US Ghee Market Size, Share, Trends and Forecast by Source, Distribution Channel, End-User, and Region, 2025-2033

US Ghee Market Overview:

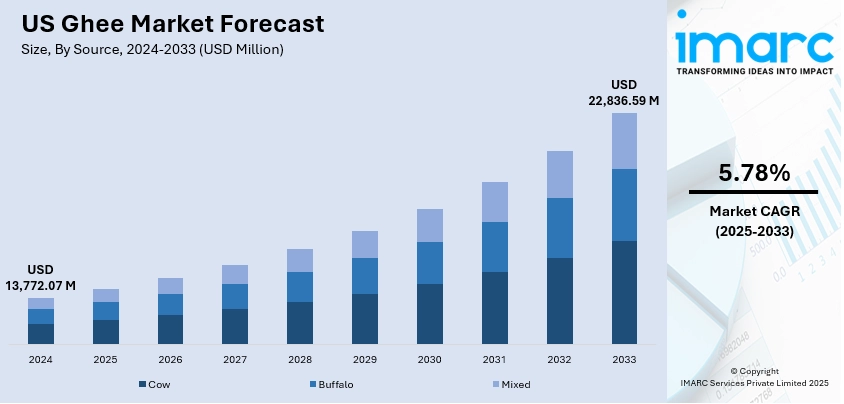

The US ghee market size reached USD 13,772.07 Million in 2024. The market is projected to reach USD 22,836.59 Million by 2033, exhibiting a growth rate (CAGR) of 5.78% during 2025-2033. The market is driven by the rising consumer inclination toward natural and traditional dietary fats, with ghee gaining popularity as a healthier alternative to butter and processed oils. Along with this, the growing awareness about Ayurveda and holistic wellness has further enhanced ghee’s appeal among health-conscious individuals. Additionally, the expanding presence of South Asian diaspora communities and their culinary preferences is contributing to sustained demand, further augmenting the US ghee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,772.07 Million |

| Market Forecast in 2033 | USD 22,836.59 Million |

| Market Growth Rate 2025-2033 | 5.78% |

US Ghee Market Trends:

Rising Popularity of Ghee in Mainstream American Households

Ghee is gaining popularity among a broader American consumer base. This shift is largely driven by a growing interest in global cuisines and traditional food practices. As more households seek out authentic cooking fats that are free from artificial additives and hydrogenated oils, ghee is embraced for its rich flavor, versatility, and purported health benefits. It is increasingly used as a replacement for butter, oil, and margarine in a variety of dishes, from roasted vegetables to baked goods. As per industry reports, ghee has high smoke points, which are around 485°F (250°C). This appeals to consumers who are conscious of preserving the nutritional quality of fats during cooking. Cooking shows, food bloggers, and wellness influencers have also contributed to ghee’s visibility and acceptance. The mainstreaming of ghee has encouraged producers to develop product variants suited to Western tastes, thereby expanding its market beyond ethnic aisles and specialty stores into national retail chains and online platforms with broader consumer reach.

To get more information on this market, Request Sample

Integration of Ghee into Functional and Diet-Specific Lifestyles

Ghee has secured a prominent place in several specialized diet categories in the US, such as keto, paleo, Whole30, and intermittent fasting regimens. This, in turn, is positively impacting US ghee market growth. Consumers adhering to these lifestyles often seek out nutrient-dense, high-fat options that offer sustained energy and metabolic benefits, and ghee fits this criterion due to its pure fat content and concentration of fat-soluble vitamins. Additionally, ghee is naturally free from lactose and casein, making it suitable for individuals with mild dairy sensitivities. Its compatibility with anti-inflammatory diets and its association with ancient wellness systems like Ayurveda further bolster its image as a functional food. Athletes, fitness enthusiasts, and those pursuing clean-eating practices increasingly use ghee not just for cooking but also as a supplement added to beverages like coffee or herbal teas. This functional versatility has led to a rise in value-added ghee products, including single-serve sachets and fortified variants that align with lifestyle branding, thus reinforcing its position in the health and wellness segments of the market.

Expansion of Domestic Production and Premiumization Strategies

The presence of ghee on U.S. restaurant menus has increased by 71% over the last four years, with notable adoption among independent and midscale dining establishments, as per industry reports. In response to rising consumer interest, domestic production of ghee in the United States has grown significantly, particularly from small- to mid-sized dairy producers aiming to capitalize on niche health trends. These producers often emphasize sourcing from grass-fed cows, sustainable farming practices, and traditional slow-cooking methods to differentiate their products in a competitive landscape. Premium branding, supported by certifications such as USDA Organic and Non-GMO Project Verified, is being used strategically to justify higher price points and appeal to discerning consumers. Packaging aesthetics, brand storytelling, and artisanal positioning are also key aspects of these premiumization efforts. Some brands are investing in educational marketing to communicate the cultural and nutritional value of ghee, thereby building trust and long-term customer loyalty. As a result, the market is witnessing not only volume growth but also a shift toward higher-margin products, enabling both startups and established players to diversify their offerings and strengthen their market presence across retail and online channels.

US Ghee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, distribution channel, and end user.

Source Insights:

- Cow

- Buffalo

- Mixed

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow, buffalo, and mixed.

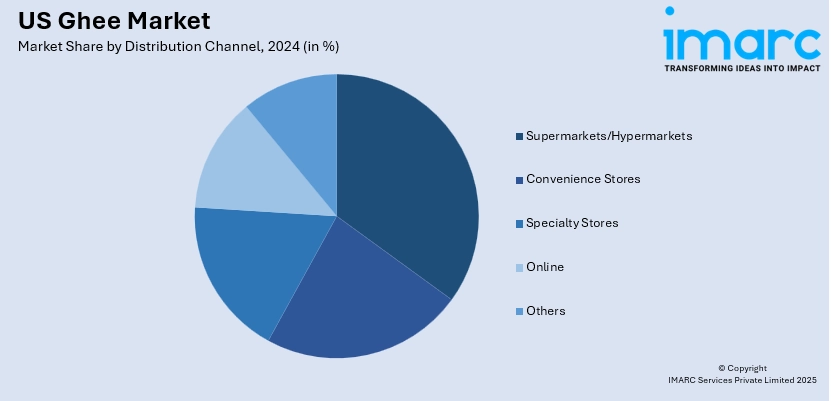

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online, and others.

End-User Insights:

- Retail

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and institutional.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Ghee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow, Buffalo, Mixed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| End-Users Covered | Retail, Institutional |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US ghee market performed so far and how will it perform in the coming years?

- What is the breakup of the US ghee market on the basis of source?

- What is the breakup of the US ghee market on the basis of distribution channel?

- What is the breakup of the US ghee market on the basis of end user?

- What is the breakup of the US ghee market on the basis of region?

- What are the various stages in the value chain of the US ghee market?

- What are the key driving factors and challenges in the US ghee market?

- What is the structure of the US ghee market and who are the key players?

- What is the degree of competition in the US ghee market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US ghee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US ghee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US ghee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)