US Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

US Cement Market Overview:

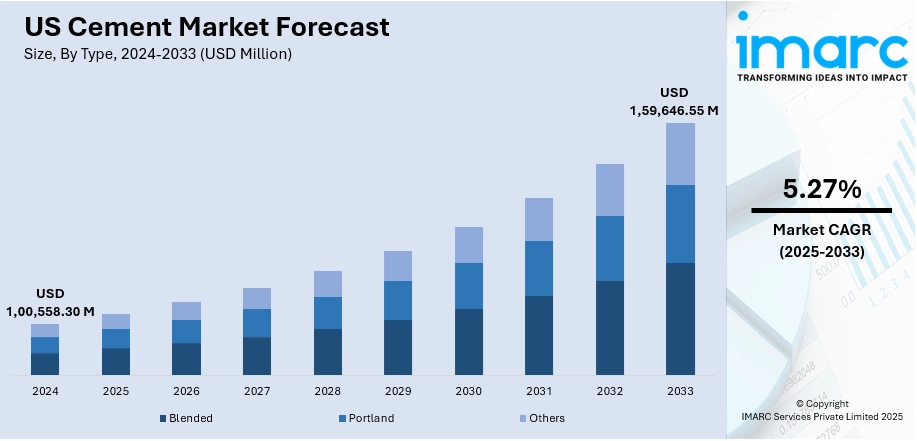

The US cement market size reached USD 1,00,558.30 Million in 2024. The market is projected to reach USD 1,59,646.55 Million by 2033, exhibiting a growth rate (CAGR) of 5.27% during 2025-2033. The market is advancing with the increased adoption of low-emission blends and the establishment of localized production facilities. Growing investment in cleaner technologies and reduced dependence on imports continue to support US cement market share across infrastructure, industrial, and public-sector construction projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,00,558.30 Million |

| Market Forecast in 2033 | USD 1,59,646.55 Million |

| Market Growth Rate 2025-2033 | 5.27% |

US Cement Market Trends:

Shift Toward Broader Cement Solutions

The US cement industry is moving away from traditional material categories and embracing a broader range of product types. Market demands for versatility, environmental performance, and regulatory alignment drive this change. Cement producers are exploring alternatives to conventional formulations, particularly as building codes and federal incentives increasingly favor materials with a lower carbon footprint. In this environment, the rebranding of the Portland Cement Association to the American Cement Association (ACA) in May 2025 represents more than a name change. It reflects a structural change in how the industry defines its role no longer limited to portland cement, the new identity embraces a wider variety of cementitious materials. This shift coincides with the rise of lower-emission cement, which surpassed 60% of the US market share by mid-2025. The adoption of these products indicates a deeper trend: the cement sector is aligning more closely with decarbonization goals while also adapting to innovations in materials science and evolving construction needs. As these materials gain acceptance, the definition of "standard" cement is evolving, prompting changes in manufacturing, standards development, and long-term planning across the supply chain.

To get more information on this market, Request Sample

Expansion of Domestic Low-Carbon Capacity

US cement production is increasingly shaped by the need to localize supply and reduce embedded emissions from transportation and imports. Cement has traditionally been imported in significant volumes due to high domestic costs and limited newer infrastructure. However, sustainability targets and logistical pressures are now pushing firms to build local, lower-carbon facilities. In June 2025, Ozinga broke ground on a new plant in East Chicago, Indiana, designed to produce one Million tons of low-carbon cement per year. Equipped with North America's largest vertical roller mill, the plant is expected to cut emissions by 700,000 metric tons annually. Projects like this signal a major reorientation in US cement strategy shifting from import-heavy supply chains to localized, emission-reducing production hubs. These investments are not only about reducing carbon output but also increasing national capacity and resilience. As demand grows, especially for infrastructure tied to federal funding, local cement production becomes a key strategic asset, further impelling US cement market growth. The trend suggests that more plants will adopt similar models, integrating advanced milling systems and utilizing alternative raw materials to meet both environmental and market requirements in a more self-sufficient manner.

US Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, portland, and others.

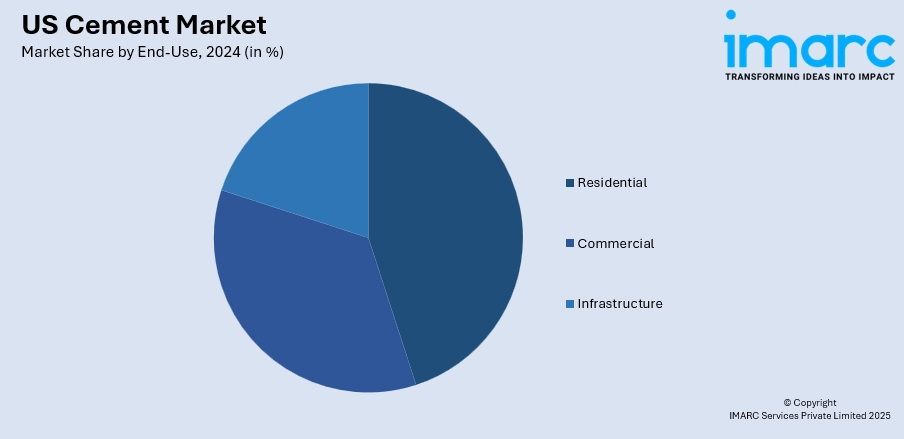

End-Use Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes residential, commercial, and infrastructure.

Region Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Cement Market News:

- June 2025: Ozinga began construction on North America’s largest low-carbon cement mill in East Chicago, Indiana. Designed to produce one million tons annually, the facility strengthened domestic cement supply, cut emissions, and supported US infrastructure with ASTM-compliant, AI-optimized, low-carbon cement blends.

- June 2025: Titan America completed full digitalization of its US cement plants using AI and machine learning. The upgrade improved throughput, reduced energy use, predicted failures, and enhanced quality control. This advancement boosted operational efficiency and lowered emissions, strengthening competitiveness in the US cement market.

US Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US cement market performed so far and how will it perform in the coming years?

- What is the breakup of the US cement market on the basis of type?

- What is the breakup of the US cement market on the basis of end-use?

- What is the breakup of the US cement market on the basis of region?

- What are the various stages in the value chain of the US cement market?

- What are the key driving factors and challenges in the US cement market?

- What is the structure of the US cement market and who are the key players?

- What is the degree of competition in the US cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US cement market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)