US Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

US Co-Working Office Space Market Overview:

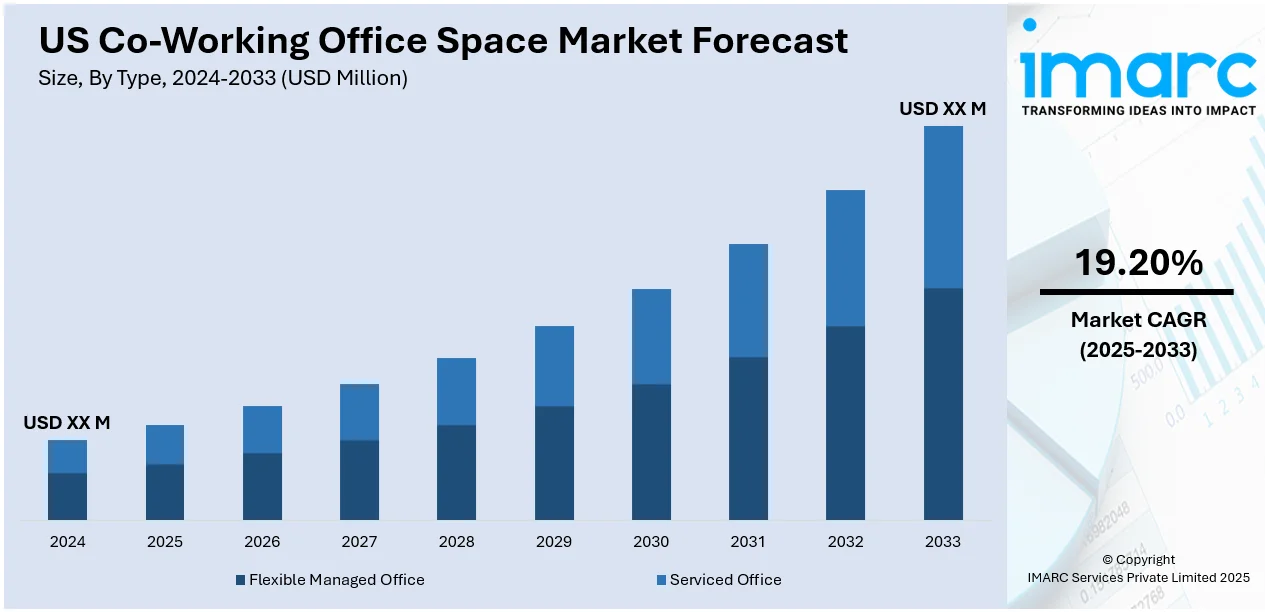

The US co-working office space market size is projected to exhibit a growth rate (CAGR) of 19.20% during 2025-2033. The market is growing steadily, driven by increased adoption of hybrid work models, rising startup activity, and strong demand for flexible leases. Major cities like New York, San Francisco, and Austin remain key hubs, while suburban and secondary markets are also rapidly expanding. Operators are adapting with tech-enabled, customizable spaces to meet diverse needs. As demand diversifies, the US co-working office space market share is expected to increase significantly further, reflecting broader trends in workplace preferences and innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 19.20% |

US Co-Working Office Space Market Trends:

Enterprise Clients

Enterprise clients are playing a growing role in the expansion of the US co-working office space market. Traditionally seen as a domain for freelancers and startups, co-working is now being embraced by large corporations looking to support hybrid work, decentralize operations, and improve agility. For instance, in June 2025, Amazon expanded its partnership with WeWork, leasing the entire 141,000-square-foot building at 4980 Great America Parkway in Santa Clara, California. This co-working arrangement supports Amazon's return-to-office mandate, accommodating its workforce as the tech giant continues to grow its real estate footprint across Silicon Valley and beyond. Companies are leasing co-working spaces for satellite offices, enabling teams to work closer to home or in client-centric locations. These setups are ideal for project-based teams that need temporary but fully equipped office environments without long-term lease commitments. Co-working operators are responding by offering enterprise-grade services private access, branded offices, enhanced IT security, and dedicated support. This demand has shifted co-working from shared open areas to more customizable, semi-private, and secure environments. The ability to scale quickly and adapt to changing needs makes co-working attractive for larger firms, contributing meaningfully to US co-working office space market expansion.

To get more information on this market, Request Sample

Rapid Suburban Growth

Suburban growth is becoming a major force behind US co-working office spaces market growth. As remote and hybrid work models take hold, professionals are seeking flexible workspaces closer to home, reducing commute times and increasing work-life balance. This shift has prompted operators to open co-working centers in suburban and secondary markets, including areas around major cities like Atlanta, Dallas, and Chicago. These locations cater to both individual professionals and distributed teams looking for convenience without sacrificing amenities. Many of these spaces offer the same features as urban hubs high-speed internet, meeting rooms, and community events—but at lower costs. Suburban co-working centers also attract businesses exploring decentralization strategies, using these spaces as satellite offices. For instance, in October 2024, WeWork launched a Coworking Partner Network in partnership with Vast Coworking Group, enhancing access to third-party coworking spaces across suburban markets in the US and Canada. This initiative aims to provide members with more flexibility and options for hybrid work environments, complementing WeWork's existing locations. The trend is reshaping demand patterns and driving sustained market growth by reaching new user segments and addressing evolving workplace preferences.

US Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

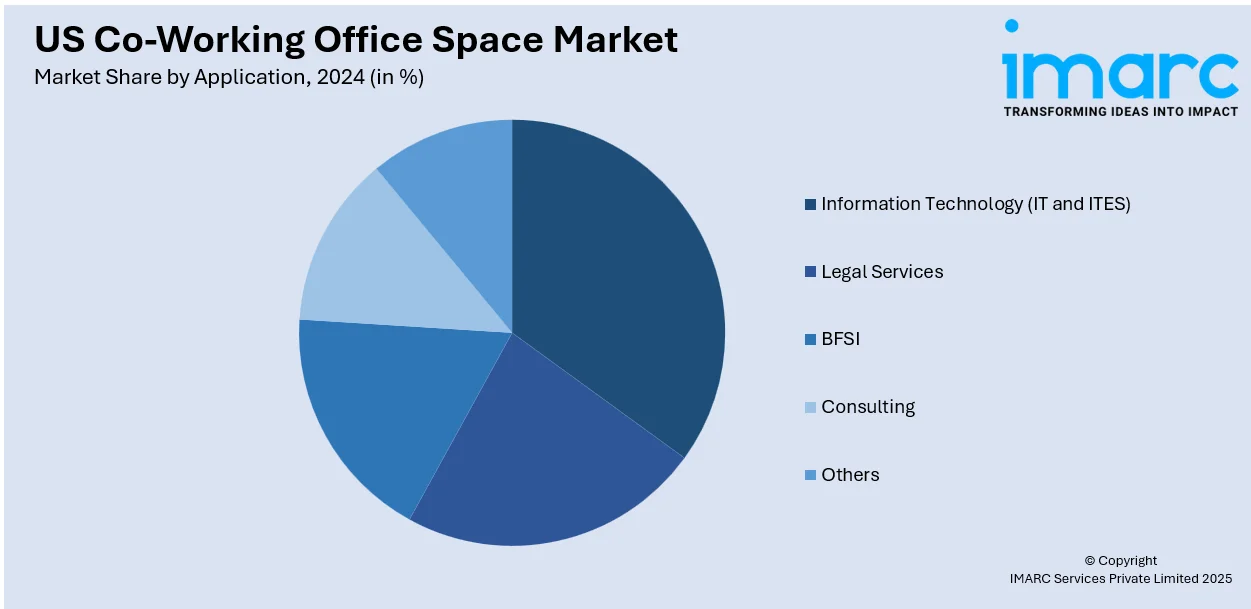

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Co-Working Office Space Market News:

- In May 2025, Brightline, a private rail service, announced its partnership with Industrious to offer coworking spaces at its Florida stations and on select trains. The partnership provides flexible workspaces for travelers, aiming to enhance productivity during commutes. Rates vary from USD 200 to USD 1,600, reflecting a growing trend in accommodating remote work needs.

- In January 2025, Rice Real Estate Co. appointed Industrious to operate the Ion's 86,000-square-foot coworking space, enhancing its hospitality-focused member experience. This partnership aims to foster collaboration among startups and businesses while introducing new amenities, networking events, and dining options, positioning the Ion as a key innovation hub in Houston.

US Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US co-working office space market performed so far and how will it perform in the coming years?

- What is the breakup of the US co-working office space market on the basis of type?

- What is the breakup of the US co-working office space market on the basis of application?

- What is the breakup of the US co-working office space market on the basis of end user?

- What is the breakup of the US co-working office space market on the basis of region?

- What are the various stages in the value chain of the US co-working office space market?

- What are the key driving factors and challenges in the US co-working office space market?

- What is the structure of the US co-working office space market and who are the key players?

- What is the degree of competition in the US co-working office space market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)