United States Olive Oil Market Expected to Reach USD 6.3 Billion by 2033 - IMARC Group

United States Olive Oil Market Statistics, Outlook and Regional Analysis 2025-2033

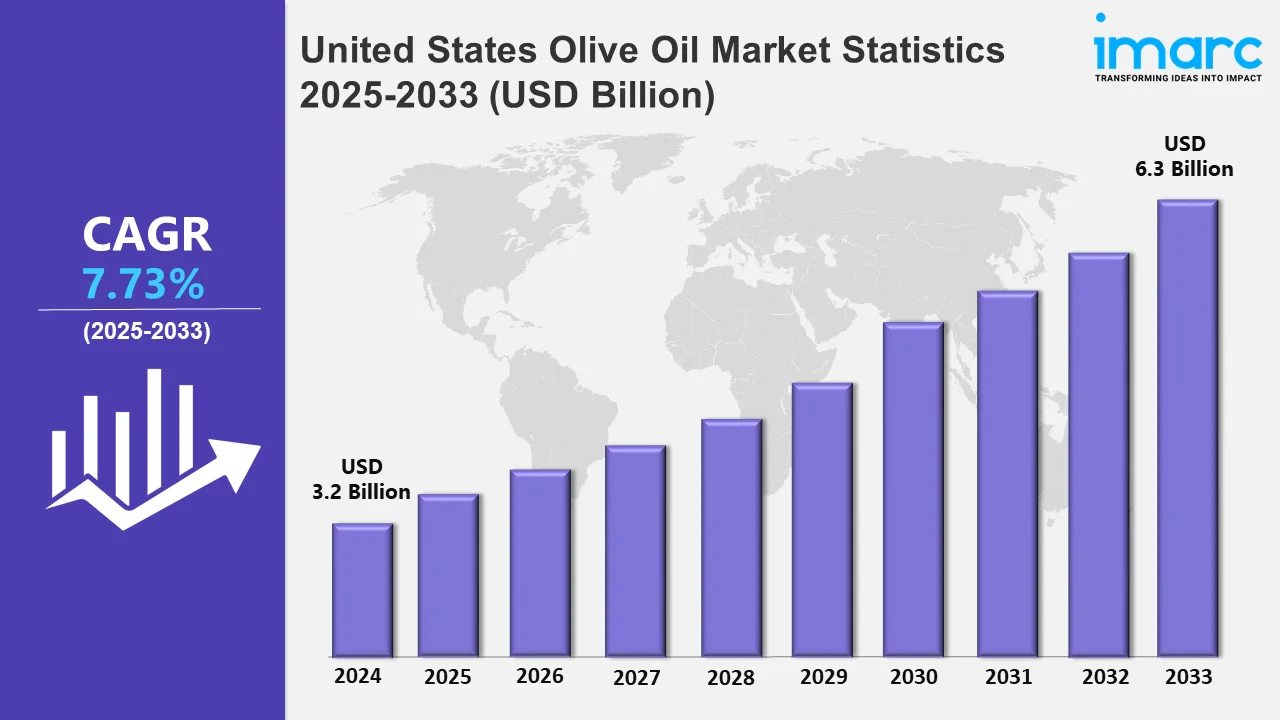

The United States olive oil market size was valued at USD 3.2 Billion in 2024, and it is expected to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.73% from 2025 to 2033.

To get more information on this market, Request Sample

The US olive oil market is bolstered by the elevating requirement for organic and non-GMO foods, widespread research and development efforts in olive oil manufacturing and processing, and ongoing advances in digital marketing and e-commerce. For example, in May 2023, Deoleo, the frontrunner in olive oil, introduced SKUs of the Bertolli and Carapelli brands, which were sustainably sourced from farms. Besides this, the high impact of Mediterranean cuisine, recognized for its extensive olive oil usage, is affecting consumer eating habits, further boosting the market growth in the United States. For instance, in January 2024, Starbucks launched extra virgin olive oil-infused beverages. The lineup, called Oleato, comprised two drinks, namely an extra virgin olive oil-infused oat milk latte and a toffee nut iced shaken espresso.

Apart from this, the increasing awareness in people regarding the advantages of olive oil, including its high level of antioxidants and anti-inflammatory components, is positively influencing the market expansion. Moreover, innovations in the production techniques of the product and the introduction of flavored oils, organic variants, and blends to cater to diverse consumer preferences are also catalyzing the market in the US. For example, in September 2024, Corto Olive Co. unveiled its limited-edition Calabrian chili olive oil, ideal for enhancing recipes and giving a relishing taste experience.

United States Olive Oil Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The escalating demand for healthier dietary fats, on account of the rising awareness regarding well-being, is catalyzing the market in the US.

Northeast Olive Oil Market Trends:

The Northeast in the US, particularly cities like Boston and New York, has a heightened preference for olive oil mainly due to the diverse population across the region, the increasing influence of Mediterranean cuisine, and the rising concentration of restaurants and consumers who value quality olive oil. For instance, in September 2024, the EU Olive Oil project, endorsed by the O.P. Associazione Olivicola Cosentina and co-financed by the European Union, participated in the Plant Based Expo held in New York to encourage consuming extra virgin olive oil produced in Europe.

Midwest Olive Oil Market Trends:

The Midwest region’s market is mainly bolstered by the increasing health consciousness among individuals, leading to the demand for natural ingredients. Additionally, the emerging farm-to-table dining trends and the elevating consumer interest in organic and sustainably sourced products are positively impacting the market in the region. For example, in December 2024, Jennifer Thornton, founder and owner of Buttercream & Olive Oil, opened a bakery, culinary school, and boutique with French antiques in North Royalton, Ohio.

South Olive Oil Market Trends:

The Southern region of the United States has been experiencing an increase in olive oil consumption, mainly across urban centers, including Houston, Atlanta, and Miami. With the escalating number of consumers seeking high-quality oils free from artificial additives, the need for cold-pressed and organic olive oils has augmented. Moreover, companies like The Virgin Olive Oiler (North Carolina) and Texas Hill Country Olive Oil Co. cater to the gourmet and health-conscious choices of individuals. Additionally, Texas Olive Ranch and Georgia Olive Farms are pioneers in producing olive oil, supplying fresh and locally-sourced oils to customers.

West Olive Oil Market Trends:

Olive oil consumption in the West region of the United States is booming due to a well-established domestic production industry, especially in California, and the increasing need for high-quality olive oil, on account of its nutritional benefits, rich flavor, and versatility in culinary applications. For example, California Olive Ranch, a top producer of extra virgin olive oil (EVOO), introduced its new Chef's Bottles in March 2024, designed to offer a handy and user-friendly alternative for relishing high-quality oil in everyday cooking.

Top Companies Leading in the United States Olive Oil Industry

There are several companies encompassing the United States olive oil market, including Cargill Incorporated, Deoleo S.A., Gallo Worldwide, Grupo Ybarra Alimentación S.L., and Sovena. In November 2023, the fast-casual eating joint Sweetgreen announced a partnership with Bari Olive Oil to source its ingredients. The restaurant chain aimed to cook veggies, proteins, and grains exclusively in extra virgin olive oil with this alliance. Moreover, in September 2024, Kosterina, a Mediterranean food and beauty products brand, made its debut in 600+ Target stores across the United States with its organic Premium Reserve Extra Virgin Olive Oil and Spicy Red Pepper Olive Oil, available online and in stores.

United States Olive Oil Market Segmentation Coverage

- Based on type, the market has been categorized into virgin olive oil, refined olive oil, extra virgin olive oil, olive pomace oil, and others. Virgin olive oil is mainly made from pure and cold-pressed olives and has a slightly elevated acidity level compared to its counterparts. Refined olive oil is prepared from olives but undergoes refining procedures to eradicate impurities and neutralize strong flavors. This form of oil is used for cooking at high temperatures, as it has a neutral taste. Moreover, extra virgin olive oil is the superior variant available. Lastly, olive pomace oil refers to the oil unearthed from the first pressing of olives, mainly their leftover pulp.

- Based on the distribution channel, the market has been classified into supermarkets and hypermarkets, convenience stores, online stores, and others. According to the market outlook, supermarkets and hypermarkets generally provide a broad category of olive oils to choose from. Moreover, convenience stores offer a more limited variety of oils, largely focusing on the basic options. Meanwhile, through online stores several niche and specialty brands of olive oil are accessible, including flavored, organic, and imported oils, those which are not available in local shops.

- Based on the application, the market has been separated into food and beverage, pharmaceuticals, cosmetics, and others. In the food and beverage sector, olive oil is mainly utilized in cooking, like sautéing and roasting, and as a base for salad dressings and marinades. Besides this, extra virgin olive oil acts as a carrier oil in numerous supplements and pharmaceuticals, owing to its anti-inflammatory characteristics and antioxidant content. In the cosmetics industry, olive oil is a common component in skincare items, including creams, lotions, and balms.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Market Growth Rate 2025-2033 | 7.73% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Virgin Olive Oil, Refined Olive Oil, Extra Virgin Olive Oil, Olive Pomace Oil, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Food and Beverage, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Cargill Incorporated, Deoleo S.A., Gallo Worldwide, Grupo Ybarra Alimentación S.L., Sovena, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Olive Oil Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)