United States Microspheres Market Report by Type (Hollow, Solid), Raw Material (Glass, Ceramic, Fly Ash, Polymer, Metal, and Others), Application (Construction Composites, Medical Technology, Life Science & Biotechnology, Paints & Coatings, Cosmetics & Personal Care, Oil & Gas, Automotive, Aerospace, and Others), and Region 2026-2034

Market Overview:

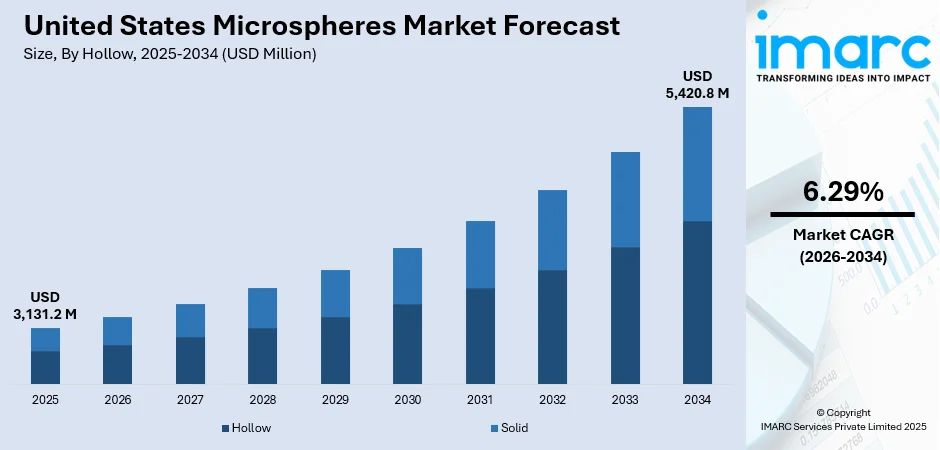

The United States microspheres market size reached USD 3,131.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,420.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.29% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,131.2 Million |

| Market Forecast in 2034 | USD 5,420.8 Million |

| Market Growth Rate (2026-2034) | 6.29% |

Access the full market insights report Request Sample

Microspheres refer to solid spherical nanoparticles with controlled opacity, particle size distribution, gravity and electrostatic charge. They are usually manufactured from natural and synthetic materials, such as cellulose, glass, silica and metal, and are commonly prepared using polymerization and emulsion techniques. They consist of biodegradable proteins and are widely used in anti-cancer and ophthalmic drug delivery systems. They are also used in the oil and gas industry for mud lubricity and torque control in the drilling fluids. Apart from this, they find extensive applications in the manufacturing of elastic, plastic, steel, cosmetic and personal care products.

To get more information on this market Request Sample

Significant growth in the medical industry, along with the growing demand for advanced drug delivery systems, is creating a positive outlook for the market. Microspheres have a superior ability to encapsulate various pharmaceutical drugs and express high biocompatibility and bioavailability. In line with this, microspheres are widely used for bone tissue engineering, radioembolization and the development of biopharmaceuticals, thereby favoring the market growth. Additionally, the widespread adoption of innovative hollow-glass microspheres (HGMS) in the construction industry is acting as another growth-inducing factor. HGMS are used for the manufacturing of light-weight extruded fine-grain cement concrete and construction composites with smooth surface finishing and high thermal insulation and crack resistance. Other factors, including the extensive infrastructural developments in the United States, coupled with the increasing demand for high-performance paints and coatings, are anticipated to drive the market further.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the United States microspheres market report, along with forecasts at the country and regional level from 2026-2034. Our report has categorized the market based on type, raw material and application.

Breakup by Type:

- Hollow

- Solid

Breakup by Raw Material:

- Glass

- Ceramic

- Fly Ash

- Polymer

- Metal

- Others

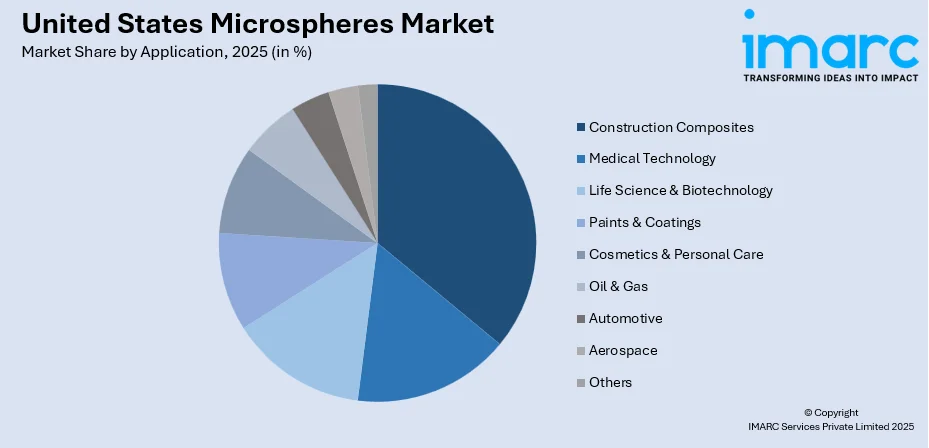

Breakup by Application:

To get detailed segment analysis of this market Request Sample

- Construction Composites

- Medical Technology

- Life Science & Biotechnology

- Paints & Coatings

- Cosmetics & Personal Care

- Oil & Gas

- Automotive

- Aerospace

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Types Covered | Hollow, Solid |

| Raw Materials Covered | Glass, Ceramic, Fly Ash, Polymer, Metal, Others |

| Applications Covered | Construction Composites, Medical Technology, Life Science & Biotechnology, Paints & Coatings, Cosmetics & Personal Care, Oil & Gas, Automotive, Aerospace, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States microspheres market performed so far and how will it perform in the coming years?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the raw material?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States microspheres market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)