United States Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033

United States Supercapacitor Market Size and Share:

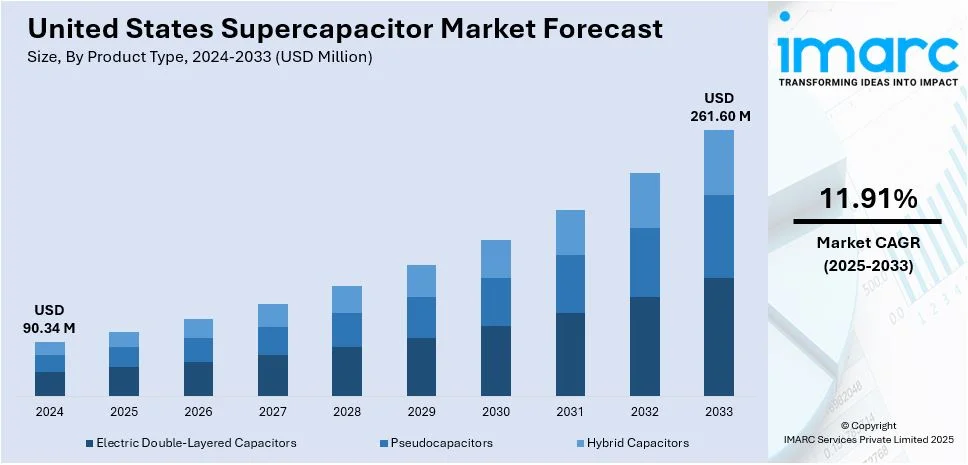

The United States supercapacitor market size was valued at USD 90.34 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 261.60 Million by 2033, exhibiting a CAGR of 11.91% from 2025-2033. The market is primarily driven by the growing demand for efficient and rapid energy storage solutions across various sectors, especially electric vehicles (EVs), renewable energy, and consumer electronics. Supercapacitors offer advantages like fast charging, high power density, and long cycle life, making them ideal for applications requiring quick bursts of energy. Additionally, increasing investments in clean energy technologies and advancements in materials like graphene are aiding the United States supercapacitor market share by improving supercapacitor performance and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 90.34 Million |

| Market Forecast in 2033 | USD 261.60 Million |

| Market Growth Rate 2025-2033 | 11.91% |

The increasing adoption of EVs and hybrid systems is a major driver for the U.S. supercapacitor market. Supercapacitors complement lithium-ion batteries by delivering quick bursts of energy during acceleration and efficiently capturing energy during regenerative braking. This reduces battery stress, enhances vehicle performance, and extends battery lifespan. As automakers focus on improving EV efficiency and durability, supercapacitors become crucial components in energy management systems. Government incentives promoting clean transportation also accelerate EV adoption, driving demand for advanced energy storage technologies like supercapacitors that support faster charging and higher power output.

Material science breakthroughs, particularly in graphene and hybrid supercapacitor technologies, are fueling rapid growth in the U.S. market by delivering greater energy density, quicker charge/discharge cycles, and better durability at lower prices. All these innovations overcome conventional constraints, and supercapacitors become viable for applications from renewable energy storage to consumer electronics. Better manufacturing techniques now provide for scalable and affordable production, further accelerating adoption. Accelerating this development, in 2024, the U.S. Department of Energy's Advanced Materials and Manufacturing Technologies Office invested more than $25 million in the advancement of revolutionary battery material and technology, such as supercapacitors. The investment speeds up research and commercialization, augmenting the U.S. leadership in advanced energy storage and creating market growth in a variety of industries.

United States Supercapacitor Market Trends:

Integration with Electric Vehicles and Hybrid Energy Storage

Supercapacitors are becoming critical in EVs and hybrid energy storage systems by allowing high-rate energy capture under regenerative braking and delivering instant power bursts for acceleration. This minimizes battery stress, prolongs battery lifespan, and enhances overall vehicle efficiency and reliability. Car manufacturers and technology companies in the United States are investing heavily in supercapacitor development to enable cleaner, greener transportation. Supporting these initiatives, the United States. Department of Energy's Critical Material Innovation Program supports research into graphene-carbon nanotube hybrids, targeting a reduction in production costs by 40% by 2030. Supercapacitor efficiency and affordability will be improved through this innovation, driving application at a faster pace and supporting overall government and industry initiatives to support electric mobility and advanced energy storage technologies.

Advances in Graphene-Based and Hybrid Supercapacitors

Emerging trends in graphene-based and hybrid supercapacitors are pushing the limits of energy storage performance. Graphene's high conductivity and surface area allow supercapacitors to charge and discharge energy more effectively, and hybrid approaches merge the advantages of battery and capacitor in optimum power and energy density. These are targeting a range of applications, from energy storage for renewable energy to handheld electronics, by enhancing charge rate, lifespan, and affordability. Partnerships between U.S. businesses and research organizations are speeding developments in this area, propelling the commercialization of these new materials and technologies. The trend represents a shift toward more diverse, high-performance energy storage solutions that can address a variety of industrial applications.

Growth in Consumer Electronics and IoT Applications

Supercapacitors are more and more widely used in consumer devices and Internet of Things (IoT) devices because they can provide instant energy bursts and extend device battery life. Supercapacitors assist smartphones, wearables, smart home devices, and other portable devices in faster charging times and better power management. Because consumers demand more battery life and instant response from devices, companies are using supercapacitors to ensure that these demands are met. This is part of a larger market trend towards smarter, more efficient consumer electronics. The expansion of IoT and connected devices continues to drive demand for supercapacitors, making them essential components for powering next-generation devices with little downtime.

United States Supercapacitor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States supercapacitor market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product type, module type, material type, and end use industry.

Analysis by Product Type:

- Electric Double-Layered Capacitors

- Pseudocapacitors

- Hybrid Capacitors

According to the United States supercapacitor market forecast, the electric double-layered capacitors (EDLCs) store energy through electrostatic charge separation without chemical reactions, offering high power density and rapid charge/discharge cycles. They have a long lifespan and are ideal for applications needing quick energy bursts, such as regenerative braking and backup power systems, but typically have lower energy density.

Besides this, the pseudocapacitors use fast and reversible redox reactions to store energy, providing higher energy density than EDLCs. They offer a balance between battery-like storage and capacitor speed, making them suitable for applications requiring moderate energy and power. However, they often have a shorter cycle life compared to EDLCs.

Furthermore, the hybrid capacitors combine features of EDLCs and batteries, offering improved energy and power densities. They use asymmetrical electrodes to deliver better charge capacity and efficiency. Ideal for EVs and portable electronics, hybrid capacitors provide a compromise between high power, long life, and enhanced energy storage performance.

Analysis by Module Type:

- Less than 25V

- 25-100V

- More than 100V

Supercapacitor modules with less than 25V are commonly used in low-power applications like small consumer electronics, IoT devices, and backup systems. They provide quick energy delivery in compact systems, supporting functions like memory protection and short-duration power support without the need for complex energy management.

Additionally, the modules in the 25–100V range serve mid-range power applications such as industrial automation, grid energy support, and certain automotive systems. They offer a balance between voltage capacity and energy output, making them versatile for moderate energy storage needs where reliability and fast cycling are essential.

Apart from this, the high-voltage modules above 100V are used in demanding applications like EVs, heavy machinery, and renewable energy systems. These modules provide robust energy and power output, supporting high-performance requirements such as regenerative braking, load leveling, and system stabilization over extended operating cycles.

Analysis by Material Type:

- Carbon and Metal Oxide

- Conducting Polymer

- Composite Materials

Based on the United States supercapacitor market outlook, the carbon and metal oxide materials are widely used in supercapacitors for their excellent conductivity and stability. Carbon offers high surface area for charge storage, while metal oxides provide pseudocapacitive behavior, enhancing energy density. This combination is ideal for applications requiring long cycle life and high power output.

In line with this, the conducting polymers offer fast charge transport and high capacitance due to their redox-active properties. They're lightweight and flexible, making them suitable for compact and wearable electronics. However, they typically have lower cycle life and stability compared to other materials, limiting their use in long-term, high-performance applications.

Moreover, the composite materials blend properties of carbon, metal oxides, and polymers to optimize performance. They aim to improve energy density, conductivity, and mechanical strength. These materials are tailored for specific applications requiring balanced characteristics, offering a versatile solution for advanced supercapacitor development in automotive, aerospace, and grid systems.

Analysis by End Use Industry:

.webp)

- Automotive and Transportation

- Consumer Electronics

- Power and Energy

- Healthcare

- Others

Supercapacitors in automotive applications support regenerative braking, engine start-stop systems, and electric vehicle power boosts. Their fast charging and long cycle life improve energy efficiency and system durability. They're increasingly integrated into hybrid and EVs to enhance performance and reduce reliance on conventional batteries.

Concurrently, in consumer electronics, supercapacitors enable quick charging, backup power, and extended device life. Used in smartphones, wearables, and cameras, they support energy-demanding functions like flash operation and memory retention. Their small size and reliability make them ideal for compact, high-performance electronic devices with frequent power cycling needs.

Additionally, the supercapacitors stabilize energy supply in renewable energy systems and smart grids. They provide rapid power delivery, voltage regulation, and load balancing. Ideal for wind and solar integration, they complement batteries by handling short-term energy fluctuations, improving system reliability and responsiveness during demand surges or outages.

Moreover, in healthcare, supercapacitors power portable and emergency medical equipment, such as defibrillators and infusion pumps. Their fast response, reliability, and long cycle life are critical in life-saving devices. They ensure uninterrupted operation and quick recharging, making them valuable in settings where consistent power is vital.

Besides this, the other applications include aerospace, military, and industrial automation. In these sectors, supercapacitors provide backup power, energy recovery, and operational stability under extreme conditions. Their durability and rapid energy delivery support systems requiring resilience, such as satellites, drones, robotics, and uninterruptible power supplies in mission-critical environments.

Breakup by Region:

- Northeast

- Midwest

- South

- West

The Northeast region sees supercapacitor demand driven by advanced research and development (R&D) institutions and a strong presence of electronics and medical device industries. Urban infrastructure projects and smart city initiatives also support adoption, particularly for grid energy management and backup power in dense metropolitan areas like New York and Boston.

Also, the Midwest, industrial automation, automotive manufacturing, and renewable energy projects drive supercapacitor usage. The region’s strong automotive base, especially in states like Michigan and Ohio, supports demand for energy-efficient vehicle systems. Supercapacitors also assist in stabilizing energy flows in wind-rich areas across the Great Plains.

Along with this, the South benefits from robust growth in consumer electronics manufacturing, aerospace, and energy sectors. States like Texas and Florida see increasing use of supercapacitors in grid stabilization, EVs, and industrial applications. Favorable climate for solar energy also promotes integration with supercapacitor-based storage systems for enhanced efficiency.

Furthermore, the West leads in clean technology adoption, with California at the forefront of electric vehicle deployment and renewable energy integration. Supercapacitors are used extensively in energy storage, EV infrastructure, and tech innovation hubs. The region’s strong emphasis on sustainability and advanced technology fuels United States supercapacitor market growth.

Competitive Landscape:

The competitive environment of the U.S. supercapacitor market is marked by aggressive innovation, technological evolution, and strategic partnerships. Players are intent on manufacturing high-performance, affordable, and scalable energy storage technology to address increasing needs across industries such as automotive, electronics, and renewable energy. The industry is fueled by ongoing (R&D) efforts to improve energy density, charge/discharge capability, and lifecycle strength. Competitive tactics comprise collaborations with research centers, patent creation, and growth in evolving applications like IoT and intelligent infrastructure. With the growth in demand for clean power and optimal power systems, competition is on the rise, with companies competing on the basis of material innovation, performance, and flexibility of integration for various end-use applications.

The report provides a comprehensive analysis of the competitive landscape in the United States supercapacitor market with detailed profiles of all major companies, including:

- Cornell Dubilier Electronic

- Ioxus

- Kemet Corporation

- Kyocera AVX Components Corporation

Latest News and Developments:

- March 2025: Clarios announced a USD 6 billion plan to strengthen U.S. manufacturing and critical mineral supply chains, focusing on advanced battery production, including supercapacitors, and recycling. The strategy aims to reduce reliance on imports, create jobs, and enhance energy independence through innovations in energy storage and critical minerals processing.

- March 2025: NVIDIA unveiled the GB300 server, set for launch in the second half of 2025, featuring a lithium-ion supercapacitor for stable power supply in AI and cloud computing servers. The supercapacitor offers high power density, rapid charging, and discharging capabilities, driving demand in the supercapacitor market.

- February 2025: Abracon launched the ADCH-S05R5S series supercapacitor, featuring advanced EDLC technology for high energy and power density. With a minimal discharge rate and excellent cycle life, it is ideal for applications like power assist circuits, IoT energy harvesting, and SSD power backup, while meeting RoHS standards.

- January 2025: Clarios secured its first OEM deal to supply supercapacitors for 12-volt and 48-volt electrical systems in passenger vehicles. The technology, designed for high-power bursts, is also being developed for heavy-duty commercial vehicles, with discussions underway with manufacturers for future applications in the sector.

- November 2024: NETL researchers developed a low-cost process to convert coal tar pitch into high-quality graphene, enhancing supercapacitor performance by up to 55%. This breakthrough addresses the challenge of large-scale, affordable graphene production, improving supercapacitor efficiency for energy storage systems used in renewable power and uninterruptible power sources.

United States Supercapacitor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Double-Layered Capacitors, Pseudocapacitors, Hybrid Capacitors |

| Module Types Covered | Less than 25V, 25-100V, More than 100V |

| Material Types Covered | Carbon and Metal Oxide, Conducting Polymer, Composite Materials |

| End Use Industries Covered | Automotive and Transportation, Consumer Electronics, Power and Energy, Healthcare, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Cornell Dubilier Electronic, Ioxus, Kemet Corporation, Kyocera AVX Components Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States supercapacitor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States supercapacitor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States Supercapacitor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States supercapacitor market was valued at USD 90.34 Million in 2024.

The United States supercapacitor market is projected to exhibit a CAGR of 11.91% during 2025-2033, reaching a value of USD 261.60 Million by 2033.

Key factors driving the U.S. supercapacitor market include rising demand for efficient energy storage, growth in EVs, and advancements in renewable energy systems. Increasing adoption in consumer electronics and industrial automation, along with innovations in materials like graphene, also contribute to enhanced performance and broader application potential.

Some of the major players in the United States supercapacitor market include Cornell Dubilier Electronic, Ioxus, Kemet Corporation, Kyocera AVX Components Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)