United States Private LTE Market Size, Share, Trends and Forecast by Component, Technology, Frequency Band, Deployment Mode, Industry Vertical, and Region, 2026-2034

United States private LTE Market Size and Share:

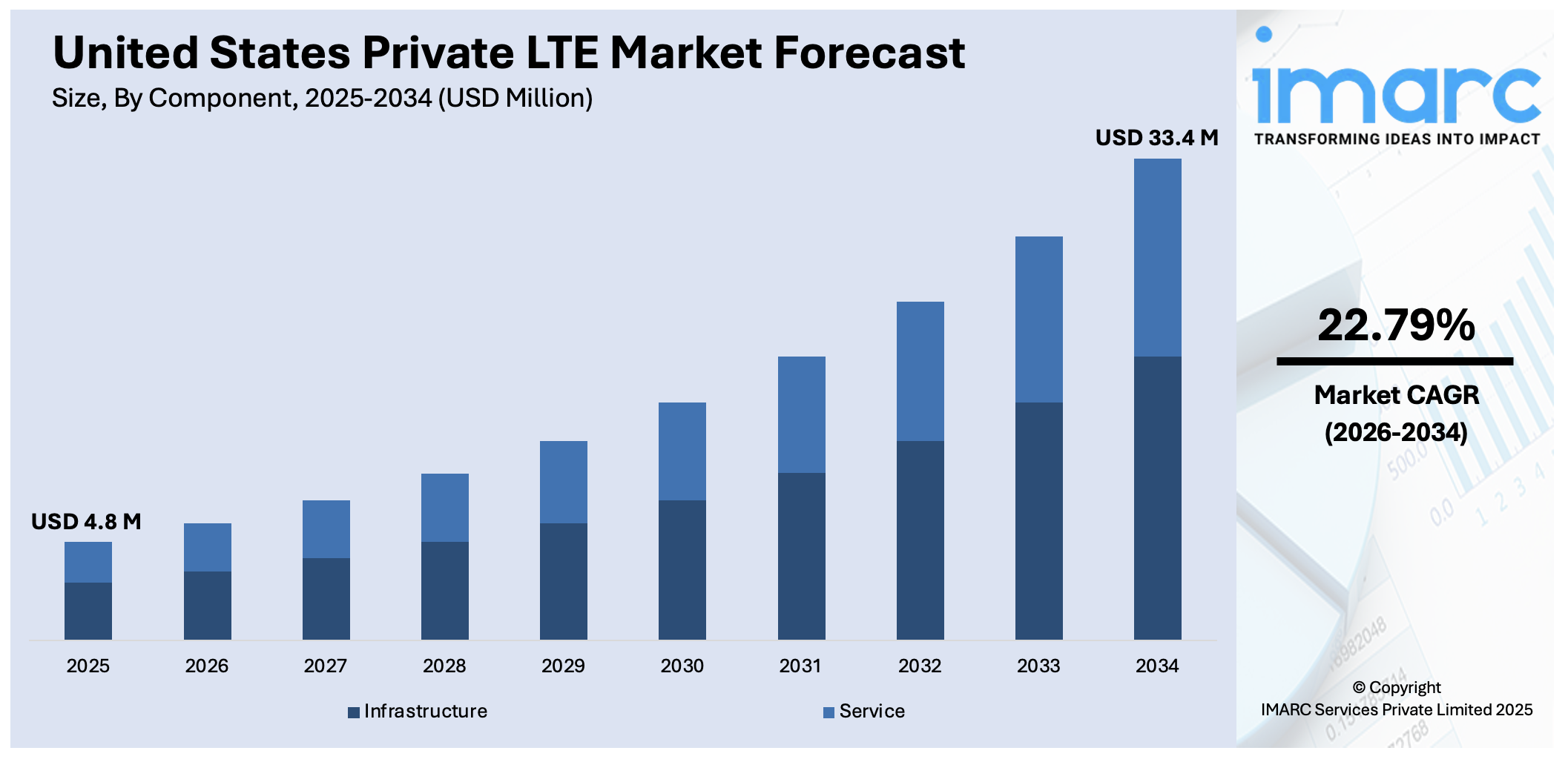

The United States private LTE market size was valued at USD 4.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 33.4 Million by 2034, exhibiting a CAGR of 22.79% from 2026-2034. The growing demand for private LTE networks is driven by their ability to provide high data speeds, low latency, and reliable performance. These features make them ideal for industries requiring secure, robust connectivity such as manufacturing, logistics, and public safety. As organizations seek better control over their communication infrastructure and enhanced data privacy, private LTE networks are becoming increasingly attractive. Their scalability and ability to support mission-critical applications further contribute to the United States private LTE market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Million |

| Market Forecast in 2034 | USD 33.4 Million |

| Market Growth Rate 2026-2034 | 22.79% |

The increasing adoption of Industrial Internet of Things (IoT) and Industry 4.0 technologies is a key driver of US private LTE industry. These advanced systems rely on real-time data sharing, automation, and connectivity between machines and systems. Private LTE networks offer the low latency, high reliability, and security necessary for such operations. As manufacturing plants and industrial facilities modernize, they require wireless networks capable of supporting robotics, sensor networks, and predictive maintenance systems. Private LTE delivers these capabilities, making it essential for organizations looking to improve efficiency, safety, and productivity through digital transformation initiatives.

To get more information on this market Request Sample

The introduction of shared spectrum options like the Citizens Broadband Radio Service (CBRS) has significantly increased the accessibility of private LTE deployment in the U.S. Enterprises no longer need expensive spectrum licenses, enabling greater flexibility and control over their networks. This shift is especially beneficial for sectors such as logistics, education, and healthcare, where customized, secure connectivity solutions are essential. More over 400,000 CBRS devices were in use nationwide as of July 1, 2024, with majority of them located in rural areas. This widespread adoption highlights how CBRS empowers organizations to build dedicated networks tailored to specific performance needs. The simplified spectrum access and cost-efficiency of CBRS are driving broader industry adoption of private LTE, supporting evolving digital transformation and operational demands.

United States private LTE Market Trends:

Integration of Private LTE with Edge Computing and AI

The convergence of private LTE networks with edge computing and artificial intelligence (AI) is revolutionizing enterprise connectivity. By processing data near its source, edge computing significantly reduces latency, enabling faster and more reliable real-time decision-making. When combined with AI, this approach powers advanced capabilities like predictive analytics and automated responses, boosting operational efficiency. Industries including manufacturing, healthcare, and logistics are adopting this integration to support critical applications such as autonomous vehicles (AVs), real-time monitoring, and smart infrastructure management. This fusion creates more intelligent and adaptive network solutions, allowing organizations to respond swiftly to changing operational needs, improve safety, and enhance productivity through smarter, data-driven insights.

Adoption of Neutral Host Models Using Shared Spectrum

The use of shared spectrum, especially the Citizens Broadband Radio Service (CBRS), is driving the growth of neutral host models in private LTE networks. These models enable multiple service providers to share a single network infrastructure, which improves coverage and significantly lowers deployment costs. Large venues such as stadiums, hospitals, and university campuses benefit greatly, as they can deploy private LTE networks that cater to both internal operational needs and public access demands. This shared infrastructure optimizes resource usage while ensuring consistent, reliable connectivity for diverse user groups. By leveraging CBRS, organizations achieve a cost-effective, scalable solution that balances security, performance, and accessibility across various environments.

Enhanced Security Measures in Private LTE Deployments

As cyber threats grow increasingly sophisticated, organizations are placing greater emphasis on strengthening the security of private LTE networks. In 2024, the average cost of a data breach hit a record high of $4.88 million, with human error accounting for 88% of breaches. These concerning figures demonstrate how urgently improved security measures like strong encryption, intrusion detection systems, and safe access controls are needed. Such protocols are especially vital for sectors handling sensitive information, including healthcare, finance, and critical infrastructure. By prioritizing security, private LTE networks not only deliver reliable, high-performance connectivity but also protect against vulnerabilities and potential cyberattacks, ensuring data integrity and operational continuity.

United States private LTE Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States private LTE market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on component, technology, frequency band, deployment mode, industry vertical.

Analysis by Component:

- Infrastructure

- Service

Based on the United States private LTE market forecast, the infrastructure forms the foundation of private LTE networks, including hardware like radios, base stations, core networks, and antennas. Demand is driven by industries deploying customized, high-performance networks for critical operations. Investment in infrastructure ensures scalability, low latency, and secure connectivity, essential for supporting IoT, automation, and edge computing.

Apart from this, the services encompass network design, integration, deployment, and managed operations. As organizations lack in-house expertise, service providers play a crucial role in enabling efficient, secure network implementation. Ongoing support, maintenance, and optimization services ensure reliable performance, especially in complex environments such as healthcare, defense, manufacturing, and large-scale enterprise settings.

Analysis by Technology:

- FDD

- TDD

FDD technology uses separate frequency bands for uplink and downlink, enabling simultaneous two-way communication with minimal interference. It is widely adopted in private LTE deployments requiring consistent coverage and voice communication, especially in suburban and rural settings where symmetrical traffic and broader range are critical for reliable connectivity.

Moreover, the TDD uses a single frequency band for both uplink and downlink, alternating in time slots. It offers flexibility in adjusting bandwidth allocation based on traffic patterns, making it ideal for data-heavy environments. TDD is commonly used in urban and industrial settings, supporting high-capacity applications and dense device networks.

Analysis by Frequency Band:

- Licensed

- Unlicensed

- Shared Spectrum

Licensed spectrum offers exclusive use, providing high reliability, security, and minimal interference ideal for mission-critical applications. It is favored by large enterprises and public sector entities that require guaranteed performance. Though more costly, it ensures controlled access and stable connectivity, particularly in regulated environments like defense, healthcare, and utilities.

Also, the unlicensed spectrum is cost-effective and readily accessible, allowing quicker deployment of private LTE networks without licensing fees. However, it may face higher interference risks. It’s well-suited for non-critical applications in sectors like retail, education, and small enterprises seeking affordable, flexible wireless connectivity without the complexities of spectrum ownership.

Besides this, shared spectrum, such as CBRS, balances cost and performance by enabling dynamic, prioritized access. It supports scalable, secure private LTE deployments across diverse industries. Widely adopted in the U.S., it allows enterprises to build robust networks without the high expense of licensed spectrum, while maintaining better reliability than unlicensed options.

Analysis by Deployment Model:

- Centralized

- Distributed

Centralized deployment consolidates network functions in a single core location, simplifying management and reducing costs. It suits organizations with centralized operations and smaller geographic footprints. While easier to maintain, it may face latency challenges in wide-area coverage, making it ideal for compact campuses or facilities with focused connectivity needs.

Along with this, the distributed deployment spreads network components across multiple locations, enhancing coverage and reducing latency. It supports large, geographically dispersed enterprises requiring localized processing and real-time responsiveness. This model is essential for industries like manufacturing and logistics, where reliable, low-latency communication across multiple sites improves operational efficiency and scalability.

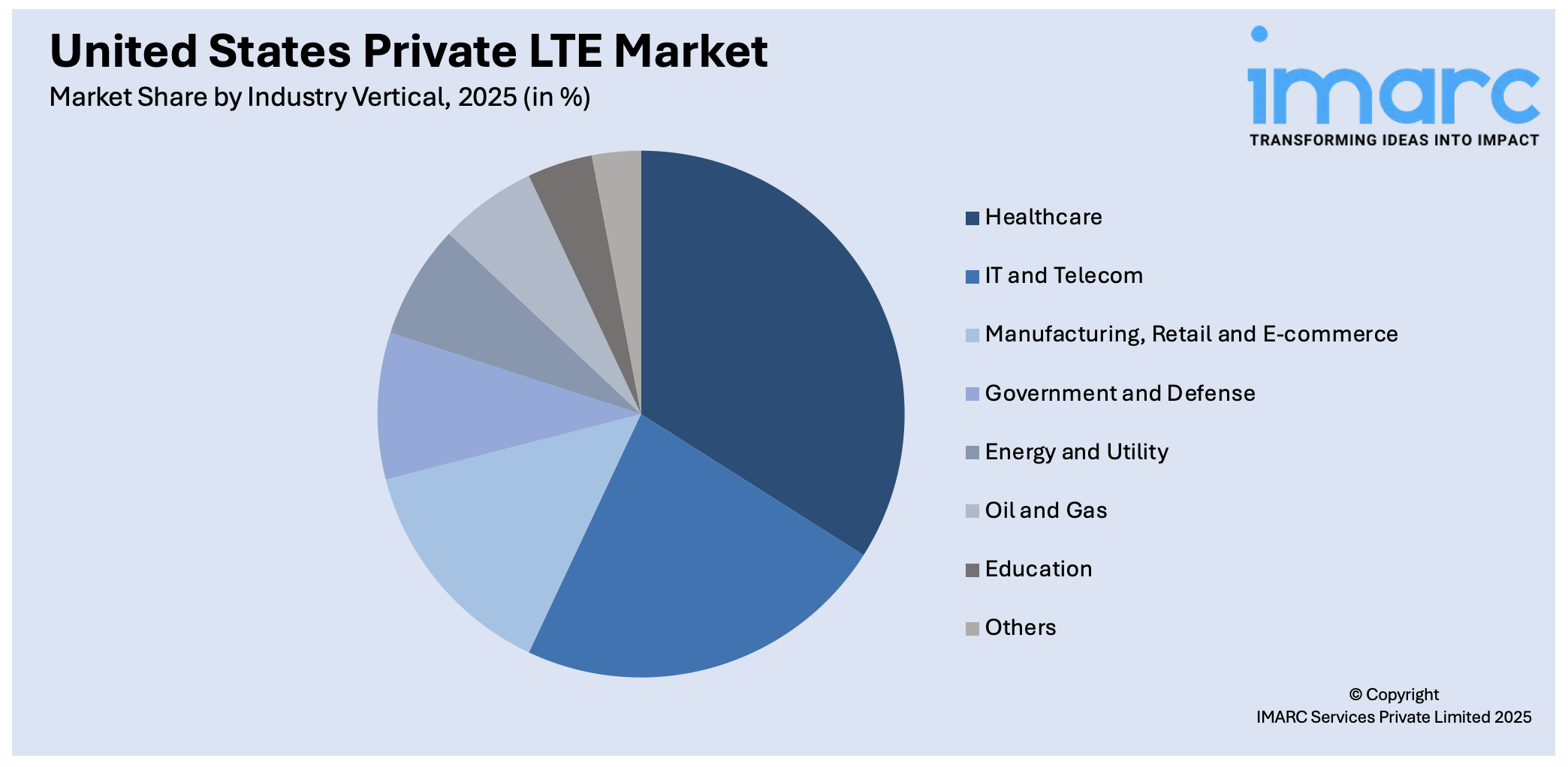

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- Healthcare

- IT and Telecom

- Manufacturing, Retail and E-commerce

- Government and Defense

- Energy and Utility

- Oil and Gas

- Education

- Others

Healthcare organizations leverage private LTE for secure, high-speed connectivity to support telemedicine, remote monitoring, and digital health records. The network's reliability and low latency enhance patient care and data protection, particularly in hospitals, clinics, and mobile health units, driving increasing adoption across urban and rural healthcare settings.

In line with this, the IT and telecom companies adopt private LTE to enhance internal operations and develop innovative services. These networks support edge computing, IoT, and cloud integration while enabling secure testing environments. They also act as service providers, deploying private LTE solutions for clients seeking customized, high-performance wireless infrastructure.

Moreover, the manufacturing, retail, and e-commerce supports automation, real-time analytics, and robotics in manufacturing, while enhancing inventory management and customer experience in retail. In e-commerce, it ensures secure, efficient operations in warehouses and distribution centers. These sectors rely on the network’s reliability and scalability to maintain competitive, tech-driven operations.

Besides this, the government and defense agencies implement private LTE for secure communication, emergency response, and operational continuity. The networks offer controlled, resilient infrastructure critical for mission-sensitive tasks. They also support smart city initiatives, surveillance, and infrastructure monitoring, helping improve public safety, coordination, and digital service delivery across jurisdictions.

Furthermore, the energy and utility sectors use private LTE for grid monitoring, fault detection, and asset management. These networks provide secure, real-time data exchange across vast infrastructure, enhancing operational reliability and response times. Private LTE also supports renewable energy integration and smart grid functionality in this data-intensive environment.

Also, in remote and hazardous environments, private LTE provides the oil and gas industry with reliable, secure communication for drilling, monitoring, and safety systems. The network supports automation, predictive maintenance, and environmental monitoring, ensuring operational efficiency and safety in upstream, midstream, and downstream segments.

However, the educational institutions deploy private LTE to extend secure, high-speed connectivity across campuses and remote learning environments. The network supports smart classrooms, e-learning platforms, and digital administration systems. It ensures reliable access to educational resources, especially in underserved areas where public networks may be insufficient or inconsistent.

Alongside this, the other sectors like transportation, hospitality, and construction adopt private LTE to improve mobility, coordination, and service delivery. These industries benefit from customizable, low-latency networks that support IoT, real-time tracking, and operational efficiency. Use cases range from airport communication to hotel automation and remote construction site connectivity.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Based on the United States private LTE market outlook, the Northeast region sees strong private LTE adoption driven by financial institutions, healthcare systems, and urban infrastructure projects. Dense population centers require secure, high-capacity networks to support smart city initiatives and digital transformation. The region benefits from strong tech ecosystems and supportive public-private partnerships for connectivity expansion.

Additionally, the private LTE growth in the Midwest is fueled by manufacturing, agriculture, and logistics sectors embracing digital technologies. Industrial IoT applications and rural connectivity challenges drive demand for secure, low-latency networks. The availability of shared spectrum and strong interest in smart farming and automation contribute to the United States private LTE market growth.

Besides this, the South exhibits high demand for private LTE in energy, transportation, and public safety sectors. The region’s large geographic area and mix of urban and rural zones highlight the need for scalable, reliable connectivity. Adoption is also supported by growing tech hubs and investments in infrastructure modernization across states.

Furthermore, the Western U.S. leads in private LTE adoption, driven by innovation in technology, media, and education sectors. High-tech industries, smart campuses, and government initiatives promote widespread deployment. The region’s focus on sustainability and smart infrastructure aligns with the capabilities of private LTE, fostering continued growth and experimentation.

Competitive Landscape:

The competitive landscape of the United States private LTE market is characterized by rapid innovation, strategic collaborations, and a focus on technological differentiation. Companies are actively investing in advanced network infrastructure, leveraging edge computing, AI, and shared spectrum solutions to enhance service offerings. Market players are also tailoring solutions to meet the unique demands of industries such as manufacturing, logistics, and healthcare. The regulatory environment, particularly access to shared spectrum like CBRS, has lowered entry barriers and intensified competition. Vendors are focusing on flexible, scalable, and secure network solutions to attract enterprise clients. Overall, the market is dynamic and evolving, driven by the need for high-performance connectivity, customization, and the integration of next-generation technologies.

The report provides a comprehensive analysis of the competitive landscape in the United States private LTE market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Pennsylvania-based Rajant Corporation introduced LTE Enhance, an industrial-grade technology that combines LTE and Rajant Mesh into a single edge-compute-enabled network. LTE Enhance, which is made for remote administration and real-time automation, enables businesses to easily combine private LTE and some public LTE carriers with Rajant's Kinetic Mesh networks to create a high-capacity, adaptable network that guarantees applications stay online even during the most demanding industrial settings.

- March 2025: OneLayer, a provider of OT device management and security services for private LTE/5G networks, entered into a partnership with Ericsson to launch Zero Touch Zero Trust Network Access technology. This innovative solution provides organizations with comprehensive zero-trust security and device onboarding automation at scale in order to facilitate the rapid expansion of devices on their own private networks, upgrade infrastructure, and optimize ROI for their private cellular networks.

- March 2025: Semtech Corporation revealed a significant addition to its AirLink router line-up with more support for the Anterix spectrum. A key component of the partnership between Semtech and Anterix is the incorporation of the recently standardized Band 106 private LTE band into the ultra-rugged AirLink XR60 5G router, which is designed to meet the vital requirements of the utilities and energy industries.

- March 2025: Ubiik launched the Maverick 220, an LTE-M/NB-IoT module developed especially for private LTE networks, utilities, and industrial IoT (IIoT) applications. The Maverick 220 significantly expands the spectrum of LTE-enabled IoT devices by breaking the industry-standard 23 dBm power constraint with an unparalleled transmit power of up to 28 dBm for LTE-M and 30 dBm for NB-IoT.

- February 2025: Ericsson entered into a multi-year contract with the Lower Colorado River Authority (LCRA) to deploy a private LTE network in 68 Texas counties. The network will facilitate grid modernization initiatives, offer dependable, low-latency communications, and assist in protecting utility operations from escalating risks.

United States private LTE Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Infrastructure, Service |

| Technologies Covered | FDD, TDD |

| Frequency Bands Covered | Licensed, Unlicensed, Shared Spectrum |

| Deployment Models Covered | Centralized, Distributed |

| Industry Verticals Covered | Healthcare, IT and Telecom, Manufacturing, Retail and E-commerce, Government and Defense, Energy and Utility, Oil and Gas, Education, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States private LTE market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States private LTE market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States private LTE industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States private LTE market was valued at USD 4.8 Million in 2025.

The United States private LTE market is projected to exhibit a CAGR of 22.79% during 2026-2034, reaching a value of USD 33.4 Million by 2034.

Key factors driving the U.S. private LTE market include the need for secure, reliable, and high-speed connectivity across industries, growing adoption of Industrial IoT and automation, availability of shared spectrum like CBRS lowering costs, and increasing demand for low-latency networks supporting mission-critical applications and digital transformation initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)