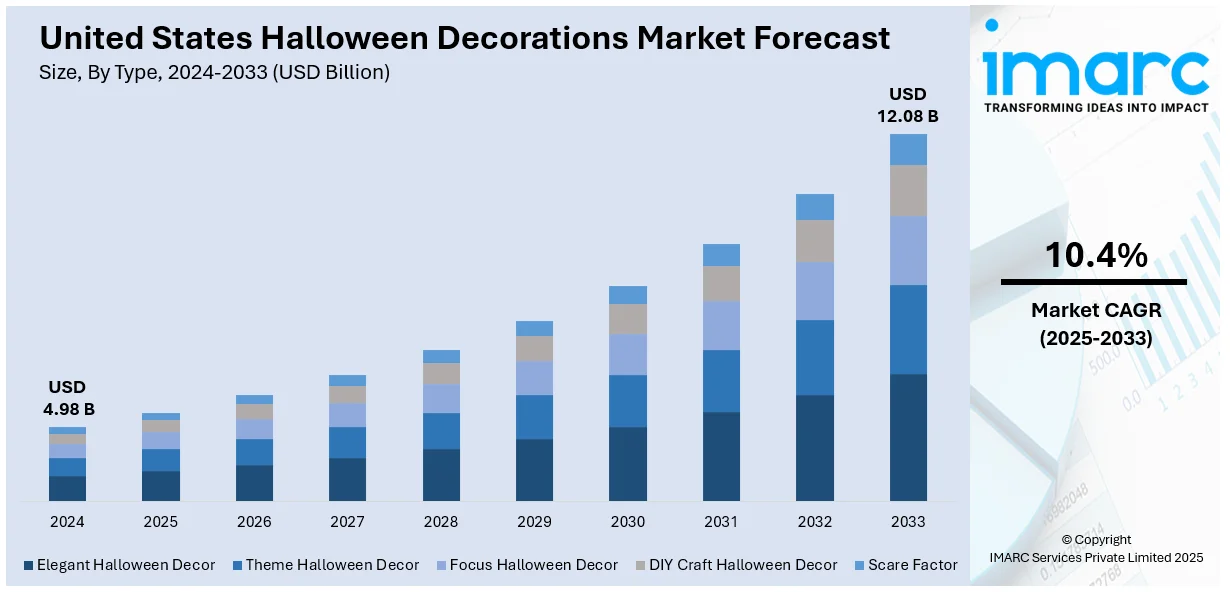

The United States halloween decorations market size was valued at USD 4.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.08 Billion by 2033, exhibiting a CAGR of 10.4% from 2025-2033. The market in is fueled by growing consumer interest in holiday celebrations, especially Halloween, which is highly ingrained in American culture. The market is boosted by the expanding role of social media, which promotes innovative and visually appealing home displays. Moreover, growth in do-it-yourself (DIY) projects and advance retail promotions further fuels demand. Broadening product lines that appeal to varied themes also facilitate continued growth, adding to the overall rise in United States Halloween decorations market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.98 Billion |

| Market Forecast in 2033 | USD 12.08 Billion |

| Market Growth Rate (2025-2033) | 10.4% |

Halloween has evolved into a deeply rooted cultural tradition in the United States, as a primary seasonal event that promotes widespread participation among all age groups. The enduring popularity surrounding the holiday greatly drives the growth of the Halloween decorations market. Families, friends, and society at large thus prepare for the occasion by investing more and more in developing visually appealing places that symbolize the festive occasion. For instance, in July 2024, The Home Depot's 2024 Halloween assortment, including its top-selling 12-foot Skelly with personalized eyes and animatronic characters, sold out fast, highlighting strong early demand for Halloween decor. Moreover, this preparation is usually done weeks ahead of time and includes home decor, front yards, and public event areas. Festivities often involve themed gatherings, trick-or-treating, community gatherings, and block parties, all of which invoke the practice of decorative presentations. This mass-based engagement creates consumer enthusiasm and fuels demand for new, high-quality, and diverse decorative items. Consequently, Halloween has become a pillar of holiday spending in the United States, with decorations being the focal point to make overall celebratory experience even better year after year.

The spatial arrangement and nature of American residential areas, especially suburban communities, and single-family homes contribute a great deal towards ensuring demand for Halloween decorations. Independent housing units with spacious outdoor spaces provide a perfect place for the display of seasonal decorations, thus exterior decorations become a prominent aspect of Halloween festivities. For example, in September 2024, IKEA rolled out its expanded Halloween assortment with more than 30 budget-friendly items for under $25, such as ghost pillows, LED lamps, and themed serving dishes, both in-store and online. Furthermore, front lawns, porches, and driveways are often repurposed as thematic displays from whimsical to haunting, gaining the notice of neighbors and guests. This visual tradition not only creates a sense of neighborhood camaraderie but also competitive and creative expression on the part of homeowners. The architecture flexibility and spatial availability in these communities allow for the employment of oversized props, detailed lighting schemes, and synchronized color schemes. Furthermore, numerous communities hold regional decoration competitions or neighborhood street themes, again encouraging citizens to spend money on elaborate displays. This neighborhood setting offers both the incentive and the opportunity for decorative expression, enabling ongoing consumer interest and year-to-year expansion in the Halloween decorating market.

United States Halloween Decorations Market Trends:

Social Media and Experiential Demand Drive Decorative Innovation

The United States Halloween decorations market has risen sharply with the growing consumer demand for rich and visually enhanced experiences. A key driver of this demand is the impact of social media platforms, which have created a culture of sharing beautifully decorated houses. This online exposure has triggered the spirit of competition where residents and party planners vie with one another using gorgeous and picture-worthy installations. In a 2019 report by the National Opinion Research Center (NORC) at the University of Chicago, 76% of American adults celebrate Halloween, demonstrating a ubiquitous cultural acceptance. The need to produce shared, photo-worthy experiences has played a major role in catalyzing growth in sales of oversized props, animatronic characters, and thematic lighting. Merchants have responded with decor collections crafted for online promotion, fueling growth further. Social interaction has therefore become a cultural and economic driver of Halloween decoration trends.

DIY Culture Drives Demand for Customized Halloween Decor

The heightening popularity of Do-It-Yourself projects has emerged as a key driver of the United States halloween decorations market growth. Consumers are increasingly looking to create customized and unique decor items that express their creativity and conform to particular themes. A 2025 Pennsylvania Association of Realtors survey of more than 1,000 participants discovered that 74% intended to finish a do-it-yourself project within the year, and 98% had attempted such projects previously. This high degree of participation in DIY culture has supported a vibrant marketplace for decoration kits, craft materials, and modular products that can be customized. Retailers and producers have responded by providing versatile and theme-based products that are geared towards diverse creative tastes. This trend towards customization not only fosters personal expression but also instigates repeat purchasing as customers seek to update and re-imagine their decorative themes every year.

Pop Culture and Entertainment Define Consumer Taste

Popular culture has increasingly become a dominant force in the U.S. Halloween decor market, guiding consumer interests through iconic characters, trending themes, and entertainment-driven narratives. In September 2024, Spirit Halloween introduced a new line inspired by recent box office releases, such as Marvel's Deadpool, Pixar's Inside Out 2, and cult classic Beetlejuice. These choices reflect a robust consumer demand for themed decor that is tied to popular films and television series. Themed inflatables, wall decorations, and life-sized cutouts are top sellers among fans who want to recreate scenes or bring popular characters to life. Pop culture permeates even group costumes and party decorations that go along with them, solidifying the communal celebratory vibe. As entertainment franchises are leading popular culture, their inclusion in Halloween items fuels creativity and extends appeal throughout age ranges. Therefore, the market flourishes on this harmony between media power and consumer buying habits, cementing the holiday's transformation into a multi-generational, thematic celebration.

United States Halloween Decorations Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States halloween decorations market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, type of costumes, and distribution channel.

Analysis by Type:

- Elegant Halloween Decor

- Theme Halloween Decor

- Focus Halloween Decor

- DIY Craft Halloween Decor

- Scare Factor

Theme Halloween Decor had a 38.8% market share of the United States Halloween decorations market outlook in 2024, indicating its leading position in the industry. The robust growth of this segment is fueled by shoppers' growing preference for coordinated and immersive Halloween displays that are guided by trendy or retro themes. Themed decor makes it possible for customers to produce highly sophisticated displays that are coordinated with a certain look, e.g., traditional horror, antique designs, or contemporary pop culture symbols. This need is also driven by the power of social media, where visually appealing and imaginative setups attract a crowd and prompt further participation. Retailers and manufacturers have pushed back by introducing varied themed collections, from gothic mansions to playful fantasy worlds, responding to different consumer tastes. The growth in the segment illustrates the value of aestheticized experience in the Halloween holiday decorating market, enticing consumers to spend more money on decorations that add atmosphere and narrative to their holidays, thus confirming the large market share of themed Halloween decorations.

Analysis by Type of Costumes:

- Witch

- Spider-Man

- Dinosaur

- Stranger Things

- Others

Witch costume was 28.8% of the United States Halloween costume market share in 2024, holding a wide margin over other popular costume ideas. The long-lasting popularity of witch costumes can be linked to their flexibility and cultural acceptability. They are inclusive across a wide age range, including children, and cater to extensive customization options, enabling the wearer to represent historical, contemporary, or fantastical variations of the old witch character. Widespread use of witch costumes is sustained through ongoing creativity in design, including the use of innovative items such as light emitting diode (LED) lights, novel material, and accessories that add value to the total image. Also, witch characters are well ingrained in Halloween traditions and popular culture, providing long-term relevance and demand. The segment's significant market share is indicative of customers' penchant for recognizable and iconic costumes that render witch costumes a perennial bestseller during the Halloween festival and a key driver of the market as a whole.

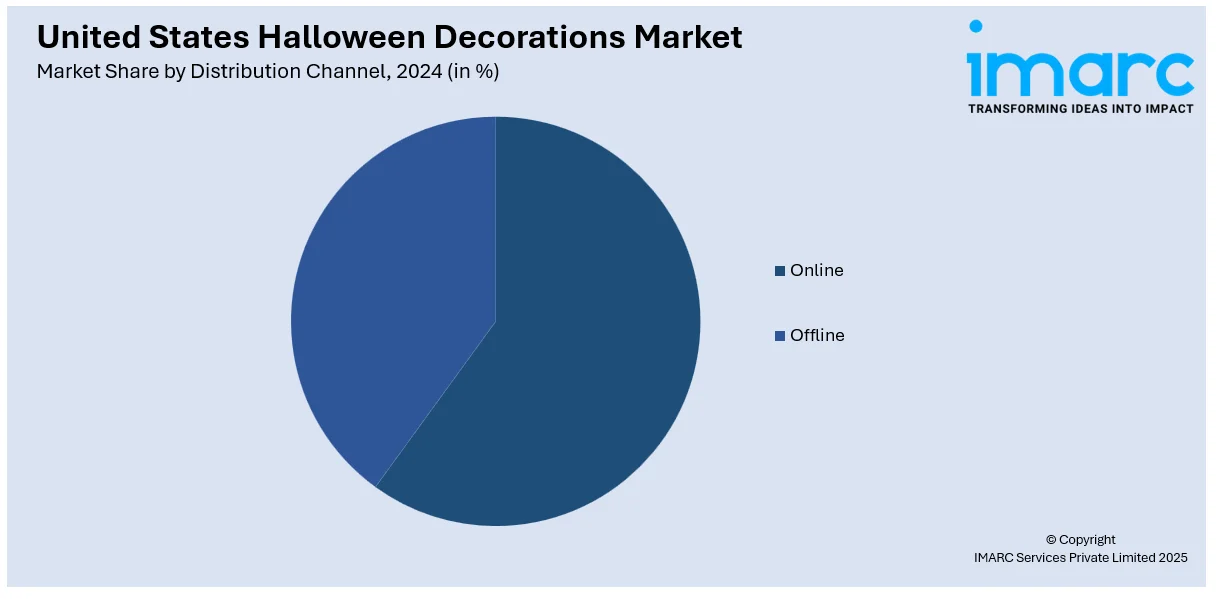

Analysis by Distribution Channel:

- Online

- Offline

Online sales led the United States halloween decorations market forecast in 2024, making up 58.7% of the distribution channel share. This significant market share reflects the increasing consumer preference for convenient and accessible purchasing experiences. The popularity of e-commerce sites has enabled retailers to target a broader population with extensive product lines, competitive prices, and the convenience of home delivery. Customers are able to compare a wide variety of products, check reviews, and access special online-only collections. The retailers have made further investments in digital advertising, easy checkout options, and targeted shopping experiences, sustaining the growth of sales online. This dominance of the channel reinforces the pivotal role played by digital platforms and technology in influencing consumer culture and increasing market share in the Halloween decorations industry.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The South market had a 35% share in the United States Halloween decorations market in 2024, illustrating its enormous contribution to the overall market landscape. This powerful marketplace is driven by demographic forces, such as a large population base and heterogeneity of cultural practices that include Halloween celebrations. The climate of the South provides favorable conditions for prolonged outdoor festivities, promoting elaborate display of decorations and public events. The growing urban and suburban population in the region also drives more consumer expenditures on seasonal decorations. South retailers have ridden these trends by shaping the products sold there to suit local tastes, such as a combination of traditional and contemporary decor. Advertisements often include regional themes and local cultural representation, further appealing to shoppers. The market share of the region corresponds to the active Halloween culture and the economic influence of seasonal holiday consumerism, again solidifying the South as a major player in the United States Halloween decorations market.

Competitive Landscape:

The United States Halloween decorations market competitive environment is characterized by a broad assortment of retailers, from large general merchandise retailers to special season and single-channel seasonal stores as well as online stores. These retailers compete on product assortment, design creativity, price strategies, and distribution effectiveness. With consumers gravitating toward immersive and thematic experiences, retailers are increasingly providing trend-driven collections that fit into mainstream cultural motifs, seasonal trends, and customer lifestyle groups. The marketplace also indicates a high degree of focus on early product launches, with an assortment of retailers pushing Halloween inventory several months in advance of October to bank early demand. Shopper engagement and brand distinction are amplified through in-store displays, experiential marketing, and limited-edition product lines. Online platforms continue to increase their reach, offering bespoke decor possibilities and access to more designs. The synergy between physical store presence and ecommerce ingenuity defines the competitive landscape and fuels persistent market action.

The report provides a comprehensive analysis of the competitive landscape in the United States halloween decorations market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Monya L. introduced the Holiday Tabletop Decoration, a comprehensive seasonal decoration solution for Halloween, Christmas, and Easter. Every kit comes with a variety of holiday-themed decorations. The Halloween Kit, in particular, changes tabletops into a terrifying cemetery location, featuring a cauldron, witches, pumpkins, a haunted house with skeletons and ghosts, gravestones, a pile of bones, sand, rocks, sticks, leaves, and a crumbling archway.

- January 2025: Party City, a U.S. party supply retailer, entered a stalking horse agreement to sell its intellectual property and wholesale assets, to New Amscan PC, an affiliate of Ad Populum. This move aims to revitalize the Party City brand, particularly its popular Halloween decorations and costumes, by leveraging Ad Populum's expertise in pop culture merchandise and distribution.

- October 2024: Dunkin’ announced the re-launch of its DunKings tracksuits and Halloween costumes. The tracksuits and costumes, which were first featured in the brand's Super Bowl commercial and sold out quickly, were limited edition releases.

- September 2024: Chipotle and Spirit Halloween partnered to launch a meme-inspired costume collection, bringing viral Chipotle-themed jokes to life. The collection includes bodysuits resembling a napkin, fork, water cup, burrito, and to-go bag, each priced at USD 40.

- July 2024: Home Depot's 2024 Halloween line-up, dubbed "Ghoulish Giants", introduced a range of oversized and animated decorations. Highlights included the return of the 12-foot "Skelly" skeleton, now with customizable LCD eyes, and the addition of a 7-foot skeleton dog companion.

United States Halloween Decorations Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Elegant Halloween Decor, Theme Halloween Decor, Focus Halloween Decor, DIY Craft Halloween Decor, Scare Factor |

| Type of Costumes Covered | Witch, Spider-Man, Dinosaur, Stranger Things, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States halloween decorations market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States halloween decorations market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States halloween decorations industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The halloween decorations market in the United States was valued at USD 4.98 Billion in 2024.

The United States halloween decorations market is projected to exhibit a CAGR of 10.4% during 2025-2033, reaching a value of USD 12.08 Billion by 2033.

Key drivers of the United States Halloween decorating industry include deep cultural involvement in seasonal festivities, growing consumer interest in themed and immersive experiences, and broad homeownership with outdoor display area. Furthermore, the power of social media, interest in do-it-yourself activities, and front-end retail promotions contribute to purchasing power, turning Halloween into an important annual opportunity for spending on decorating.

The South region holds the largest size of the United States Halloween decorations market, with 35% share in 2024. This is inspired by its high population diversity and density, desirable climate for outdoor celebrations, and high cultural connection with celebrating Halloween. These factors combined contribute to increased consumer expenditure on the decorations, and hence the South remains a crucial market segment in the industry overall.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)