U.S. Menswear Market Expected to Reach USD 190 Billion by 2033 - IMARC Group

U.S. Menswear Market Statistics, Outlook and Regional Analysis 2025-2033

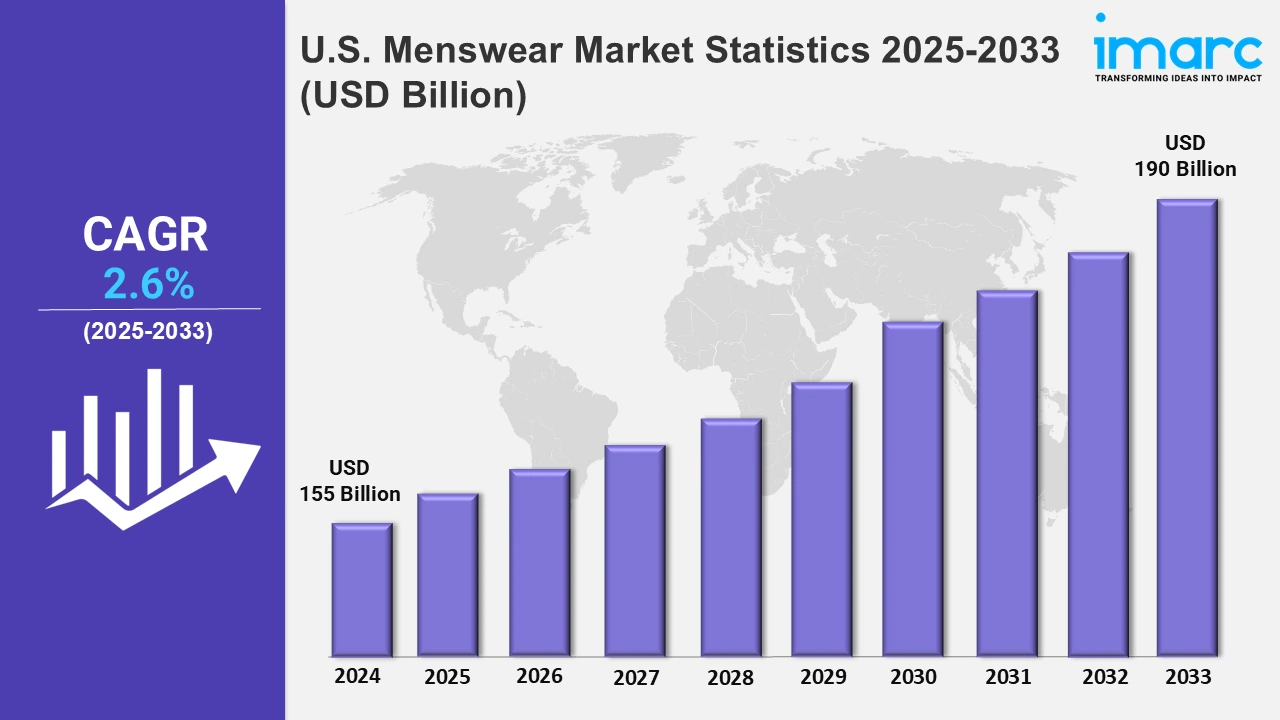

The U.S. menswear market size was valued at USD 155 Billion in 2024, and it is expected to reach USD 190 Billion by 2033, exhibiting a growth rate (CAGR) of 2.6% from 2025 to 2033.

To get more information on this market, Request Sample

The menswear industry is moving toward multifunctional sportswear that combines comfort, utility, and adaptation for busy lives. With an emphasis on performance-driven clothes, manufacturers are introducing multi-purpose collections that appeal to both casual and sportswear, reflecting the growing demand for fashionable yet useful clothing. For example, in July 2024, Pacsun made its debut in the US men's sportswear market by introducing the versatile Active. Recreation. Comfort. (A.R.C.) collection, designed for adaptability and performance.

Moreover, the industry is moving toward adaptable and fashionable clothing that can transition between informal and formal circumstances. With an emphasis on versatility, new collections include blazers, polos, cardigans, and accessories, meeting customer requirements for practical yet attractive wardrobe options. For instance, in May 2024, Macy’s unveiled a unique and versatile menswear collection in the US, featuring blazers, polos, cardigans, and accessories, designed to offer a stylish and adaptable wardrobe for various occasions. Furthermore, the menswear industry in the United States is developing in response to rising customer demand for environmentally friendly, multifunctional, and technologically advanced clothing. To meet changing consumer expectations, brands are incorporating eco-friendly materials, digital shopping experiences, and adaptable fashion trends. Additionally, there is a growing interest in performance-based menswear, notably athletics, athleisure, and outdoor clothes, as men seek useful yet fashionable attire for a variety of activities. For example, Patagonia and Vuori (California) are investing in sustainable performance materials, and Nike (Oregon) incorporates smart textiles into sportswear. Meanwhile, premium brands such as Todd Snyder (New York) are combining organic cotton and recycled materials into their offerings. The menswear sector in the US is responding to current needs by focusing on sustainability, internet shopping, and performance-driven design, assuring long-term growth and alignment with eco-conscious and tech-savvy consumers' expectations.

U.S. Menswear Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The growing interest of consumers in sustainability and ethical fashion in various regions of the US is significantly driving the growth of the market. Additionally, the elevating emphasis on comfort and functionality while maintaining a sense of style boosts the growth of the market.

Northeast Menswear Market Trends:

The Northeast, especially New York and Boston, is adopting sustainable clothing. Brands such as Noah and Todd Snyder (New York) are pioneers in eco-friendly fashion with ethical sourcing. The "Metamorphose" initiative, which promotes sustainability, shows consumer awareness. Everlane, which has a major presence in the region, promotes transparency and responsible fashion. New York's secondhand luxury marketplaces, like The RealReal, help to foster circular fashion by influencing purchasing habits toward sustainability.

Midwest Menswear Market Trends:

The Midwest, home to industries such as manufacturing and farming, is experiencing a renaissance of historical workwear. Carhartt (Detroit, Michigan) remains a strong competitor, combining durability with streetwear appeal. Red Wing Shoes (Minnesota) continues to manufacture excellent and handmade boots. Local businesses like Tellason (Iowa) concentrate on rugged raw denim, supporting the region's preference for utility menswear. Workwear-inspired fashions like chore jackets and heavyweight materials are regaining popularity.

South Menswear Market Trends:

The South, with its warm temperature and relaxed lifestyle, is fueling the development of casual and athleisure clothing. Macy's (Texas stores) has increased its unique menswear collections with breathable materials and lightweight designs. Pacsun (headquartered in California but popular in the South) has introduced its A.R.C. line, which caters to adaptive sportswear trends. Southern towns such as Atlanta and Austin are experiencing an increase in demand for everyday comfort-focused design, with manufacturers selling adaptable and moisture-wicking clothes that can be worn all year.

West Menswear Market Trends:

The West, particularly California and Colorado, combines fashion and performance. Patagonia (Ventura, California) and Vuori (Encinitas, California) are the market leaders in sustainable sportswear for both outdoor and urban wear. REI (Seattle, Washington) reports an increase in demand for men's hiking gear. With outdoor lifestyles established in locations like Denver and San Francisco, customers emphasize on technical fabrics, layering pieces, and multi-functional menswear, boosting demand for clothes that can be worn for adventure or everyday usage.

Top Companies Leading in the U.S. Menswear Industry

Some of the leading U.S. menswear market companies have been mentioned in the report. Key players are focusing on collaborations and partnerships with designers, influencers, and celebrities to boost brand awareness and attract younger audiences. Furthermore, firms are expanding their product lines to include sustainable and ethically manufactured clothes, in response to the growing demand for eco-friendly fashion. For example, in June 2024, the U.S. Embassy Public Affairs launched the "Metamorphose" project, a joint initiative dedicated to promoting sustainability in fashion.

U.S. Menswear Market Segmentation Coverage

- Based on the product type, the market has been segmented into trousers, denims, shirts and t-shirts, ethnic wear, and others. Trousers, including formal and informal styles, meet both professional and recreational purposes. Denim is a wardrobe essential, combining durability with current fashion trends. Shirts and t-shirts are the most preferable items of clothing for everyday use since they combine adaptability and comfort. Ethnic wear, while specialized, thrives in cultural and festive segments.

- Based on the season, the market is categorized into summer wear, winter wear, and all-season wear. Summer wear prioritizes lightweight materials and breathability for comfort in hot weather. Winter wear includes insulated fabrics, layering choices, and outerwear for warmth. All-season wear, which includes adaptable materials and transitional designs, provides year-round practicality while accommodating changing temperatures and customer preferences.

- Based on the distribution channel, the market has been divided into supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others. Supermarkets and hypermarkets provide affordability and convenience. Exclusive stores provide premium and brand-focused experiences. Multi-brand retail outlets offer a wide range of products that meet a variety of styles and budgets. Online stores offer accessibility, tailored recommendations, and competitive pricing, resulting in a substantial development in digital fashion shopping.

| Report Features | Details |

|---|---|

| Market Size in 2025 | USD 155 Billion |

| Market Forecast in 2033 | USD 190 Billion |

| Market Growth Rate 2025-2033 | 2.6% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Menswear Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)