United States Pharmacy Automation Market Report by Product Type (Automated Medication Dispensing Systems, Automated Storage and Retrieval Systems, Automated Packaging and Labeling Systems, Tabletop Tablet Counters, and Others), Application (Drug Dispensing and Packaging, Drug Storage, Inventory Management), End User (Hospital Pharmacies, Retail Pharmacies, and Others), and Region 2025-2033

Market Overview:

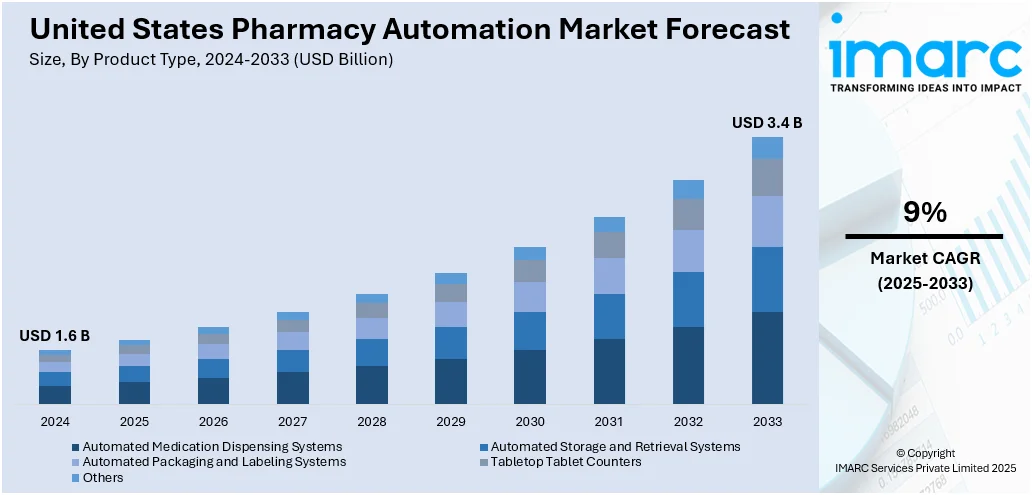

United States pharmacy automation market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 9% during 2025-2033. The ongoing advancements in automation technology, including robotics and artificial intelligence, which contribute to the continuous improvement of pharmacy automation systems, are driving the market.

United States Pharmacy Automation Market Insights:

- Robotics automate pharmacy operations, minimizing mistakes and expediting dispensing.

- AI-based systems enable predictive inventory monitoring and streamlined stock management.

- Central fill systems maximize prescription filling for reducing costs across multi-site pharmacy operations.

- Cloud-based technology facilitates real-time inventory monitoring and process automation over a remote infrastructure.

- Automation frees pharmacists to spend more time on clinical care and counseling.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate (2025-2033) | 9% |

Pharmacy automation refers to the use of technology and machinery to streamline and enhance various aspects of pharmaceutical processes. These systems automate tasks such as medication dispensing, packaging, labeling, and inventory management. By leveraging robotics, computerized systems, and advanced software, pharmacy automation aims to improve efficiency, accuracy, and safety in medication handling. Automated dispensing machines reduce human error, ensure precise dosage, and enhance medication adherence. Additionally, these systems can handle high volumes of prescriptions, leading to quicker turnaround times and improved customer service. Pharmacy automation also plays a crucial role in minimizing the risk of medication errors, optimizing workflow, and allowing pharmacy staff to focus on patient care and counseling. Overall, pharmacy automation contributes to a more efficient and reliable healthcare system by integrating technology into the medication management process.

To get more information on this market, Request Sample

United States Pharmacy Automation Market Trends:

Increased Use of Robotic Dispensing Systems

The United States market for pharmacy automation is seeing rising incorporation of robotic dispensing systems due to the pressure to achieve speed, precision, and efficiency within large-volume pharmacies. Robotic units automate the process of counting, filling, labeling, and storing medication, greatly eliminating the risk of human error and improving patient safety. Hospitals, retail chains, and mail-order pharmacies are embracing automated dispensing technologies in order to deal with labor shortages, cut operational expenses, and achieve better service delivery. Also, the increased emphasis on regulatory compliance, including the Drug Supply Chain Security Act (DSCSA), is encouraging pharmacies to put in place systems providing traceability and glitch-free processes. Robotic dispensing enables high throughput during rush hours, reduces drug waste, and enables the pharmacist to spend more time on patient care. With innovation in artificial intelligence and machine learning, newer robotic platforms are also able to perform real-time inventory tracking and predictive stock management, further consolidating the growth path of the market.

Adoption of Central Fill Pharmacy Models

Central fill pharmacy systems are also increasingly popular in the U.S. because they can simplify prescription filling in networks of retail and outpatient outlets. Under the central fill model, a single highly automated central facility prepares prescriptions, which are distributed to branches of individual pharmacies for pick-up or delivery. As per the sources, in May 2025, Walmart opened its biggest automated prescription filling facility in Maryland, covering 102,000 square feet and filling as many as 100,000 prescriptions every day, increasing access and convenience to 700+ U.S. stores. Moreover, this enables local pharmacists to spend more time on clinical services and patient interaction than on dispensing. Central fill automation maximizes operational effectiveness, minimizes mistakes, and minimizes total cost by centralizing labor and inventory management. The model is particularly worth it to pharmacy chains, health organizations, and mail-order firms that have a high volume of prescriptions to process quickly and accurately. In addition, in an era where consumer expectations are increasing for convenience and same-day or next-day delivery, central fill systems provide a scalable and reliable solution. As prescription quantities increase and patient care models shift, central fill automation will continue to be an essential component of the pharmacy automation market.

Growth of Cloud-Based Pharmacy Management Solutions

Cloud solutions are increasingly being the pillar of pharmacy automation in America, providing a seamless integration of hardware, data, and analytics to support pharmacy operations. These systems facilitate real-time updates of inventory, automated prescription processes, and remote monitoring of equipment performance. They specifically appeal to independent pharmacies and mid-sized healthcare organizations looking for affordable, scalable automation with minimal initial investment. With its cybersecurity reinforcements and HIPAA-compliant platforms, cloud platforms keep patient information secure but at the same time offer actionable information on patient behavior, medication compliance, and operational chokepoints. The inclusion of electronic health records (EHRs), auto-refill reminders, and e-prescribing capabilities in cloud-based systems is further accelerating care coordination among pharmacists and prescribers. Cloud technology is also making it simpler to update software and deliver remote technical support, minimizing downtime and maintenance expenses. With digital healthcare transformation gaining speed, cloud-based pharmacy automation is all set to grow exponentially, providing flexibility, smartness, and enhanced patient service performance throughout the pharmacy ecosystem.

United States Pharmacy Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Automated Medication Dispensing Systems

- Automated Storage and Retrieval Systems

- Automated Packaging and Labeling Systems

- Tabletop Tablet Counters

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes automated medication dispensing systems, automated storage and retrieval systems, automated packaging and labeling systems, tabletop tablet counters, and others.

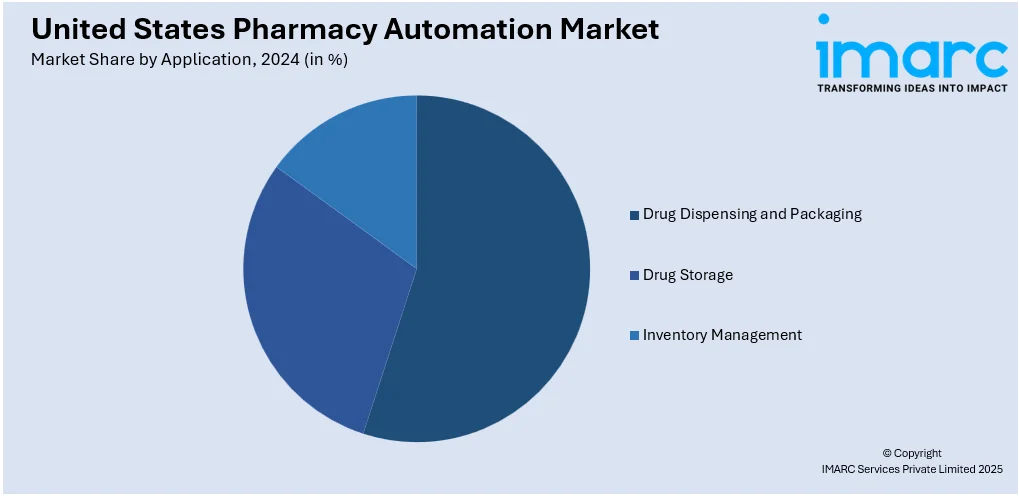

Application Insights:

- Drug Dispensing and Packaging

- Drug Storage

- Inventory Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes drug dispensing and packaging, drug storage, and inventory management.

End User Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital pharmacies, retail pharmacies, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Asteres Inc.

- Capsa Healthcare

- McKesson Corporation

- Omnicell Inc.

- RxSafe LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In March 2025, Alto launched Alto Technologies, a fresh AI-driven pharmacy platform that brings together automation and pharmacist knowledge. The end-to-end solution accelerates hub and dispensing operations to enhance the access, adherence, and affordability of medication. The launch represents a significant move in pharmacy automation for healthcare providers, payors, and manufacturers.

- In May 2025, Opio Connect introduced its methadone-dispensing robot "Bodhi" to automate dosing in addiction clinics. Rolling out at Man Alive, it increases care by minimizing nurse workload, increasing safety, and providing accurate dispensing—representing a major milestone in pharmacy automation for opioid treatment throughout the United States.

- In August 2024, Omnicell launched its Central Med Automation Service, a scalable, subscription-based solution to maximize centralized medication management in U.S. health systems. It combines robotics, intelligent devices, and software to advance pharmacy workflows, promote patient safety, and facilitate the transition to more efficient, automated pharmacy care models across the country.

United States Pharmacy Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Automated Medication Dispensing Systems, Automated Storage and Retrieval Systems, Automated Packaging and Labeling Systems, Tabletop Tablet Counters, Others |

| Applications Covered | Drug Dispensing and Packaging, Drug Storage, Inventory Management |

| End Users Covered | Hospital Pharmacies, Retail Pharmacies, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Asteres Inc., Capsa Healthcare, McKesson Corporation, Omnicell Inc., RxSafe LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States pharmacy automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States pharmacy automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States pharmacy automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmacy automation refers to the use of technology, robotics, and software systems to automate various tasks in the medication-use process within pharmacies. These tasks include dispensing, packaging, labeling, storing, and tracking medications. Automation improves workflow efficiency, reduces medication errors, enhances inventory management, and frees pharmacists to focus more on patient care and clinical services.

The United States pharmacy automation market was valued at USD 1.6 Billion in 2024.

The United States pharmacy automation market is projected to exhibit a (CAGR) of 9% during 2025-2033, reaching a value of USD 3.4 Billion by 2033.

Rising demand for medication accuracy, staff shortage, increased healthcare digitization, growing geriatric population, and cost-efficiency goals are driving adoption. Regulatory pressure to reduce errors and streamline operations, along with technological advancements like AI-powered dispensing and robotic systems, are also boosting growth. Hospitals and retail pharmacies are investing in automation to improve patient outcomes and workflow efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)