United States Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

United States Used Car Market Size and Share:

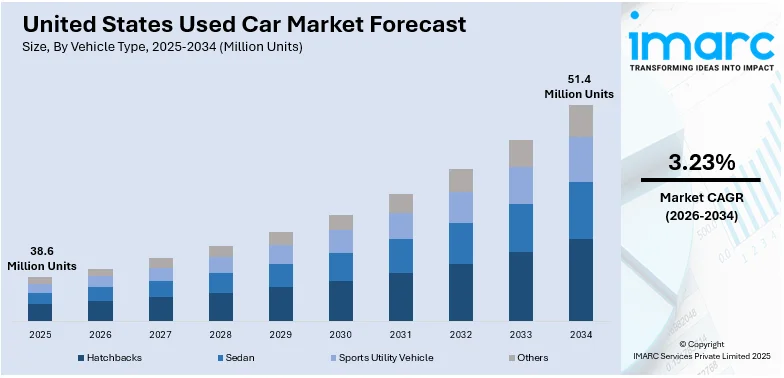

The United States used car market size reached 38.6 Million Units in 2025. Looking forward, IMARC Group estimates the market to reach 51.4 Million Units by 2034, exhibiting a CAGR of 3.23% from 2026-2034. The market is primarily driven by the growth of certified pre-owned programs offering reliability, rising demand for eco-friendly electric and hybrid vehicles, and the increasing expansion of online marketplaces providing transparent, convenient buying experiences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

38.6 Million Units |

|

Market Forecast in 2034

|

51.4 Million Units |

| Market Growth Rate (2026-2034) | 3.23% |

Access the full market insights report Request Sample

The market in the United States is primarily fueled by the growing cost-consciousness among consumers, with buyers seeking value over new vehicle purchases amid economic uncertainties and inflation. Furthermore, continual technological advancements, such as vehicle history reports and online platforms, enhance transparency and buyer confidence. Bumper.com’s Smart Insights, launched on June 12, 2024, uses generative AI to analyze vehicle history, offering crucial data on accidents, maintenance records, and mileage, simplifying research for consumers. Certified pre-owned programs provide warranties and reliability, further boosting appeal. Additionally, the increasing availability of fuel-efficient and hybrid models supports sustainability-focused buyers, making eco-friendly vehicles a growing segment in the market and addressing both economic and environmental concerns.

To get more information on this market Request Sample

In addition to this, rapid digitalization of the used car market is driving growth, with various platforms offering seamless purchasing experiences, including transparent pricing, financing options, and delivery. Trade-in programs by dealerships and digital platforms simplify the selling process, augmenting market supply. Additionally, modern vehicles are demonstrating exceptional durability and longevity, making them increasingly suitable for extended use while maintaining performance and reliability. Furthermore, the growing demand for SUVs and trucks for family and recreational purposes further strengthens the market.

United States Used Car Market Trends:

Rise of Certified Pre-Owned Programs

Certified pre-owned (CPO) programs are increasingly popular in the United States used car market, offering enhanced trust and quality assurance to cost-conscious buyers. These programs ensure rigorous inspections, extended warranties, and reliable performance, providing value without compromising quality. For example, Kia’s CPO program, launched on July 10, 2024, guarantees peace of mind with a 149-point inspection, comprehensive powertrain warranty, 24/7 roadside assistance, and a detailed vehicle history report. Additional perks include a 30-day/2,000 km exchange privilege, attractive financing options, travel breakdown coverage, and rental car reimbursement, augmenting customer satisfaction. Automakers and dealerships are investing heavily in CPO initiatives to increase buyer confidence and stand out in the competitive market. With access to modern vehicles equipped with advanced safety and infotainment features, CPO programs cater to younger buyers seeking dependable, feature-rich options at competitive prices.

Growing Focus on Electric and Hybrid Vehicles

The United States used car market is experiencing a growing demand for electric and hybrid vehicles, mainly prompted by heightened environmental awareness along with rising fuel costs. As per an article by U.S. Energy Information Administration, for 2Q24, electric and hybrid sales constitute 18.7 per cent of light-duty vehicle sales where year-over-year hybrid sales rose up by 30.7 per cent, to comprise 9.6 per cent of the market share. Battery electric vehicles sales were led by luxury cars, accounting for 73.8 per cent of this area and 32.8 per cent of all luxury sales. The rise in the array of used green models, augmented by federal incentives and clean energy strategies, is redefining the landscape. Ongoing technological improvements for the battery itself, increased warranties, and better infrastructure have all helped consumer acceptance of a used electric and hybrid battery model. This trend fits with the sustainability goals and is therefore attractive to the eco-conscious buyer, thus propelling growth in the eco-friendly part of the used car market.

Rapid Expansion of Online Marketplaces

Online platforms are revolutionizing the used car market by providing convenient, transparent, and streamlined purchasing experiences. Companies offer end-to-end solutions, including financing, trade-ins, and vehicle delivery, enabling consumers to access extensive inventories and compare prices nationwide. Advanced tools such as virtual car tours, AI-driven insights, and history reports enhance transparency and build trust. For instance, on January 17, 2024, Vay launched its teledriving mobility service in Las Vegas. This innovative service allows users to book cost-effective, per-minute electric car rentals via an app, with a teledriver remotely delivering the vehicle for hassle-free journeys. Vay’s safety-certified technology highlights the growing integration of digital tools in mobility services. This shift caters to tech-savvy buyers seeking minimal in-person interactions, reshaping consumer behavior and modernizing the used car market significantly.

United States Used Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States used car market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type, vendor type, fuel type, and sales channel.

Analysis by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Hatchbacks are a popular choice in the United States used car market due to their affordability, fuel efficiency, and compact size, making them ideal for urban commuting. Buyers often prefer hatchbacks for their versatile cargo space and ease of parking in crowded cities. Models like the Honda Civic Hatchback and Ford Focus are particularly sought after for their reliability and performance, driving consistent demand in this segment.

Sedans remain a dominant category in the U.S. used car market, appealing to families and professionals alike for their comfort, safety, and advanced features. Well-known models such as the Toyota Camry and Honda Accord are preferred consumer choices due to their dependability and cost-effectiveness.

Sports utility vehicles (SUVs) are the leading market given of their versatility, ample seating, and off-road capabilities. With consumer preference for larger vehicles on the rise, SUVs such as the Toyota RAV4 and Ford Explorer are in high demand. The ability to handle diverse terrains and provide a sense of safety makes SUVs an attractive option for families and adventure enthusiasts, driving their dominance in the market.

Analysis by Vendor Type:

- Organized

- Unorganized

The organized sector in the United States used car market is characterized by certified dealerships and online platforms offering structured buying processes, quality assurance, and post-sale services. Buyers trust organized players like CarMax and AutoNation for transparent pricing, vehicle inspections, and financing options. This segment is growing rapidly, fueled by technological advancements and a shift in consumer preference toward reliable and hassle-free transactions, enhancing the overall buyer experience and driving market growth.

The unorganized sector dominates a significant portion of the market, consisting of individual sellers and smaller dealerships. This segment appeals to cost-conscious buyers due to its affordability and negotiable pricing. However, the lack of standardized quality checks and limited after-sales support often poses challenges. Despite these drawbacks, the unorganized sector remains crucial for its accessibility and local reach, catering to a diverse range of consumer needs in the market.

Analysis by Fuel Type:

- Gasoline

- Diesel

- Others

Gasoline-powered cars are mainly preferred as they are available in more numbers, relatively cheaper for purchase, and most users are familiar with them. They are smoother to ride, reliable, and gasoline stations are very much within reach in all parts of the country. Models such as the Toyota Camry and Honda Accord enjoy strong sales in the gasoline category since users find them to be generally more versatile and suitable for daily family use.

Diesel vehicles occupy a niche segment in the U.S. market, appealing to consumers who prioritize fuel efficiency and towing capabilities. They are particularly popular among buyers seeking trucks and SUVs for heavy-duty applications, such as the Ford F-250 and Chevrolet Silverado. Despite stricter emission regulations and limited availability, diesel cars attract specific audiences due to their durability and long engine life, maintaining steady demand in certain regions and use cases.

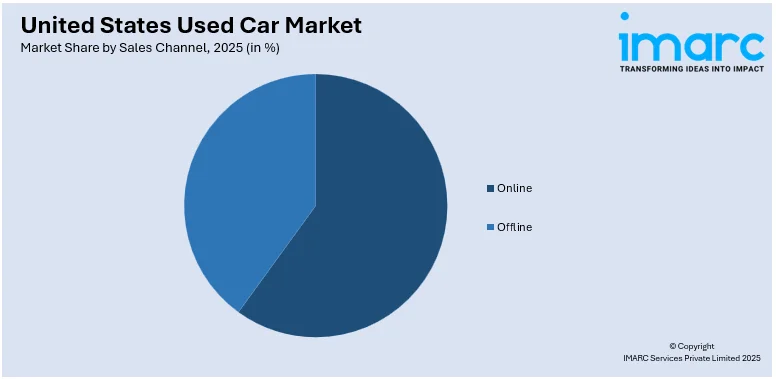

Analysis by Sales Channel:

To get detailed segment analysis of this market Request Sample

- Online

- Offline

The online segment of the United States used car market is rapidly expanding, driven by convenience, transparency, and a broad inventory accessible to buyers nationwide. Platforms like Carvana and Vroom offer features such as virtual car tours, financing options, and doorstep delivery, appealing to tech-savvy consumers. The ability to compare prices, read reviews, and access certified pre-owned vehicles made online channels a preferred choice, revolutionizing how used cars are bought and sold.

The offline market remains a significant component of the industry, with traditional dealerships and local sellers providing a hands-on purchasing experience. Buyers value the opportunity to inspect vehicles, negotiate prices, and receive personalized assistance. Dealerships often offer trade-ins, warranties, and financing options, making offline transactions a reliable choice for many. Despite the growth of online platforms, the offline market continues to flourish, especially among buyers who prioritize face-to-face interactions and trust in local sellers.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northwest region of the United States used car market is characterized by strong demand for fuel-efficient vehicles and hybrids due to the region’s eco-conscious consumer base. Buyers in states like Washington and Oregon prioritize practicality and sustainability, with compact cars and SUVs being popular choices. Additionally, the prevalence of outdoor lifestyles in the region drives interest in all-wheel-drive vehicles that can adapt to various weather conditions and traverse challenging terrains.

The Midwest used car market focuses on durability and affordability, with high demand for trucks, SUVs, and sedans. Buyers in states like Illinois and Ohio prioritize reliable vehicles that can endure harsh winters and provide versatility for both urban and rural use. Pickup trucks such as the Ford F-150 and Chevrolet Silverado are particularly popular, reflecting the region’s agricultural and industrial background. Affordability and long-term reliability are key factors influencing consumer choices.

In the South, the market flourishes on the popularity of SUVs and trucks, reflecting the region’s preference for spacious and powerful vehicles. States like Texas and Florida see high demand for vehicles suited to long commutes and family needs. Warm weather and favorable road conditions lead to strong interest in both gasoline-powered and hybrid models. The affordability and availability of used cars render this region a significant contributor to the U.S. market.

The West region’s used car market is driven by a mix of urban and outdoor lifestyles, leading to strong demand for fuel-efficient vehicles, hybrids, and SUVs. States like California and Nevada prioritize environmentally friendly options, including electric and hybrid cars, due to stricter emissions regulations and incentives. Outdoor enthusiasts also seek durable SUVs and trucks capable of handling mountainous terrains. The diverse preferences in the West make it a dynamic and changing segment of the market.

Competitive Landscape:

The competitive landscape of the market is characterized by a mix of organized players, and numerous unorganized local dealerships and private sellers. Organized players dominate through large inventories, certified pre-owned programs, financing options, and value-added services, attracting customers seeking reliability and convenience. Meanwhile, the unorganized segment remains significant, offering affordable options and flexibility in pricing. Online platforms are transforming the market by leveraging technology to streamline transactions, providing virtual tours, and ensuring nationwide accessibility. Additionally, traditional dealerships are expanding digital capabilities to remain competitive. The market is also influenced by shifting consumer preferences for eco-friendly vehicles and the integration of advanced analytics to enhance customer experiences.

The report provides a comprehensive analysis of the competitive landscape in the United States used car market with detailed profiles of all major companies.

Latest News and Developments:

- July 17, 2024: TrueCar, Inc. launched TrueCar+, a platform enabling consumers to purchase over 3,200 new, used, and certified pre-owned vehicles entirely online. Offering transparent pricing, online financing, trade-in options, and home delivery, TrueCar+ simplifies car buying with a seamless, end-to-end process. Key features include TrueCar allowing consumers to purchase new, used, and certified pre-owned vehicles entirely online with transparent pricing, trade-in options, online financing, and home delivery, aiming to simplify and modernize the car-buying process.

- September 23, 2024: HGreg expanded its luxury pre-owned brand, HGreg Lux, with a USD 30 Million boutique in West Palm Beach, Florida, offering up to 150 vehicles, same-day delivery, cryptocurrency payments, and a five-day money-back guarantee.

United States Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States used car market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States used car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A used car, also known as a pre-owned vehicle, is a previously owned automobile that is resold through private sellers, dealerships, or certified pre-owned programs. Used cars are popular for their affordability and availability, serving various applications such as personal transportation, business use, and fleet operations.

The United States used car market size reached 38.6 Million Units in 2025.

IMARC estimates the United States used car market to exhibit a CAGR of 3.23% during 2026-2034.

Affordability, certified pre-owned programs, and the growing popularity of eco-friendly vehicles are key drivers of the United States market. Additionally, the increasing influence of digital platforms providing transparent and seamless purchasing experiences, coupled with economic uncertainties, motivates consumers to choose used vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)