United States Tea Market Size, Share, Trends and Forecast by Product Type, Packaging, Distribution Channel, Application, and Region, 2026-2034

United States Tea Market Summary:

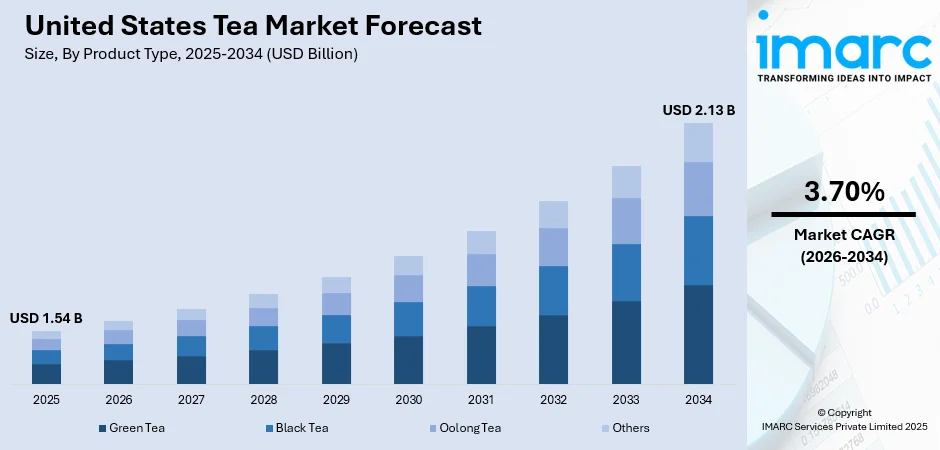

The United States tea market size was valued at USD 1.54 Billion in 2025 and is projected to reach USD 2.13 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034.

The United States tea market is experiencing sustained growth driven by increasing health awareness among consumers seeking natural and functional beverage alternatives. Tea consumption is gaining momentum as consumers shift away from sugary carbonated drinks toward beverages offering antioxidant properties and wellness benefits. The market is characterized by diverse product offerings spanning traditional black and green teas to herbal infusions and ready-to-drink formats. Demographic shifts, particularly growing interest among millennials in specialty tea varieties, combined with expanding retail availability and premiumization trends, are strengthening the United States tea market share.

Key Takeaways and Insights:

-

By Product Type: Black tea dominates the market with a share of 42% in 2025, owing to its robust flavor profile, high caffeine content, and widespread use as the base for both hot and iced tea preparations. Its cultural integration into daily routines continues driving sustained demand across households.

-

By Packaging: Tea bags lead the market with a share of 58% in 2025, reflecting consumer preference for convenience, portion control, and ease of preparation. The format's compatibility with fast-paced lifestyles ensures consistent adoption across residential and commercial settings.

-

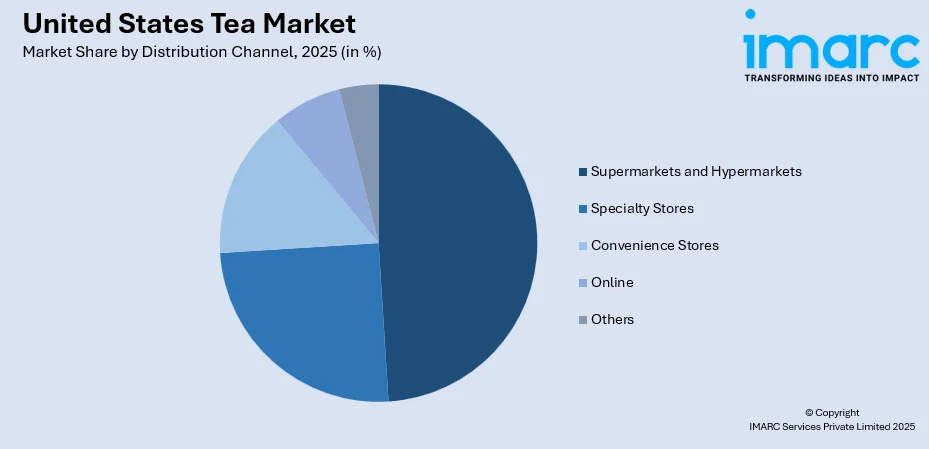

By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with a market share of 49% in 2025, driven by extensive product variety, competitive pricing, and consumer preference for one-stop shopping experiences that facilitate brand comparison and discovery.

-

By Application: Residential dominates the market with a share of 83% in 2025, attributable to increasing at-home consumption patterns, growing awareness of tea's health benefits, and expanding availability of diverse tea varieties through retail channels nationwide.

-

By Region: South is the largest region with 32% share in 2025, driven by the deeply ingrained iced tea culture across southeastern states, favorable climate conditions encouraging year-round cold tea consumption, and established regional manufacturing presence.

-

Key Players: Key players drive the United States tea market by expanding product portfolios, investing in functional and wellness-oriented formulations, and strengthening distribution networks. Their focus on sustainability initiatives, innovative packaging solutions, and strategic acquisitions supports market penetration and brand loyalty across diverse consumer segments.

To get more information on this market Request Sample

The United States tea market continues demonstrating resilience supported by favorable regulatory developments and shifting consumer preferences toward healthier beverage alternatives. Recent regulatory recognition validates tea's position as a health-promoting beverage and is expected to encourage broader consumer adoption across diverse demographic segments. The market benefits from strong domestic demand for both traditional hot tea varieties and ready-to-drink iced tea formats, with iced tea consumption representing the dominant share of overall tea consumption nationwide. Consumer interest in functional beverages offering specific health benefits, including antioxidant properties, digestive support, and stress relief, continues expanding the market's appeal beyond traditional tea enthusiasts to health-conscious demographics seeking natural caffeine alternatives to coffee. Growing awareness of tea's wellness attributes, combined with expanding product availability across retail channels and innovative flavor offerings, positions the category favorably for sustained growth throughout the forecast period.

United States Tea Market Trends:

Rising Consumer Preference for Functional and Wellness Teas

American consumers are increasingly gravitating toward teas offering targeted health benefits beyond basic refreshment. Functional teas formulated with adaptogens, prebiotics, and botanical ingredients are gaining significant traction as consumers seek beverages supporting immunity, digestion, and stress management. This trend aligns with broader wellness movements emphasizing preventive health measures through dietary choices. Tea manufacturers are responding by developing innovative blends incorporating ingredients such as ashwagandha, turmeric, and mushroom extracts to address specific consumer wellness goals and differentiate product offerings in competitive retail environments.

Expansion of Premium and Specialty Tea Segments

Premiumization represents a defining trend in the United States tea market as consumers demonstrate willingness to pay higher prices for quality, origin-specific, and artisanal tea products. Specialty teas with distinctive flavor profiles, organic certifications, and single-origin options are drawing in discriminating customers looking for superior drinking experiences. The proliferation of bubble tea shops in urban areas has exposed younger populations to a variety of tea styles. This premiumization extends across both hot and cold tea categories, supporting overall market value growth despite volume pressures in conventional segments.

Growing Adoption of Sugar-Reduced and Clean Label Products

Consumer awareness regarding sugar intake is reshaping product development strategies across the tea industry. As health-conscious consumers look for alternatives to traditional sweetened beverages, ready-to-drink tea products with reduced sugar, zero sugar, or natural sweetener formulas are gaining market share. Clean label positioning emphasizing natural ingredients, absence of artificial additives, and transparent sourcing practices resonates strongly with consumer values. Manufacturers are reformulating existing products and launching new variants meeting evolving expectations for nutritional transparency and ingredient simplicity.

Market Outlook 2026-2034:

The United States tea market outlook remains positive through the forecast period, supported by sustained consumer interest in health-oriented beverage alternatives and continued product innovation across categories. Evolving consumer preferences toward natural, minimally processed beverages position tea favorably within the broader non-alcoholic beverage landscape. The market generated a revenue of USD 1.54 Billion in 2025 and is projected to reach a revenue of USD 2.13 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034. Expansion will be driven by ongoing premiumization trends, increasing availability through diverse retail and online channels, and growing consumer recognition of tea's functional health benefits supported by favorable regulatory endorsements. Manufacturers will continue investing in flavor innovation, sustainable sourcing practices, and convenient packaging formats to capture emerging consumer segments.

United States Tea Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Black Tea |

42% |

|

Packaging |

Tea Bags |

58% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

49% |

|

Application |

Residential |

83% |

|

Region |

South |

32% |

Product Type Insights:

- Green Tea

- Black Tea

- Oolong Tea

- Others

Black tea dominates with a market share of 42% of the total United States tea market in 2025.

Black tea maintains its leadership position in the United States market owing to its bold flavor characteristics and high caffeine content that appeals to consumers seeking energizing beverage options. The variety serves as the foundational ingredient for the nation's deeply rooted iced tea culture, particularly across southern states where sweetened iced tea consumption remains exceptionally high. Black tea dominates the country's tea import landscape, underscoring its fundamental role in domestic consumption patterns and manufacturing operations. Its robust flavor profile makes it the preferred base for both hot and cold tea preparations across households and foodservice establishments nationwide.

The segment benefits from extensive product availability across ready-to-drink formats, tea bags, and loose-leaf variants that accommodate diverse consumer preferences and preparation methods. Black tea's versatility enables manufacturers to develop innovative flavor combinations and functional formulations while maintaining familiar taste profiles consumers expect. Its established presence in both retail and foodservice channels ensures consistent demand, with brands continuously introducing new products and seasonal offerings to sustain consumer engagement and capture emerging market opportunities.

Packaging Insights:

- Plastic Containers

- Loose Tea

- Paper Boards

- Aluminum Tin

- Tea Bags

- Others

Tea bags lead with a share of 58% of the total United States tea market in 2025.

Tea bags maintain commanding market presence due to their unmatched convenience, consistent brewing quality, and compatibility with American consumer preferences prioritizing speed and simplicity in beverage preparation. The format enables precise portion control while eliminating the perceived complexity associated with loose-leaf tea brewing methods. Research indicates that a significant majority of tea drinkers in the United States prefer tea bags for daily preparation, citing ease of use and minimal cleanup requirements as primary decision factors. The standardized brewing experience provided by tea bags ensures consistent flavor profiles across preparations, appealing to consumers seeking reliable taste experiences.

Consumer adoption of tea bags reflects practical considerations including storage convenience, extended shelf life, and simplified cleanup compared to loose-leaf alternatives. Retail merchandising benefits from standardized packaging dimensions enabling efficient shelf utilization and clear product differentiation. In December 2024, TreeHouse Foods completed its USD 205 Million acquisition of Harris Tea, the largest private-label tea packer in the United States, strengthening manufacturing capabilities and distribution networks for tea bag products. Major brands continually expand flavor portfolios and introduce functional varieties within the tea bag format to maintain consumer engagement.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 49% share of the total United States tea market in 2025.

Supermarkets and hypermarkets serve as primary procurement points for tea products, leveraging extensive shelf space allocation and diverse product assortments to attract consumers seeking variety and value. Major retail chains dedicate significant merchandising resources to tea categories, providing visibility for established brands and emerging products alike. The channel's promotional activities and competitive pricing strategies enhance accessibility while driving trial among consumers exploring new tea varieties. Seasonal promotions and loyalty programs further encourage repeat purchases and brand exploration within these retail environments.

The one-stop shopping convenience offered by supermarkets and hypermarkets aligns with consumer preferences for efficient grocery experiences where tea purchases integrate seamlessly into regular shopping routines. Strategic product placement near complementary categories and checkout areas supports impulse purchases while dedicated tea sections facilitate informed decision-making through clear organization and product information. The channel's established infrastructure for both national brand distribution and private label programs ensures comprehensive category coverage meeting diverse consumer requirements across price points and quality tiers, making supermarkets and hypermarkets indispensable distribution partners for tea manufacturers nationwide.

Application Insights:

- Residential

- Commercial

Residential represents the leading segment with 83% share of the total United States tea market in 2025.

The residential segment dominates United States tea consumption reflecting widespread household adoption of tea as a daily beverage choice supporting health and wellness objectives. At-home tea preparation has strengthened as consumers increasingly prioritize homemade beverages over out-of-home purchases, a trend accelerated by lifestyle changes emphasizing domestic comfort and cost consciousness. American households across diverse demographic groups have embraced tea as a staple beverage, incorporating it into regular daily routines and wellness practices. The convenience of preparing tea at home allows consumers to customize brewing strength, sweetness levels, and flavor profiles according to individual preferences.

Expanding retail availability of premium and specialty tea products enables residential consumers to access quality previously limited to specialized establishments. The proliferation of single-serve formats and convenient packaging solutions addresses household preferences for quick preparation without sacrificing quality. Growing awareness of tea's health benefits, including antioxidant properties and hydration support, encourages increased consumption frequency within residential settings where consumers exercise greater control over ingredient selection and preparation methods aligned with personal wellness goals.

Regional Insights:

- Northeast

- Midwest

- South

- West

South dominates the market with a share of 32% of the total United States tea market in 2025.

The South region leads United States tea consumption driven by deeply entrenched iced tea traditions that distinguish southeastern states from other regions nationwide. Sweetened iced tea serves as a cultural staple across the region, consumed year-round with significant volume consumption during warm weather months extending through much of the calendar year. The favorable climate conditions throughout the South encourage consistent cold beverage consumption, reinforcing tea's position as a preferred refreshment choice among regional consumers. Hospitality traditions further embed iced tea into social gatherings, family meals, and restaurant dining experiences across southern communities.

The region hosts major tea manufacturing and distribution operations, including recent investments such as Milo's Tea Company's USD 53 Million expansion of its Spartanburg County, South Carolina facility announced in November 2024, creating additional production capacity to meet growing regional and national demand. This established manufacturing infrastructure, combined with strong cultural affinity for tea beverages and proximity to key distribution networks, positions the South region as the dominant contributor to overall United States tea market consumption throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the United States Tea Market Growing?

Increasing Health Consciousness and Wellness-Oriented Consumer Behavior

Growing consumer awareness regarding the health benefits associated with tea consumption represents a primary driver of market expansion in the United States. Tea's natural antioxidant properties, presence of beneficial compounds including polyphenols and flavonoids, and association with cardiovascular health and weight management resonate strongly with health-conscious demographics. Consumers increasingly recognize tea as a functional beverage supporting mental clarity, digestive wellness, and immune function without artificial additives. This health positioning enables tea to capture demand shifting away from sugar-laden carbonated beverages and energy drinks toward natural alternatives.

Regulatory Recognition Supporting Tea's Health Positioning

Favorable regulatory developments are strengthening tea's market position as a recognized health-promoting beverage choice. Recent government initiatives establishing updated nutritional labeling criteria have enabled qualifying tea products to display health-related claims on packaging, enhancing consumer awareness of tea's wellness attributes. This official recognition by federal health authorities validates tea's nutritional profile and is expected to influence consumer purchasing decisions at retail locations nationwide. The regulatory acknowledgment reinforces tea's positioning as a naturally beneficial beverage aligned with dietary guidelines promoting healthier consumption patterns. These developments provide tea manufacturers with enhanced marketing opportunities and position the category advantageously relative to competing beverages unable to meet stringent health claim requirements. As consumers increasingly rely on packaging claims to guide purchasing decisions, regulatory support strengthens tea's competitive standing within the broader beverage landscape.

Product Innovation and Diversification Across Tea Categories

Continuous product innovation across tea segments drives market growth by expanding consumer appeal and addressing evolving preferences. Manufacturers are developing novel formulations incorporating functional ingredients, unique flavor combinations, and convenient formats that attract new consumers while encouraging increased consumption among existing tea drinkers. Ready-to-drink tea products featuring zero sugar, natural sweeteners, and clean label positioning capture health-conscious demand within the convenience-oriented beverage segment. Premium and specialty tea offerings including single-origin varieties, organic certifications, and artisanal blends support premiumization trends contributing to market value growth. The expansion of bubble tea establishments and innovative tea-based beverages introduces younger demographics to tea consumption, cultivating long-term market participation.

Market Restraints:

What Challenges the United States Tea Market is Facing?

Intense Competition from Coffee and Alternative Beverages

The United States tea market faces persistent competitive pressure from deeply entrenched coffee culture and expanding alternative beverage categories. Coffee maintains dominant positioning in American daily routines and workplace consumption patterns. Energy drinks, functional waters, and specialty coffee beverages compete directly for health-conscious consumer attention, potentially limiting tea market share expansion.

Import Dependency and Supply Chain Vulnerabilities

The United States relies heavily on imported tea with minimal domestic commercial production, creating exposure to international supply chain disruptions and pricing volatility. Tariff policies affecting major tea-producing countries including China, India, and Sri Lanka impact import costs. Currency fluctuations, shipping constraints, and geopolitical factors can influence product availability and pricing stability across market segments.

Price Sensitivity and Economic Pressures on Consumer Spending

Economic uncertainty and inflationary pressures influence consumer purchasing decisions, potentially constraining premium tea segment growth. Price-sensitive consumers may reduce discretionary spending on specialty tea products or trade down to value-oriented alternatives. Market data indicates volume declines despite dollar sales growth, suggesting unit price increases may limit consumption expansion among budget-conscious households.

Competitive Landscape:

The United States tea market exhibits a moderately consolidated competitive landscape with established multinational corporations competing alongside regional specialists and emerging brands. Major players maintain market presence through extensive distribution networks, brand recognition, and diversified product portfolios spanning multiple tea categories. Competition intensifies around product innovation, health-focused positioning, and sustainability initiatives as manufacturers seek differentiation in crowded retail environments. Strategic acquisitions are reshaping industry structure as companies pursue vertical integration and category expansion. Private label offerings from major retailers present competitive pressure while creating opportunities for contract manufacturing partnerships.

United States Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Green Tea, Black Tea, Oolong Tea, Others |

| Packagings Covered | Plastic Containers, Loose Tea, Paper Boards, Aluminium Tin, Tea Bags, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States tea market size was valued at USD 1.54 Billion in 2025.

The United States tea market is expected to grow at a compound annual growth rate of 3.70% from 2026-2034 to reach USD 2.13 Billion by 2034.

Black tea dominated the market with a share of 42%, owing to its robust flavor profile, high caffeine content, and widespread use as the base for iced tea preparations across the United States.

Key factors driving the United States tea market include increasing health consciousness among consumers, favorable regulatory developments including FDA's "healthy" label designation, growing demand for functional beverages, premiumization trends, and expanding retail distribution channels.

Major challenges include intense competition from coffee and alternative beverages, import dependency creating supply chain vulnerabilities, tariff impacts on tea-sourcing countries, price sensitivity among consumers, and economic pressures affecting discretionary spending on premium tea products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)