United States Mobile Phone Insurance Market Report by Phone Type (New Phone, Refurbished), Coverage (Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection), Distribution Channel (Mobile Operators, Device OEMs, Retailers, Online, and Others), End User (Corporate, Personal), and Region 2026-2034

Market Overview:

The United States mobile phone insurance market size reached USD 13.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 31.0 Billion by 2034, exhibiting a growth rate (CAGR) of 9.81% during 2026-2034. The increasing adoption of high-end smartphones with rising device costs, growing awareness about the benefits of mobile phone insurance coverage, and rising smartphone dependency for personal and professional use are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.3 Billion |

| Market Forecast in 2034 | USD 31.0 Billion |

| Market Growth Rate 2026-2034 | 9.81% |

Access the full market insights report Request Sample

United States Mobile Phone Insurance Market Analysis:

- Major Market Drivers: There are growing smartphone prices and the increase in financing programs that are driving the United States mobile phone insurance market growth. Consumers prefer such insurance to reduce repair or replacement costs that surge demand and strengthen the value proposition of device protection services nationwide.

- Major Market Trends: The market analysis identifies heightened interest in adaptive, app-based coverage, mobile plan bundling with coverage, and sustainable protection choices. Digital natives are increasingly drawn to painless claim processes, driving innovation and diversification of insurer platforms and channels.

- Competitive Landscape: Telecom operators, OEMs, and third-party vendors are increasing competition in the United States mobile phone insurance market share. Vendors are segmenting based on instant replacements, online claims, theft protection, and customized pricing, developing a congested but innovative insurance environment throughout the nation.

- Challenges and Opportunities: While ambiguities in policies and fraud risks impede growth, the market size keeps growing. The potential exists in reaching out to Gen Z customers, using AI for claim authentication, and designing insurance for refurbished and low-end smartphones that are increasingly popular.

Mobile phone insurance is a type of coverage that protects smartphone owners against potential financial losses resulting from damage, loss, theft, or malfunctions of their devices. It offers a safety net for expensive smartphones, providing peace of mind to users by allowing them to repair or replace their phones at a reduced cost or no cost at all, depending on the policy. Mobile phone insurance typically covers various scenarios, including accidental damage, liquid damage, screen breakage, mechanical or electrical breakdowns, and unauthorized use of the device. This insurance product is increasingly popular among smartphone owners who seek to safeguard their valuable devices from unforeseen events that could otherwise incur significant expenses.

The increasing adoption of high-end smartphones with inflating device costs is motivating consumers to seek mobile phone insurance coverage to protect their significant investments, which in turn has contributed to their uptake in the United States. As smartphones become more sophisticated and expensive, the financial risks associated with accidental damage, theft, or malfunction become more pronounced, making insurance a valuable safeguard. Moreover, the heightening awareness among consumers about the benefits of mobile phone insurance, such as extended warranties, device replacement, and comprehensive protection, has augmented the demand for insurance policies. Apart from this, the rising willingness to invest in insurance coverage for added peace of mind due to the rising number of users realizing the potential risks and consequences of smartphone vulnerabilities has catalyzed the market growth. Besides this, the growing significance of smartphones in modern life, serving as a communication tool, work device, and entertainment hub, intensifying the need to protect it, has accelerated the product adoption rate. Furthermore, the increasing dependency on smartphones for personal and professional activities pushes consumers to secure their devices through insurance, thus contributing to market growth.

United States Mobile Phone Insurance Market Trends/Drivers:

Rise in Smartphone Financing and Lease Programs

The rise in smartphone financing and lease programs offered by carriers and retailers across the United States is providing a positive thrust to the growth of the mobile phone insurance market. With the increasing cost of high-end smartphones, many consumers are turning to installment plans and lease options to make these devices more affordable. As a result, they are more inclined to safeguard their valuable investments through mobile phone insurance. By opting for insurance coverage, consumers can mitigate the financial burden of potential repairs or replacements that could arise from accidental damages, theft, or malfunctions during the term of their financing or lease agreement. Smartphone financing and lease programs often require customers to maintain the phone in good condition, making insurance an attractive option to ensure compliance with these terms and to protect against unforeseen incidents that could result in costly out-of-pocket expenses. These dynamics are contributing significantly to the expansion of the United States mobile phone insurance market size, reflecting a broader shift toward preventive protection strategies.

Increase in Mobile Phone Ownership Among Younger Generations

The United States mobile phone insurance market is being driven by the growing prevalence of mobile phone ownership among younger generations, particularly Millennials and Gen Z. With their active lifestyles and frequent phone usage, the risk of accidental damage or loss becomes more pronounced. Consequently, younger users recognize the importance of protecting their valuable devices and are increasingly investing in mobile phone insurance to ensure uninterrupted connectivity and seamless mobile experiences. Additionally, the propensity of younger generations to upgrade to the latest smartphone models further stimulates the demand for insurance coverage, as they seek to safeguard their investments and maintain their devices in pristine condition. The growing awareness about the potential financial risks and the need for added protection among these demographics contribute significantly to the expansion of the mobile phone insurance market in the United States. A deeper United States mobile phone insurance market analysis reveals how consumer behavior patterns, especially among youth, are influencing product offerings and coverage innovations.

United States Mobile Phone Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the United States mobile phone insurance market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Breakup by Phone Type:

To get detailed segment analysis of this market Request Sample

- New Phone

- Refurbished

New phone represents the most popular phone type

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished. According to the report, new phone represents the largest segment.

The introduction of new phones in the United States mobile phone insurance market has a significant impact on consumer behavior and the demand for insurance coverage. With each new phone release, consumers are enticed by advanced features, improved performance, and cutting-edge technology, driving a desire to upgrade to the latest models. However, the high cost of new smartphones makes them valuable and vulnerable assets, strengthening the need for insurance protection. As consumers invest in these state-of-the-art devices, they become more conscious of safeguarding their valuable purchases against accidental damage, theft, and malfunctions.

Moreover, the availability of mobile phone insurance offers reassurance to consumers, enabling them to fully enjoy their new phones without worrying about potential financial burdens in the event of unforeseen incidents. The continuous cycle of new phone releases stimulates a consistent demand for mobile phone insurance, making it a crucial aspect of the smartphone market in the United States.

Breakup by Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Physical damage accounts for the majority of the market share

A detailed breakup and analysis of the market based on the coverage has also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection. According to the report, physical damage accounted for the largest market share.

Physical damage coverage addresses one of the most common risks faced by smartphone owners – accidental damage. As smartphones become an integral part of daily life, the risk of dropping, cracking, or damaging these valuable devices increases substantially. Physical damage coverage provides consumers with the assurance that their smartphones are protected against such mishaps, reducing the financial burden of costly repairs or replacements.

This coverage option is particularly appealing to smartphone owners who invest in high-end devices, as the cost of repairing or replacing sophisticated smartphones can be significant. With physical damage coverage in place, consumers can use their smartphones with confidence, knowing that they have a safety net in case of accidents. As the demand for reliable protection against accidental damage continues to grow, physical damage coverage plays a pivotal role in driving the United States mobile phone insurance market, providing peace of mind to smartphone owners across the nation.

Breakup by Distribution Channel:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

Mobile phone insurance is majorly distributed through online channels

A detailed breakup and analysis of the market has been provided based on distribution channel. This includes mobile operators, device OEMs, retailers, online, and others. According to the report, online accounted for the largest market share.

The online distribution channel offers convenience, accessibility, and a wide range of coverage options to consumers. With the increasing popularity of online shopping and digital transactions, more consumers are turning to online platforms to purchase mobile phone insurance policies. The online distribution channel allows insurance providers to reach a broader audience, including tech-savvy millennials and Gen Z consumers who are accustomed to digital interactions. Through user-friendly websites and mobile apps, consumers can easily compare different insurance plans, understand coverage details, and make informed decisions at their own pace.

Additionally, online distribution offers faster policy issuance, immediate coverage activation, and seamless claims processing, enhancing the overall customer experience. The convenience of buying insurance online and managing policies digitally appeals to modern-day consumers, catalyzing the demand for mobile phone insurance through the online distribution channel and propelling the growth of the market in the United States.

Breakup by End User:

- Corporate

- Personal

Personal holds the largest share in the market

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes corporate and personal. According to the report, personal accounted for the largest market share.

The personal consumer is a significant driving force behind the United States mobile phone insurance market. As smartphones become indispensable tools for personal communication, work, entertainment, and social connectivity, individuals increasingly recognize the value of protecting their valuable devices. The risk of accidental damage, loss, or theft is a common concern among personal smartphone users, making mobile phone insurance an attractive option to safeguard their investments. The desire for seamless connectivity and uninterrupted access to digital resources prompts consumers to seek insurance coverage that provides financial protection and peace of mind.

Moreover, the convenience of purchasing insurance policies online, tailored coverage options, and quick claims processing further appeal to personal users, making mobile phone insurance a sought-after service in the United States. As the reliance on smartphones grows and consumers prioritize device protection, the demand for mobile phone insurance for personal uses continues to grow, thus supporting the growth of the market in the country.

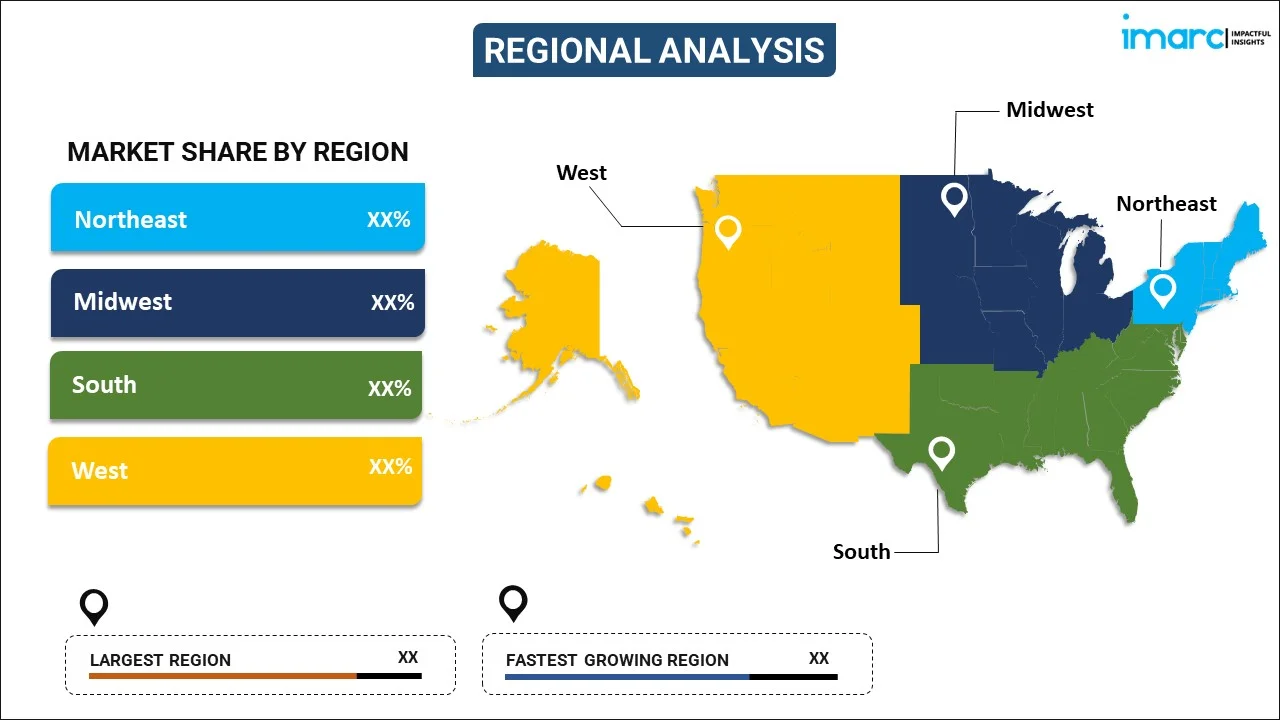

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West. According to the report, South accounted for the largest market share.

The South region plays a significant role in driving the United States mobile phone insurance market due to several factors. The South has a large population and a high concentration of smartphone users, making it a substantial market for mobile phone insurance. As smartphone ownership becomes increasingly prevalent in this region, there is a growing awareness of the need to protect these valuable devices. Moreover, the South is known for its active and outdoorsy lifestyle, increasing the risk of accidental damage to smartphones. This heightened risk of damage boosts the demand for insurance coverage, providing users with the confidence to use their devices in various settings without fear of potential financial burdens.

Additionally, the South region has a vibrant and competitive insurance industry, with numerous providers offering a wide range of coverage options. This competitive landscape fosters innovation, leading to the introduction of tailored insurance solutions that cater to the diverse needs of smartphone users in the region.

Competitive Landscape:

The key players in the market have made several innovations and advancements to meet the evolving demands of consumers and businesses. They are offering more comprehensive and flexible coverage options to meet the evolving needs of smartphone users. Insurers are introducing on-demand insurance plans, allowing consumers to activate coverage only when they need it, providing a cost-effective and customizable approach. Additionally, some companies are incorporating digital claims processing and chatbot assistance, streamlining the claims filing process and improving customer service efficiency. Another notable innovation is the inclusion of device upgrade protection, enabling policyholders to upgrade to the latest smartphone models with discounted rates or waived deductibles. Furthermore, insurance providers are collaborating with device manufacturers and retailers to offer seamless insurance purchases at the point of sale, simplifying the process for consumers.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latest News and Developments:

- In April 2024, Spectrum Mobile unveiled its Anytime Upgrade feature and new low-cost Repair and Replacement Plan. Part of the Unlimited Plus plan, Anytime Upgrade lets customers switch devices at any time without traditional limitations. The protection plan provides full device coverage at a competitive price, boosting mobile flexibility and security.

- In November 2024, T-Mobile revealed an extension of its insurance product line with the introduction of Protection 360 HomeTech in the United States. The new policy, for $25 per month, covers more than just mobile phones, including unlimited Wi-Fi-enabled devices, representing a changing trend in the U.S. mobile phone insurance space.

United States Mobile Phone Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States mobile phone insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States mobile phone insurance market was valued at USD 13.3 Billion in 2025.

We expect the United States mobile phone insurance market to exhibit a CAGR of 9.81% during 2026-2034.

The increasing incidences of accidental damage, phone thefts, device malfunction, etc., along with the growing number of flagship mobile users, are primarily driving the United States mobile phone insurance market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for mobile phones, thereby negatively impacting the United States mobile phone insurance market.

Based on the phone type, the United States mobile phone insurance market has been segmented into new phone and refurbished, where new phone currently exhibits a clear dominance in the market.

Based on the coverage, the United States mobile phone insurance market can be divided into physical damage, electronic damage, virus protection, data protection, and theft protection. Currently, physical damage accounts for the majority of the total market share.

Based on the distribution channel, the United States mobile phone insurance market has been segregated into mobile operators, device OEMs, retailers, online, and others. Among these, online currently exhibits clear dominance in the market.

Based on the end user, the United States mobile phone insurance market can be bifurcated into corporate and personal. Currently, personal holds the largest market share.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where South currently dominates the United States mobile phone insurance market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)