United States Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2026-2034

United States Real Estate Market Size & Trends

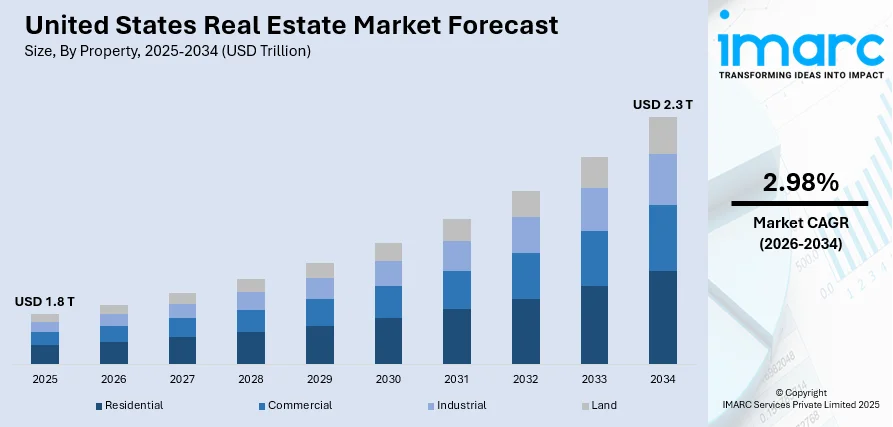

The United States real estate market size was valued at USD 1.8 Trillion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.3 Trillion by 2034, exhibiting a CAGR of 2.98% from 2026-2034. The market is primarily driven by increasingly adaptive reuse and office conversions, rapidly expanding single-family build-to-rent (BTR) communities, and the growing integration of artificial intelligence (AI), reshaping urban spaces, increasing rental housing options, and enhancing efficiency through AI-driven predictive analytics and automation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.8 Trillion |

| Market Forecast in 2034 | USD 2.3 Trillion |

| Market Growth Rate (2026-2034) | 2.98% |

Access the full market insights report Request Sample

United States Real Estate Analysis:

- Major Market Drivers: The United States real estate market forecast demonstrates strong demographic changes, such as millennials attaining peak homebuying years and baby boomers downsizing. Urban migration patterns and remote work flexibility, combined with historically low unemployment rates, fuel demand. Infrastructure investments and favorable lending conditions continue supporting property valuations, while government incentives for first-time buyers and green building initiatives stimulate residential and commercial development across diverse markets.

- Key Market Trends: Technology integration dominates through smart home features, virtual property tours, and blockchain-based transactions. Mixed-use developments combine residential, retail, and office spaces. Sustainable construction practices and energy-efficient buildings gain prominence. Co-living arrangements and build-to-rent communities expand. Growth in suburbs and secondary cities accelerates with affordability concerns driving buyers away from expensive metropolitan cores and changing traditional investment patterns.

- Competitive Landscape: The players in this market range from large institutional investors to the individual buyer or developer. Regional nuances create niches where local expertise confers competitive advantages. The digital platforms democratize access to property and raise competition. Investment trusts and private equity firms are increasingly eyeing residential assets. Brokerages are going for technology-enabled models, while traditional players are renewing operations in a bid to retain market share in an evolving consumer expectation landscape.

- Challenges and Opportunities: Affordability constraints and inventory shortages are major challenges, especially for first-time buyers. The regulatory complexities and zoning restrictions place limits on development. However, opportunities come up through underserved markets, projects of adaptive reuse, and the development of affordable housing. Climate-resilient construction and renovation markets grow. Technology innovation facilitates efficient property management and investment analysis, and demographic shifts create demand for senior housing and multi-generational living options.

The market in the region is undergoing tremendous transition due to population and consumerist changes. There are also remote and hybrid models of work with a demand in suburban and exurban areas which are seeking expansive living spaces that improve quality life. Additionally, the rise in the aging population that demands senior housing and assisted living facilities is driving the United States real estate market growth. For example, on October 3, 2024, National Investment Center for Seniors Housing & Care stated that U.S. senior housing occupancy increased from 85.8% in Q2 2024 to 86.5% in Q3, with 611,000 occupied units across 31 primary markets. Simultaneously, urban real estate is transforming through mixed-use developments and smart city initiatives, enhancing investment opportunities in both residential and commercial sectors. Moreover, favorable tax incentives and infrastructure spending, are quite tight, further fueling market resilience and development.

To get more information on this market Request Sample

Apart from this, the ongoing tech advancement and economic market dynamics also propel growth in the real estate market in the United States. In accordance with this, constantly changing PropTech innovations, such as, AI-driven property analytics and blockchain-based transactions, contribute to market clarity. For example, on 8 October 2024, CoreLogic® launched Araya, its AI-powered property intelligence platform for advanced analytics covering more than 5 million professionals in the industry. Araya, covering 99.9% of U.S. properties, yields insights into property values, market trends, and climate risk, making decisions stronger in the USD 40+ Trillion U.S. housing market. In addition to this, the increasing trend of crowdfunding in real estate and online investment platforms continues to enhance investor participation and market liquidity. Furthermore, institutional investors are increasingly committing funds towards real estate assets, augmenting capital inflows and market appeal.

United States Real Estate Market Trends:

Rise of Adaptive Reuse and Office Conversions

The increasing adoption of remote and hybrid work models is accelerating the adaptive reuse, a key aspect of the emerging trends in real estate in the United States, particularly in urban areas experiencing high office vacancies. Developers are actively converting underutilized office buildings into residential, mixed-use, or hospitality properties to meet changing market demands. Notably, on November 25, 2024, CBRE reported a 63% increase in U.S. office conversion projects, reaching 103 in 2024, up from 2023. Office-to-multifamily conversions accounted for 75% of Q3 projects, rising from 63% in Q1. High office vacancy rates and declining asset values are key drivers of this trend, with further expansion expected as cities implement incentives, and distressed properties enter the market at steeper discounts. This transformation is particularly evident in cities with struggling Class B and C office buildings. Additionally, adaptive reuse supports sustainability by minimizing construction waste and reducing carbon footprints, aligning with government tax incentives and zoning reforms that encourage efficient space utilization.

Expansion of Single-Family Build-to-Rent (BTR) Communities

A rising affordability gap in homeownership fuels demand for single-family build-to-rent communities across the United States. Institutional investors and real estate developers are rapidly expanding their presence in the sector to satisfy renters seeking a suburban lifestyle but without the costs of ownership. For instance, on July 25, 2024, AVANTA Residential launched a preferred equity program that will support BTR developments, acquisitions, and recapitalizations. Amid high interest rates, AVANTA aims to help sponsors secure capital. Backed by Hunt Companies and Invesco Real Estate, AVANTA leverages its expertise in BTR investments to create successful real estate opportunities across the U.S. BTR communities offer modern amenities, professional property management, and flexible leasing options, making them attractive to young professionals, families, and retirees. This trend is particularly prevalent in high-growth Sun Belt states, where demand for quality rental housing continues to rise. With fluctuating mortgage rates and persistent housing shortages, the United States real estate market outlook suggests substantial expansion in the BTR sector, positioning it as a key driver in shaping the future of suburban rental markets.

Rapid Integration of Artificial Intelligence (AI)

Artificial intelligence (AI) is becoming progressively dependent in the market, streamlining operations across residential and commercial sectors. AI-powered platforms enhance property valuations, predictive analytics, and automated transactions, improving efficiency and decision-making. Real estate firms leverage AI-driven chatbots for customer service, virtual property tours for enhanced remote viewing, and machine learning models for investment risk assessment. Additionally, AI optimizes property management through predictive maintenance and energy efficiency solutions, thereby strengthening the United States real estate market demand. For example, on April 30, 2024, Realeflow introduced Leadflow AI Agent, an AI-driven lead generation system for real estate salespeople and brokers. Using predictive analytics, it identifies motivated home sellers 90–180 days before listing, reducing marketing costs and increasing efficiency. As AI advancements continue, integration into real estate operations is expected to become standard, fostering greater transparency, lowering operational costs, and improving the experience for investors, buyers, and tenants.

United States Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States real estate market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on property, business, and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

Residential properties play a fundamental role in the expansion of the United States real estate market share, providing housing solutions for a diverse population. The sector encompasses single-family homes, condominiums, and multifamily apartments, catering to buyers, renters, and investors. The increasing affordability gap has led to a rise in build-to-rent (BTR) communities, allowing individuals to enjoy suburban living without the financial burden of homeownership. Additionally, residential real estate serves as a significant investment avenue, with institutional investors and developers capitalizing on rental demand. Government policies, mortgage rates, and demographic shifts influence this sector, making it a key driver of economic growth and urban development.

Commercial properties are crucial for business operations and economic expansion, encompassing office spaces, retail centers, hotels, and mixed-use developments. The rise of adaptive reuse and office conversions reshaped urban landscapes as high office vacancy rates prompt developers to repurpose properties into residential or hospitality spaces. Retail properties are changing with e-commerce growth, emphasizing experiential shopping and omnichannel strategies. Meanwhile, the hospitality sector continues to recover from pandemic disruptions, fueled by business and leisure travel. Commercial real estate investments remain attractive due to long-term lease agreements, ensuring steady returns for investors in a dynamic market.

Industrial properties are an essential component of the United States market, driven by the growth of e-commerce, logistics, and manufacturing industries. Warehouses, distribution centers, and fulfillment hubs have become increasingly valuable, with demand for last-mile delivery infrastructure rising. Institutional investors are heavily investing in industrial assets due to their strong performance and high rental yields. The sector also benefits from advancements in automation and AI-driven supply chain optimization, further increasing efficiency. As global supply chains shift, industrial real estate will continue expanding, reinforcing its importance in supporting domestic production, trade, and economic resilience across the United States.

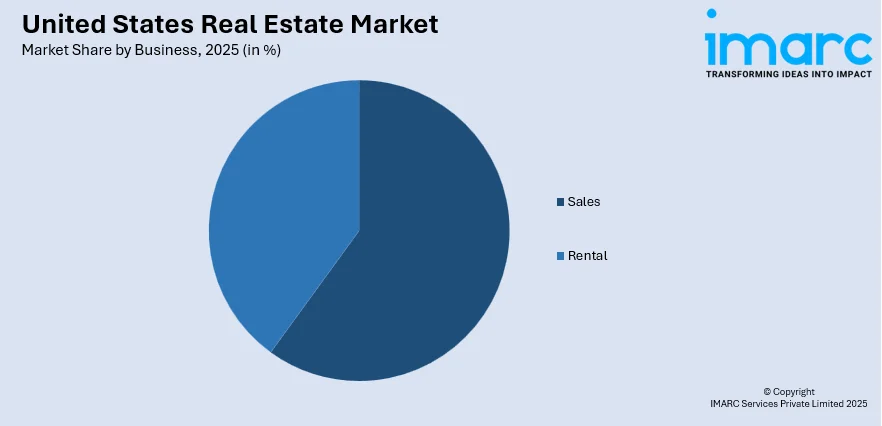

Analysis by Business:

To get detailed segment analysis of this market Request Sample

- Sales

- Rental

Sales transactions are a crucial component of the market, driving economic activity and wealth creation. Residential home sales, influenced by mortgage rates, housing supply, and demographic trends, enable property ownership, which remains a cornerstone of financial stability for many Americans. The commercial and industrial property sectors also rely on sales transactions, where investors seek income-generating assets with long-term appreciation potential. Additionally, institutional investors and real estate firms actively engage in acquisitions to expand their portfolios, capitalizing on market trends. The sales market is highly cyclical, responding to interest rate fluctuations, economic conditions, and regulatory policies.

The rental business plays a pivotal role in providing flexible housing and commercial space solutions, particularly as homeownership becomes less attainable for many due to rising prices and borrowing costs. Build-to-rent (BTR) communities are expanding to meet the growing demand for high-quality rental housing, while multifamily properties continue to attract investors seeking stable rental income. In commercial real estate, office, retail, and industrial properties generate revenue through long-term lease agreements, ensuring steady cash flow for landlords. The rental market’s resilience, even during economic downturns, underscores its importance in United States real estate market stability and investment growth.

Analysis by Mode:

- Online

- Offline

Online platforms have revolutionized the industry, enhancing accessibility, efficiency, and transparency for buyers, sellers, and investors. Digital tools, including AI-driven listing platforms, virtual property tours, and predictive analytics, enable users to render informed decisions with greater ease. Lead generation software, such as AI-powered predictive models, helps agents identify motivated sellers early, improving sales efficiency. E-commerce-style marketplaces facilitate seamless transactions, while blockchain technology enhances security in property dealings. Online platforms also empower remote investors, broadening market reach beyond geographic limitations. As technology advances, the digital transformation of real estate will continue to drive innovation and market efficiency.

Offline real estate transactions remain fundamental, particularly in high-value commercial and residential deals that require in-person negotiations and property inspections. Physical site visits, open houses, and direct agent interactions provide buyers with tangible insights that digital platforms cannot fully replicate. Traditional real estate networks, including brokerage firms and real estate exhibitions, play a vital role in building trust and fostering relationships among stakeholders. Offline transactions are also essential for legal and regulatory processes, requiring face-to-face interactions for contract signings and due diligence. Despite digital advancements, the United States market for real estate continues to rely on offline engagement to ensure transaction security and buyer confidence.

Region Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is a critical hub in the United States real estate industry, characterized by high property values, dense urban centers, and strong demand for commercial and residential properties. Cities like New York, Boston, and Philadelphia attract institutional investors due to their economic stability and business-friendly environments. The Northeast’s real estate sector benefits from well-established infrastructure, prestigious educational institutions, and corporate headquarters driving employment. The demand for mixed-use developments and adaptive reuse projects is rising as cities seek to modernize aging properties and accommodate shifting residential and commercial needs.

The Midwest region offers affordability and steady growth, making it a desirable market for investors and homebuyers alike. Cities like Chicago, Minneapolis, and Columbus serve as economic hubs, supporting diverse real estate opportunities. The region’s lower cost of living and business-friendly policies attract companies and residents seeking stability. Industrial real estate thrives in the Midwest, with major logistics and manufacturing centers driving demand for warehouses and distribution facilities. Additionally, the rise of build-to-rent (BTR) communities is reshaping suburban housing markets as affordability challenges impact homeownership rates, increasing the appeal of well-managed rental properties in growing metropolitan areas.

The South region is experiencing rapid expansion in the market, fueled by population growth, corporate relocations, and economic diversification. States like Texas, Florida, and Georgia attract businesses with low taxes and pro-development policies, leading to increased demand for residential and commercial properties. The Sun Belt continues to see high migration rates, further augmenting single-family build-to-rent (BTR) communities and multifamily developments. Additionally, industrial real estate is expanding, supported by e-commerce growth and supply chain improvements. The region’s affordability, strong job market, and warm climate render it a dominant force in shaping the future of real estate investments.

Competitive Landscape:

The United States real estate market remains highly competitive, driven by diverse players across residential, commercial, and industrial segments. Large institutional investors, including REITs and private equity firms, dominate high-value properties, leveraging capital inflows and technological advancements. PropTech companies are reshaping traditional brokerage models with AI-driven analytics and digital transactions. Leading real estate developers integrate sustainable designs and mixed-use projects to align with shifting consumer preferences. To illustrate, on May 29, 2024, CBRE reported that U.S. cities can revitalize urban cores by strengthening vibrant mixed-use districts. CBRE identified 68 such districts in 19 markets, with 43.5 million sq. ft. of office space viable for conversion. Financial institutions play a crucial role by offering mortgage solutions and investment vehicles, while fluctuating interest rates, regulatory policies, and economic conditions intensify competition, pushing firms toward innovation.

The report provides a comprehensive analysis of the competitive landscape in the United States real estate market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2025: Fractional Syndication LLC (New York) launched The Investors Pool, a blockchain-based tokenization platform allowing U.S. and international investors to acquire fractional ownership of real-estate assets starting at ~$100. The platform operates under U.S. Reg D and Reg S frameworks. This launch highlights fintech-real estate convergence and democratized property investment.

- December 2, 2024: Compass Inc., Christie's International Real Estate, and @properties unveiled a strategic partnership to expand domestic and international growth. Compass will grow Christie's affiliate network, while @properties retains its independent branding. The deal includes title, mortgage, and lead-generation services, aligning with Compass’s strategy to enhance high-margin offerings in real estate services.

- October 29, 2024: Invesco Real Estate announced USD 958 Million in Q3 loan obligations across 11 U.S. floating-rate senior loans and one European loan. Total U.S. loan commitments reached IUSD 1.7 Billion across 24 loans. Notable deals include industrial, multifamily, and self-storage properties. Invesco has committed USD 16 Billion in North American real estate loans since 2017.

- October 3, 2024: Azora and Advenir announced a USD 3 Billion collaboration to combat the U.S. housing crisis. The new firm, Advenir Azora, aims to develop 10,000 single-family rental houses as well as acquire 5,000 existing buildings. Combining Azora’s capital strength with Advenir’s expertise, the partnership targets high-demand markets amid favorable investment conditions.

- August 29, 2024: MCI USA announced a partnership with the National Association of REALTORS® (NAR) to propel non-dues revenue and manage display halls at NAR events. Starting January 1, 2025, MCI USA will enhance vendor engagement and optimize event experiences, supporting NAR’s mission to empower 1.5 million real estate professionals.

- April 15, 2024: Janus Henderson Investors announced an alliance with Forum Investment Group to promote the Forum Real Estate Income Fund. The Fund targets high-income, low-volatility real estate private credit and debt investments. This collaboration enhances investor access to institutional real estate debt opportunities, expanding Janus Henderson’s distribution and client service capabilities.

United States Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States real estate market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States real estate market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States real estate market was valued at USD 1.8 Trillion in 2025.

The market in the United States is growing due to adaptive reuse and office conversions, expansion of single-family build-to-rent (BTR) communities, and the integration of artificial intelligence (AI). Changing demographics, hybrid work models, senior housing demand, PropTech innovations, real estate crowdfunding, institutional investments, and government incentives also contribute to market expansion and resilience.

The United States real estate market is projected to reach a value of USD 2.3 Trillion by 2034, growing at a CAGR of 2.98% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)