United States Lime Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

United States Lime Market Size and Share:

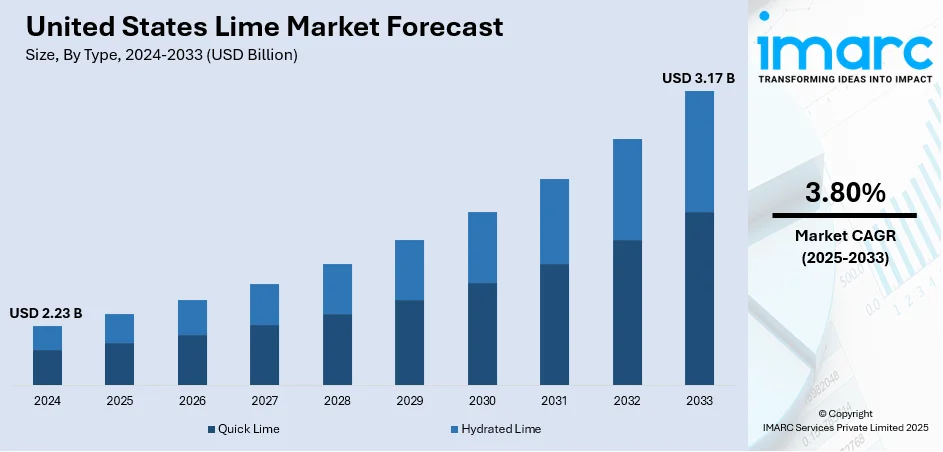

The United States lime market size was valued at USD 2.23 Billion in 2024. The market is projected to reach USD 3.17 Billion by 2033, exhibiting a CAGR of 3.80% from 2025-2033. South United States market is currently dominating the market with a share of 39.8% owing to the amplifying demand in industries like construction, water treatment, mining, and agriculture. The rising demand for infrastructure expansion, environmental friendliness, and industrial efficiency is stimulating extensive use of lime products. Improvements in manufacturing processes and quality control are also stimulating market competitiveness. Moreover, usage in flue gas desulfurization and soil conditioning is gaining significance. These multi-faceted and dynamic applications play a major part in overall growth within the United States lime market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.23 Billion |

| Market Forecast in 2033 | USD 3.17 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

Rising urbanization and industrialization throughout the United States are making major contributions to the increased growth of the lime market. As cities expand and industrial centers grow, demand for materials to form the foundations used in building, infrastructure, and manufacturing expands similarly. Lime is extensively utilized in asphalt stabilization, sludge treatment from sewers, and waste neutralization—three very important processes in contemporary urban development and environmental regulation. Moreover, with the growth of industrial parks and manufacturing districts, there is an increased need for products that facilitate operations like metallurgy, chemical manufacture, and construction aggregates. The stability, chemical nature, and multipurpose use of lime make it a highly favored material for these industries. Public infrastructure investment growth and upgrading aged assets also boost consumption. Such urban and industrial growth not only enhances lime's position in current applications but also leads to innovation in new areas of use, thus serving as a consistent driver for long-term market demand in various regions of the country. According to the sources, in April 2024, Mississippi Lime Company revamped its brand to MLC, introducing a fresh worldwide identity to build international lime solutions presence in conjunction with UK-based subsidiary Singleton Birch.

To get more information on this market, Request Sample

More investment in sustainable agricultural methods is becoming a crucial driving force behind the United States lime market. Farmers are moving towards practices that maintain long-term soil fertility, and lime is at the forefront by adjusting soil pH, hence improving nutrient absorption and boosting crop output. The change is also driven by government initiatives that encourage sound soil stewardship and enhanced agricultural efficiency. As per the reports, in December 2024, TETRA Technologies introduced the TETRA Oasis TDS system to the Permian Basin, improving water reuse and mineral recovery—lime-associated by-products included to cater to environmental need within the United States lime market. Moreover, outside of conventional agriculture, lime is growing in use in turf care, horticulture, and organic agriculture, markets that stress soil equilibrium and plant vitality without heavy dependence on man-made chemicals. With national food security increasingly an emphasis, demand for healthy, responsibly grown produce grows, further validating the importance of lime. Also fueling year-round demand are growing numbers of farmers who understand the long-term advantages of continuing liming regimens. These trends indicate that diversification of agriculture combined with sustainability objectives is set to continue to develop new opportunities for lime use, underpinning steady United States lime market growth in both large-scale and small-scale farming enterprises.

United States Lime Market Trends:

Construction and Infrastructure Boom Boosting Demand for Lime

The US lime market is underpinned substantially by the strong expansion in the construction and infrastructure industries. With the spending on construction exceeding USD 2.1 trillion in April 2025, lime products like plaster, mortar, and limewash are high-demand products for domestic, commercial, and civil construction. They need to ensure continuous quality and durability, both provided by lime-based products. The increase in house construction, urban growth, and highway extensions has driven the demand for lime, particularly in cement blending and masonry construction. In addition, lime plays an essential role in soil stabilization and layering of road foundations, solidifying its place in the construction process. With the U.S. concentrating on new housing construction and infrastructure modernization, high-demand for quality lime persists, positioning construction as one of the key drivers of growth for the lime industry. The cost-effectiveness, accessibility, and sustainability attributes of the material account for its appeal among contractors and builders nationwide.

Water Treatment and Environmental Protection Accelerating Usage

Environmental sustainability is transforming lime demand in the U.S., especially in water treatment and air pollution abatement. Since more than 80% of sewage is untreated worldwide, the application of lime to treat wastewater and eliminate impurities has become imperative. Lime improves the quality of water by balancing pH levels, causing heavy metals to precipitate, and killing pathogens. Poor water quality is responsible for more than 80% of diseases and half of all child mortality in the world, highlighting the pressing demand for efficient solutions to treatment. At the same time, environmental protection policies focusing on minimizing industrial emissions promoted the application of lime in flue gas desulfurization to restrict sulfur dioxide release. Lime has also become a material of choice for the treatment of industrial waste and environmental remediation because it is chemically stable and inexpensive. With increasing awareness of public health and environmental conservation, lime's environmental uses are ready for explosive expansion. United States lime market trends place lime squarely at the center for sustainability and environmental protection initiatives.

Agriculture and Chemicals Industry Bolster Lime Market Outlook

The U.S. agricultural and chemical industries play pivotal roles in the sustained growth of the lime market. Agriculturalists increasingly apply lime to balance soil pH, facilitate nutrient uptake, and enhance crop yields, most notably in areas of naturally acidic or highly cultivated soils. Such usage improves overall soil health over the long term and facilitates sustainable agriculture practices. At the same time, the nation's position as a world leader in chemical manufacturing, producing more than 13% of world output, propels heavy lime use in industrial applications. In the chemical sector, lime is critical in pH regulation, neutralization, and as a reagent in several chemical reactions. Process automation and upgraded kiln designs have also promoted more efficient production and consistent quality of lime, making it more attractive across industries. As industrial chemical and fertilizer demand increases in domestic and export economies, lime's value as a versatile and dependable input continues to grow, solidifying its position in the country's economic landscape.

United States Lime Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States lime market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Quick Lime

- Hydrated Lime

Quick lime was the leader in 2024 in United States lime market outlook, with a share of about 82.2% of the total. This superiority is due to its extensive industrial uses, particularly in industries like the manufacturing of steel, treatment of flue gas, and the production of chemicals. Its capability of rapid reaction with water and adsorbing impurities renders it an essential compound for applications requiring quick and effective chemical reactions. Quick lime has widespread applications in the adjustment of pH levels, desilication of iron ore in metallurgy, and treatment of wastewater. Its high calcium value and reactivity justify its application in a wide range of industrial processes, especially where high-temperature, quick-acting chemical inputs are required. In building construction, it increases the binding quality of substances in mortar and plaster. The regular need for quick lime is also spurred by infrastructure construction and maintenance as well as pollution control laws focusing on emissions reduction, both of which demand efficient and dependable chemical treatment—areas in which quick lime provides documented efficiency and economy.

Analysis by Application:

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

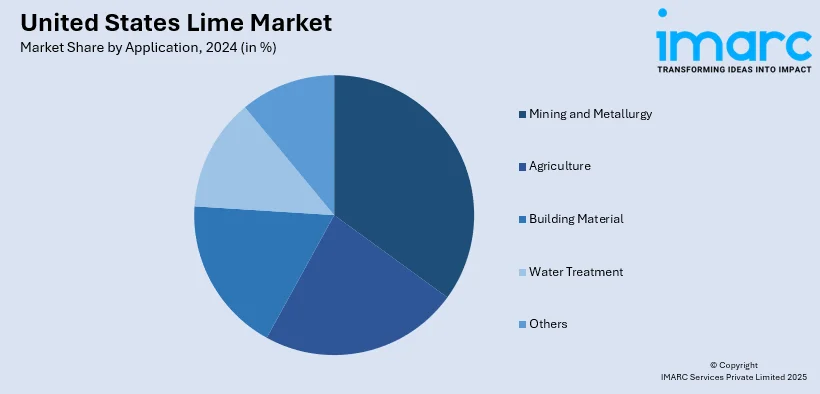

Mining and metallurgy are the largest application segment in the United States lime market forecast, spurred by lime's essential function in metal extraction and processing. In metallurgical processes, lime plays several roles such as purifying impurities from molten metals, facilitating slag formation, and keeping the process in basic condition during refining. Its use is particularly crucial in the manufacture of steel and non-ferrous metals, where it provides quality, strength, and meets performance standards. In mining, lime is used in flotation and cyanide treatment, especially for gold and silver extraction of precious metals. The U.S. has a healthy metals industry that requires steady amounts of high-quality lime, thus stabilizing the market. Additionally, revitalization of local mining projects and national strategic interest in acquiring key minerals also drive lime consumption. The effectiveness, cost-effectiveness, and utility of lime continue to render it a reagent of choice in these applications, facilitating productivity as well as environmental regulation in industrial processes.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The South region of United States dominates the lime market in 2024 with a 39.8% share because of its base of heavy industries, rich raw material resources, and geographic location benefits. Countries like Texas, Alabama, and Georgia are home to major manufacturing centers, steel mills, and chemical processing units, all of which generate heavy lime consumption. Also supporting demand are active mining and metallurgical production in this area. The South also has a robust agricultural sector where lime is utilized to counteract acid soils and increase crop yield. Its nearness to limestone deposits reduces the cost of production and transportation, thus making lime more widely available and cost-effective for local end-users. Infrastructure development, urbanization, and expenditure on water treatment and environmental services continue to boost market growth in this region. The industrial mix of the region and policy-led focus on sustainable operations are likely to sustain its top position among the lime market during the forecasting period.

Competitive Landscape:

The United States lime market's competitive dynamics are defined by a broad range of producers varying from large manufacturers to regionally oriented suppliers. Market players are concentrating on process innovation, cost reduction, and uniform quality to ensure competitiveness. Product differentiation in the form of custom-made formulations for individual applications such as industrial processing, agriculture, and environmental services is also gaining prominence. Geographic reach and effective distribution channels also play an important role in creating market presence, with the suppliers looking to cut lead times and cater to diverse end-use industries quickly. Strategic partnerships with construction, agriculture, and environmental companies assist in developing long-term supply contracts and retaining customers. Firms are also investing in digital technologies to improve better forecasting of demand, inventory management, and customer relationship management. The increasing relevance of sustainability and reduction of carbon footprint is encouraging players to seek out green production technology and circular economy practices that are influencing market positioning and competitive forces.

The report provides a comprehensive analysis of the competitive landscape in the United States lime market with detailed profiles of all major companies, including:

- Cheney Lime & Cement Company

- Minerals Technologies Inc.

- Mississippi Lime Company

- Pete Lien & Sons, Inc.

- United States Lime & Minerals, Inc.

Latest News and Developments:

- June 2025: GAMMA Investing LLC boosted its holdings in United States Lime & Minerals, Inc. by 10,831.6% in the first quarter, according to its most recent SEC filing. The institutional investor now owns 8,308 shares of the construction firm's stock, up from a purchase of another 8,232 shares in the quarter.

- May 2025: The Portland Cement Association changed its name to the American Cement Association to acknowledge greater production of materials beyond Portland cement, such as lime-based and lower-carbon products. This move targeted decarbonization efforts, as more than 60% of U.S. consumption consisted of sustainable cement, including mixes of lime, further supporting the industry's pledge of becoming carbon-neutral.

- January 2024: Mississippi Lime Company (MLC), a lime product and technical solutions supplier, made a significant investment in constructing a cutting-edge, environmentally sustainable kiln at its recently acquired Bonne Terre, Missouri, facility. The new kiln will be equipped with advanced natural gas technology, which will lower the site's carbon footprint, enhance lime quality, and provide a low-dust workplace for employees. The Bonne Terre mine, which has been in production for close to a century, was bought out by MLC in 2022 and predominantly manufactures dolomitic quicklime (magnesium calcium oxide). The construction of the kiln is to commence in early 2024, with commissioning by 2026.

United States Lime Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quick Lime, Hydrated Lime |

| Applications Covered | Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Cheney Lime & Cement Company, Minerals Technologies Inc., Mississippi Lime Company, Pete Lien & Sons, Inc., United States Lime & Minerals, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States lime market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States lime market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States lime industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lime market in the United States was valued at USD 2.23 Billion in 2024

The United States lime market is projected to exhibit a CAGR of 3.80% during 2025-2033, reaching a value of USD 3.17 Billion by 2033.

Demand from metallurgy, environmental regulations, and construction industries drives the U.S. lime market. Its application in steel production, flue gas desulfurization, and purification of water fuels uptake. Agriculture and chemical industry growth, as well as regulations on sustainability, further fuels market growth through greater dependence on lime-based technologies in these applications

The largest market share in the U.S. lime market belongs to the South region at 39.8% in 2024. The region's strong industrial base, availability of limestone, and high lime consumption in steel production, agriculture, and construction are the reasons behind this dominance. Strong infrastructure growth and good logistics also help place the South in the leading market position.

Some of the major players in the United States lime market include Cheney Lime & Cement Company, Minerals Technologies Inc., Mississippi Lime Company, Pete Lien & Sons, Inc., United States Lime & Minerals, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)