United States Potato Starch Market Size, Share, Trends and Forecast by Category, Application, and Region, 2026-2034

United States Potato Starch Market Size and Share:

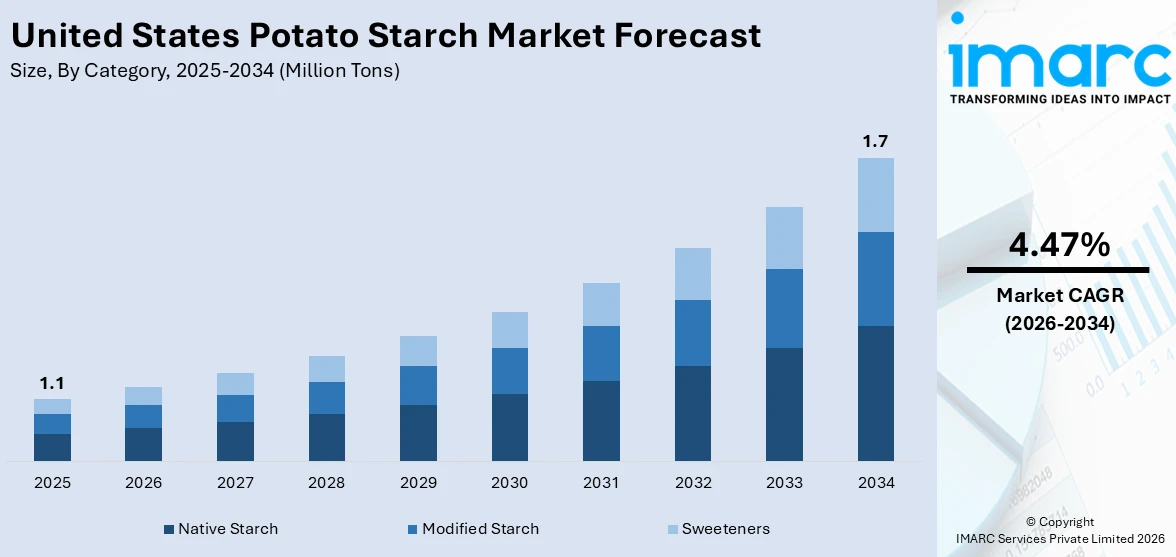

The United States potato starch market size reached 1.1 Million Tons in 2025. The market is projected to reach 1.7 Million Tons by 2034, exhibiting a CAGR of 4.47% from 2026-2034. Growth in the market is fueled by increasing consumer preference for clean-label, gluten-free products, alongside rising usage in processed foods, pharmaceuticals, and textile manufacturing. Innovations in food processing and the surge in ready-to-eat meals also support demand. Furthermore, eco-friendly trends are boosting the appeal of plant-based thickeners. The expanding footprint across diverse applications highlights the rising United States potato starch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 1.1 Million Tons |

| Market Forecast in 2034 | 1.7 Million Tons |

| Market Growth Rate 2026-2034 | 4.47% |

One of the drivers of the United States potato starch market is the growing focus on sustainable sourcing and green farming practices. As the concern regarding climate change and conservation of resources increases, both manufacturers and consumers are focusing more on ingredients that have a reduced environmental impact. Potato starch, which is a product of commonly grown crops that use land and water rather efficiently, achieves these sustainability criteria. As per the sources, in August 2024, KMC introduced Gelamyl 625, potato starch-based ingredient providing superior elasticity and low-energy processing to plant-based confectionery for sustainable, gelatin-free sweets with adjustable texture and enhanced production efficiency. Moreover. tts manufacturing process tends to be minimal waste, where by-products are recycled for animal feed or bioenergy, making it more attractive. Further, the increasing institutional and policy attention to encouraging sustainable agricultural inputs is impacting the choice of ingredients in the food, textile, and paper sectors. This emphasis is driving the uptake of potato starch in formulations based on environment, social, and governance (ESG) standards. The industry thus gains from the convergence of consumer values, corporate responsibility efforts, and environmental compliance strategies, all of which are driving the increasing use and demand for potato starch in the United States.

To get more information on this market Request Sample

Another key driver impacting the United States potato starch market outlook is growing utilization of plant-derived ingredients in industrial and non-food uses. Alongside its long-established food uses, potato starch is increasingly being used in the production of biodegradable packaging, adhesives, pharmaceuticals, and personal care products because of its binding, film-forming, and moisture-retention capabilities. The need for bio-based raw materials in these applications is being driven by the momentum to decrease dependency on petrochemical derivatives and adopt renewable substitutes. Specifically, the versatility of potato starch with other biopolymers enables innovation in creating environmentally friendly packaging solutions, which are gaining ground through retail and logistics chains. Within the pharmaceutical sector, it is used as a tablet and capsule disintegrant, while in cosmetics, it is prized for its smoothness and absorbency. That increasing functional application across industries is driving increased consumption levels, solidifying its place as an industrious and sustainable ingredient within the new era of industrial innovation and green production within the United States.

United States Potato Starch Market Trends:

Increasing Demand for Clean-Label and Natural Ingredients

The increasing consumer focus on health and wellness is significantly driving the demand for clean-label products. United States shoppers increasingly associate the term “natural” with ethical animal treatment and environmental responsibility, with a majority willing to pay more for such assurances. This shift in mindset is encouraging food manufacturers to reformulate their products using fewer artificial additives and more recognizable, plant-based ingredients. According to the United States potato starch market forecast, this trend is contributing to the rising adoption of potato starch, which is a natural and non-modified ingredient that fits perfectly with clean-label demands. Its clean label status and functional flexibility are making it a manufacturer favorite among those catering to the clean-label movement. Specifically, potato starch's attraction is that it comes from one natural source and is minimally processed, heightening its attractiveness to label-aware consumers. Consequently, the clean-label trend is not only driving potato starch use but also impacting research and development (R&D) directions, sourcing, and product positioning across the broader food and beverage industry.

Gluten-Free and Allergen-Free Uses Drive Demand

The growing incidence of gluten intolerance and food allergy among United States consumers is driving a spike in demand for allergen-free and gluten-free ingredients. Some 6% of American consumers are gluten-intolerant, triggering a significant market trend towards safe food choices. Potato starch, with its innate gluten-free characteristic and the absence of common allergens, emerges as a safe and general-purpose ingredient in this changing scenario. It is picking up pace especially in gluten-free baking, snack food formulations, and processed food segments. As consumers specifically look for inclusive food products which meet certain health requirements without affecting taste or texture, potato starch is being utilized more and more to improve both product safety as well as palatability. With its unflavored neutrality and versatility, it is applicable to a vast majority of products, further adding to its popularity in the gluten-free market. This change is promoting innovation and diversification of food product ranges, making potato starch a strategic option for healthy and allergen-sensitive markets.

Functional Benefits and Processed Foods Growth

Increased demand for convenient, ready-to-eat (RTE) meals and processed foods is powerfully enhancing the application of potato starch. This shift is most remarkable in the United States convenience foods and snack market, which is likely to cross USD 32.6 billion by 2026. The greater viscosity of potato starch, its high-quality gelling, and superior water-binding capability render it a critical component in numerous processed food product applications. Whether it is soups and sauces or confectionery and dairy products, it helps as a thickening and stabilizer agent to improve product quality and shelf-life. In addition, the continuous effort of the food industry to create new formulations and enhance texture and stability has expanded potato starch application beyond conventional applications. As consumers further adopt convenient meal solutions and high-end food experiences, food processors are increasingly turning to multifunctional ingredients such as potato starch to address performance and clean-label demands, thus fueling sustained market expansion.

United States Potato Starch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States potato starch market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on category and application.

Analysis by Category:

- Native Starch

- Modified Starch

- Sweeteners

In 2025, the native starch held a major 64.3% market share in the United States potato starch market growth, emerging as the dominant type of segment. Native starch is still a sought-after choice because it's naturally free from additives, economical, and its widespread applications cut across multiple industries without undergoing chemical or physical treatment. It is especially prized for its functional properties such as thickening, stabilizing, and binding in food and non-food uses. Demand for native starch is also heightened by its clean-label compliance, whereby consumers increasingly demand minimally processed products. Native starch can also be used with conventional and industrial processing conditions, thus being highly versatile for various formulations. Its widespread application in the bakery, dairy, meat processing, and paper industries showcases its supremacy. With growing focus on transparent and natural ingredient sourcing, native potato starch continues to experience consistent demand, cementing its supremacy in the United States potato starch market.

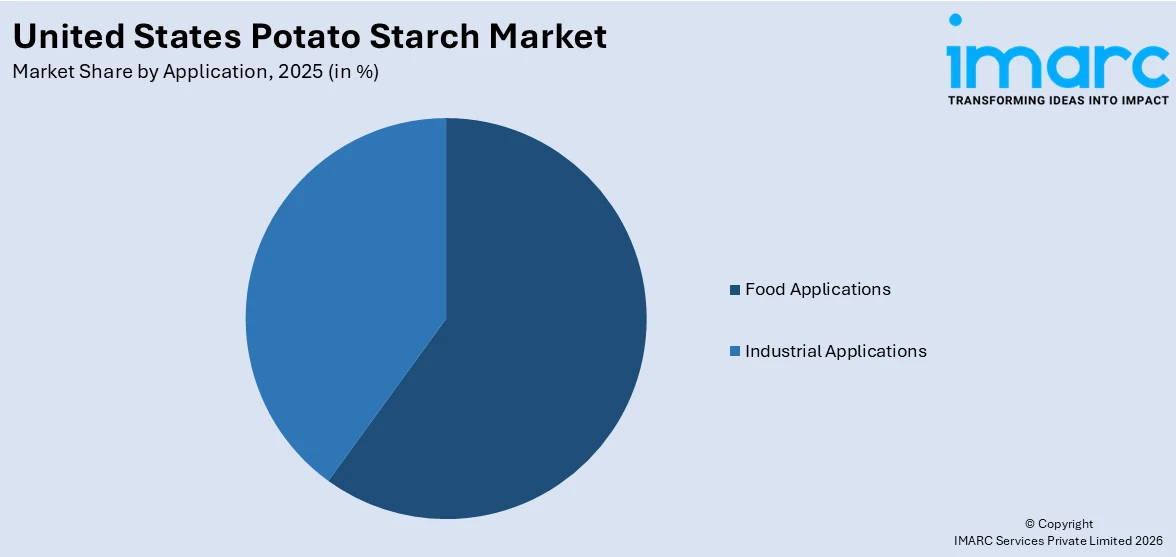

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Food Applications

- Industrial Applications

As per the United States potato starch market analysis the food applications were leading in 2025, with a strong 74.3% market share. Such dominance can be explained by the broad functional application of the ingredient in food processing, such as its ability to act as a thickener, texturizer, and moisture keeper. Potato starch finds extensive applications in processed foods like sauces, gravies, dairy, bakery, and ready-to-eat meals, all of which are seeing consistent consumer consumption due to changing dietary habits and time inefficiencies. The rise in demand for gluten-free and allergen-free solutions has also helped increase its presence within specialty food segments. Additionally, the desire of the food industry to provide clean-label and minimally processed ingredients further validates the application of potato starch due to its plant origin and additive-free status. Its neutral flavor, high binding power, and positive sensory traits enable effortless incorporation within many food applications. With ongoing growth in product innovation and food consumption driven by convenience, the food category is still the main contributor to overall market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast shows steady demand for potato starch due to its well-established food processing sector and increasing consumer demand for clean-label products. The market is further supported by urban consumers looking for convenient, gluten-free, and plant-based offerings, resulting in steady growth in bakery, dairy, and ready-to-eat food categories.

The Midwestern region has significant market potential based on the robust agricultural foundation and industrial processing facilities. Potato starch demand is supported by food manufacturing plants within the region and growing uses in non-food markets such as adhesives and bioplastics. Ongoing innovation and access to raw materials support market growth.

In the South, population expansion and changing food consumption habits are speeding up the use of potato starch, particularly in gluten-free and processed foods. Improved health awareness and growth in food retail and manufacturing centers support the development of the segment, with a plenty of space for both domestic demand and supply.

The potato starch market in the West region is fueled by an active health-oriented consumer base and an increasing focus on sustainable food production. It is also driven further by the establishment of food innovation centers and a higher application in organic, vegan, and allergen-free products, positioning the region as a key driver of market growth.

Competitive Landscape:

The United States potato starch market has a highly competitive environment based on product diversification, innovation, and supply chain optimization. The players invest heavily in research to upgrade the functional properties of potato starch for niche uses in food, pharmaceuticals, textiles, and biodegradable products. A heightened focus is being placed on creating high-purity and specialty-grade starches designed for precise industrial applications, including controlled viscosity or moisture retention. The makers are also increasing domestic sourcing operations in order to provide consistent quality and traceability. Strategic alliances with food processors, packagers, and bioplastic material developers also augment market positioning. Cutting-edge manufacturing technologies and automation are being used to increase production without sacrificing environmental compliance and product integrity. In addition, branding initiatives also emphasize more sustainability, traceability, and nutritional transparency to meet changing consumer demands. As competition stiffens, differentiation through tailor-made solutions and value-added formulations continues to be key to fortifying market share and regional presence.

The report provides a comprehensive analysis of the competitive landscape in the United States potato starch market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, KMC launched CheeseMaker CF66, a potato starch-based food ingredient for plant-based pizza cheese. The new product provides higher stretchability, meltability, and texture, improving both functionality and nutrition. Unveiled at Food Ingredients Europe, it represents a milestone in sustainable, allergen-free cheese alternatives for the expanding plant-based market.

- In October 2024, Folkland Foods acquired a $3 million investment to expand its organic potato processing business in Erie County. The project, spearheaded by parent firm Troyer Inc. which promote sustainable agriculture practices, and enhance production of clean-label frozen potato products, increasing Pennsylvania's farm innovation and state regional economic growth.

United States Potato Starch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Categories Covered | Native Starch, Modified Starch, Sweeteners |

| Applications Covered | Food Applications, Industrial Applications |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States potato starch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States potato starch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States potato starch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The potato starch market in the United States reached 1.1 Million Tons in 2025.

The United States potato starch market is projected to exhibit a CAGR of 4.47% during 2026-2034, reaching a volume of 1.7 Million Tons by 2034.

Some of the key drivers for the United States potato starch market are the growing need for clean-label and plant-based food products, enhanced application in food and industrial sectors, and rising consumer interest in gluten-free variants. Advancements in technology related to starch processing and product formulation innovation also lead to increased usage across the packaging, pharmaceutical, and textile industries.

The native starch segment has the maximum share of the United States potato starch market with around 64.3%. Its high share is attributed to widespread applications in food categories like soups, sauces, and baked goods. The consumer likes its clean-label appeal, natural basis, and universal application in food and industrial formulation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)