US Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

US Board Games Market Overview:

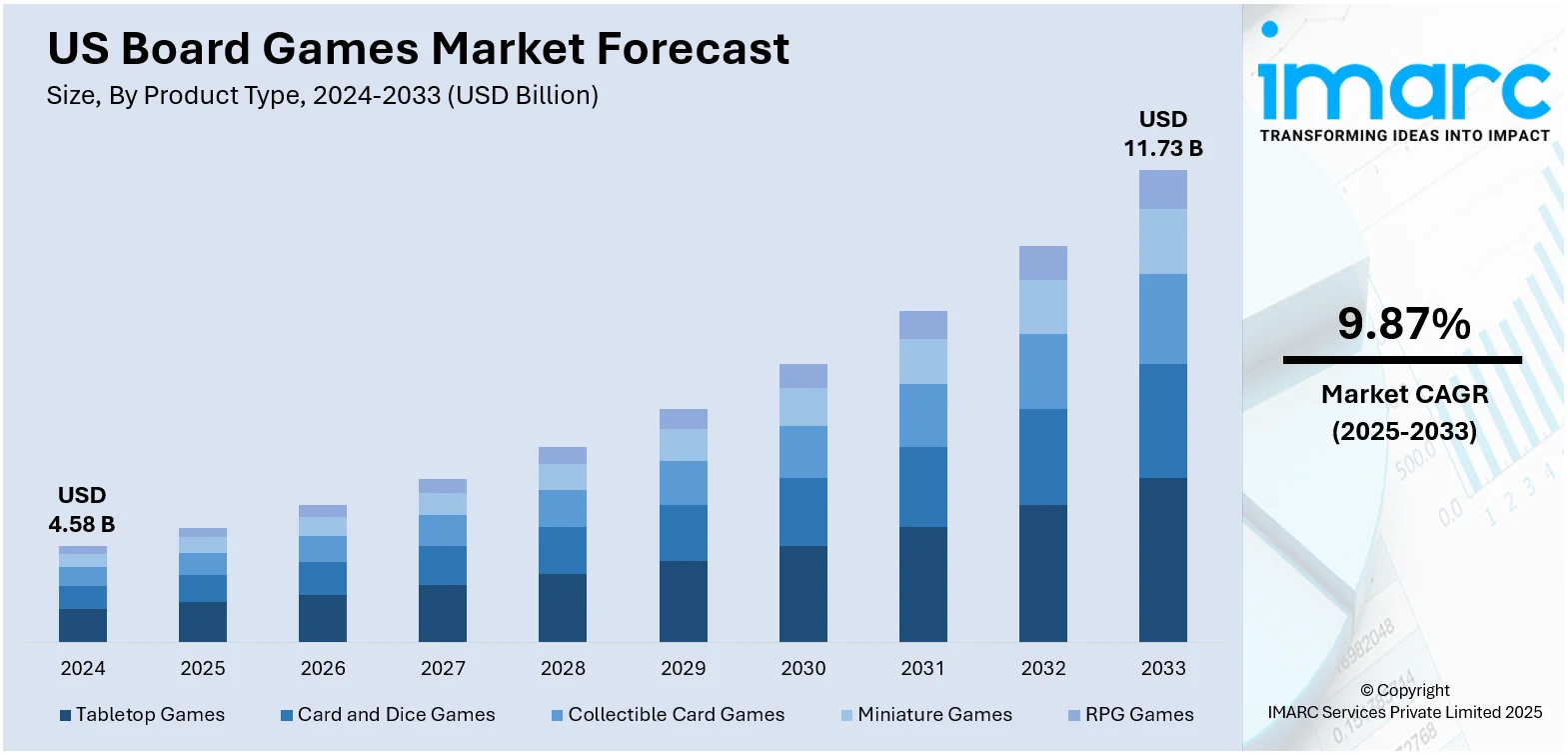

The US board games market size reached USD 4.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.73 Billion by 2033, exhibiting a growth rate (CAGR) of 9.87% during 2025-2033. Wider retail placement and smart online sales make board games easy to find and buy, encouraging casual shoppers. Furthermore, gaming cafés and bars turn playing into a social experience, helping people connect, discover new titles, and deepen interest in the hobby, thereby contributing to the expansion of the US board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.58 Billion |

| Market Forecast in 2033 | USD 11.73 Billion |

| Market Growth Rate 2025-2033 | 9.87% |

US Board Games Market Trends:

Better Retail Presence and Distribution

Board games once resided hidden in specialty shops known only to devoted enthusiasts, but now they occupy prominent spaces in large stores, online platforms, and even supermarkets. This expanded availability allows people to discover a new title while grabbing everyday necessities, increasing the chances of spontaneous buys. Eye-catching packaging, vibrant hues, and strategic placements close to seasonal sections quickly attract interest. Digital marketplaces and direct-to-consumer (DTC) platforms enable small publishers to sell directly to gamers worldwide, eliminating the necessity for extensive marketing expenditures. Quick shipping, simple returns, and preorder benefits make obtaining the newest release effortless. Clubs and subscription boxes provide an additional dimension, delivering curated selections to members monthly and maintaining their enthusiasm to expand their collections. For instance, the Sims Board Game has been confirmed by Goliath Games for a US release on July 20, 2025, with a price of $19.99 and available for pre-order at Target. This well-known franchise now occupies shelves that casual shoppers peruse, transforming a routine task into an opportunity to acquire something novel for game night. Created for 2–5 players aged 12 and older, the game allows enthusiasts to gather Aspiration Points while managing recognizable Sims needs, merging a popular digital universe with a tangible activity. Simplified purchasing and intelligent distribution like this sustain interest and attract new enthusiasts to the hobby without requiring them to search for specialized shops.

To get more information on this market, Request Sample

Rise of Experiential Gaming Venues

The increasing number of gaming cafés, bars, and dedicated play spaces in cities and towns is bolstering the US board games market growth. These venues transform board gaming into a social event outside the home, providing people with a place to gather, meet new players, and try out games they might not own. For newcomers, cafés offer an easy entry point with staff explaining rules, suggesting titles, and creating a welcoming vibe that removes the stress of learning alone. For dedicated fans, they offer variety and community without requiring the purchase of every game. Many locations also host themed nights, tournaments, or membership programs that encourage repeat visits and foster loyal user bases. This environment also boosts sales indirectly, as players often buy games they discover and enjoy during café sessions. By blending entertainment, food, and community, these spaces help expand the reach of board gaming beyond living rooms, giving people more reasons to play and spend time together. In 2025, 94.3 WCYY reported that Owlbear's Rest, a new gaming café in Westbrook, Maine, will hold its grand opening on May 30 at Stockhouse Station. Inspired by Dungeons & Dragons, the café will offer themed game nights, snacks, and membership options for extended play.

US Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

A detailed breakup and analysis of the market based on the game type have also been provided in the report. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

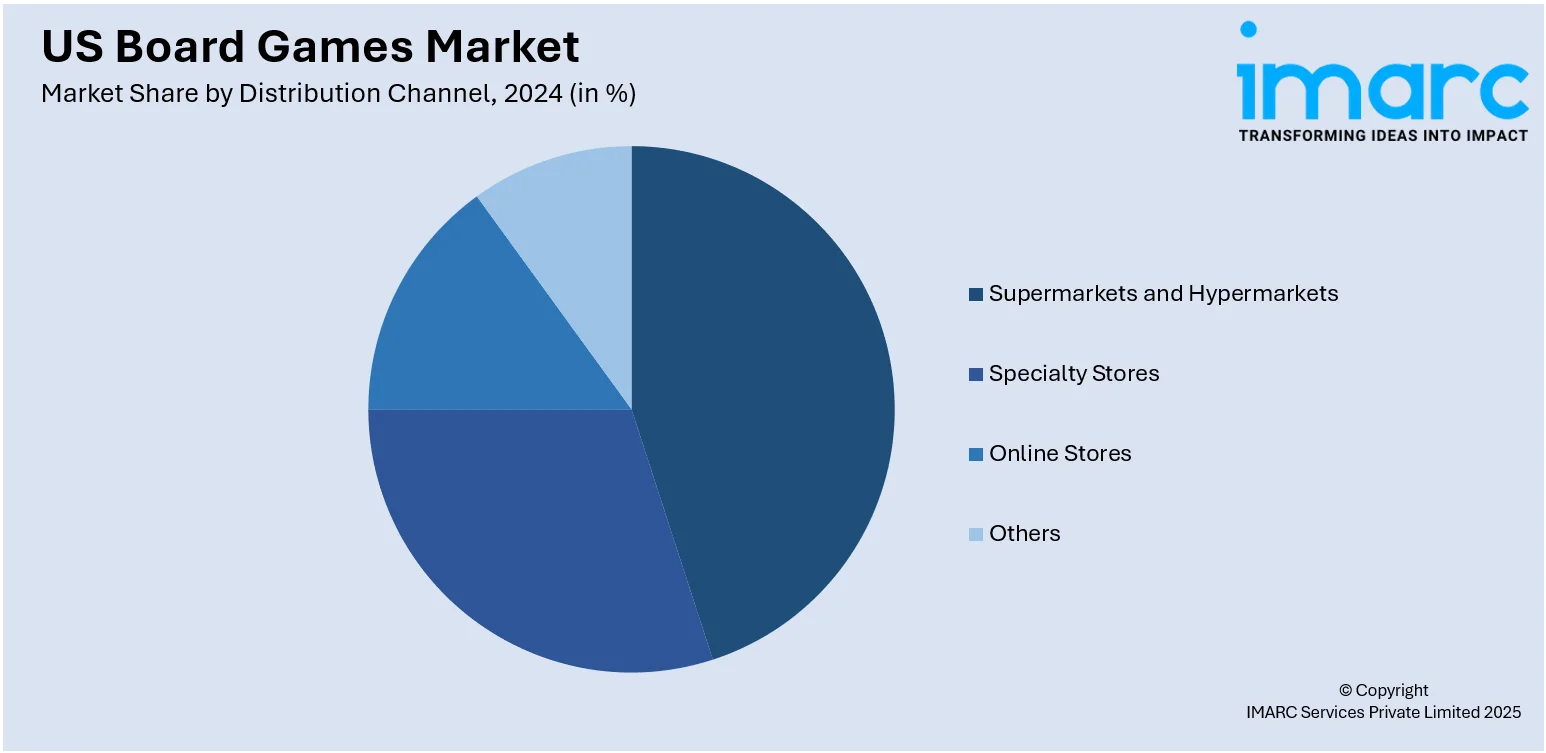

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Board Games Market News:

- In June 2025, The Elder Scrolls: Betrayal of the Second Era board game became available in the US for $225 via Amazon. Designed for 1–4 players, it offers an open-world RPG experience across Tamriel, featuring customizable characters and modular gameplay. A Valenwood expansion is also available for $50, adding new content and regions.

- In March 2025, Exploding Kittens announced five new tabletop games, including Exploding Kittens: The Board Game, launching in the US on July 21, 2025. Other titles like Exploding Pigeon and Giants Moving Tiny Furniture will also be released in the US exclusively at Target.

US Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US board games market performed so far and how will it perform in the coming years?

- What is the breakup of the US board games market on the basis of product type?

- What is the breakup of the US board games market on the basis of game type?

- What is the breakup of the US board games market on the basis of age group?

- What is the breakup of the US board games market on the basis of distribution channel?

- What is the breakup of the US board games market on the basis of region?

- What are the various stages in the value chain of the US board games market?

- What are the key driving factors and challenges in the US board games market?

- What is the structure of the US board games market and who are the key players?

- What is the degree of competition in the US board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)