US Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

US Glamping Market Overview:

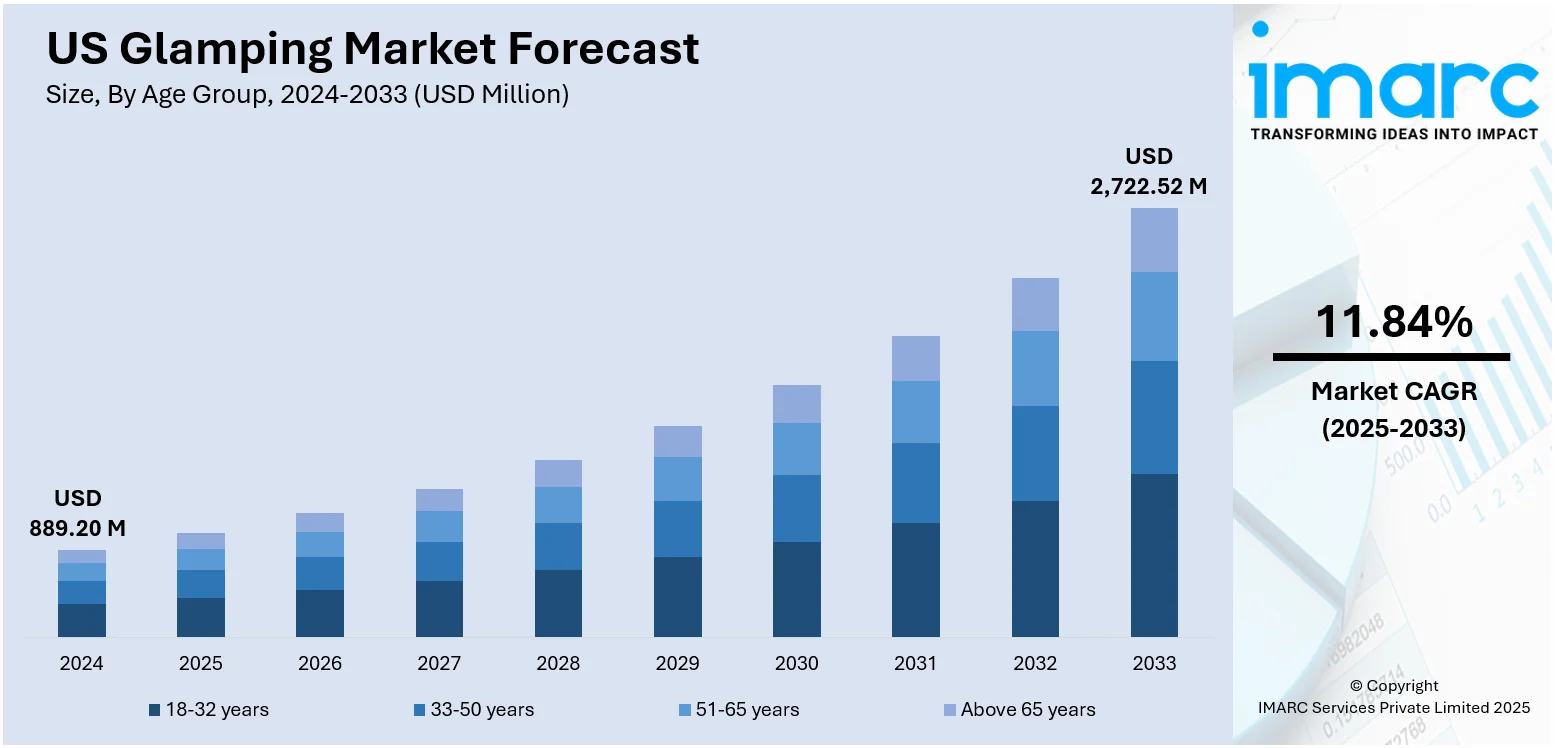

The US glamping market size reached USD 889.20 Million in 2024. The market is projected to reach USD 2,722.52 Million by 2033, exhibiting a growth rate (CAGR) of 11.84% during 2025-2033. The market is fueled by growing consumer demand for distinctive, experience-driven travel that combines outdoor adventure with high-end amenities. Moreover, the rise of millennial and Gen Z travelers looking for distinctive, off-the-grid locations with contemporary comforts is speeding up investments in luxury cabins and tents in scenic US destinations. Additionally, the increasing popularity of sustainable tourism and green accommodations further makes lamping a desirable alternative to conventional hotels, which is also expanding the US glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 889.20 Million |

| Market Forecast in 2033 | USD 2,722.52 Million |

| Market Growth Rate 2025-2033 | 11.84% |

US Glamping Market Trends:

Eco-Friendly Design and Sustainable Tourism

One of the most influential trends in the market is the growing focus on sustainable tourism practices and eco-friendly infrastructure. According to industry reports, around 75% of international tourists have indicated a willingness to travel more sustainably over the next 12 months, which is a growing trend among US travelers. Thus, the operators are incorporating low-impact development practices, employing renewable resources such as reclaimed wood, canvas, and bamboo for structures that harmonize with the surrounding landscape. Solar power, composting toilets, and water harvesting mechanisms are being implemented to reduce resource consumption and conform to environmental norms. Moreover, the tourists are environmentally aware and actively look for glamping sites that endorse their conservation and sustainability values. Responding to this, operators are working together with local communities to provide food and materials, stimulating regional economies as well as lessening carbon footprints. Besides this, off-grid energy systems and limited infrastructure construction are becoming more favored compared to conventional utilities, particularly in remote areas. Additionally, ecologically based educational programs on wildlife conservation, local ecology, and sustainable tourism are incorporated into guest activities in order to increase awareness. This trend not only minimizes operational effect but also maximizes brand distinction in a values-led and competitive travel landscape.

To get more information on this market, Request Sample

Experiential Travel and Demographic Diversification

Increased experiential travel and customer base diversification are benefiting the US glamping market growth. Modern travelers, especially Gen Z and millennials, value memorable, distinctive experiences more than goods for leisure purposes, which is fueling the demand for outdoor accommodation that combines adventure with comfort. According to industry reports, Gen Z and Millennials lead the most vacation trips in the US. More than half of the adults in each group take leisure travel three or more times a year, and about 30% make one to two trips per year. These cohorts are drawn to accommodations that offer a strong connection to nature without compromising on amenities, leading to the growing popularity of glamping formats such as geodesic domes, safari tents, and cliffside cabins. At the same time, families and older visitors are entering the marketplace looking for accessible, low-risk outdoor adventure experiences in comfort. Therefore, operators are diversifying products to appeal to more than one segment, e.g., activity-based family lodges, solo-traveler wellness retreats, and couples' arrangements. In addition to this, most of the glamping destinations these days provide guided, meaning-driven experiences like food tours, wildlife safaris, artistic workshops, and seasonal festivals that are attractive across generations. This shift in demographic composition is challenging the industry to find a balance between adventure, comfort, and customization that fulfills a broad range of expectations and travel patterns.

US Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

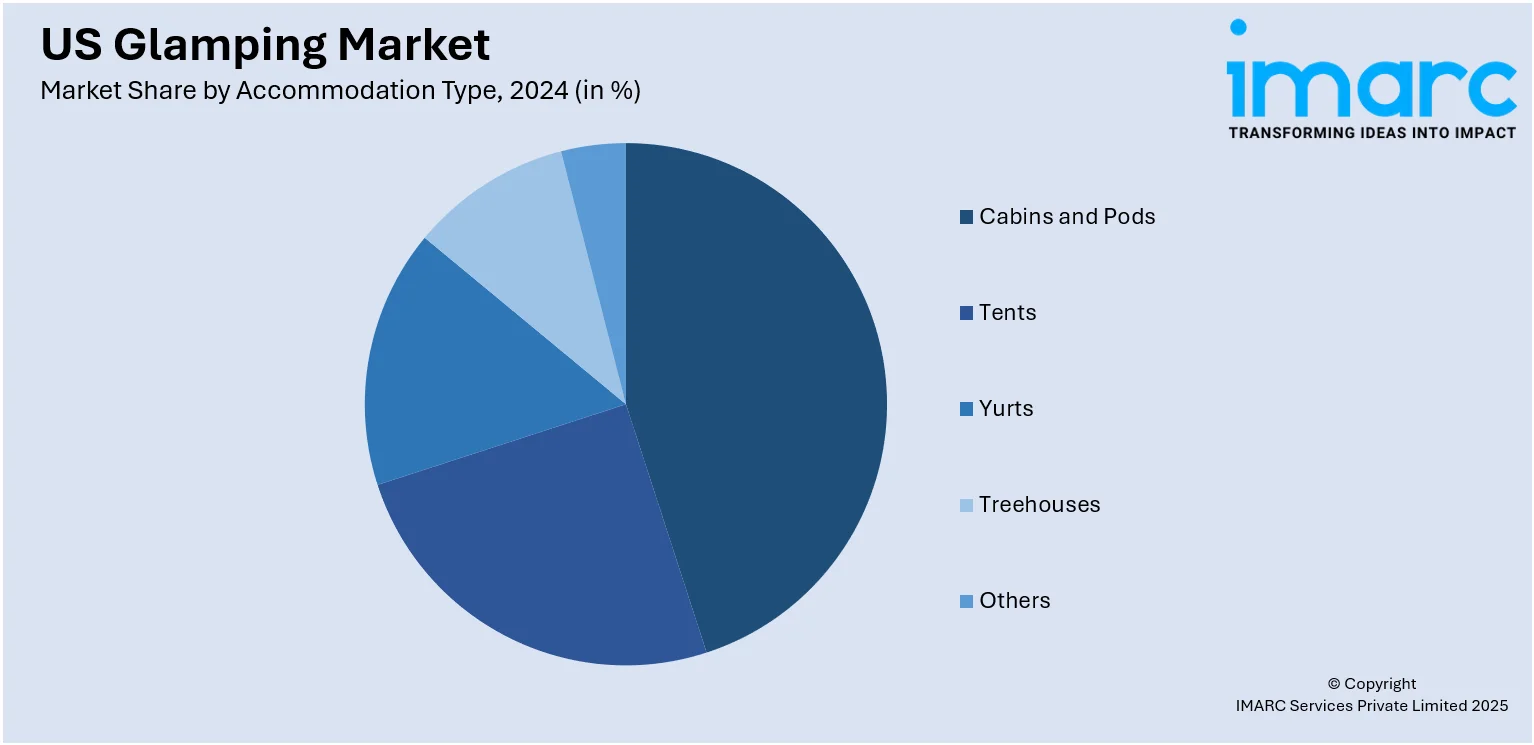

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Glamping Market News:

- On May 20, 2025, Hipcamp announced that it had doubled its US campsite inventory, now offering over 500,000 outdoor stays across the country, including campgrounds, RV parks, and unique private properties. This expansion positions Hipcamp as the world's largest platform for outdoor accommodations, unifying a diverse range of glamping experiences under a single app. The move comes ahead of the summer travel season and responds to growing demand, as over half of US campers report difficulty finding available sites due to increased participation in outdoor recreation.

- On May 27, 2025, Yogi Bear's Jellystone Park Camp-Resorts announced the upcoming launch of its newest location, Jellystone Park Austin North, scheduled to open in mid-June in Georgetown, near Austin, Texas. Developed by CityStreet Residential Partners and managed by Blue Water, the resort is a rebranded expansion of the former Jetstream RV Resort at Stone Oak Ranch and will offer over 400 RV sites, upscale glamping cabins, water attractions, and a range of family-friendly amenities. This marks the fourth Jellystone Park opening in 2025, reflecting the brand's broader growth initiative under Warner Bros.

US Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the US glamping market on the basis of age group?

- What is the breakup of the US glamping market on the basis of accommodation type?

- What is the breakup of the US glamping market on the basis of booking mode?

- What is the breakup of the US glamping market on the basis of region?

- What are the various stages in the value chain of the US glamping market?

- What are the key driving factors and challenges in the US glamping market?

- What is the structure of the US glamping market and who are the key players?

- What is the degree of competition in the US glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)