US Generative AI Market Size, Share, Trends and Forecast by Offering Type, Technology Type, Application, and Region, 2025-2033

US Generative AI Market Overview:

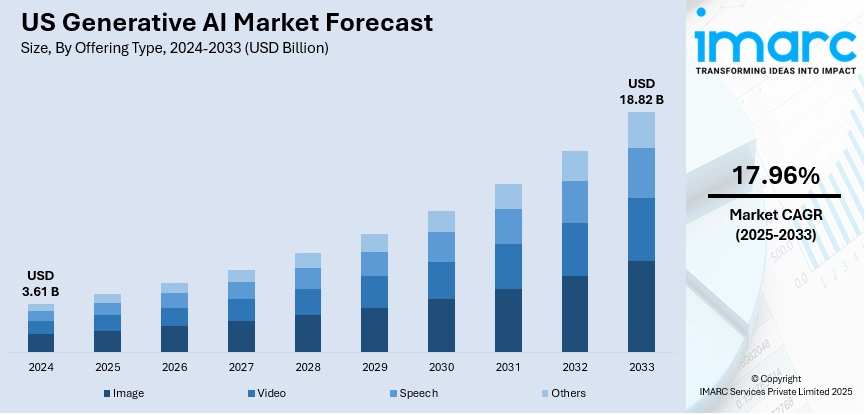

The US generative AI market size reached USD 3.61 Billion in 2024. Looking forward, the market is expected to reach USD 18.82 Billion by 2033, exhibiting a growth rate (CAGR) of 17.96% during 2025-2033. The market is driven by US leadership in foundational model development, with strong integration of generative AI into enterprise applications. The expansion of generative AI in healthcare, finance, and creative industries is accelerating demand for tailored solutions. Additionally, evolving regulatory frameworks and ethical AI initiatives are fostering responsible innovation, further augmenting the US generative AI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.61 Billion |

| Market Forecast in 2033 | USD 18.82 Billion |

| Market Growth Rate 2025-2033 | 17.96% |

US Generative AI Market Trends:

Dominance of Foundational AI Model Development and Commercialization

The United States is at the forefront of global generative AI innovation, driven by its leadership in foundational model development and commercialization. Major technology firms and research institutions across the country have pioneered some of the world’s largest and most advanced generative AI models, supported by extensive datasets, computational infrastructure, and world-class engineering talent. Venture capital funding and active startup ecosystems across technology hubs such as Silicon Valley, Boston, and New York continue to drive new AI applications in both enterprise and consumer markets. Additionally, the integration of generative AI capabilities into mainstream productivity software, enterprise workflows, and creative tools has accelerated adoption across industries. U.S.-based firms are shaping global standards, influencing regulatory discussions, and establishing dominant market positions for both proprietary and open-source generative AI platforms. For instance, on June 16, 2025, Universal Health Services (UHS) announced the nationwide deployment of Hippocratic AI’s generative AI agents to conduct over 150,000 post-discharge follow-up calls annually across its network of 400 healthcare facilities. After successful pilots, UHS expanded the program to enhance patient recovery monitoring and reduce readmissions. Open-source initiatives and academic collaborations are enhancing the speed of innovation while democratizing access to generative AI tools. These combined forces firmly position the United States generative AI market growth trajectory as one of the strongest globally.

To get more information on this market, Request Sample

Enterprise Adoption Across Diverse Industry Verticals

Generative AI is increasingly embedded within U.S. enterprise workflows across sectors ranging from finance to entertainment. Financial institutions are deploying large language models for automated compliance reporting, customer service interactions, and document summarization tasks. Healthcare providers leverage generative AI for synthesizing patient records, enhancing diagnostics, and supporting medical research. Meanwhile, the media, advertising, and gaming sectors rely heavily on generative models to produce text, images, and video content, driving efficiency in creative pipelines. Large corporations and small enterprises alike are exploring tailored generative AI solutions to reduce operational costs, accelerate innovation cycles, and remain competitive in fast-evolving markets. The growth of AI-powered developer tools is enabling more businesses to build bespoke applications suited to specific operational needs. Additionally, cross-sector collaborations with AI research labs are producing domain-specific generative models capable of solving industry challenges with unprecedented precision. Leading AI companies are establishing internal governance bodies and releasing guidelines on responsible deployment practices for generative systems. Additionally, federal funding for AI research increasingly emphasizes safe, explainable, and socially beneficial innovations. On September 10, 2024, Deloitte launched AI Factory as a Service, a turnkey generative AI solution built on NVIDIA’s AI Enterprise and Oracle’s enterprise AI stack, providing scalable GenAI deployments for businesses across industries. As part of its AI strategy, Deloitte is investing over USD 2 billion in global technology learning, with 120,000 professionals undergoing AI training through the Deloitte AI Academy™. With the U.S. accelerating enterprise AI adoption, Deloitte’s launch reinforces America’s position as a leader in AI-driven business transformation. As organizations deepen their investments in AI-driven processes, generative AI is becoming an integral part of the U.S. digital economy.

US Generative AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering type, technology type, and application.

Offering Type Insights:

- Image

- Video

- Speech

- Others

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes image, video, speech, and others.

Technology Type Insights:

- Autoencoders

- Generative Adversarial Networks

- Others

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes autoencoders, generative adversarial networks, and others.

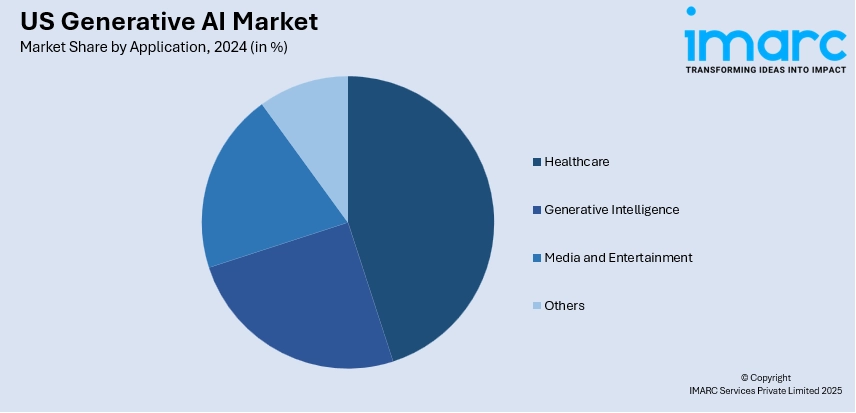

Application Insights:

- Healthcare

- Generative Intelligence

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes healthcare, generative intelligence, media and entertainment, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all major regional markets. This includes Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Generative AI Market News:

- On June 16, 2025, Adobe announced that Lumen Technologies significantly accelerated its B2B marketing operations by adopting Adobe GenStudio’s generative AI solutions, reducing campaign launch time from 25 days to just 9 days. By leveraging AI-driven tools such as Adobe Firefly and Custom Models, Lumen scaled the production of tailored marketing content while maintaining brand consistency across channels. As Russia intensifies efforts to advance its generative AI ecosystem, such developments in the U.S. underscore the global momentum toward deploying generative AI.

- On June 2, 2025, the U.S. FDA officially launched Elsa, a secure generative AI tool designed to enhance operational efficiency across its scientific and regulatory functions. Built within a GovCloud environment, Elsa assists with summarizing documents, accelerating clinical reviews, and supporting data handling without compromising sensitive industry data.

US Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered | Image, Video, Speech, Others |

| Technology Types Covered | Autoencoders, Generative Adversarial Networks, Others |

| Applications Covered | Healthcare, Generative Intelligence, Media and Entertainment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US generative AI market performed so far and how will it perform in the coming years?

- What is the breakup of the US generative AI market on the basis of offering type?

- What is the breakup of the US generative AI market on the basis of technology type?

- What is the breakup of the US generative AI market on the basis of application?

- What is the breakup of the US generative AI market on the basis of region?

- What are the various stages in the value chain of the US generative AI market?

- What are the key driving factors and challenges in the US generative AI market?

- What is the structure of the US generative AI market and who are the key players?

- What is the degree of competition in the US generative AI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US generative AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US generative AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US generative AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)