United States Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristics, Raw Material, End Use Industry, and Region, 2026-2034

United States Positive Displacement Pumps Market Summary:

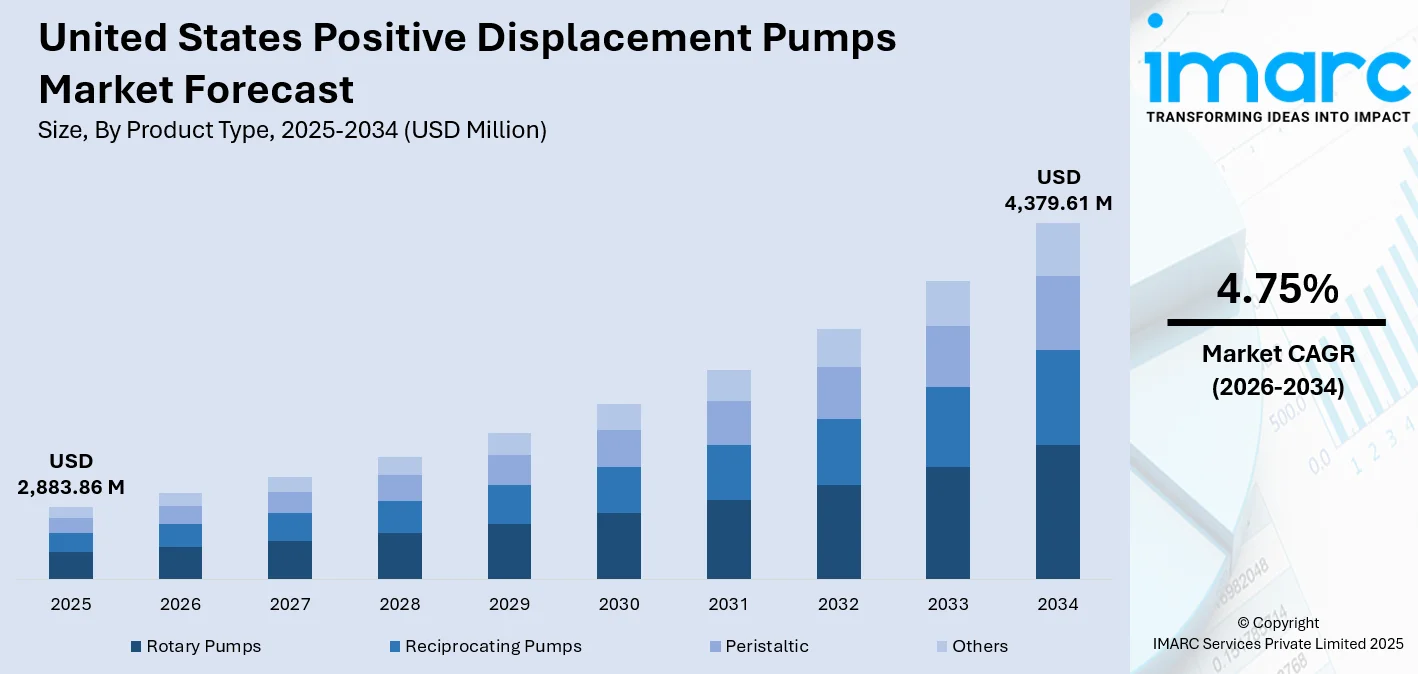

The United States positive displacement pumps market size was valued at USD 2,883.86 Million in 2025 and is projected to reach USD 4,379.61 Million by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

The United States positive displacement pumps market growth is primarily driven by the growing number of oil and gas exploration activities, coupled with substantial federal investment in water and wastewater infrastructure modernization. The increasing adoption of smart pump technologies with Internet of Things (IoT)-enabled monitoring capabilities is enhancing operational efficiency across industrial applications. Furthermore, stringent environmental regulations are encouraging industries to upgrade to energy-efficient pumping solutions that reduce energy utilization while maintaining optimal performance. The convergence of industrial automation, infrastructure development, and sustainability initiatives is reshaping the competitive landscape and creating significant opportunities in the market.

Key Takeaways and Insights:

- By Product Type: Rotary pumps dominate the market with a share of 43% in 2025, driven by their superior efficiency in handling high-viscosity fluids, compact design requiring lower maintenance, and widespread application across oil and gas, chemical processing, and food manufacturing industries.

- By Capacity: Medium capacity pumps lead the market with a share of 46% in 2025, reflected by their versatility across various industrial applications, optimal balance between flow rate and pressure requirements, and cost-effectiveness for mid-scale operations.

- By Pump Characteristics: Standard pumps represent the largest segment with a market share of 50% in 2025. This dominance is because of their broad suitability across oil and gas, chemical processing, water and wastewater, and food applications, where reliability and steady flow matter more than customization.

- By Raw Material: Cast iron dominates the market with a share of 35% in 2025, due to its cost efficiency, durability, vibration damping, and widespread acceptance across water, oil, and industrial applications.

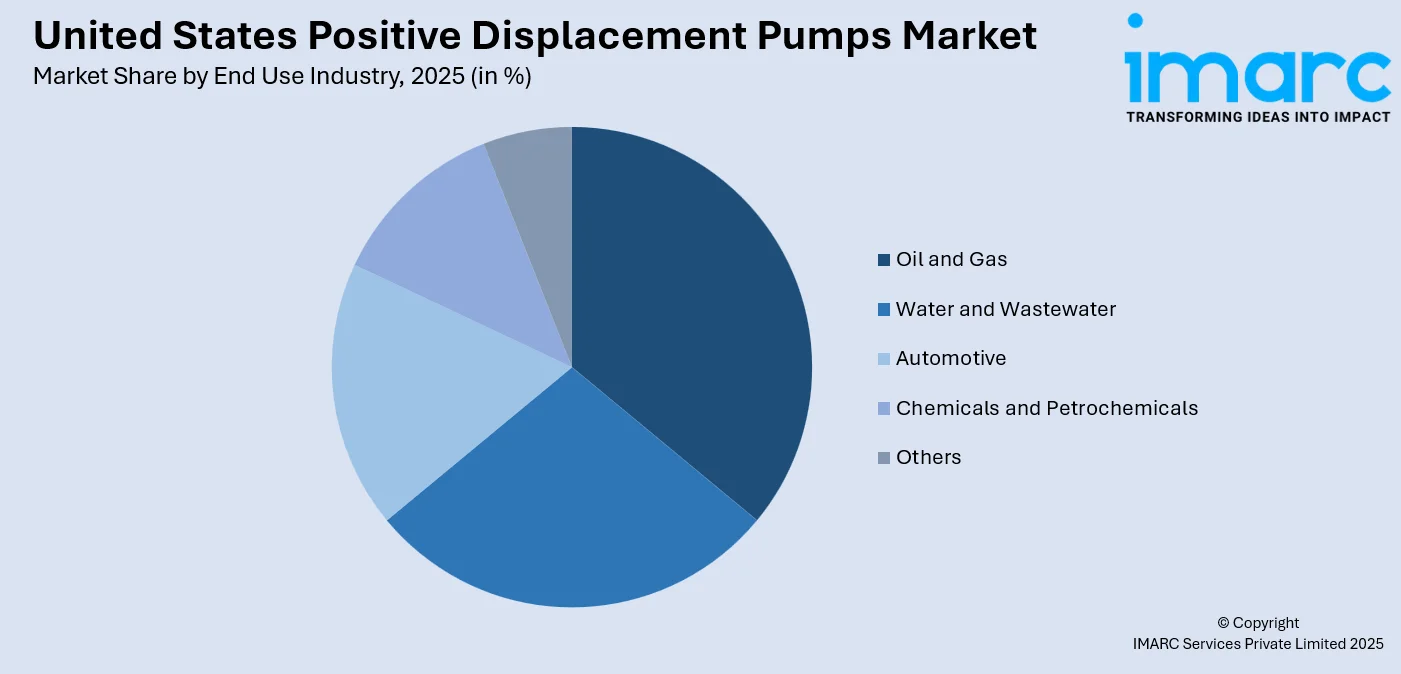

- By End Use Industry: Oil and gas lead the market with a share of 30% in 2025, supported by extensive drilling operations, pipeline infrastructure development, and the growing demand for high-pressure pumping solutions in hydraulic fracturing applications.

- By Region: South represents the largest segment with a market share of 34% in 2025, owing to the concentrated petroleum refining activities in Texas and Louisiana, expanding LNG export infrastructure, and significant industrial manufacturing presence.

- Key Players: The United States positive displacement pumps market exhibits moderate competitive intensity, with established multinational corporations competing alongside specialized regional manufacturers across diverse end-use applications and price segments.

To get more information on this market Request Sample

The United States positive displacement pumps market plays an essential role in supporting industrial operations across energy, water treatment, chemical processing, and manufacturing activities. Market growth is supported by sustained capital spending on pipeline networks, refinery upgrades, and industrial facility improvements aimed at improving reliability and capacity. Large-scale energy transport and storage projects increase demand for pumps capable of handling high-pressure, viscous, and chemically sensitive fluids with consistent flow control. In 2025, Phillips 66 and Kinder Morgan initiated a binding open season for the Western Gateway Pipeline, designed to transport refined products from Borger, Texas, to Arizona and California, with connectivity to Las Vegas. The project involved construction of a new Borger-to-Phoenix pipeline and directional reversals of existing pipelines to support east-to-west movement. Such infrastructure developments increase the need for dependable positive displacement pumps used in fuel transfer, lubrication, and chemical injection systems, contributing to the market growth across the United States.

United States Positive Displacement Pumps Market Trends:

Increasing Oil, Gas, and Energy Operations

Energy sector activity remains a major source of demand across upstream midstream and downstream operations where positive displacement pumps support crude oil handling refined fuel transfer chemical injection and lubrication systems. These pumps provide stable flow under high pressure conditions which supports reliable operation in challenging environments. This demand is strengthened by continued investment in pipeline development and system upgrades. In 2024, U.S. pipeline companies completed five petroleum liquids projects, including expansions and conversions by Enterprise Products Partners, ONEOK, and Targa Resources, mainly transporting refined products and NGLs from the Permian Basin and Gulf Coast to regional markets. Such projects drive the demand for reliable pumping equipment that supports continuity efficiency and reduced operational downtime.

Growth in Water and Wastewater Treatment Projects

Federal and state level funding initiatives aimed at modernizing water infrastructure are catalyzing the demand for positive displacement pumps across municipal treatment systems. Aging facilities require reliable solutions for sludge handling chemical transfer and accurate dosing operations. In 2025, the U.S. EPA supported USD 50 Billion investment program funded through the Bipartisan Infrastructure Law and the Inflation Reduction Act, focusing on modernizing aging infrastructure, replacing lead pipes, addressing emerging contaminants, and ensuring equitable access nationwide. Positive displacement pumps are well suited for these tasks due to their metering accuracy and ability to operate under variable loads.

Emphasis on Process Efficiency and Flow Control

Manufacturers are placing greater emphasis on tighter process control to reduce material losses energy usage and production variability across industrial operations. Positive displacement pumps support these objectives by delivering controlled flow rates that remain consistent regardless of pressure changes. For instance, in 2024, Vogelsang USA launched its new EP series of rotary lobe positive displacement pumps, designed for oil, gas, chemical, and other industrial applications. The pumps handled high pressures up to 260 psi and temperatures up to 392 °F, with pulsation-free, low-shear operation and advanced seal technologies for reliability. An Automatic Supply Unit (ASU) further extended seal life, ensuring low maintenance and high operational uptime. Such product developments highlight industry alignment with automation and digital monitoring strategies.

Market Outlook 2034:

The United States positive displacement pumps market demonstrates growth potential over the forecast period, supported by ongoing investment in energy infrastructure and industrial modernization programs. Demand from sectors like oil and gas, water treatment chemical processing, and manufacturing continues to offer a favorable the market outlook. The market generated a revenue of USD 2,883.86 Million in 2025 and is projected to reach a revenue of USD 4,379.61 Million by 2034, growing at a compound annual growth rate of 4.75% from 2026-2034.

United States Positive Displacement Pumps Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Rotary Pumps |

43% |

|

Capacity |

Medium Capacity Pumps |

46% |

|

Pump Characteristics |

Standard Pumps |

50% |

|

Raw Material |

Cast Iron |

35% |

|

End Use Industry |

Oil and Gas |

30% |

|

Region |

South |

34% |

Product Type Insights:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

Rotary pumps dominate with a market share of 43% of the total United States positive displacement pumps market in 2025.

Rotary pumps lead the market due to their ability to handle a wide range of viscosities while delivering smooth and continuous flow. Their compact design and high efficiency make them suitable for demanding industrial operations.

Their strong market position is also supported by lower pulsation, reduced vibration, and reliable performance under high pressure conditions. These characteristics reduce maintenance requirements and downtime, making rotary pumps a preferred choice across energy chemical and manufacturing sectors.

Capacity Insights:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

Medium capacity pumps lead with a market share of 46% of the total United States positive displacement pumps market in 2025.

Medium capacity pumps hold the biggest market share, driven by their ability to manage moderate flow rates while maintaining pressure stability. They are widely suitable for industrial applications that require consistent performance without the cost and complexity of high-capacity systems.

Their dominance is further influenced by versatility across sectors, including oil and gas, water treatment, and manufacturing. Medium capacity pumps offer easier integration, lower operating costs, and reliable operation, which makes them ideal for both new installations and replacement projects.

Pump Characteristics Insights:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

Standard pumps exhibit a clear dominance with a 50% share of the total United States positive displacement pumps market in 2025.

Standard pumps dominate the market attributed to their proven reliability and broad compatibility with common industrial applications. Their standardized designs simplify installation operation and maintenance across a wide range of operating environments.

Their dominance is also driven by cost effectiveness and wide availability through established manufacturers and distributors. Standard pumps reduce procurement lead times, support easier spare parts access, and are frequently selected for replacement projects where customization is unnecessary.

Raw Material Insights:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

Cast iron dominates with a market share of 35% of the total United States positive displacement pumps market in 2025.

Cast iron holds the biggest market share, supported by its favorable balance of strength, durability, and cost efficiency. Its notable wear resistance and vibration damping properties make it suitable for continuous operation in demanding industrial environments.

Its widespread use is also influenced by ease of casting, machining, and repair, which lowers manufacturing and maintenance costs. Cast iron offers adequate corrosion resistance for many applications and is readily available through established domestic supply chains.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

Oil and gas lead with a market share of 30% of the total United States positive displacement pumps market in 2025.

Oil and gas represent the largest segment because of the extensive requirements for reliable fluid handling across upstream midstream and downstream operations. Positive displacement pumps support crude transfer, chemical injection, lubrication, and fuel handling under high pressure conditions.

The oil and gas sector generates steady replacement demand supported by pipeline development, refinery upgrades, and shale production activity. In 2026, Intensity Infrastructure Partners and Rainbow Energy Center announced the first phase of a 36 inch natural gas pipeline in North Dakota, with a capacity of 1,100,000 Dth per day, supporting rising power, industrial, and data center demand. Such projects drive the need for durable positive displacement pumps that ensure stable flow and reliable continuous operation.

Regional Insights:

- Northeast

- Midwest

- South

- West

South exhibits a clear dominance with a 34% share of the total United States positive displacement pumps market in 2025.

The South leads the market due to its strong concentration of oil and gas production, refining, and petrochemical activities. States, including Texas Louisiana and Oklahoma host extensive pipeline and processing infrastructure. In 2025, ONE Gas announced a 43-mile natural gas pipeline project in southeast Oklahoma valued at $150–160, strengthening regional energy reliability and supporting long term gas demand.

The region also benefits from strong industrial manufacturing, water treatment, and construction activity. Ongoing infrastructure investment, favorable business conditions, and proximity to ports and processing hubs, further support higher adoption of positive displacement pumps across diverse end use sectors.

Market Dynamics:

Growth Drivers:

Why is the United States Positive Displacement Pumps Market Growing?

Expansion of Pharmaceutical and Life Sciences Manufacturing

Pharmaceutical and life sciences manufacturing in the United States is increasing, driven by domestic production initiatives and rising demand for regulated healthcare products. Positive displacement pumps are widely used in these facilities for their accuracy repeatability and controlled handling of sensitive formulations. In 2024Ingersoll Rand Inc announced an agreement to acquire ILC Dover for approximately USD 2.325 Billion strengthening its life sciences portfolio by integrating positive displacement pumps and liquid handling technologies with single use biopharmaceutical solutions. This development reflects the growing industry investment in specialized fluid handling capabilities. As facilities expand and modernize demand continues to rise for pumping equipment that supports precise transfer stable performance and compliance with strict validation and documentation requirements.

Rising Use in Construction and Infrastructure Projects

The growing number of construction and infrastructure projects requiring positive displacement pumps for transferring and dosing viscous materials, such as concrete additives grouts sealants and coatings, is influencing the market. These pumps play an important role in construction activities including foundation development tunneling road construction and structural reinforcement where precise material delivery is necessary. In 2025, the South San Joaquin and Oakdale Irrigation Districts initiated the USD 84 Million Canyon Tunnel Project in Californias Central Valley to modernize water delivery systems and protect communities from landslide risks. Such projects drive the demand for controlled flow solutions that improve application consistency reduce material loss and support durable performance across residential commercial and large-scale infrastructure developments.

Growing Demand in Mining and Minerals Processing

In mining and minerals processing positive displacement pumps are essential for transporting slurries tailings and abrasive mixtures under harsh operating conditions. Their ability to maintain steady flow supports reliable handling of high solids materials while limiting flow instability and excessive equipment wear. In 2025, the U.S. Department of Energy launched a $355 million funding plan to boost domestic critical mineral production, split into $275 million for pilot-scale industrial facilities and $80 million for field testing new mining technologies. This investment is accelerating mining activity and process upgrades. As production expands, there is a rise in the demand for dependable pumping systems used in reagent dosing concentrate transfer thickener underflow and continuous mineral processing operations.

Market Restraints:

What Challenges the United States Positive Displacement Pumps Market is Facing?

High Initial Capital Investment Requirements

Advanced positive displacement pump systems require significant upfront capital outlay, which can limit adoption among smaller operators and cost sensitive end users. Higher procurement costs are driven by the use of specialized materials customized designs and integrated monitoring features. Facilities operating under strict capital expenditure constraints may delay upgrades or select lower cost alternatives despite long term performance and reliability benefits.

Competition from Alternative Pump Technologies

Positive displacement pumps face competition from centrifugal and other pump technologies that may be preferred in applications with lower viscosity fluids or variable flow demands. These alternatives often involve lower initial investment and simpler system design. Equipment selection depends on operating pressure fluid characteristics and process requirements which can lead certain users to favor other displacement solutions in specific use cases.

Supply Chain Volatility and Material Cost Fluctuations

Fluctuations in raw material prices and ongoing supply chain disruptions continue to affect manufacturing costs and equipment availability. Variations in steel cast iron and specialty alloy pricing influence production economics and pricing strategies. Extended lead times for critical components can delay project execution and create uncertainty for end users planning equipment procurement and system upgrades.

Competitive Landscape:

The United States positive displacement pumps market exhibits moderate competitive intensity characterized by the presence of established multinational corporations alongside specialized regional manufacturers competing across diverse end-use applications and price segments. Leading players are pursuing strategies centered on technological innovation, strategic acquisitions, and expansion of service capabilities to differentiate their offerings and capture market share. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven solutions emphasizing advanced monitoring capabilities and energy efficiency to value-oriented products targeting cost-conscious industrial clients. The competitive landscape is increasingly shaped by digital transformation initiatives, sustainability requirements, and user demand for comprehensive solutions integrating equipment supply, installation support, and aftermarket services.

Recent Developments:

- October 2025: Diener Precision Pumps, based in the United States, launched the Multistream Series Gear Pump, a positive displacement pump designed to replace up to four pumps with a single compact unit. The new pump features up to four independent inlets or outlets, pulseless seal-free operation, and enables simultaneous fluid transfer or mixing while reducing system complexity and cost. The Multistream Series targets medical, analytical, and industrial fluid handling applications requiring high precision, reliability, and space efficiency.

- September 2025: At PACK EXPO Las Vegas 2025, Ampco Pumps highlighted its positive displacement pumps, including the ZP3, ZP4, ZP1+, and AL Series rotary-lobe pumps. The event showcased their hygienic, efficient, and low-maintenance designs for food, beverage, pharmaceutical, and industrial applications.

- February 2025: SPX FLOW announced the launch of the APV DW+ Positive Displacement Pump, the next generation of its DW Series. It was designed to deliver pulsation-free, low-shear and energy-efficient performance for high-viscosity applications across food and beverage, personal care, pet food and industrial markets.

United States Positive Displacement Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristicss Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater, Automotive, Chemicals and Petrochemicals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States positive displacement pumps market size was valued at USD 2,883.86 Million in 2025.

The United States positive displacement pumps market is expected to grow at a compound annual growth rate of 4.75% from 2026-2034 to reach USD 4,379.61 Million by 2034.

Rotary pumps dominate the market with 43% market share in 2025, driven by their efficiency in handling high-viscosity fluids, compact design, and widespread application across oil and gas, chemical processing, and food manufacturing industries.

Key factors driving the United States positive displacement pumps market include federal investment in water and wastewater infrastructure modernization. In 2025 the U.S. EPA supported a USD 50 billion investment program targeting drinking water wastewater and stormwater upgrades. Positive displacement pumps enable accurate dosing sludge handling and reliable operation under variable loads.

Major challenges include high initial capital investment requirements for advanced pump systems, competition from alternative pump technologies, such as centrifugal pumps, supply chain volatility affecting raw material costs, and the need for skilled personnel to operate and maintain increasingly sophisticated pumping equipment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)