United States Home Office Furniture Market Report by Product (Seating, Storage Units and File Cabinets, Desks and Tables, and Others), Material Type (Wood, Metal, Plastic, Glass, and Others), Price Range (Low, Medium, High) Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others), and Region 2026-2034

Market Overview:

The United States home office furniture market size reached USD 15.39 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 23.34 Billion by 2034, exhibiting a growth rate (CAGR) of 4.71% during 2026-2034. The remote work dynamics, ergonomic priorities, technological integration, customization trends, urban living challenges, health awareness are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.39 Billion |

| Market Forecast in 2034 | USD 23.34 Billion |

| Market Growth Rate (2026-2034) | 4.71% |

Access the full market insights report Request Sample

Home office furniture refers to the range of furnishings designed to create an efficient and comfortable workspace within the confines of one's residence. This specialized furniture aims to facilitate productivity, organization, and ergonomic well-being while working remotely. Essential components typically include desks, chairs, storage solutions, and supplementary accessories. A well-structured home office setup promotes a conducive environment for focused work, supporting professionals in maintaining their workflow and effectively managing tasks. A pivotal feature of home office furniture is its adaptability to diverse spatial constraints and design preferences. Ergonomic considerations play a significant role, with adjustable chairs and ergonomic desks being integral components that ensure proper posture and minimize discomfort during extended periods of work. Additionally, storage solutions such as shelving units, filing cabinets, and modular organizers enhance organization, enabling individuals to maintain an uncluttered workspace.

The surge in remote work arrangements, triggered by global events, has led to a higher demand for home office furniture. As businesses and individuals adapt to flexible work models, the need for ergonomic and functional home office setups has risen significantly. Additionally, health and well-being considerations have brought ergonomic furniture to the forefront. With prolonged work hours at home, consumers seek furniture that ensures comfort and proper posture, driving the demand for adjustable chairs, sit-stand desks, and ergonomic accessories. Other than this, consumers increasingly prioritize furniture that aligns with their interior aesthetics. Modular and customizable designs allow individuals to curate home office spaces that resonate with their personal style, influencing the purchasing decisions. Besides this, the trend of urban living, often accompanied by limited space, has necessitated the demand for compact and multifunctional home office solutions. Foldable desks, wall-mounted organizers, and space-efficient chairs cater to this demographic. In line with this, the growing awareness of the impact of the work environment on mental and physical well-being drives demand for furniture that promotes a healthy workspace. This includes furniture designed to reduce strain, incorporate natural materials, and provide adequate lighting. Moreover, the integration of technology in furniture design is a driving force. Furniture equipped with charging ports, cable management solutions, and built-in connectivity options cater to the tech-savvy workforce, enhancing productivity and convenience.

United States Home Office Furniture Market Trends/Drivers:

Increasing Remote Work Trend

As businesses embrace flexible work arrangements, the demand for home office furniture has surged. Professionals seek dedicated spaces that emulate the functionality and comfort of traditional office environments. This trend necessitates ergonomic desks, chairs, and accessories that enable sustained productivity. With remote work becoming a long-term reality for many, the focus on creating efficient and comfortable workspaces at home is driving the need for specialized furniture solutions.

Ergonomic Emphasis

Prolonged hours spent at desks necessitate chairs with lumbar support, adjustable armrests, and adaptable height features to promote good posture and prevent strain-related discomfort. Sit-stand desks are gaining traction as they facilitate alternating between sitting and standing, enhancing circulation and reducing fatigue. Ergonomically designed furniture not only enhances physical comfort but also fosters increased concentration and overall work efficiency, making it a central factor driving the home office furniture market.

Technological Integration

With the proliferation of electronic devices, furniture equipped with USB charging ports, wireless charging pads, and cable management solutions caters to the connectivity demands of modern professionals. Smart furniture designs incorporate IoT (Internet of Things) capabilities, allowing users to control lighting, temperature, and even adjust furniture settings through mobile apps. This synergy between technology and furniture enhances convenience and productivity, meeting the needs of a tech-savvy workforce that relies on various devices to accomplish tasks efficiently. As technology continues to evolve, so does its integration into the very fabric of home office furniture, shaping market trends and consumer preferences.

United States Home Office Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States home office furniture market report, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on product, material type, price range, and distribution channel.

Breakup by Product:

To get detailed segment analysis of this market Request Sample

- Seating

- Storage Units and File Cabinets

- Desks and Tables

- Others

Seating represents the most widely used product

The report has provided a detailed breakup and analysis of the market based on the product. This includes seating, storage units and file cabinets, desks and tables, and others. According to the report, seating represented the largest segment.

Chairs are foundational components of any workspace, whether at home or in a traditional office setting. With the shift towards remote work, the importance of comfortable and ergonomic seating has intensified, as professionals spend extended hours engaged in tasks. This emphasis on well-being has driven the demand for ergonomic chairs that provide lumbar support, adjustable features, and cushioning for prolonged comfort. Moreover, seating options have diversified to cater to various preferences and work styles. From traditional swivel chairs to modern ergonomic designs and even hybrid seating solutions, the array of choices enables consumers to tailor their home office environments to their specific needs. As companies prioritize employee health and productivity, investing in quality seating becomes a strategic choice. The substantial impact of seating on overall work experience, coupled with the rise of remote work, has led to its prominence as the largest product segment in the home office furniture market.

Breakup by Material Type:

- Wood

- Metal

- Plastic

- Glass

- Others

Wood accounts for the majority of the market share

A detailed breakup and analysis of the market based on the material type has also been provided in the report. This includes wood, metal, plastic, glass, and others. According to the report, wood accounted for the largest market share.

Wood has an enduring and universal appeal, evoking a sense of warmth, elegance, and timelessness. This aesthetic quality makes wood a preferred choice for creating home office spaces that seamlessly blend with existing interiors, promoting a cohesive and inviting atmosphere. Furthermore, wood offers a remarkable level of versatility in design and customization. It can be crafted into a wide range of styles, from classic to contemporary, allowing manufacturers to cater to diverse consumer preferences. The availability of various wood types, finishes, and stains adds to this flexibility, enabling consumers to choose pieces that align with their individual tastes. In terms of durability and longevity, wood is renowned for its robust nature, ensuring that home office furniture retains its value and usability over time. This durability aligns well with the investment mindset of consumers seeking furniture that can withstand the demands of daily use.

Breakup by Price Range:

- Low

- Medium

- High

Medium represents the leading price range

The report has provided a detailed breakup and analysis of the market based on the price range. This includes low, medium, and high. According to the report, medium represented the largest segment.

The medium price range strikes a balance between affordability and quality, appealing to a wide spectrum of consumers. This segment caters to those seeking durable and functional office furniture without overspending. Additionally, remote work trends have surged, prompting many to invest in comfortable and ergonomic home office setups. The medium price range provides options that meet these evolving needs without straining budgets. Furthermore, market research indicates that consumers increasingly value the value-for-money proposition offered by the medium price segment. This segment often features well-designed, versatile pieces that enhance productivity and adapt to varying work styles. The medium price range's popularity can also be attributed to effective marketing strategies employed by industry players.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores hold the largest share in the market

A detailed breakup and analysis of the market has been provided based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others. According to the report, specialty stores accounted for the largest market share.

Specialty stores specialize exclusively in home office furniture, catering to the specific needs of consumers seeking tailored solutions for their workspace requirements. In a landscape where remote work is increasingly prevalent, individuals are searching for furniture that is not only functional but also aligns with their aesthetic preferences and ergonomic needs. Specialty stores excel in providing a wide variety of home office furniture options, ranging from ergonomic chairs and adjustable desks to innovative storage solutions, all under one roof. Moreover, the expertise and knowledge possessed by specialty store staff enable them to guide consumers in selecting furniture that maximizes productivity and comfort. This personalized attention adds value to the shopping experience, ensuring that customers make informed decisions. As the demand for thoughtfully designed home office furniture continues to rise, specialty stores carve a distinct niche by catering to this specific market segment with expertise, variety, and customer-centric services.

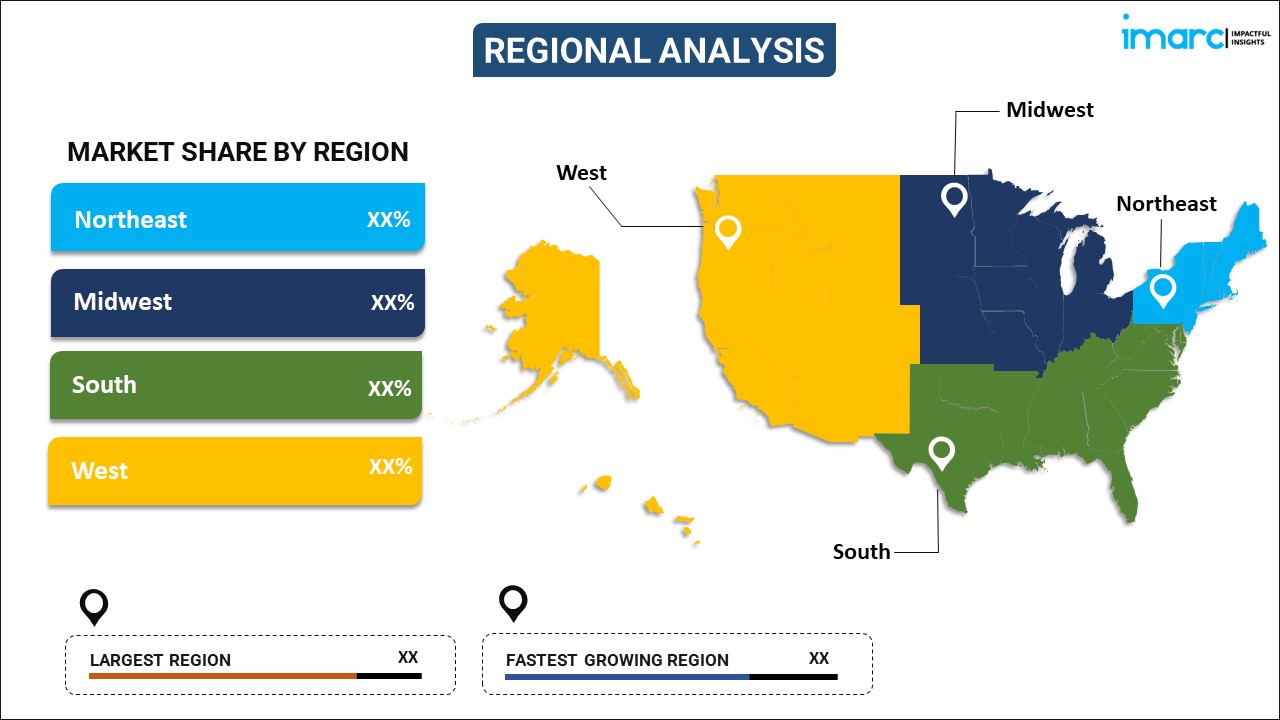

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

South accounts for the largest share in the market

A detailed breakup and analysis of the market has been provided based on region. This includes Northeast, Midwest, South, and West. According to the report, South accounted for the largest market share.

The rapid population growth across the region has led to an increased demand for housing, including larger homes with dedicated office spaces. This trend was accelerated by the COVID-19 pandemic, which prompted many individuals and companies to adopt remote work arrangements. Additionally, the South offers a cost-effective living environment compared to some northern metropolitan areas, attracting both individuals and businesses seeking affordability. This has driven a surge in home office furniture purchases as people look to create functional workspaces within their homes. Furthermore, the diverse economy of the South, including tech hubs like Austin and research centers like the Research Triangle in North Carolina, has fostered a climate of innovation and entrepreneurship. As a result, businesses in the South often prioritize ergonomically designed home office setups, boosting the demand for quality furniture.

Competitive Landscape:

Leading companies are focused on developing innovative home office furniture solutions that cater to the changing work landscape. This includes ergonomic chairs with advanced lumbar support, height-adjustable desks that promote flexible working postures, and multi-functional furniture pieces that optimize space utilization. Additionally, recognizing the importance of technology, key players are integrating smart features into their furniture designs. This includes furniture with built-in charging ports, wireless charging capabilities, and even IoT connectivity, enhancing user convenience and efficiency. Other than this, to align with diverse consumer preferences, major players offer customization options. This allows customers to select finishes, colors, and materials that suit their individual tastes and complement their home décor. Besides this, numerous key players are committed to sustainable practices. They use eco-friendly materials, promote responsible sourcing, and adopt manufacturing processes that minimize environmental impact. This resonates with environmentally conscious consumers and aligns with global sustainability trends. In line with this, recognizing the significance of digital platforms, key players have robust online stores that facilitate easy browsing and purchasing. They provide detailed product information, virtual displays, and online customer support, enabling consumers to make informed decisions from the comfort of their homes.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

United States Home Office Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Seating, Storage Units and File Cabinets, Desks and Tables, Others |

| Material Types Covered | Wood, Metal, Plastic, Glass, Others |

| Price Ranges Covered | Low, Medium, High |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States home office furniture market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States home office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States home office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States home office furniture market was valued at USD 15.39 Billion in 2025.

We expect the United States home office furniture market to exhibit a CAGR of 4.71% during 2026-2034.

The introduction of furniture rental services, along with the rising demand for aesthetically appealing styles and finishes that are lightweight, comfortable, portable, and consume minimal space, is primarily driving the United States home office furniture market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing need for home office furniture among individuals due to the growing adoption of remote working scenario in the United States.

Based on the product, the United States home office furniture market has been divided into seating, storage units and file cabinets, desks and tables, and others. Among these, seating currently exhibits a clear dominance in the market.

Based on the material type, the United States home office furniture market can be categorized into wood, metal, plastic, glass, and others. Currently, wood accounts for the majority of the market share.

Based on the price range, the United States home office furniture market has been segregated into low, medium, and high, where medium currently holds the largest market share.

Based on the distribution channel, the United States home office furniture market can be bifurcated into supermarkets and hypermarkets, specialty stores, online stores, and others. Currently, specialty stores exhibit a clear dominance in the market.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where South currently dominates the United States home office furniture market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)