United States Portable Generator Market Report by Fuel Type (Portable Diesel, Generators, Portable Gas Generators, and Others), Application (Residential, Commercial, Industrial, Infrastructure), Power Output (Less than 3 kW, 3-10kW, More than 10Kw), and Region 2026-2034

United States Portable Generator Market Size, Share & Analysis

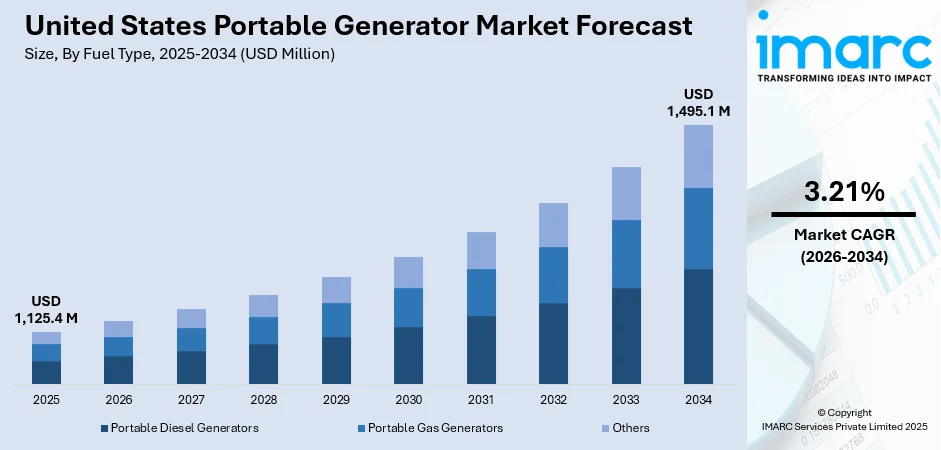

The United States portable generator market size reached USD 1,125.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,495.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.21% during 2026-2034. The market is driven by increasing power outages, more dependence on backup power, and higher outdoor and construction usage. Improvements in inverter technology, fuel efficiency, and carbon monoxide protection are driving product demand. Suppliers are launching models meeting changing emissions standards. This technology, combined with increasing residential and recreational demand, is bolstering the United States portable generator market share and setting it up for further growth across multiple end-user segments such as homes, businesses, and remote or off-grid sites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,125.4 Million |

|

Market Forecast in 2034

|

USD 1,495.1 Million |

| Market Growth Rate 2026-2034 | 3.21% |

Access the full market insights report Request Sample

Portable generators, also known as engine-generators, are internal combustion engines which provide electricity to vital devices in an area during a power outage. They run on a fuel-powered engine which turns an on-board alternator to generate power. Portable generators are ideal for places where power outages are common so as to keep essential devices running in homes, corporate buildings, restaurants, shops, construction sites, etc.

To get more information on this market Request Sample

Over the years, portable generators have emerged as a low-priced alternative to standby generators to keep power running in a case of an emergency. Apart from this, the installation and operating costs are minimal for portable generators, thereby making them an ideal option for residents, small-businesses, camp-sites, etc. Moreover, portable generators are fuel efficient. They provide optimal output with minimal fuel consumption. These generators run longer on the same amount of fuel. As a result, they cost less to operate and provide uninterrupted power to one’s facility.

United States Portable Generator Market Trends:

Enhanced Demand Due to Power Blackouts and Weather Resilience

United States portable generator market demand is increasing as people grow more concerned with power reliability, especially with severe weather conditions. Both consumers and businesses are investing in portable standby solutions to guarantee business continuity during sudden blackouts attributed to hurricanes, snowstorms, or wildfires. The aging infrastructure of the national power grid and a rising occurrence of climate-related disruptions have made portable generators a key component in residential, commercial, and industrial emergency preparedness. Portable units are being bought as a cost-effective option by many homeowners over standby generators, and companies utilize them to keep key operations going during outages. This is particularly true in areas subject to natural hazards or under infrastructural development. Increasing consciousness of energy security and autonomy has also led to increased uptake. Consequently, portable generators are being considered as convenient, versatile means for power resilience under both general and emergency use applications in the nation.

Expansion in Environment-Friendly and Technologically Improved Generators

The United States portable generator market outlook is developing towards more cleaner, more intelligent power solutions. Growing environmental concerns and tighter emissions standards are encouraging consumers as well as manufacturers to opt for green generator options. As per sources, in January of 2025, Generac launched six new portable generators that include inverter designs for sales in 49 and 50 states and an 8000W CARB-legal gasoline model, meeting PGMA-ANSI G300-2023 carbon monoxide safety standards. Moreover, this involves a focus towards inverter technology, dual-fuel options, and lower noise and emission models. Technology advancements in digital features are also influencing market choices, as smart generators provide monitoring remotely, load balancing, and fuel efficiency control through mobile applications. These technologies appeal to those who need convenience, sustainability, and improved integration with contemporary energy systems like solar panels or battery storage. Producers are retaliating by introducing portable generators that not only conform to existing environmental regulations but also are optimized for performance with enhanced control functionality. With consumers putting a greater premium on clean energy as well as digital connectivity, this trend is likely to further accelerate, enabling the United States portable generator market growth in various applications.

Increased Adoption in Recreational and Construction Segments

The US portable generator market is growing rapidly owing to rising demand in the form of recreational and construction-based applications. Outdoor recreation like camping, tailgating, and travel in RVs has increased in popularity and created demand for portable power sources that are compact, quiet, and reliable. Inverter generators are usually preferred by such enthusiasts that offer clean power for sensitive electronics in remote locations. At the same time, the building sector still depends greatly on portable generators to power equipment and tools in regions where permanent electricity facilities are not present. Builders need solid units capable of supporting high loads while being safe and transportable on construction sites. This two-purpose situation—both lifestyle and industrial use, highlights the portability and practicality of portable generators. As lifestyle becomes increasingly recreational and technology-reliant, and infrastructure projects increase in number, these segments shall continue to sustain high demand, influencing product innovation and purchasing trends within the U.S. portable generator market.

United States Portable Generator Market Opportunities:

The United States portable generator market forecast offers a number of favorable opportunities fueled by changing energy requirements, changing consumer trends, and policy developments. With growing focus on emergency readiness and power resilience, especially in areas subject to weather-related disruptions, portable backup demand is forecast to increase moderately. The market also derives a boost from the increasing activity in recreational camping, RV vacations, and tailgating, all of which require lightweight, quiet generators. Infrastructure projects and off-grid real estate projects also provide the impetus for demand in hardier, high-output models. There is a significant opportunity to innovate with greener and intelligent generators, as consumers demand energy-efficient, emissions-compliant engines with digital features. Increasing demand for integration of clean energy, such as solar-compatible or hybrid generator systems, further enhances the growth potential. Players emphasizing sustainability, portability, and ease of use are poised to take advantage of emerging demand and become a strong force in this dynamic and changing United States portable generator market trends.

United States Portable Generator Market Challenges:

The market is subjected to some challenges that can impact its growth trend even with high demand. Emissions and noise level regulatory pressures are increasing, necessitating investment in cleaner, compliant technologies from manufacturers, which can increase the cost of production and reduce the number of low-cost variants. The market also faces fuel dependency and environmental issues, especially for gasoline- and diesel-powered equipment. Cleaner technologies are on the horizon, but take-up is slow due to cost and infrastructure constraints. A further factor to be considered is market saturation in developed segments, which could reduce opportunities for growth of traditional products. Consumer education continues to be important, as proper maintenance, usage, and safety procedures are vital to achieving optimal product performance and to preventing risks like carbon monoxide poisoning. As per United States portable generator market analysis the market continues to grow, facing these issues with innovation, policy adaptation, and greater public understanding will be critical in ensuring sustainable and responsible growth across a range of user groups and applications.

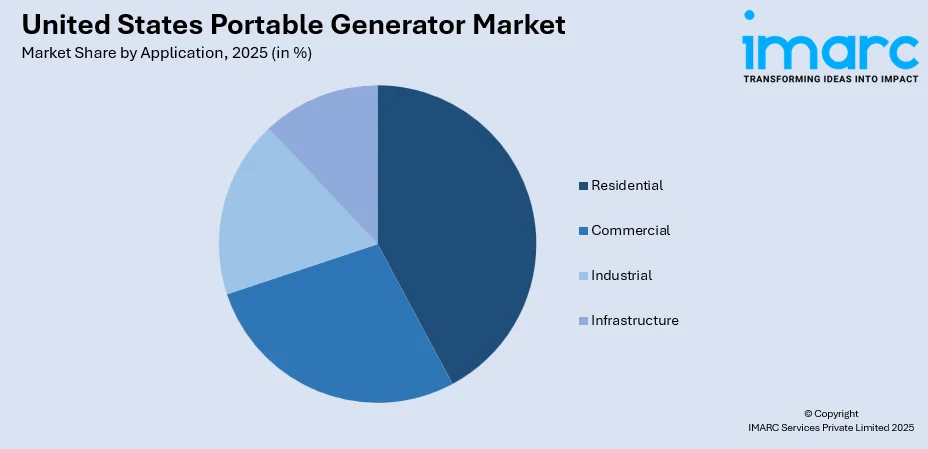

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States portable generator market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on fuel type, application and power output.

Breakup by Fuel Type:

- Portable Diesel Generators

- Portable Gas Generators

- Others

Breakup by Application:

To get detailed segment analysis of this market Request Sample

- Residential

- Commercial

- Industrial

- Infrastructure

Breakup by Power Output:

- Less than 3 kW

- 3-10kW

- More than 10Kw

Breakup by Region:

- Northeast

- Midwest

- South

- West

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape

- Competitive Structure

- Key Player Profiles

IMARC Group’s latest report provides a deep insight into the United States portable generator market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the United States portable generator market in any manner.

Latest News and Developments:

- In June 2025, Anker Solix rolled out the F3000 power station in the United States and Canada. Specifically created for home backup and off-grid deployment, it provides 3 kWh capacity, 3.6 kW output, rapid charging, EV and generator compatibility, and up to 12.3 kWh expandable storage for versatile residential energy support.

- In April 2025, Ecoflow, based in the U.S., released the River 3 Plus, a 286 Wh portable power generator with one-hour AC charging. Expandable to 858 Wh, it accepts solar, car, and generator input. A wireless model with a 5,000 mAh power bank should be released later in 2025 for extra convenience.

- In March 2025, Honda launched the EU3200i generator, providing 3,200 watts of inverter power for RV, outdoor, and home backup use. At only 59.1 pounds, it offers quiet operation, CO-MINDER® protection, and parallel capability up to 6,400 watts, providing power, portability, and reliability in a single compact package.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Fuel Type, Application, Power Output, Region |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The portable generator market in the United States was valued at USD 1,125.4 Million in 2025.

The United States portable generator market is projected to exhibit a CAGR of 3.21% during 2026-2034, reaching a value of USD 1,495.1 Million by 2034.

United States portable generator market is propelled by escalating power outages from severe weather, residential and commercial backup power demand growth, outdoor recreational activities growth, and usage in construction sites. Improvements in inverter technology, fuel efficiency, and safety features such as CO sensors also fuel the growth in consumer demand for small, reliable portable power solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)