U.S. Pet Wearable Market Size, Share, Trends, and Forecast by Product, Technology, Application, End User, Distribution Channel, and Region, 2025-2033

U.S. Pet Wearable Market Size and Share:

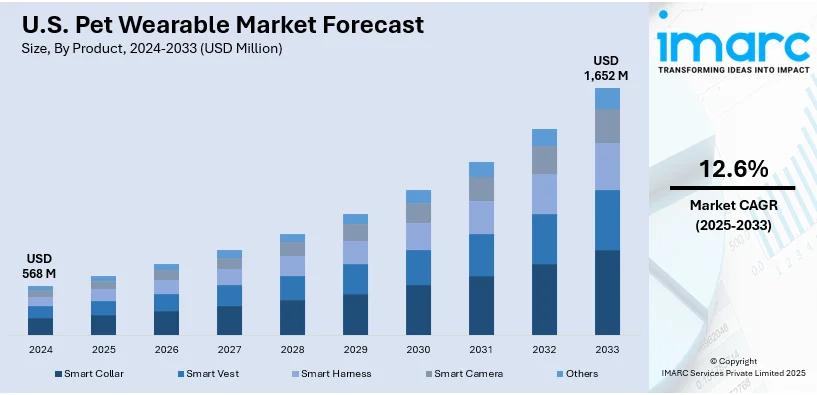

The U.S. pet wearable market size was valued at USD 568 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,652 Million by 2033, exhibiting a CAGR of 12.6% from 2025-2033. The market is witnessing robust expansion, mainly influenced by innovations in wearable technologies, heightening pet ownership, and magnifying emphasis on pet safety and health. Furthermore, major products, such as health monitors and GPS trackers, are gaining traction, highlighting increased customer requirement for connected, upgraded solutions to improve pet care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 568 Million |

| Market Forecast in 2033 | USD 1,652 Million |

| Market Growth Rate (2025-2033) | 12.6% |

The U.S. pet wearable market is driven by the increasing adoption of pets as integral family members, leading to heightened awareness of pet health, safety, and well-being. For instance, as per industry reports, in 2024, 82 million households in the United States own a pet, with 58 million owning a dog. This has significantly fueled demand for devices like activity trackers, GPS-enabled collars, and health monitors that provide real-time insights into a pet's behavior, location, and overall condition. In addition to this, rising disposable income and a growing preference for premium pet care products have further accelerated market growth, as consumers increasingly seek technologically advanced solutions to ensure their pets' safety and maintain their health.

Advancements in wearable technology, such as miniaturization, improved battery efficiency, and IoT integration, are also some critical factors that are significantly driving the market expansion. These innovations enable seamless connectivity and data sharing, enhancing user convenience and expanding application potential in areas like veterinary diagnostics and pet fitness tracking. For instance, in October 2024, Personifi AI, a U.S.-based startup, launched its innovative, AI-based cognitive wearable Shazam Band, for pets. This next-gen pet wearable is integrated with machine learning (ML), data sets, and advanced sensors to comprehend pet's health demands, emotions, and reasoning. Moreover, the expanding availability of pet wearables across e-commerce and retail platforms ensures accessibility for a broader customer base, boosting adoption rates nationwide.

U.S. Pet Wearable Market Trends:

Integration of IoT and Smart Technologies

The U.S. pet wearable market is witnessing a surge in IoT integration, allowing devices to communicate seamlessly with smartphones and smart home systems. Advanced wearables now feature real-time tracking, health monitoring, and behavioral analysis, offering pet owners comprehensive insights through connected apps. These technologies are improving user convenience and enabling proactive pet care. The rising concern over pets going missing in the U.S. has further amplified demand for IoT-enabled tracking devices, providing owners with reliable solutions for locating their pets quickly. For instance, as per industry reports, each year, 10 million pets go missing in the U.S., with nearly one-third of pets lost at some point in their lifetime. This growing demand reflects broader consumer preferences for smart technologies, reinforcing the role of IoT as a cornerstone of innovation in the pet wearable industry.

Rising Demand for Health Monitoring Solutions

Health monitoring wearables are emerging as a prominent trend in the U.S. pet wearable market, driven by increased awareness of pet fitness and well-being. Devices equipped with sensors to track heart rate, activity levels, and calorie expenditure are becoming highly sought after. Moreover, these wearables cater to the growing focus on preventive care, helping owners detect potential health issues early. The increasing prevalence of obesity in dogs further amplifies this trend, as owners seek tools to monitor activity levels and manage weight effectively. For instance, as per industry reports, approximately 56% of pet dogs and 60% of pet cats in the United States are classified as overweight or obese. In addition, veterinary professionals are also leveraging these devices for continuous monitoring, enhancing the accuracy of diagnoses and treatment plans. This trend highlights the industry's shift toward personalized and data-driven pet care, significantly impacting the market dynamics in the region.

Increasing Popularity of GPS-Enabled Devices

The requirement for GPS-enabled pet wearables continues to escalate, chiefly fueled by the demand efficient location tracking and increasing concerns over pet safety. Such devices, which provide geofencing features and real-time tracking, are especially preferred by owners of outdoor pets. For instance, in September 2024, Halo, a U.S.-based company, launched its new Halo Collar 4, featuring the industry’s first dual-frequency GPS dog fence, utilizing L1 and L5 GPS bands for unmatched accuracy even in urban or low-signal environments. Designed for all dog sizes, its adjustable system ensures a precise fit for neck sizes ranging from 8 to 30.5 inches. Additionally, enhanced connectivity and accuracy in GPS technology have further solidified its importance in the market. As urbanization increases and the number of free-roaming pets declines, GPS-enabled wearables are becoming indispensable tools for ensuring pet security, reflecting a broader societal emphasis on accountability and care.

U.S. Pet Wearable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. pet wearable market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, technology, application, end user, distribution channel, and region.

Analysis by Product:

- Smart Collar

- Smart Vest

- Smart Harness

- Smart Camera

- Others

Smart collars hold a significant share in the U.S. pet wearable market, driven by their multifunctionality and widespread adoption among pet owners. These devices offer features like GPS tracking, activity monitoring, and behavior analysis, ensuring enhanced pet safety and health management. The integration of advanced technologies, such as mobile app connectivity and real-time notifications, has further increased their appeal. Additionally, their compatibility with various pet types and ease of use makes smart collars a popular choice, solidifying their position as a key product in the market.

Smart vests represent a growing segment in the U.S. pet wearable market, primarily used for professional and therapeutic purposes. Designed for working dogs in sectors like law enforcement, search and rescue, and therapy, these vests are equipped with sensors to monitor stress, temperature, and location. Moreover, their ability to provide actionable data for handlers enhances operational efficiency and pet safety. The rising awareness of pet welfare and technological advancements are expanding their adoption beyond professional applications, contributing to their increasing market share.

Smart harnesses are gaining traction in the U.S. pet wearable market, combining comfort with advanced functionality for pets. These devices integrate features such as location tracking, activity monitoring, and health metrics, appealing to pet owners seeking comprehensive solutions for their pets' well-being. Smart harnesses are particularly valued for their ergonomic design, ensuring minimal discomfort for pets during use. In addition, their durability and versatility across various pet sizes and lifestyles further drive their market share, reflecting a growing preference for functional yet pet-friendly wearable technology.

Smart cameras occupy a notable share of the U.S. pet wearable market, catering to the increasing demand for remote monitoring of pets. These devices provide real-time video streaming, activity tracking, and even two-way communication, allowing owners to stay connected with their pets. Furthermore, smart cameras are particularly popular among working pet owners who prioritize their pets' security and companionship. Integration with home automation systems and advanced features, such as AI-powered behavior detection, has boosted their adoption, underscoring their importance within the market.

Analysis by Technology:

- GPS

- RFID

- Sensors

- Others

GPS technology holds a significant market share within the U.S. pet wearable market, driven by its ability to provide real-time location tracking. These devices enable pet owners to monitor their pets' movements, enhancing safety and preventing loss. Additionally, the growing adoption of GPS-enabled collars and trackers reflects an increasing emphasis on pet security. Advanced features such as geofencing and activity tracking further enhance their appeal. Furthermore, rising consumer preference for seamless, app-based monitoring solutions contributes to the expansion of GPS technology in this market segment.

RFID technology plays a crucial role in the U.S. pet wearable market, offering efficient identification and tracking solutions. These devices, often embedded in microchips or tags, allow for quick identification of lost pets by scanning their unique RFID codes. Veterinary clinics and shelters widely adopt RFID systems for their reliability and ease of use. Moreover, as pet microchipping becomes a standard practice, RFID-based wearables gain traction. Their affordability and compatibility with existing identification systems position RFID as a competitive technology in this market.

Sensors are a vital component of the U.S. pet wearable market, facilitating health monitoring and activity tracking. Equipped with biometric sensors, these devices measure parameters such as heart rate, temperature, and activity levels, providing valuable insights into a pet’s well-being. In addition, advances in sensor technology have enabled more compact, accurate, and durable devices, aligning with consumer demand for comprehensive pet health solutions. The integration of sensors into smart collars and harnesses enhances functionality, positioning them as essential tools for proactive pet care.

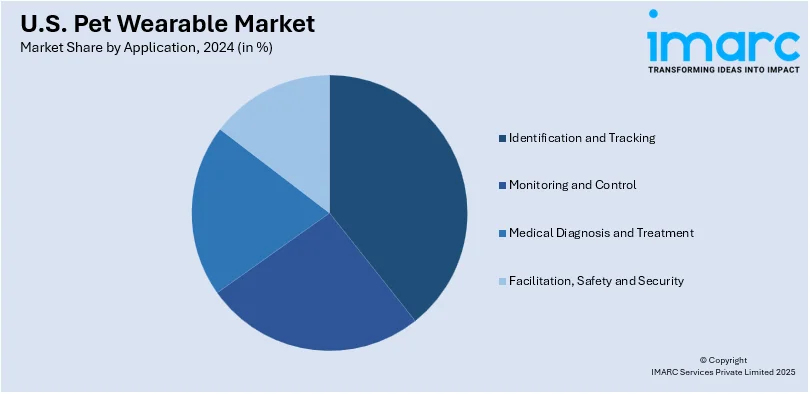

Analysis by Application:

- Identification and Tracking

- Monitoring and Control

- Medical Diagnosis and Treatment

- Facilitation, Safety and Security

The identification and tracking segment hold a significant share in the U.S. pet wearable market, driven by the rising adoption of RFID and GPS-enabled devices. These technologies allow pet owners to locate and recover lost pets efficiently, addressing growing concerns about pet safety. The demand is further fueled by advanced features, such as geofencing alerts and real-time tracking, which enhance convenience and security for pet owners. As pet ownership continues to rise, the adoption of tracking devices is becoming a core application in the market.

The monitoring and control segment plays a pivotal role in the U.S. pet wearable market, focusing on health and behavioral management. Devices equipped with sensors track activity levels, sleep patterns, and caloric intake, enabling pet owners to maintain optimal health for their animals. Furthermore, advanced features, such as remote monitoring via smartphones, offer convenience and real-time insights, aligning with the growing preference for proactive pet care. This segment benefits from increasing awareness of pet wellness and the integration of IoT technology in wearables.

The medical diagnosis and treatment segment is gaining prominence in the U.S. pet wearable market, driven by demand for preventive care and early disease detection. Devices embedded with health sensors monitor vital signs, including heart rate and temperature, aiding veterinarians and owners in identifying potential health issues. The segment's growth is further supported by technological advancements in wearable biosensors and telemedicine compatibility. Additionally, these innovations address the need for accessible and efficient healthcare solutions for pets, enhancing their overall well-being and longevity.

Facilitation, safety, and security wearables cater to pet owners’ need for enhanced safety measures. This segment includes devices like smart fences and anti-barking collars, which help manage pets in confined spaces or address behavioral challenges. Wearables in this category are increasingly equipped with intelligent features to prevent accidents or escape attempts. Moreover, the emphasis on improving pet safety and reducing risks has solidified this segment's market share, supported by technological innovations tailored to pet owners’ security concerns.

Analysis by End User:

- Households

- Commercial

The household segment holds a significant share in the U.S. pet wearable market, driven by rising pet ownership and increasing awareness of pet health among families. Pet owners are adopting wearable devices to monitor health metrics, track location, and enhance overall pet safety. The integration of advanced features, such as activity tracking and behavioral insights, appeals to individual pet owners seeking convenient, tech-enabled solutions. Furthermore, the growing humanization of pets and willingness to invest in their well-being contribute to the expansion of this segment within the market.

The commercial segment represents a substantial share of the U.S. pet wearable market, fueled by demand from veterinary clinics, pet boarding facilities, and animal shelters. These organizations leverage wearable technology to enhance pet care, track health data, and ensure safety, especially for pets under temporary care. Moreover, advanced devices assist in managing large pet populations more efficiently while providing real-time insights into their health and behavior. The commercial sector benefits from rising industry standards and regulations, further encouraging the adoption of pet wearables in professional environments.

Analysis by Distribution Channel:

- Modern Trade

- Franchised Outlets

- Specialty Stores

- E-Commerce

- Others

Modern trade represents a significant segment in the distribution channel of the U.S. pet wearable market, driven by the presence of large retail chains and hypermarkets. These outlets offer a diverse range of pet wearables, including GPS trackers, health monitors, and activity trackers, catering to a broad consumer base. Moreover, their ability to showcase multiple brands and provide attractive discounts enhances customer accessibility and drives sales. Additionally, the convenience of one-stop shopping and consistent inventory levels makes modern trade an influential channel for distributing pet wearables to health-conscious pet owners.

Franchised outlets play a pivotal role in the U.S. pet wearable market, leveraging strong brand loyalty and localized customer engagement. These outlets often specialize in premium and niche pet products, including wearable devices, ensuring quality assurance and tailored customer service. Furthermore, their established presence in urban and suburban areas allows for targeted marketing efforts, directly addressing the preferences of pet owners. In addition, with the backing of parent companies, franchised outlets maintain competitive pricing and exclusive product offerings, reinforcing their importance within the distribution network.

Specialty stores are integral to the U.S. pet wearable market, focusing on curated collections of advanced pet products and personalized services. These stores cater to discerning pet owners seeking high-quality, innovative wearables such as health trackers and behavioral monitors. Moreover, their expertise in the pet care segment builds trust and encourages repeat business. Additionally, specialty stores also provide educational resources and demonstrations, helping customers make informed purchasing decisions. This channel’s emphasis on customer experience and product knowledge establishes it as a key contributor to the market's growth.

E-commerce has emerged as a dominant distribution channel for pet wearables in the United States, driven by the convenience of online shopping and access to a wide product range. Digital platforms allow pet owners to compare features, prices, and reviews, enabling informed decisions. The availability of direct-to-consumer options and rapid delivery further enhances market penetration. Additionally, e-commerce also supports subscription services and personalized recommendations, aligning with consumer preferences for convenience and customization. As a result, online platforms are increasingly central to the growth of pet wearable sales nationwide.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region accounts for a significant share of the U.S. pet wearable market, driven by a high density of pet owners prioritizing advanced health monitoring and tracking solutions. Urban areas, with their higher disposable incomes and tech-savvy populations, contribute to the adoption of premium pet wearables. Additionally, growing awareness of pet wellness in states such as New York and Massachusetts foster steady demand for innovative devices. The region's focus on pet safety and healthcare aligns with the increasing availability of technologically advanced products catering to these needs.

The Midwest region demonstrates consistent growth in the U.S. pet wearable market, supported by a strong presence of pet-friendly households and affordability-focused buyers. States like Illinois and Ohio are leading in the adoption of GPS-enabled devices and activity trackers. Moreover, rising pet healthcare awareness and the presence of regional manufacturers offering cost-effective wearable solutions are further accelerating market expansion. In addition, the region's blend of urban and rural populations fosters diverse usage patterns, reflecting increased demand for tracking and health-monitoring devices across various pet demographics.

The South region holds a prominent position in the U.S. pet wearable market, attributed to its large pet-owning population and growing investment in pet health and safety. States such as Texas and Florida are major contributors, with a robust demand for GPS trackers and fitness monitoring devices tailored for active pets. Furthermore, the region's warmer climate and outdoor lifestyles increase the need for wearable technology that ensures pet safety during activities. Additionally, expanding retail and e-commerce networks make pet wearables increasingly accessible to a wider consumer base.

The West region leads in innovation and adoption within the U.S. pet wearable market, fueled by tech-centric states like California. A focus on integrating advanced technologies such as IoT and AI into pet wearables drives market growth. Moreover, high disposable incomes and a strong emphasis on pet wellness contribute to demand for premium devices. Additionally, the active lifestyles of pet owners in this region support adoption of fitness trackers and health monitoring solutions. The region's progressive consumer base further fosters an environment for continuous market expansion.

Competitive Landscape:

The competitive landscape of the U.S.pet wearable market is characterized by the presence of established players and emerging startups, focusing on innovation and product differentiation. Key companies are investing in advanced technologies, such as AI-based health monitoring and real-time tracking features, to enhance functionality. Moreover, partnerships with veterinary services and integration with IoT ecosystems are further strengthening market positions. For instance, in February 2024, Strava, a U.S-based physical exercise tracking service provider, announced a strategic partnership with Fi, a U.S.-based smart connected dog collar developer. This partnership will enable pet owners to track their dogs' steps from Fi smart collar through the Strava application. In addition, the sector is witnessing increasing competition as brands prioritize user-friendly designs and enhanced data analytics to meet consumer demands. This dynamic environment fosters continuous innovation and intensifies the competition within the market.

The report provides a comprehensive analysis of the competitive landscape in the U.S. pet wearable market with detailed profiles of all major companies, including:

- Garmin Ltd.

- High Tech Pet Products Inc.

- PetPace LLC

- Whistle Labs Inc. (Mars Incorporated)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In August 2024, Pawgic AI, a U.S.-based pet technology firm, launched its new AI-powered smart collar developed to enhance monitoring and care for pets. This innovative collar offers comprehensive pet well-being assessment through real-time activity tracking, health monitoring via advanced sensors, mood analysis, precise GPS with geo-fencing, and seamless integration with a user-friendly mobile app.

- In March 2024, PetPace, a U.S.-based leading pet wearable technology company, launched its AI-based PetPace 2.0, an AI-powered smart dog collar designed to deliver real-time medical analysis for early health monitoring, detection, and treatment. Equipped with GPS tracking, it measures key vital signs and biometrics, including temperature, pulse, respiratory rate, heart rate variability, behavior, activity, sleep quality, and posture.

U.S. Pet Wearable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smart Collar, Smart Vest, Smart Harness, Smart Camera, Others |

| Technologies Covered | GPS, RFID, Sensors, Others |

| Applications Covered | Identification and Tracking, Monitoring and Control, Medical Diagnosis and Treatment, Facilitation, Safety and Security |

| End Users Covered | Households, Commercial |

| Distribution Channels Covered | Modern Trade, Franchised Outlets, Specialty Stores, E-Commerce, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Garmin Ltd., High Tech Pet Products Inc., PetPace LLC, Whistle Labs Inc. (Mars Incorporated), etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. pet wearable market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. pet wearable market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. pet wearable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pet wearables are smart devices designed for animals, integrating technologies like GPS, RFID, and sensors to monitor health, activity, and location. These devices are widely applied in pet healthcare, fitness tracking, behavior analysis, and safety, catering to both consumer and veterinary sectors for enhanced animal care and management.

The U.S. pet wearable market was valued at USD 568 Million in 2024.

IMARC estimates the U.S. pet wearable market to exhibit a CAGR of 12.6% during 2025-2033.

The market is principally driven by rising pet ownership, increased focus on pet health and safety, advancements in wearable technology, and growing demand for GPS-enabled tracking devices and health monitoring solutions, reflecting heightened awareness of pet well-being among owners.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)