United States Lobster Market Size, Share, Trends and Forecast by Species, Weight, Product Type, And Distribution Channel, Region, 2026-2034

United States Lobster Market Size and Share:

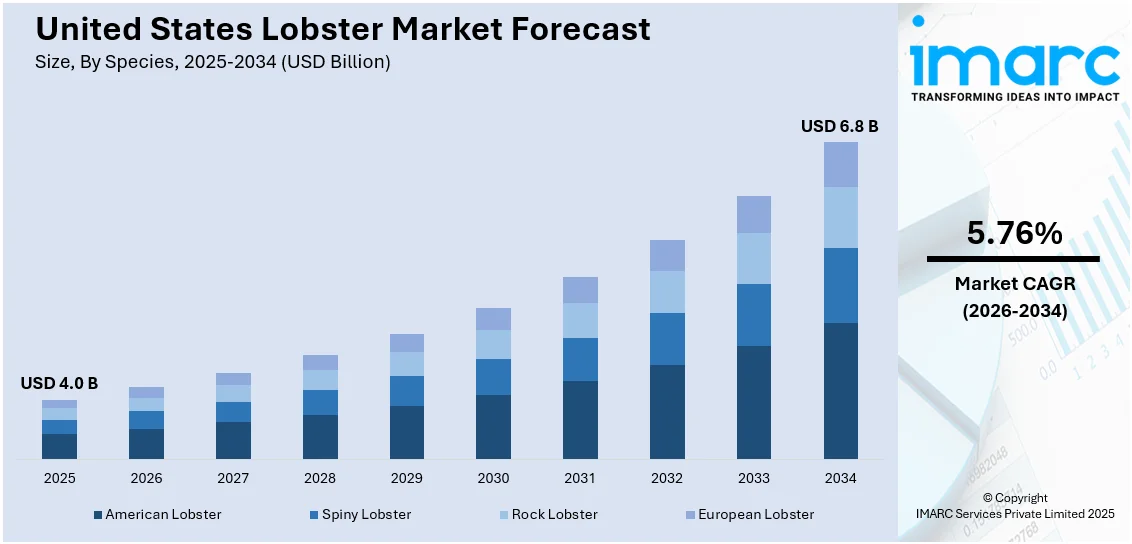

The United States lobster market size was valued at USD 4.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.8 Billion by 2034, exhibiting a CAGR of 5.76% from 2026-2034. The market is driven by strong consumer demand, rising seafood consumption and expanding export opportunities. Key factors include sustainable fishing practices, advancements in cold storage and growing popularity in foodservice and retail sectors thus surging the United States lobster market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.0 Billion |

|

Market Forecast in 2034

|

USD 6.8 Billion |

| Market Growth Rate (2026-2034) | 5.76% |

United States Lobster Market Analysis:

- Market Trends: Some of the key United States lobster market trends are the growing online seafood sales, increased interest in premium dining experiences, rising demand for convenient lobster products, broader culinary integration, and heightened focus on sustainable sourcing and certifications are shaping the lobster market.

- Market Drivers: Consumer preference for healthier, protein‑rich seafood, growing appreciation for gourmet cuisine, increased household cooking experimentation, sustainability‑minded purchases, and expanding culinary uses of lobster drive ongoing market momentum across retail and foodservice.

- Market Opportunities: Developing ready‑to‑cook (RTC) and value‑added products, enhancing direct‑to‑consumer delivery options, tapping emerging domestic and global markets, and adopting sustainable fishing practices present strong opportunities for businesses within the evolving United States lobster market analysis.

- Market Challenges: Environmental changes impacting lobster habitats, strict regulatory policies, high operational and distribution costs, fluctuating market prices, and growing sustainability expectations from consumers and advocacy groups pose persistent challenges for industry players.

To get more information on this market Request Sample

The United States lobster market is driven by growing consumer demand for premium seafood especially in the fine dining, retail and export markets. Increasing disposable income and the increasing demand for high-protein diets are driving the United States lobster market growth. According to the data published by the Bureau of Economic Analysis (BEA), in December 2024, personal income rose by $92.0 billion (0.4%) while disposable personal income increased by $79.7 billion (0.4%). Personal consumption expenditures surged $133.6 billion (0.7%). Personal saving stood at $843.2 billion with a saving rate of 3.8%. PCE price index increased by 0.3% month-over-month. Foodservice is an important sector where restaurants and seafood chains are focused on lobster-based dishes. The adoption of sustainable harvesting practices and certification programs is enhancing consumer trust which further increases the demand for responsibly sourced lobster. Technological advancements in storage, transportation, and processing improve product quality and extend shelf life.

Export demand particularly from China, Europe, and Canada remains a key growth factor. Trade agreements and tariff reductions impact market dynamics affecting international sales. Climate change and ocean temperature shifts affect lobster populations, prompting regulatory adjustments and seasonal harvesting controls. The shift toward frozen and value-added lobster products including tails and meat supports broader market penetration. For instance, in March 2024, Phillips Foods a major U.S. crabmeat supplier announced the acquisition of two Canadian processing plants in Nova Scotia and Prince Edward Island to expand its lobster and snow crab operations. The company plans to launch new refrigerated pasteurized lobster meat products and a frozen crab toast appetizer showcasing them at Seafood Expo North America. Direct-to-consumer sales and online seafood marketplaces further expand accessibility catering to evolving consumer purchasing behaviors and preferences.

United States Lobster Market Trends:

Rising E-Commerce and D2C Sales

The e-commerce and direct-to-consumer sales are transforming the U.S. lobster market growth. The Census Bureau reports U.S. retail ecommerce sales reached $300.1 billion in Q3 2024 up 2.6% from Q2 2024 and 7.4% year-over-year. Total retail sales for Q3 were $1,849.9 billion a 1.3% increase from Q2. E-commerce accounted for 16.2% of total sales in the quarter. Online seafood platforms allow consumers to buy fresh, frozen or value-added lobster products directly from suppliers without going through the traditional retail channel. This saves time and gives access to more varieties of products and makes prices more transparent. Direct shipping services ensure that the product is delivered faster with advanced packaging that maintains product quality. With more consumers seeking premium seafood experiences at home the demand for premium lobster offerings through these digital channels continues to grow. This is supported by the increasing preference for personalized shopping and direct access to sustainable sourcing practices.

Growth in Export Markets

The lobster market in U.S. is growing robustly in exports mainly due to strong demand from key international markets especially China, Europe and Canada. China's middle class is expanding and its consumption of premium seafood has increased the market for U.S. lobster while European demand is growing particularly in high-end restaurants and retail chains. According to the data published by Food and Agriculture Organization, during Q2 2023, US live lobster exports to China surged to 830 tonnes valued at USD 16.25 million marking increases of 69% by volume and 55% by value from Q2 2022. Despite stable EU imports tighter supplies and strong demand may lead to rising prices amid economic uncertainties. Canada is a significant trading partner with U.S. lobster complementing local supply. Trade agreements as well as tariff reductions are important mechanisms for improving the access of exports to markets while strengthening export dynamics. International sales combined with the growing international consumption of seafood continue driving expansion in U.S. lobster.

Rising Demand for Premium Seafood

Consumer demand for sustainable high-quality lobster is on the rise in the United States. As diners become increasingly aware of the environmental impact of their food choices, restaurants, retailers and online platforms are prioritizing responsibly sourced lobster. For instance, in November 2024, Red Lobster announced a revamped menu that introduces seven new items and brings back the beloved hush puppies. The updated menu aims to attract seafood lovers while reducing its overall size by 20%. Although the popular Ultimate Endless Shrimp promotion has been discontinued Lobsterfest will continue offering an enhanced experience for guests. Sustainability certifications and traceability programs are increasingly important to consumers looking for ethically caught products. In response seafood suppliers are emphasizing sustainable harvesting practices including certified traps and low-impact fishing techniques. This is further reflected in premium lobster products whose demand is high with restaurants specialty retailers and online platforms targeting high-end consumers willing to pay the premium for high-quality environmentally friendly seafood.

United States Lobster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States lobster market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on species, weight, product type, and distribution channel.

Analysis by Species:

- American Lobster

- Spiny Lobster

- Rock Lobster

- European Lobster

American lobster dominates the U.S. market because of high demand in domestic and international markets especially North America, Europe and Asia. It is primarily harvested from the cold waters of the Atlantic especially Maine and Massachusetts. The superior taste, texture and size give it a greater market share while sustainable fishing practices and rigorous regulations ensure consistency in supply which further increases its market strength. American lobster dominance in the U.S. market is contributed to by the increased preference of consumers for premium seafood and foodservice applications.

Analysis by Weight:

- 0.5 – 0.75 lbs

- 0.76 – 3.0 lbs

- Over 3 lbs

Lobsters weighing between 0.76 to 3.0 lbs are dominating the United States lobster market because it is a size of preference for restaurants and retail sales. The balance of meat yield, flavor and ease of preparation makes them consumers' and chefs' favorite. High demand comes from foodservice, fine dining and export markets in this segment. Regulations on sustainable harvesting ensure that supply is constant which makes this size range even more dominant in the U.S. lobster industry.

Analysis by Product Type:

- Whole Lobster

- Lobster Tail

- Lobster Meat

- Lobster Claw

Whole lobster dominates the United States lobster market as the demand is very strong in the foodservice and retail sectors. Consumers prefer fresh whole lobsters for their flavor and versatility in preparation. The highest-end restaurants and seafood markets generate significant sales, and live lobsters are very popular. The growth of online seafood delivery services has made it easier for consumers to obtain whole lobsters. Sustainable fishing practices and well-regulated fisheries further support supply consistency reinforcing the segment's leadership in the U.S. lobster market.

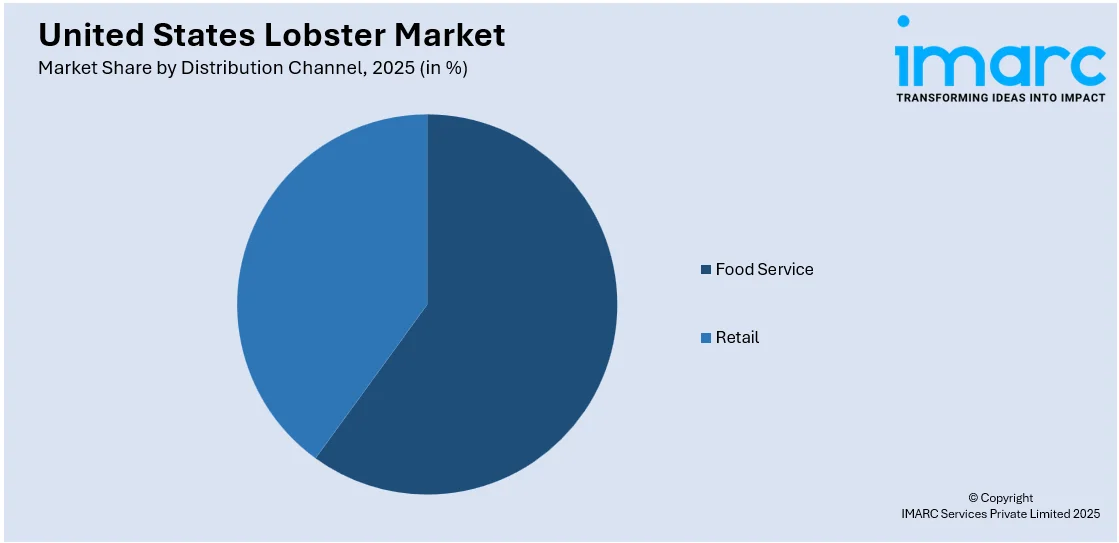

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Food Service

- Retail

The food service sector leads the United States lobster market due to high demand from restaurants, hotels and catering services. Lobster is a premium seafood choice in fine dining, casual eateries and seafood chains with dishes such as lobster rolls, bisques and grilled lobster becoming popular. Seasonal promotions and special seafood menus also increase demand. Further factors are consumer's growing demand to eat out, increasing seafood specific restaurants and also online food ordering which leads to market expansion.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast holds the significant place in the United States lobster market due to its rich lobster fishing industry particularly in Maine and Massachusetts. The region benefits from abundant natural resources a well-established supply chain and a strong seafood processing sector. High consumer demand both domestically and internationally further drives market growth making it the leading hub for lobster production.

The Midwest plays a growing role in the U.S. lobster market primarily as a key consumer region. With a rising number of seafood restaurants and specialty grocery stores demand for fresh and frozen lobster is increasing. Improved cold chain logistics and distribution networks have enhanced accessibility allowing Midwestern consumers to enjoy high-quality lobster despite being far from coastal fisheries.

The Southern U.S. is an emerging market for lobster fueled by increasing consumer preference for premium seafood in states like Florida, Texas and Georgia. The region's tourism industry especially in coastal areas supports demand in restaurants and resorts. The growing popularity of seafood boils and Cajun-style cuisine has contributed to rising consumption boosting the lobster market in the South.

The Western U.S. has a strong lobster market due to high demand in states like California, Washington and Oregon. The region’s coastal cities have a thriving seafood culture with premium restaurants and retailers catering to consumers seeking fresh and sustainable seafood. The presence of international trade ports also facilitates imports and exports enhancing market accessibility and growth.

Competitive Landscape:

The United States lobster market is highly competitive with numerous players operating across different segments including fishing, processing, distribution and food service. Market participants focus on maintaining high-quality standards sustainable fishing practices and efficient supply chains to meet growing consumer demand. Innovation in packaging, cold storage and distribution has enhanced product shelf life and expanded market reach. Companies compete based on pricing, product differentiation and strategic partnerships with restaurants, retailers and online seafood platforms. The rise of ecommerce and direct-to-consumer sales has further intensified competition allowing businesses to target a broader customer base. Additionally, sustainability initiatives and adherence to fishing regulations are critical factors influencing market positioning as environmentally conscious consumers increasingly prioritize responsibly sourced lobster products.

The report provides a comprehensive analysis of the competitive landscape in the United States lobster market with detailed profiles of all major companies, including:

- Boston Lobster Company

- Cozy Harbor Seafood Inc.

- East Coast Seafood Company

- New England Lobster Co.

- Ready Seafood

- Sanders Family Corporation

- Southern Maine Lobster Company

- Supreme Lobster

- The Fresh Lobster Company

- The Lobster Co.

Latest News and Developments:

- In February 2025, Cousins Maine Lobster announced its expansion into Orlando and Daytona launching its first central Florida food truck this month led by franchisees Yunus and Thameem Shahul. Recognized for outstanding growth the brothers opened 12 units in a year.

- In February 2025, Cousins Maine Lobster announced its plans to visit Des Moines, IA, offering their renowned lobster rolls and other seafood favorites. The tour aims to build brand awareness and attract potential franchisees, with stops in Marshalltown and Ankeny, alongside online ordering via their mobile app.

- In December 2024, Red Lobster announced the launch of a Happy Hour menu available Monday to Friday from 3 to 6 p.m. This initiative follows a revamped menu rollout and aims to support the chain's recovery efforts after its bankruptcy in May under new management.

- In August 2024, Quiznos announced the Lobster & Seafood Sub as a permanent menu item following high demand. Founded in 1981, Quiznos specializes in toasted sandwiches and fresh ingredients.

United States Lobster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | American Lobster, Spiny Lobster, Rock Lobster, European Lobster |

| Weights Covered | 0.5– 0.75 lbs, 0.76 – 3.0 lbs, Over 3 lbs |

| Product Types Covered | Whole Lobster, Lobster Tail, Lobster Meat, Lobster Claw |

| Distribution Channels Covered | Food Service, Retail |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States lobster market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States lobster market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States lobster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lobster market was valued at USD 4.0 Billion in 2025.

The United States lobster market is driven by rising consumer demand for premium seafood, strong exports, and expanding food service applications. Growth in fine dining, increased disposable income, and the popularity of sustainable sourcing further boost demand. Additionally, advancements in cold chain logistics and processing technologies enhance market expansion.

IMARC estimates the lobster market to reach USD 6.8 Billion by 2034, exhibiting a CAGR of 5.76% during 2026-2034.

American lobster dominates the United States lobster market, accounting for the largest market share due to its high demand in both domestic and export markets. Its superior taste, texture, and availability along the Northeast coast contribute to its market leadership. The species' strong presence in fine dining and seafood processing further strengthens its dominance.

Some of the major key players include Boston Lobster Company, Cozy Harbor Seafood Inc., East Coast Seafood Company, New England Lobster Co., Ready Seafood, Sanders Family Corporation, Southern Maine Lobster Company, Supreme Lobster, The Fresh Lobster Company, The Lobster Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)