U.S. Network Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

U.S. Network Security Market Size and Share:

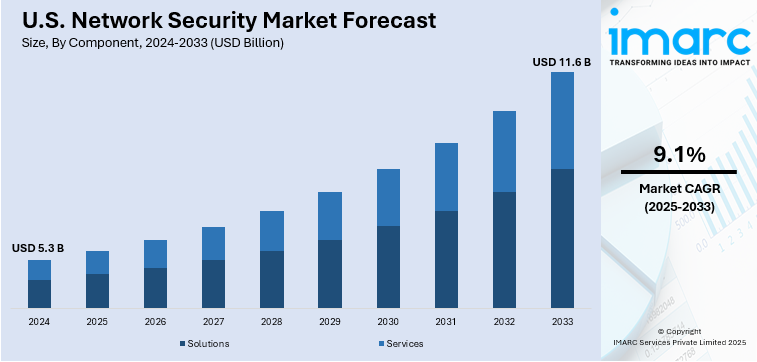

The U.S. network security market size was valued at USD 5.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.6 Billion by 2033, exhibiting a CAGR of 9.1% from 2025-2033. The market is expanding rapidly, driven by increasing cyber threats, regulatory compliance demands, and the adoption of advanced technologies like AI and IoT. Businesses are prioritizing robust solutions to safeguard sensitive data, ensure operational continuity, and address the growing risks associated with digital transformation and remote work environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.3 Billion |

| Market Forecast in 2033 | USD 11.6 Billion |

| Market Growth Rate (2025-2033) | 9.1% |

The U.S. network security market is driven by the rising frequency and sophistication of cyberattacks, compelling businesses to prioritize robust security measures. Increasing reliance on digital infrastructure, fueled by remote work and cloud adoption, has heightened vulnerabilities, creating a significant demand for advanced network security solutions. Regulatory requirements further push organizations to invest in cybersecurity frameworks to safeguard sensitive data, thereby propelling market growth. For instance, the U.S. Federal Budget for Fiscal Year 2025, announced in March 2024, emphasizes cybersecurity by allocating USD 25 million to strengthen the FBI’s cyber response capabilities. These investments aim to protect critical infrastructure and align with the National Cybersecurity Strategy’s comprehensive approach to addressing emerging cyber threats effectively. Additionally, the growing awareness of financial and reputational risks associated with data breaches is prompting enterprises to allocate higher budgets for network protection technologies.

Technological advancements, such as the integration of artificial intelligence and machine learning, are playing a pivotal role in driving the adoption of advanced network security solutions. These technologies enhance real-time monitoring and threat mitigation, addressing the complexities of modern cyberattacks. The proliferation of IoT devices and the expanding digital ecosystem have significantly broadened the attack surface, necessitating comprehensive security strategies. Government initiatives aimed at securing critical infrastructure and public awareness campaigns about cybersecurity further bolster the demand for reliable and scalable network security services across diverse industries. For instance, in November 2024, the U.S. AI Safety Institute at NIST announced the TRAINS Taskforce to address AI-related national security and public safety risks. This initiative unites federal agencies to research, test, and manage AI risks in critical areas like cybersecurity, infrastructure, and defense, reflecting a whole-of-government effort to ensure safe and trustworthy AI development.

U.S. Network Security Market Trends:

Adoption of Artificial Intelligence in Security Solutions

The integration of artificial intelligence (AI) into network security is transforming the United States market, enabling more sophisticated threat detection and response capabilities. For instance, in October 2024, the U.S. Commerce Department announced a policy easing export restrictions on advanced AI chips for data centers in the Middle East and Central Asia. This initiative allows foreign data centers to seek special status, simplifying shipments for U.S. companies and supporting global AI development and deployment efforts. Advanced technologies powered by intelligence review extensive data in real time to spot irregularities and swiftly address potential cybersecurity breaches efficiently and effectively. Furthermore, these tools improve predictive security measures through the examination of events to reduce false positives and offer practical recommendations, for action.

Growth of Cloud Security Solutions

The rapid shift to cloud computing is driving the demand for advanced cloud security solutions in the U.S. network security market. As businesses migrate sensitive data and operations to the cloud, ensuring data integrity and protection from unauthorized access has become a top priority. Cloud-native security tools are gaining traction for their scalability, flexibility, and ability to address dynamic threats in hybrid and multi-cloud environments, thereby favoring the market growth. For instance, in July 2024, IBM and Microsoft announced an enhanced cybersecurity partnership to strengthen customers' cloud environments. IBM will integrate Microsoft security products, including Microsoft Sentinel and Defender solutions, into its AI-driven TDR Cloud Native platform for advanced threat detection and response. The collaboration introduced an identity management solution using Microsoft's Entra tools, optimizing security, efficiency, and costs for clients. Moreover, the market is witnessing increased investments in cloud security services, including encryption, identity management, and zero-trust frameworks.

Rising Focus on Zero-Trust Architecture

The adoption of zero-trust architecture is emerging as a significant trend in the U.S. network security market, reflecting the growing need for stringent access control measures. Unlike traditional perimeter-based models, zero-trust frameworks operate on the principle of continuous verification, ensuring that no user or device is trusted by default. This approach is particularly effective in mitigating insider threats and securing distributed networks, which have become prevalent due to remote work and IoT adoption. Organizations are increasingly implementing zero-trust solutions to enhance their defense mechanisms and comply with regulatory requirements, positioning this architecture as a cornerstone of modern cybersecurity strategies. For instance, in October 2024, Xage Security Government (Xage) secured a USD 1.5 million Sequential Phase II SBIR contract to strengthen U.S. Navy security with Zero Trust capabilities. This collaboration supports the Navy's strategic initiatives, including enhanced data protection, tactical edge capabilities, and compliance with the Department of Defense's Zero Trust Target Strategy by 2027.

U.S. Network Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. network security market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based component, deployment mode, organization size, industry vertical, and region.

Analysis by Component:

- Solutions

- Firewalls

- Antivirus/Antimalware

- Network Access Control (NAC)

- Data Loss Prevention

- IDS/IPS

- Secure Web Gateways

- DDoS Mitigation

- Unified Threat Management

- Others

- Services

- Professional Services

- Managed Services

In the U.S. network security market, solutions dominate due to their ability to address diverse and evolving cyber threats. Firewalls, antivirus/antimalware, and secure web gateways provide foundational protection, while advanced tools like intrusion detection/prevention systems (IDS/IPS) and data loss prevention (DLP) tackle sophisticated threats. Unified threat management (UTM) simplifies security by integrating multiple functions, while DDoS mitigation ensures uninterrupted services amidst attacks. Their continuous innovation and integration with AI and machine learning keep them indispensable for businesses.

Services dominate the U.S. network security market due to the increasing complexity of cyber threats and the need for continuous protection. Managed services provide organizations with 24/7 monitoring, threat detection, and incident response, ensuring rapid action against attacks. Professional services, on the other hand, offer tailored solutions for system design, deployment, and optimization, aligning security strategies with business goals. With many companies facing resource constraints and a shortage of in-house expertise, outsourcing to skilled providers has become essential. Additionally, the dynamic nature of cybersecurity requires ongoing updates and expert management, making services a critical component for maintaining effective and scalable network protection.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

Cloud-based deployment is a rapidly growing segment in the U.S. network security market, driven by the increasing adoption of cloud computing and remote work models. Organizations prefer cloud-based solutions for their scalability, flexibility, and cost-efficiency, enabling real-time threat detection and automated updates without the need for extensive infrastructure. Small and medium sized enterprises (known as SMEs) and companies, with operations spread across locations find these solutions particularly appealing. Cloud based security tools play a role, in tackling the changing landscape of cyber threats and maintaining strong protection by offering centralized management and smooth integration across various hybrid environments.

On-premises deployment remains a critical segment in the U.S. network security market, especially among organizations with strict data sovereignty, compliance, or operational control requirements. Solutions in this category delivers greater degree of customization and control of security infrastructure, and hence it is considered as the preferred alternatives by sectors like government, defense and finance service. Moreover, on site systems are appreciated for their capability to function autonomously without relying on networks which helps minimize interruptions, in case of connectivity problems. Despite the increasing popularity of cloud-based options, on site installations remain crucial in meeting requirements and protecting confidential information.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises are significant drivers of the U.S. network security market due to their expansive operations, extensive digital infrastructure, and handling of vast amounts of sensitive data. These organizations face heightened risks from sophisticated cyberattacks, prompting substantial investments in advanced security solutions such as Zero Trust architecture, endpoint protection, and real-time threat detection. Stringent requirements for compliance further accelerate market adoption. Large enterprises emphasize an integrated and scalable security framework for protection of critical systems, business continuity, and safeguard their reputation in an increasingly connected and complex digital world.

Small and medium-sized enterprises (SMEs) are increasingly adopting network security solutions to protect their growing digital operations from cyber threats. SMEs are particularly vulnerable to ransomware, phishing, and data breaches, making affordable and easy-to-deploy security tools essential. Cloud-based security solutions and managed security services are widely embraced due to their cost-effectiveness and scalability. As SMEs navigate evolving regulatory requirements and seek to build customer trust, investments in network security are becoming a priority to ensure operational continuity and safeguard sensitive information in a competitive business environment.

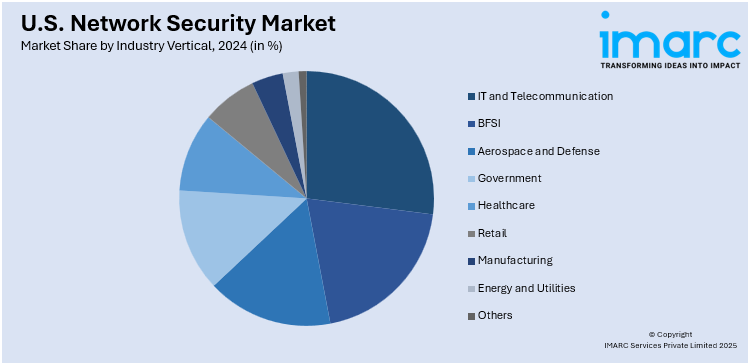

Analysis by Industry Vertical:

- IT and Telecommunication

- BFSI

- Aerospace and Defense

- Government

- Healthcare

- Retail

- Manufacturing

- Energy and Utilities

- Others

The IT and telecommunication drives significant demand in the U.S. network security market due to its reliance on digital infrastructure and data-intensive operations. Companies in this sector face persistent cyber threats, including data breaches and distributed denial-of-service (DDoS) attacks, necessitating robust security frameworks. Advanced threat detection, encryption, and firewall solutions are widely adopted to safeguard sensitive information and maintain service continuity. With the rapid adoption of 5G and cloud technologies, the sector continues to invest heavily in network security solutions to mitigate risks and ensure compliance with regulatory standards.

The banking, financial services, and insurance (BFSI) is a critical contributor to the U.S. network security market, given its high vulnerability to cyberattacks targeting sensitive financial data. Institutions within this sector implement stringent security measures, including multi-factor authentication, intrusion detection systems, and fraud prevention tools. Regulatory frameworks such as GDPR and PCI DSS further drive the adoption of advanced security solutions. As digital banking and fintech services grow, BFSI organizations are increasingly investing in cybersecurity to protect customer data, ensure compliance, and maintain trust in their operations.

The aerospace and defense in the United States requires highly advanced network security solutions to protect classified data, critical systems, and intellectual property. This sector faces sophisticated threats, including nation-state cyberattacks and espionage attempts, driving the adoption of Zero Trust architectures, encryption, and advanced monitoring tools. With increasing digitalization in defense operations and reliance on secure communication networks, the demand for innovative security technologies is rising. Collaboration between government and private entities further strengthens cybersecurity measures, ensuring the resilience of national defense systems.

The government plays a crucial role in the network security market, driven by the need to safeguard sensitive data, critical infrastructure, and national security systems. Government agencies face persistent cyber threats, including ransomware and espionage, necessitating robust security frameworks like Zero Trust models. Investments in advanced tools such as endpoint protection, encryption, and threat intelligence are prioritized to secure operations. Federal initiatives, including the implementation of the National Cybersecurity Strategy, further emphasize the importance of coordinated cybersecurity efforts across agencies to protect public resources and enhance resilience.

The healthcare in the United States faces growing cybersecurity challenges due to the increasing digitization of medical records and reliance on connected devices. Network security is critical for protecting sensitive patient data from breaches and ensuring the integrity of healthcare systems. With rising threats such as ransomware attacks, healthcare organizations are adopting encryption, multi-factor authentication, and intrusion detection tools. Regulatory requirements like HIPAA further drive the adoption of robust security solutions, ensuring compliance and safeguarding patient trust while supporting the sector's continued digital transformation.

The retail is a key market for network security in the United States due to its extensive use of digital payment systems and customer data collection. Cyber threats like credit card fraud and data breaches make robust security measures essential for retailers. Solutions such as endpoint protection, encryption, and fraud detection tools are widely implemented to ensure secure transactions. With the rise of e-commerce and omnichannel retail strategies, the sector is increasingly investing in advanced network security solutions to protect sensitive data and maintain consumer confidence.

The manufacturing in the United States is adopting network security solutions to address the growing risks associated with digital transformation and automation. Connected systems, including IoT and industrial control systems (ICS), have expanded the attack surface, making cybersecurity a critical priority. Manufacturers invest in tools like intrusion detection, endpoint protection, and secure remote access to safeguard operations and intellectual property. As the sector moves toward Industry 4.0, network security plays a vital role in ensuring the resilience and reliability of production processes against cyber threats.

The energy and utilities in the United States requires robust network security to protect critical infrastructure from cyber threats. This sector faces unique challenges, including threats to power grids, pipelines, and other essential services. Advanced security solutions such as real-time monitoring, encryption, and access controls are implemented to mitigate risks. Regulatory frameworks like the NERC CIP standards drive compliance and enhance security measures. With increasing adoption of smart grid technologies and IoT devices, the sector continues to prioritize investments in cybersecurity to ensure uninterrupted service delivery and operational safety.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is a key contributor to the U.S. network security market due to its dense population and concentration of financial institutions, healthcare providers, and technology firms. The region faces significant cybersecurity threats, prompting investments in advanced security solutions to protect critical data and systems. Regulatory compliance requirements, particularly in finance and healthcare, drive demand for robust network security frameworks. With the presence of many Fortune 500 companies, the Northeast remains a hotspot for innovative cybersecurity strategies, making it a pivotal region for market growth.

The Midwest region of the United States is experiencing steady growth in the network security market, fueled by the expansion of manufacturing, agriculture, and logistics industries. These sectors increasingly rely on digital infrastructure, making them targets for cyberattacks. Businesses are investing in advanced threat detection and response tools to safeguard operations. Additionally, regional growth in cloud adoption and IoT applications contributes to the rising demand for network security solutions. The Midwest’s focus on protecting critical infrastructure and adhering to federal cybersecurity standards ensures continued market development in the region.

The South is a dynamic region in the U.S. network security market, driven by rapid industrial growth and an expanding technology sector. With major hubs like Atlanta, Austin, and Raleigh, the region has seen increasing investments in cybersecurity to combat threats across diverse industries, including energy, healthcare, and finance. The region’s focus on digital transformation and cloud adoption has heightened the need for robust network security solutions. Additionally, government initiatives and collaborations with private entities to protect critical infrastructure further strengthen the market’s growth prospects in the South.

The West remains a critical region in the U.S. network security market, driven by the presence of major technology companies and innovation hubs like Silicon Valley. High levels of cloud adoption, IoT integration, and digital innovation increase the region’s exposure to cyber threats, fueling demand for advanced security solutions. Industries such as entertainment, technology, and defense invest heavily in safeguarding their digital assets. Regulatory compliance in sectors like healthcare and finance also plays a significant role in driving market growth.

Competitive Landscape:

The U.S. network security market features intense competition among key players offering advanced solutions to address evolving cyber threats. Industry leaders invest heavily in research and development to deliver innovative technologies, including Zero Trust architectures, AI-driven threat detection, and cloud-native security tools. Companies also focus on strategic partnerships, mergers, launches, and acquisitions to expand their portfolios and market reach. For instance, in October 2024, Recorded Future, a U.S based cybersecurity company, launched advanced ransomware detection capabilities to address threats across the entire attack lifecycle. These features include customized ransomware risk profiles, real-time victimology and actor insights, and AI-generated reporting for actionable intelligence. Powered by Recorded Future AI, these tools enhance early detection, visibility, and proactive defenses, enabling organizations to mitigate ransomware threats effectively, safeguard operations, and reduce financial, operational, and reputational risks. The rising demand for managed and professional services has driven significant growth, with providers offering scalable, tailored solutions for businesses of all sizes. Additionally, regulatory compliance requirements and increasing cyberattack sophistication continue to shape the competitive dynamics, compelling firms to prioritize robust, adaptive security frameworks.

The report provides a comprehensive analysis of the competitive landscape in the U.S. network security market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Palo Alto Networks, a U.S based multinational cybersecurity company, and IBM announced a strategic partnership to deliver AI-powered cybersecurity solutions, addressing the growing complexity of digital threats. This collaboration integrates Palo Alto Networks' advanced security platforms with IBM’s watsonx AI and consulting expertise. The partnership aims to enhance threat detection, streamline security operations, and drive innovation, providing customers with next-generation security capabilities to protect data, hybrid cloud environments, and critical applications across industries.

U.S. Network Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | IT and Telecommunication, BFSI, Aerospace and Defense, Government, Healthcare, Retail, Manufacturing, Energy and Utilities, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. network security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. network security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. network security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Network security refers to the strategies, technologies, and practices designed to protect networks, systems, and data from cyber threats. It involves tools like firewalls, encryption, and intrusion prevention systems. Network security is applied across industries to safeguard sensitive information, ensure operational continuity, and meet regulatory compliance standards in an increasingly digital environment.

The U.S. network security market was valued at USD 5.3 Billion in 2024.

IMARC estimates the U.S. network security market to exhibit a CAGR of 9.1% during 2025-2033.

The U.S. network security market is driven by the increasing frequency of cyberattacks, rising adoption of cloud computing, and growing regulatory compliance requirements. Advancements in technologies like AI and IoT further expand security needs. Businesses prioritize network security to protect sensitive data, ensure continuity, and address the evolving complexity of modern cyber threats.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)