United States Occupational Health Market Size, Share, Trends and Forecast by Offering, Category, Employee Type, Site Location, Type, Industries, and Region, 2026-2034

United States Occupational Health Market Summary:

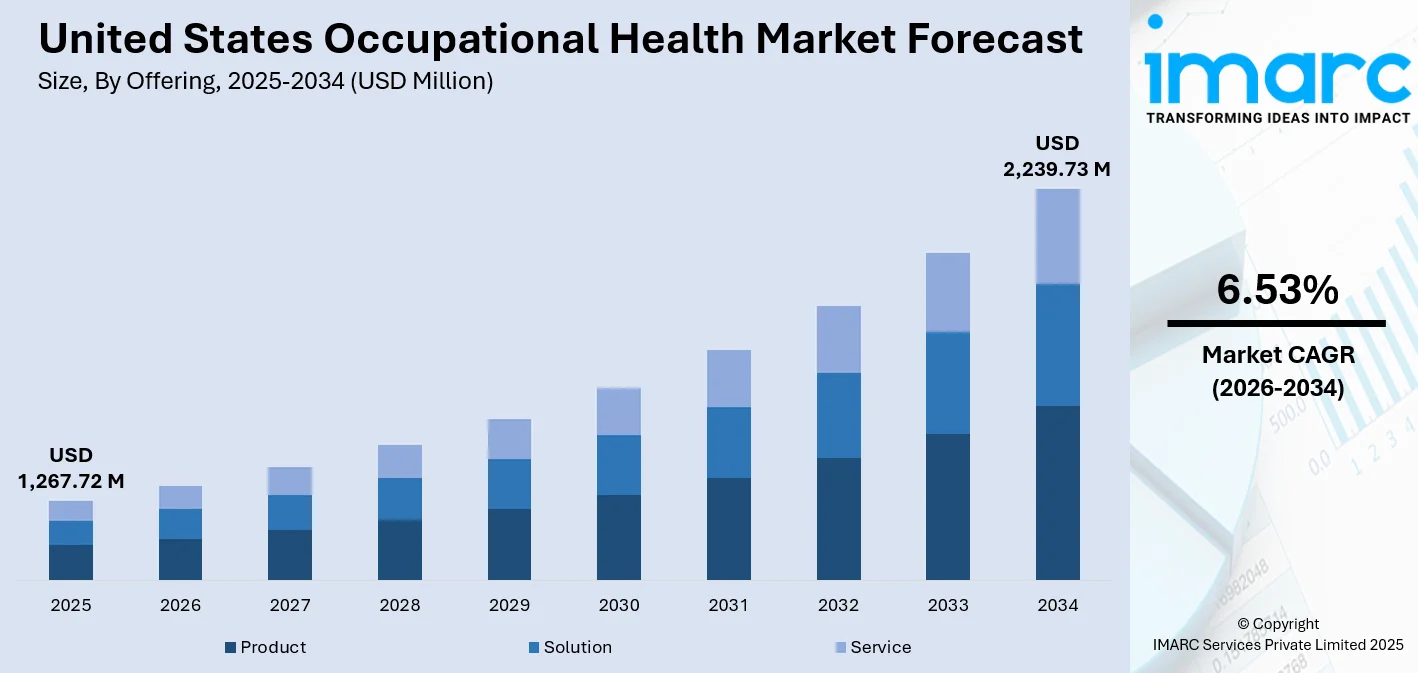

The United States occupational health market size was valued at USD 1,267.72 Million in 2025 and is projected to reach USD 2,239.73 Million by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

The United States occupational health market is experiencing robust expansion driven by heightened regulatory compliance requirements and increasing employer awareness of workforce wellness benefits. Organizations across diverse industries are prioritizing comprehensive health and safety programs to reduce workplace injuries, minimize absenteeism, and enhance overall productivity. The integration of digital health technologies, telemedicine platforms, and wearable safety devices is revolutionizing how employers monitor and address occupational hazards. According to the U.S. Bureau of Labor Statistics, private industry employers documented 2.6 Million nonfatal workplace injuries and illnesses in 2023, underscoring the critical need for effective occupational health services. Growing emphasis on mental health support, ergonomic interventions, and preventive care measures reflects a fundamental shift toward proactive workforce health management. Rising healthcare costs and competitive labor markets are compelling employers to invest in comprehensive wellness programs that attract and retain talent while controlling benefit expenses and improving United States occupational health market share.

Key Takeaways and Insights:

- By Offering: Service dominates the market with a share of 49% in 2025, reflecting the essential role of comprehensive healthcare services, injury management, wellness programs, and compliance monitoring in supporting workforce health across diverse industrial sectors nationwide.

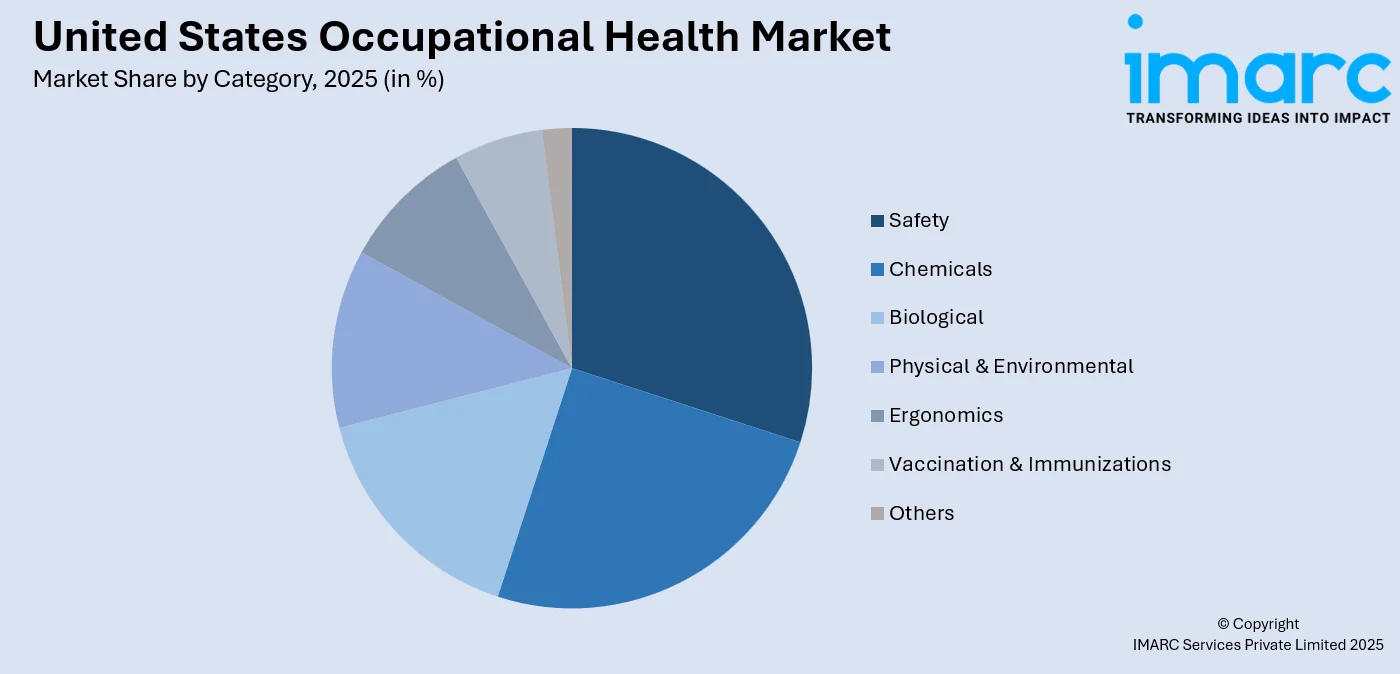

- By Category: Safety leads the market with a share of 30% in 2025, motivated by strict OSHA rules, heightened knowledge of workplace hazards, and employers' dedication to averting accidents through thorough safety training and risk assessment initiatives.

- By Employee Type: Physical presence exhibits a clear dominance with 53% share in 2025, because workers in the manufacturing, construction, and healthcare sectors who need on-site safety interventions have a concentrated need for occupational health services.

- By Site Location: On-site represents the largest segment with 45% share in 2025, reflecting employer preference for immediate access to healthcare services, rapid injury response, and convenient health screenings that minimize employee downtime and enhance productivity.

- By Type: Physical wellbeing holds the biggest share at 59% in 2025, driven by continued emphasis on preventing musculoskeletal disorders, managing chronic conditions, and maintaining workforce fitness through ergonomic assessments and physical health programs.

- By Industries: Manufacturing is the largest industry segment with 21% share in 2025, attributed to high-risk work environments, extensive regulatory requirements, and the critical need for injury prevention, safety training, and health monitoring programs.

- By Region: South dominates the market with 30% share in 2025, driven by substantial manufacturing activity, growing industrial employment, expanding healthcare infrastructure, and increasing corporate investment in workforce wellness programs across Southern states.

- Key Players: Key players drive the United States occupational health market through strategic acquisitions, service expansion initiatives, technology integration, and geographic network growth. Their investments in telemedicine platforms, digital health solutions, and comprehensive wellness programs enhance market accessibility while strengthening competitive positioning.

To get more information on this market Request Sample

The United States occupational health market is undergoing significant transformation as employers increasingly recognize the strategic importance of workforce health programs. Industry consolidation and service expansion continue to reshape the competitive landscape, with major providers expanding their networks and service capabilities. The growing demand for comprehensive occupational health solutions has attracted substantial investment interest, as healthcare organizations seek to broaden their geographic reach and enhance service offerings. Leading providers continue to strengthen their nationwide presence through strategic acquisitions and organic growth, positioning themselves to meet the evolving needs of employers across diverse industries. In February 2024, Marathon Health merged with Everside Health to create a combined entity with 680 health centers across 41 states, extending services to 2.5 Million eligible patients. These strategic developments demonstrate ongoing market consolidation and the growing emphasis on comprehensive, accessible occupational health solutions.

United States Occupational Health Market Trends:

Digital Health Integration and Telemedicine Adoption

The integration of digital health platforms and telemedicine services is transforming occupational healthcare delivery across the United States. Virtual consultations enable immediate injury assessment and treatment recommendations, reducing unnecessary emergency room visits while improving access to specialized care. Employers increasingly adopt telehealth solutions to provide convenient access to occupational medicine specialists, enabling real-time guidance for workplace injuries regardless of geographic location. This digital transformation enhances service accessibility, improves patient outcomes, and streamlines return-to-work protocols, positioning telemedicine as an essential component of modern occupational health programs nationwide.

Wearable Safety Technology and Real-Time Monitoring

Advanced wearable technologies are revolutionizing workplace safety monitoring through real-time health tracking and hazard detection capabilities. Smart devices now monitor vital signs, detect fatigue, and identify environmental hazards while transmitting immediate alerts to supervisors. These innovations enable proactive safety management and support data-driven decision-making for occupational health programs. Industries with high-risk work environments increasingly deploy connected devices to prevent accidents before they occur. The growing adoption of wearable technology reflects a fundamental shift toward predictive safety approaches that prioritize prevention over reactive treatment in occupational health strategies.

Mental Health and Holistic Wellness Integration

Employers are increasingly incorporating mental health support and holistic wellness programs into their occupational health strategies. The American Psychiatric Association reported in May 2024 that 43% of adults feel more anxious compared to 37% in 2023, highlighting growing mental health concerns. Organizations are responding by implementing comprehensive wellness initiatives that address psychological well-being alongside physical health. Programs featuring stress management resources, employee assistance services, and mental health days are becoming standard components of corporate wellness strategies.

Market Outlook 2026-2034:

The United States occupational health market is positioned for sustained expansion as regulatory requirements intensify and employer investment in workforce wellness accelerates. Technological innovation in digital health platforms, wearable safety devices, and predictive analytics will drive service enhancement and operational efficiency improvements. The market generated a revenue of USD 1,267.72 Million in 2025 and is projected to reach a revenue of USD 2,239.73 Million by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034. Growing emphasis on preventive care, mental health support, and integrated wellness solutions will shape service delivery models. Strategic acquisitions and partnerships among leading providers will accelerate market consolidation while expanding geographic coverage and service capabilities across diverse industrial sectors.

United States Occupational Health Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Offering |

Service |

49% |

|

Category |

Safety |

30% |

|

Employee Type |

Physical Presence |

53% |

|

Site Location |

On-Site |

45% |

|

Type |

Physical Wellbeing |

59% |

|

Industries |

Manufacturing |

21% |

|

Region |

South |

30% |

Offering Insights:

- Product

- Solution

- Service

Service dominates with a market share of 49% of the total United States occupational health market in 2025.

The service segment encompasses comprehensive healthcare delivery including workplace injury treatment, preventive health screenings, drug and alcohol testing, physical examinations, and rehabilitation services. Employers increasingly rely on professional occupational health service providers to manage complex regulatory requirements and deliver consistent quality care. Leading providers operate extensive networks of occupational health centers nationwide, serving thousands of patients daily and demonstrating substantial demand for professional occupational health services across diverse industries.

Professional service providers offer specialized expertise in workplace safety compliance, injury management protocols, and employee wellness programs that many organizations cannot develop internally. The growing complexity of occupational health regulations and the need for evidence-based care delivery continue driving demand for outsourced services. Integration of telemedicine capabilities enhances service accessibility, enabling rapid consultation and treatment recommendations that reduce lost worktime while improving patient outcomes across geographically dispersed workforces. Service providers continue expanding their capabilities through strategic acquisitions and technology investments, strengthening their ability to deliver comprehensive occupational health solutions that meet evolving employer requirements and workforce health needs.

Category Insights:

Access the comprehensive market breakdown Request Sample

- Safety

- Chemicals

- Biological

- Physical & Environmental

- Ergonomics

- Vaccination & Immunizations

- Others

Safety leads with a share of 30% of the total United States occupational health market in 2025.

The safety category remains paramount as OSHA regulations require employers to maintain hazard-free work environments and implement comprehensive safety programs. Federal workplace safety standards continue evolving, with regulatory agencies regularly updating penalty structures and compliance requirements to enhance worker protection. Effective January 2025, OSHA increased maximum penalties for serious violations to USD 16,550 per violation and willful violations to USD 165,514 per violation, intensifying compliance pressure on employers. Organizations across high-risk industries prioritize safety training, hazard assessments, and incident prevention programs to protect workers and avoid substantial financial penalties.

Workplace safety programs encompass comprehensive risk assessment, employee training, protective equipment management, and emergency response planning. The integration of advanced safety technologies including wearable monitoring devices and real-time hazard detection systems is enhancing prevention capabilities across diverse work environments. Industries such as manufacturing, construction, and oil and gas face particularly stringent safety requirements that drive substantial investment in specialized safety services and training programs to reduce incident rates and ensure regulatory compliance. Employers increasingly recognize that proactive safety investments deliver measurable returns through reduced injury rates, lower insurance premiums, improved workforce morale, and enhanced operational continuity that supports sustained business performance and competitive positioning within their respective industries.

Employee Type Insights:

- Remote

- Hybrid

- Physical Presence

Physical presence exhibits a clear dominance with a 53% share of the total United States occupational health market in 2025.

Workers requiring physical presence at job sites generate the highest demand for occupational health services due to elevated exposure to workplace hazards, injury risks, and environmental factors. Manufacturing, construction, healthcare, and logistics industries employ substantial workforces requiring on-site attendance where occupational health interventions are most critical. According to 2024 OSHA data, healthcare and social assistance workplaces reported 308,000 injuries, followed by transportation and warehousing with 232,000 cases and manufacturing with 220,000 cases.

Physical presence workers require comprehensive occupational health support including pre-employment physicals, ongoing health surveillance, immediate injury treatment, and return-to-work programs. The nature of hands-on work creates continuous demand for ergonomic assessments, safety training, and health monitoring that cannot be addressed through remote solutions. Employers recognize that protecting on-site workers through robust occupational health programs reduces workers compensation costs, improves productivity, and enhances workforce retention in competitive labor markets. Investment in occupational health services for physical presence workers demonstrates organizational commitment to employee wellbeing while delivering tangible operational benefits through reduced absenteeism, faster recovery outcomes, and sustained workforce engagement across demanding work environments.

Site Location Insights:

- On-Site

- Off-Site

- Shared-Site

On-site represents the leading segment with a 45% share of the total United States occupational health market in 2025.

On-site occupational health clinics provide immediate access to medical care, enabling rapid injury assessment and treatment that minimizes lost worktime. Large employers increasingly establish dedicated workplace health centers to deliver comprehensive services including injury management, preventive screenings, and wellness programs. These facilities bring healthcare directly to the workforce, eliminating travel time and reducing productivity losses associated with off-site medical appointments.

On-site delivery models offer convenience and efficiency that reduce employee time away from work while ensuring consistent care quality aligned with employer policies. These facilities enable proactive health management through regular screenings, vaccination programs, and health risk assessments conducted during working hours. The integration of on-site clinics with enterprise health management systems facilitates comprehensive workforce health data collection and analysis to support strategic wellness program development and regulatory compliance documentation. Employers recognize that dedicated workplace health facilities demonstrate organizational commitment to employee wellbeing while providing tangible operational benefits through reduced absenteeism, faster return-to-work outcomes, and improved workforce productivity across all employment categories.

Type Insights:

- Physical Wellbeing

- Social & Mental Wellbeing

Physical wellbeing holds the largest share at 59% of the total United States occupational health market in 2025.

Physical wellbeing programs address musculoskeletal health, chronic disease management, fitness assessments, and ergonomic interventions that directly impact workforce productivity and healthcare costs. Employers invest substantially in ergonomic assessments, physical therapy services, and injury prevention programs to reduce incident rates and maintain workforce health. These initiatives recognize the fundamental connection between employee physical condition and organizational performance outcomes.

Comprehensive physical wellbeing initiatives encompass preventive health screenings, fitness programs, chronic condition management, and rehabilitation services that support workforce health throughout the employment lifecycle. Integration of wearable health monitoring devices enables continuous tracking of physical health indicators and early identification of potential issues before they escalate into serious conditions. Employers recognize that maintaining workforce physical health reduces absenteeism, lowers healthcare costs, and enhances overall organizational productivity through sustained employee engagement and performance. Physical wellbeing programs increasingly incorporate personalized health coaching, nutrition guidance, and lifestyle modification support that address individual employee needs while contributing to broader organizational health objectives and creating sustainable wellness cultures within the workplace environment.

Industries Insights:

- Automobile

- Chemical

- Engineering

- Government (Including Federal)

- Manufacturing

- Mining

- Oil & Gas

- Pharmaceutical

- Ports

- Others

Manufacturing comprises the largest industry segment with 21% share of the total United States occupational health market in 2025.

The manufacturing sector generates substantial occupational health demand due to inherent workplace hazards, extensive regulatory requirements, and significant workforce populations. Manufacturing environments present elevated risk profiles requiring comprehensive health services to address the unique challenges associated with industrial production operations. Manufacturing facilities require robust safety programs, regular health surveillance, and immediate injury response capabilities to maintain workforce health and regulatory compliance across complex operational environments.

Manufacturing employers face unique occupational health challenges including exposure to hazardous materials, noise-induced hearing loss risks, repetitive motion injuries, and equipment-related accidents. Comprehensive occupational health programs in this sector encompass pre-employment physicals, periodic medical surveillance, respiratory protection programs, and ergonomic interventions designed to protect workers from industry-specific hazards. The integration of advanced safety technologies and predictive analytics enables proactive hazard identification and intervention strategies that reduce incident rates while supporting production efficiency. Manufacturing organizations increasingly prioritize occupational health investments as essential operational requirements that protect their workforce, ensure regulatory compliance, maintain production continuity, and demonstrate corporate commitment to employee safety and wellbeing throughout their facilities.

Regional Insights:

- Northeast

- Midwest

- South

- West

South comprises the largest region with 30% share of the total United States occupational health market in 2025.

The Southern region leads the United States occupational health market driven by substantial manufacturing concentration, growing industrial employment, and expanding healthcare infrastructure across major economic centers. Texas, Florida, Georgia, and North Carolina host significant manufacturing, logistics, and energy sector operations requiring comprehensive occupational health services. The region's favorable business climate attracts corporate relocations and facility expansions that generate sustained demand for workforce health programs and specialized medical services.

Growing population migration to Southern states further expands the available workforce while increasing employer investment in employee health benefits and wellness initiatives to attract and retain qualified workers in competitive labor markets. The concentration of distribution centers, manufacturing plants, and energy operations creates robust demand for occupational health services across multiple industry sectors. Regional healthcare systems continue expanding their occupational medicine capabilities to meet growing employer needs, while national occupational health providers strengthen their presence throughout Southern markets. Economic development initiatives across Southern states further accelerate industrial growth and workforce expansion, sustaining long-term demand for comprehensive occupational health services throughout the region.

Market Dynamics:

Growth Drivers:

Why is the United States Occupational Health Market Growing?

Stringent Regulatory Compliance Requirements and Enhanced Enforcement

The United States occupational health market is expanding significantly due to intensifying regulatory requirements and enhanced enforcement actions by federal and state agencies. OSHA continues strengthening workplace safety standards while increasing penalty amounts to ensure employer compliance. Recent penalty adjustments have created substantial financial incentives for regulatory compliance, compelling organizations to prioritize workplace safety investments. The agency's evolving recordkeeping requirements mandate that employers in high-hazard industries electronically submit detailed injury and illness data, increasing transparency and accountability across sectors with elevated risk profiles. Furthermore, updated standards addressing personal protective equipment fit requirements, heat hazard protection, and hazard communication protocols are compelling employers to invest in comprehensive occupational health programs. State-level regulations often exceed federal requirements, creating additional compliance complexities for multi-state employers who must navigate varying jurisdictional standards. This regulatory environment drives sustained demand for professional compliance services, safety training programs, and health monitoring systems that help organizations maintain workforce safety while avoiding costly penalties and reputational damage. Employers increasingly partner with specialized occupational health providers to navigate complex regulatory landscapes and implement evidence-based safety programs that demonstrate compliance commitment while protecting their workforce from preventable injuries and illnesses.

Rising Employer Focus on Workforce Wellness and Productivity Enhancement

Growing employer recognition of the strategic value of workforce health investments is accelerating occupational health market expansion. Organizations increasingly understand that comprehensive wellness programs reduce healthcare costs, decrease absenteeism, and enhance employee productivity and retention. According to the Employee Health Trends 2025 report, mental health support has achieved near-universal adoption with 97.8% of organizations offering employee assistance programs and 94.8% providing virtual counseling services. The competitive labor market environment compels employers to offer robust health benefits that attract and retain qualified workers. In November 2024, Ivím Health launched its Ivím at Work corporate wellness programs offering personalized health solutions with data-driven insights to reduce healthcare costs while improving productivity. Corporate wellness initiatives encompassing preventive care, chronic disease management, mental health support, and fitness programs demonstrate measurable returns through reduced medical claims and improved workforce engagement.

Technological Advancement in Digital Health and Safety Monitoring

Rapid technological innovation in digital health platforms, wearable devices, and predictive analytics is transforming occupational health service delivery and expanding market opportunities. Advanced safety technologies enable real-time health monitoring, hazard detection, and proactive intervention strategies that prevent injuries before they occur. Industry organizations and government agencies continue developing resources and tools that provide employers with evidence-based insights into workforce wellbeing, supporting data-driven decision-making for occupational health program development and implementation across diverse workplace environments. In addition, organizations implementing predictive analytics and advanced monitoring technologies report meaningful reductions in workplace injuries and near-miss incidents, demonstrating the tangible value of technology investments in occupational health. Telehealth platforms expand access to occupational medicine specialists while reducing time-to-treatment for workplace injuries regardless of geographic location. Integration of artificial intelligence, Internet of Things sensors, and cloud-based safety management systems creates comprehensive solutions that enhance prevention capabilities and improve regulatory compliance documentation. Mobile health applications empower employees to actively participate in their own health management while providing employers with aggregated wellness data. These technological advancements continue reshaping occupational health delivery models, enabling more efficient, effective, and accessible services that support workforce health across all industry sectors.

Market Restraints:

What Challenges the United States Occupational Health Market is Facing?

High Implementation Costs for Comprehensive Health Programs

The substantial investment required to implement and maintain comprehensive occupational health programs presents challenges for many organizations, particularly small and medium-sized businesses. Costs associated with establishing on-site clinics, acquiring advanced safety technologies, and maintaining qualified healthcare staff can be prohibitive. Budget constraints may limit program scope and prevent adoption of emerging technologies that could enhance workforce health outcomes and regulatory compliance capabilities.

Shortage of Qualified Occupational Health Professionals

The limited availability of specialized occupational health professionals including industrial hygienists, occupational medicine physicians, and certified safety officers constrains market growth. Healthcare workforce shortages affect organizations' ability to staff occupational health programs adequately and deliver consistent quality services. This talent gap challenges employers seeking to develop comprehensive internal capabilities and limits service provider expansion into underserved geographic areas.

Data Privacy and Technology Integration Challenges

Growing utilization of wearable health monitoring devices and digital health platforms raises concerns regarding employee data privacy and compliance with regulations such as HIPAA. Organizations face challenges integrating new technologies with existing systems while ensuring data security. Employee resistance to continuous health monitoring and uncertainty regarding appropriate data use policies may slow adoption of advanced occupational health technologies despite their potential benefits.

Competitive Landscape:

The United States occupational health market features a competitive landscape characterized by ongoing consolidation, strategic partnerships, and service portfolio expansion among leading providers. Major companies are investing in technology integration, geographic network expansion, and specialized service development to differentiate their offerings. The market includes large national providers operating extensive clinic networks alongside regional specialists and technology-focused innovators. Competition is intensifying as providers leverage acquisitions, telemedicine capabilities, and integrated wellness solutions to capture market share. Strategic investments in digital health platforms, data analytics, and predictive safety tools are creating competitive advantages while driving industry-wide innovation in service delivery models.

United States Occupational Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Product, Solution, Service |

| Categories Covered | Safety, Chemicals, Biological, Physical & Environmental, Ergonomics, Vaccination & Immunizations, Others |

| Employee Types Covered | Remote, Hybrid, Physical Presence |

| Site Locations Covered | On-Site, Off-Site, Shared-Site |

| Types Covered | Physical Wellbeing, Social & Mental Wellbeing |

| Industries Covered | Automobile, Chemical, Engineering, Government (Including Federal), Manufacturing, Mining, Oil & Gas, Pharmaceutical, Ports, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States occupational health market size was valued at USD 1,267.72 Million in 2025.

The United States occupational health market is expected to grow at a compound annual growth rate of 6.53% from 2026-2034 to reach USD 2,239.73 Million by 2034.

Service dominated the market with a share of 49%, driven by employer demand for comprehensive healthcare delivery, injury management, regulatory compliance support, and professional wellness programs across diverse industrial sectors.

Key factors driving the United States occupational health market include stringent OSHA regulatory requirements, rising employer focus on workforce wellness, technological advancement in digital health platforms, and growing emphasis on preventive care and mental health support.

Major challenges include high implementation costs for comprehensive health programs, shortage of qualified occupational health professionals, data privacy concerns with health monitoring technologies, regulatory complexity across states, and budget constraints limiting program adoption among small businesses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)