US Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2025-2033

US Community Cloud Market Overview:

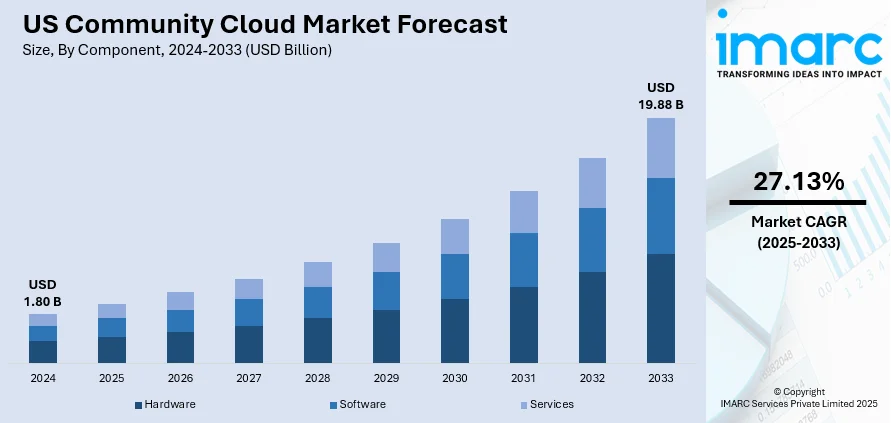

The US community cloud market size reached USD 1.80 Billion in 2024. The market is projected to reach USD 19.88 Billion by 2033, exhibiting a growth rate (CAGR) of 27.13% during 2025-2033. The market is driven by rising demand for data security, regulatory compliance, and cost-effective IT infrastructure among sectors like government, healthcare, and finance. Organizations with shared objectives prefer community clouds for controlled environments that meet industry-specific regulations such as Health Insurance Portability and Accountability Act (HIPAA), Federal Risk and Authorization Management Program (FedRAMP), and General Data Protection Regulation (GDPR). Additionally, the growing need for inter-organizational collaboration, scalable resources, and customized solutions boosts adoption. Digital transformation initiatives and the increasing use of cloud-based artificial intelligence (AI) and data analytics further accelerate US community cloud market share across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.80 Billion |

| Market Forecast in 2033 | USD 19.88 Billion |

| Market Growth Rate 2025-2033 | 27.13% |

US Community Cloud Market Trends:

Expansion of Healthcare Sector Utilization

The American healthcare industry is swiftly adopting community cloud solutions to address the sophisticated requirements of data security, HIPAA compliance, and inter-organizational collaboration. Hospitals, clinics, research organizations, and insurers enjoy community clouds by securely sharing electronic health records (EHR), clinical trial data, and patient management systems in a secured environment. This is driven by the requirement for immediate access to data, expansion in telemedicine, and multi-entity collaboration on diseases and therapies. Community clouds provide an economical solution that addresses scalability while conforming to stringent regulations. Furthermore, with the role of AI and data analysis becoming imperative to make personalized medicine possible and enhance operational effectiveness, the healthcare sector relies more and more on secure cloud environments that enable multi-entity collaboration without compromising data security. This transition is transforming information technology (IT) strategies among healthcare providers and is largely contributing to U.S. community cloud market growth.

To get more information on this market, Request Sample

Growth in Government & Public Sector Adoption

A key trend driving the U.S. community cloud market is the growing adoption by government agencies and public sector organizations. According to a Maximus survey, 91% of federal and 93% of state/local agencies have partially or fully migrated to cloud environments, with 71% of federal and 57% of state/local bodies specifically considering government-only community clouds. Heightened data privacy regulations such as FedRAMP and national security concerns are accelerating this shift. Community clouds offer secure, compliant infrastructure tailored for shared regulatory needs of federal, state, and local agencies. This ensures protection of sensitive data like tax records, defense files, and citizen information. Moreover, these clouds foster resource sharing, reducing costs while boosting scalability and operational efficiency. Government cloud-first policies and digital modernization programs further sustain this momentum, positioning the public sector as a critical driver of U.S. community cloud market growth.

Rising Demand for Industry-Specific Cloud Solutions

A growing U.S. community cloud market trends is the demand for tailored, industry-specific cloud platforms designed to meet the unique needs of sectors like finance, education, and manufacturing. Organizations within the same industry often face similar regulatory, operational, and security challenges. Community cloud solutions allow these companies to collaborate while sharing infrastructure that’s customized to address their common concerns—such as GDPR compliance for finance or FERPA requirements for education. This trend is driven by the realization that generic public clouds cannot sufficiently address industry-specific compliance and security requirements. As a result, vendors are increasingly developing specialized community clouds offering verticalized services, pre-configured security measures, and industry-focused support. The customization and shared responsibility models these clouds provide help reduce costs, improve agility, and enhance competitive advantages for industry players in the U.S. market.

US Community Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application and industry vertical.

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (server, networking, storage, and others), software (enterprise application software, collaboration tools software, and dashboards business intelligence software), and services (training services, maintenance and support, regulation and compliance, and consulting).

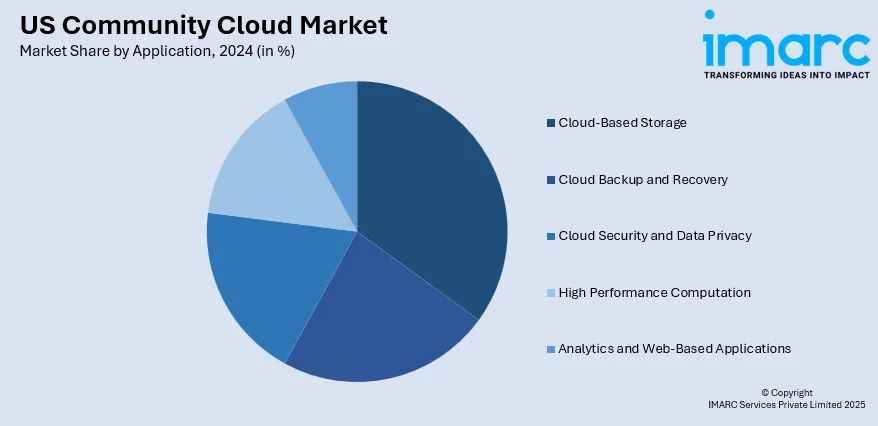

Application Insights:

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based storage, cloud backup and recovery, cloud security and data privacy, high performance computation, and analytics and web-based applications.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, gaming, government, healthcare, education, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Community Cloud Market News:

- In June 2024, Amazon spent $10 billion on North Carolina to build out its AWS cloud computing and AI infrastructure, including 500 high-skilled job creations and backing thousands more in its supply chain. The proposal features community education initiatives such as data center technician training and K-12 STEM programs. Amazon also will introduce a $150,000 community fund to aid local development, sustainability, and workforce development, further solidifying North Carolina's place as an emerging tech hub.

US Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US community cloud market performed so far and how will it perform in the coming years?

- What is the breakup of the US community cloud market on the basis of component?

- What is the breakup of the US community cloud market on the basis of application?

- What is the breakup of the US community cloud market on the basis of industry vertical?

- What is the breakup of the US community cloud market on the basis of region?

- What are the various stages in the value chain of the US community cloud market?

- What are the key driving factors and challenges in the US community cloud market?

- What is the structure of the US community cloud market and who are the key players?

- What is the degree of competition in the US community cloud market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US community cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US community cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US community cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)