United States Influenza Diagnostics Market Size, Share, Trends and Forecast by Product, Test Type, Type of Flu, End User and Region, 2025-2033

United States Influenza Diagnostics Market Size and Share:

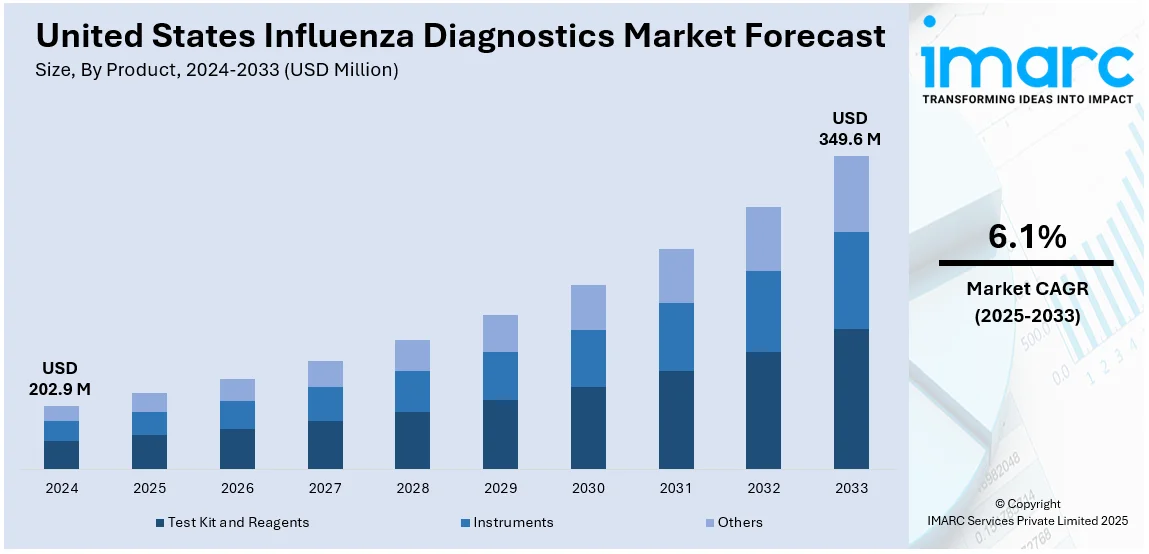

The United States influenza diagnostics market size was valued at USD 202.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 349.6 Million by 2033, exhibiting a CAGR of 6.1% from 2025-2033. The market in the United States is primarily driven by the frequent flu outbreaks, growing awareness among the population, continual innovations in testing methods, partnerships driving research advancements, widespread usage of home diagnostic solutions, favorable initiatives by the U.S. government, significant funding for vaccine advancements, and prioritization of early disease detection and outbreak management strategies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 202.9 Million |

| Market Forecast in 2033 | USD 349.6 Million |

| Market Growth Rate (2025-2033) | 6.1% |

The market in the United States is majorly driven by the increasing prevalence of seasonal influenza, which was emphasized by the centers for disease control and prevention (CDC) in November 2024, stating that the 2023–2024 influenza season resulted in approximately 40 million illnesses, 18 million medical visits, 470,000 hospitalizations, and 28,000 deaths, which highlights the critical need for early and accurate diagnostic solutions. Additionally, a growing focus on education and training for healthcare professionals on testing protocols is ensuring higher diagnostic accuracy and consistency, which is further strengthening the market's growth.

Strategic collaborations between public health agencies and private diagnostic companies are fostering innovation and accelerating the development of advanced testing methods, For example, On February 15, 2024, the biomedical advanced research and development authority (BARDA) and BioFire Defense, LLC, signed a USD 13 Million contract to advance the development of the emerging flu panel (EFP), a diagnostic test capable of identifying and distinguishing between influenza A, influenza B, and novel, emerging influenza viruses. This initiative is set to enhance U.S. pandemic preparedness by delivering rapid diagnostic tools capable of providing results within 60 minutes. Moreover, this growing focus on pandemic preparedness, driven by recent global health emergencies, further emphasizes the importance of early detection to monitor and control outbreaks effectively. Additionally, a considerable rise in the older U.S. population, who are more vulnerable to severe influenza complications, is driving healthcare providers to prioritize targeted testing and contributes significantly to the market's growth.

United States Influenza Diagnostics Market Trends:

Government Support for Expanding Diagnostic Accessibility

Government initiatives are significantly expanding access to influenza diagnostics across the United States, thereby ensuring equitable healthcare delivery. Federal programs are enabling state health departments to distribute rapid diagnostic tools and train providers in their use, particularly in underserved urban and rural areas. For example, on October 7, 2024, the U.S. food and drug administration (FDA) authorized the Healgen Rapid Check COVID-19/Flu A&B Antigen Test. This over-the-counter solution delivers results within 15 minutes using a simple nasal swab. The test demonstrated a 99% accuracy in identifying negative SARS-CoV-2 samples and a 92% accuracy for positive samples. For influenza A, it correctly identified 99.9% of negative samples and 92.5% of positive samples; for influenza B, it showed 99.9% accuracy for negative samples and 90.5% for positive samples. Additionally, subsidies for diagnostic equipment in community health centres and pharmacies are increasing accessibility, enabling timely detection and effective management of influenza outbreaks across diverse communities.

Rising Adoption of At-Home Testing Kits

The market in the United States is experiencing a shift towards at-home testing kits, driven by consumer preference for convenience. These kits allow individuals to perform rapid antigen tests at home, providing immediate results without visiting healthcare facilities. The trend is further supported by the agreement between biomedical advanced research and development authority (BARDA) and Revvity, Inc. for USD 9.2 Million to develop an at-home molecular test platform for detecting influenza A, influenza B, and SARS-CoV-2 on October 28, 2024. The system features a reusable hub and disposable cartridge, offering results within 30 minutes with just five minutes of user interaction. This reduces the number of in-person healthcare visits as much as possible and facilitates sharing with healthcare providers for timely treatments based on results. Retailers and pharmacies also enhance accessibility to the kit, making it particularly advantageous for tech-savvy and health-conscious consumers seeking its benefits.

Increasing Investments in Advanced Vaccine Development

Another factor driving growth in the United States market include the rising investments in advanced vaccine technologies. For instance, on March 27, 2024, Reuters stated that Moderna, an American pharmaceutical company, has secured a USD 750 Million funding agreement with Blackstone Life Sciences to advance its influenza vaccine development, showcasing a shift toward precision-driven solutions. These investments aim to address seasonal influenza's challenges with more effective formulations, leveraging the speed and adaptability of mRNA platforms. The increase in funding reflects a broader industry trend prioritizing enhanced immunogenicity and rapid production capabilities, reducing the time lag between strain identification and vaccine availability. This strategic focus underscores the market's commitment to innovative, scalable vaccine solutions.

United States Influenza Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States influenza diagnostics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, test type, type of flu, and end user.

Analysis by Product:

- Test Kit and Reagents

- Instruments

- Others

Test kits and reagents are essential for diagnosing influenza in the United States. They provide accurate and quick identification of the virus, which is crucial for timely treatment. These tools play a key role in differentiating influenza from other respiratory illnesses, helping to minimize misdiagnosis. Enhanced reagents improve the sensitivity and specificity of tests, aiding healthcare providers in effectively managing outbreaks, particularly during peak flu seasons.

Instruments such as PCR machines and immunoassay analyzers are vital for influenza diagnostics in the United States. These devices enable high-throughput testing, allowing labs to process large volumes of samples quickly. Their accuracy in detecting viral RNA or antigens ensures dependable results. The increasing demand for advanced diagnostics is resulting in innovations in these instruments that are propelling the market forward, improving efficiency, and supporting public health initiatives to control influenza outbreaks..

Analysis by Test Type:

- Molecular Diagnostic Tests

- Polymerase Chain Reaction

- Isothermal Nucleic Acid Amplification Tests

- Others

- Traditional Diagnostic Tests

- Rapid Influenza Diagnostic Tests

- Viral Culture Tests

- Direct Fluorescent Antibody Test

- Serological Tests

Molecular diagnostic tests, like PCR-based assays, play a crucial role in the influenza diagnostics market in the United States. These tests offer exceptional accuracy by detecting viral RNA, even in small amounts, which allows for early diagnosis. Their quick turnaround time and capability to distinguish between influenza subtypes are vital during outbreaks. These advanced techniques are especially important for guiding treatment choices and assessing vaccine effectiveness, making them essential in contemporary diagnostics.

Traditional diagnostic tests, such as rapid influenza diagnostic tests (RIDTs), are important influenza diagnostics market in the United States due to their accessibility and speed. These tests are commonly used in outpatient settings to deliver point-of-care results in just minutes. Although they may not be as sensitive as molecular tests, their cost-effectiveness and simplicity make them crucial in settings with limited resources. Traditional methods continue to be a significant part of the overall strategy for managing and controlling influenza.

Analysis by Type of Flu:

- Type A Flu

- Type B Flu

- Type C Flu

Type A influenza is the leading factor in the diagnostics market in the United States, primarily due to its potential to trigger pandemics and seasonal outbreaks. Its capacity to mutate and infect a variety of species amplifies its impact on public health. Diagnostic tools focused on Type A facilitate timely detection, which is crucial for effective containment strategies. The focus on identifying Type A strains highlights its significance in surveillance and vaccine development initiatives.

Type B influenza is mainly linked to localized outbreaks, which frequently impact children and older adults. Although it is generally less severe than Type A, its seasonal occurrence makes it an important target for diagnostics. Rapid identification of Type B influenza is crucial for administering appropriate treatment and mitigating the risk of complications. The diagnostics market in the United States prioritizes tools capable of precisely distinguishing between Type A and Type B influenza, enabling clinicians to tailor antiviral therapies and enhance patient outcomes.

Type C influenza plays a relatively nominal role in the diagnostics market due to its association with mild respiratory illness and lack of epidemic potential compared to Types A and B. However, its identification remains valuable in clinical evaluations to distinguish between influenza types. Advances in diagnostic technologies support comprehensive testing, including Type C, which helps to understand influenza's broader public health impact and guides future innovations in diagnostics.

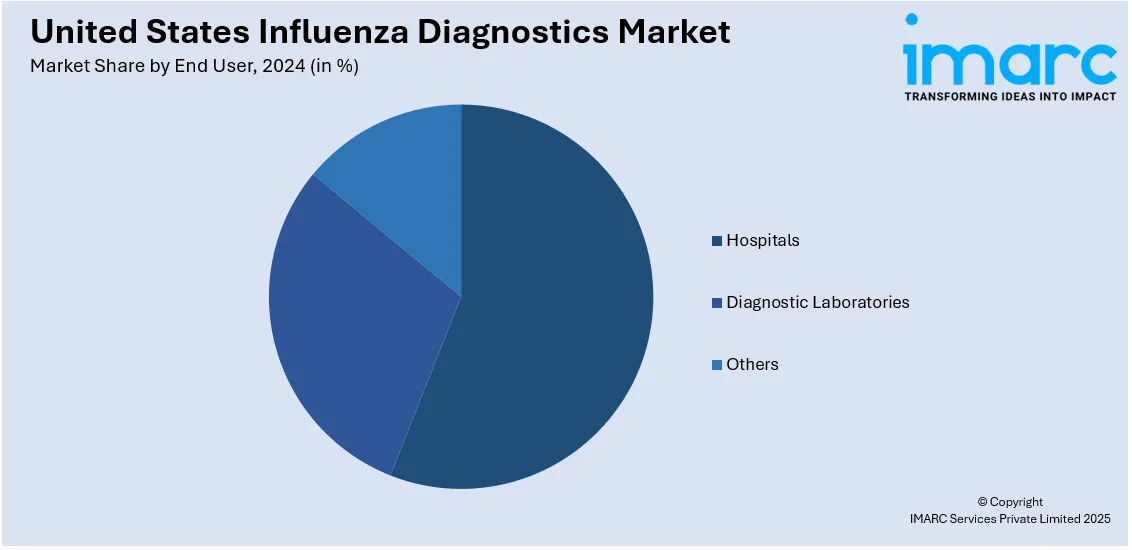

Analysis by End User:

- Hospitals

- Diagnostic Laboratories

- Others

Hospitals are vital in the United States influenza diagnostics market due to their ability to accommodate large patient volumes. Hospitals are primary hubs for testing and treatment. Hospitals ensure rapid diagnosis for severe cases, especially in high-risk patients. Equipped with advanced diagnostic tools, hospitals contribute to real-time disease monitoring and outbreak management.

Diagnostic laboratories play a major role in extensive influenza testing, as they provide specialized and high-throughput services. These labs deliver precise results using advanced methods like PCR and immunoassays, which support public health efforts. Their capability to efficiently process samples during flu seasons helps reduce the strain on hospitals. By collaborating with health agencies, diagnostic laboratories play a pivotal role in tracking influenza trends and ensuring timely interventions in the United States.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States plays a crucial role in the influenza diagnostics market due to its high population density and cold winters, which lead to increased flu transmission. The region has numerous advanced healthcare facilities and diagnostic laboratories, prioritizing early detection and treatment. Public health initiatives in the Northeast also promote widespread testing to manage seasonal outbreaks effectively.

In the Midwest, the influenza diagnostics market is influenced by a combination of urban and rural populations. The extreme weather conditions in the region increase susceptibility to influenza, driving the need for reliable diagnostic tools to enable timely interventions. The presence of leading research institutions supports advancements in diagnostic technologies. Continual efforts to expand access to testing in rural areas are addressing healthcare disparities and strengthening overall flu management in the region.

The Southern region is a significant market for influenza diagnostics due to its large and diverse population. Warmer climates lead to year-round flu cases, requiring consistent diagnostic efforts. The high prevalence of chronic conditions, such as diabetes and asthma, underscores the need for early and accurate flu diagnosis. The increasing number of diagnostic labs and healthcare providers is improving access to advanced testing solutions across the region.

The West plays a vital role in the U.S. influenza diagnostics market, emphasizing innovation and technology. With leading biotechnology companies and research institutions, the region is at the forefront of developing rapid and accurate diagnostic tools. Diverse climates and populations necessitate tailored approaches to flu diagnostics. Public health campaigns in this area focus on preventive measures and early detection to reduce the impact of influenza outbreaks.

Competitive Landscape:

The United States influenza diagnostics market remains highly competitive due to continual technological advancements and strategic collaborations among key industry players. For example, on October 23, 2024, Quest Diagnostics secured contracts from the centers for disease control and prevention (CDC) to develop diagnostic tests targeting H5 avian influenza and oropouche virus. These agreements enable rapid support for public health laboratories during outbreaks while ensuring readiness through sustained funding for essential equipment and reagents. In addition to this, the increasing demand for rapid and accurate diagnostic solutions is prompting companies to innovate and expand their product portfolios. This competitive environment fosters continuous improvement in diagnostic technologies, aiming to meet the evolving needs of healthcare providers and patients.

The report provides a comprehensive analysis of the competitive landscape in the United States influenza diagnostics market with detailed profiles of all major companies.

Latest News and Developments:

- On October 10, 2024, Emory University in Atlanta, U.S. reported the availability of over-the-counter combination tests capable of diagnosing both influenza A, influenza B, and COVID-19 from a single nasal swab. These tests offer a convenient method for individuals to determine the cause of respiratory symptoms at home quickly. Dr. Greg Martin, a principal investigator at ACME POCT, emphasized the significance of these tests in enabling timely and appropriate treatment decisions during the respiratory virus season.

- On October 30, 2024, the U.S. Department of Agriculture (USDA) announced enhanced testing and monitoring protocols for H5N1 avian influenza, aiming to safeguard livestock and public health. These measures include a tiered strategy for collecting milk samples to assess the virus's presence, thereby informing biosecurity and containment efforts. This initiative is poised to significantly impact the United States influenza diagnostics market by increasing demand for advanced testing solutions and fostering innovation in diagnostic technologies.

United States Influenza Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Test Kit and Reagents, Instruments, Others |

| Test Types Covered |

|

| Type of Flus Covered | Type A Flu, Type B Flu, Type C Flu |

| End Users Covered | Hospitals, Diagnostic Laboratories, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States influenza diagnostics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States influenza diagnostics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States influenza diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Influenza diagnostics in the United States involve laboratory tests designed to detect influenza viruses in respiratory specimens. These diagnostics are crucial for timely identification and management of influenza infections, aiding in appropriate treatment decisions and public health interventions.

The United States influenza diagnostics market was valued at USD 202.9 Million in 2024.

IMARC estimates the United States influenza diagnostics market to exhibit a CAGR of 6.1% during 2025-2033.

The key drivers of United States influenza diagnostics market are recurring seasonal outbreaks of influenza, increased public awareness, advancements in diagnostic technologies, and the need for rapid and accurate disease detection.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)