US Hair Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

US Hair Care Market Summary:

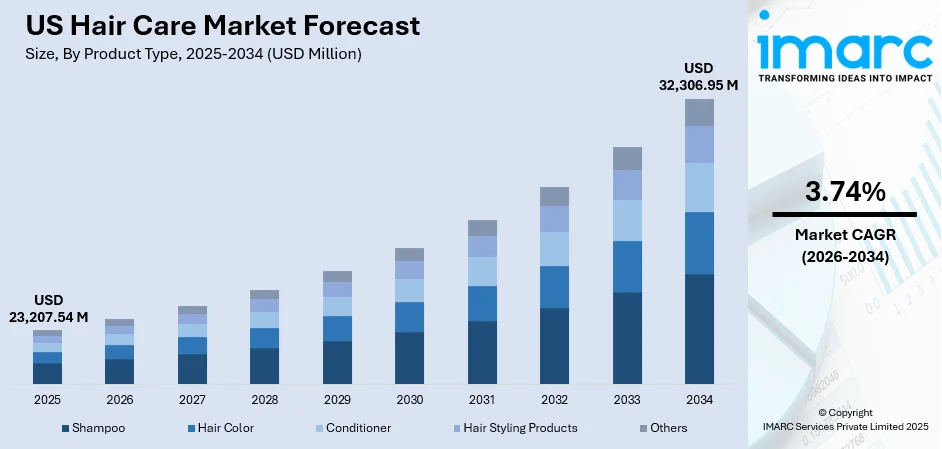

The US hair care market size was valued at USD 23,207.54 Million in 2025 and is projected to reach USD 32,306.95 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

The US hair care market represents a mature, yet dynamic industry characterized by evolving consumer preferences toward premium, natural, and specialized formulations. The market demonstrates robust penetration across diverse demographics, with increasing emphasis on scalp health, ingredient transparency, and personalized solutions. Strong retail infrastructure combined with expanding e-commerce channels continues to reshape product accessibility and consumer purchasing behavior nationwide.

Key Takeaways and Insights:

-

By Product Type: Shampoo dominates the market with a share of 45% in 2025, driven by consistent consumer demand for daily cleansing products and the introduction of specialized variants addressing specific hair concerns including dandruff control, volumizing, and damage repair formulations.

-

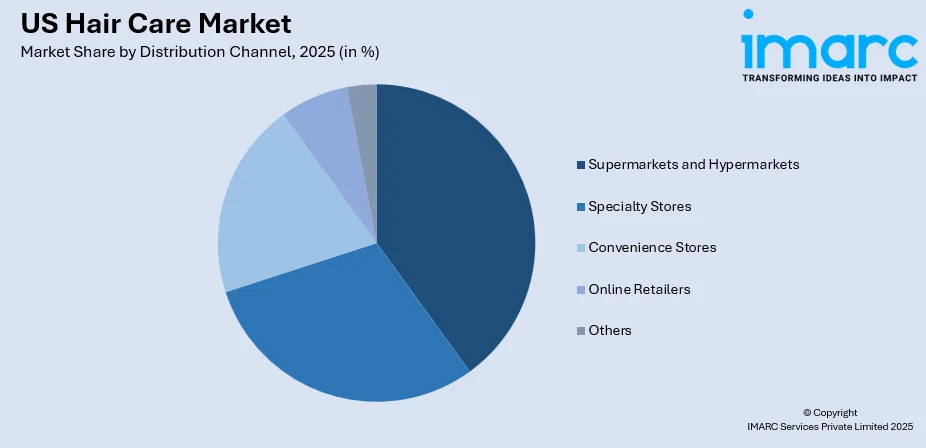

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 40% in 2025, owing to their extensive product assortments, competitive pricing strategies, convenient one-stop shopping experiences, and widespread geographic presence facilitating easy consumer access across urban and suburban regions.

-

Key Players: The US hair care market exhibits a highly competitive landscape with established multinational corporations leveraging strong brand portfolios alongside emerging direct-to-consumer brands focusing on clean-label formulations and digital engagement strategies.

To get more information on this market Request Sample

The US hair care market continues to expand, propelled by heightened consumer awareness regarding scalp health and hair wellness. In 2025, Beyoncé’s hair care brand Cécred announced an expansion into more than 1,400 Ulta Beauty stores nationwide, marking one of the largest retail rollouts for a specialty hair care brand and signaling strong retailer confidence in the category’s growth potential. Rising demand for clean-label, sustainably sourced ingredients drives product innovation across shampoos, conditioners, and treatment categories. Consumers increasingly prioritize ingredient transparency and seek products free from parabens, sulfates, and synthetic additives. The growing influence of social media and beauty influencers accelerates trend adoption, particularly among younger demographics seeking personalized solutions. E-commerce platforms complement traditional retail channels, enabling brands to reach broader audiences while offering subscription models and customized recommendations that enhance consumer engagement and brand loyalty.

US Hair Care Market Trends:

Rising Demand for Scalp-Centric Formulations

Consumers increasingly recognize scalp health as foundational to overall hair wellness, treating scalp care as an extension of skincare routines. In May 2025, American custom haircare brand Prose launched a tailored scalp serum designed to address individual scalp needs such as dryness, sensitivity, and oil imbalance, emphasizing science-backed, personalized formulations that support a balanced microbiome and stronger hair. This shift fuels demand for targeted solutions addressing dandruff, sensitivity, dryness, and follicular strength. Formulations featuring probiotics, salicylic acid, zinc pyrithione, and botanical actives gain popularity among health-conscious buyers seeking preventative care, long-term scalp balance, and improved hair growth outcomes through clinically backed, gentle, and dermatologically tested products globally today.

Premiumization and Salon-Quality Home Care

Premiumization accelerates as consumers invest in high-performance haircare promising visible, salon-quality results at home. In 2025, Sally Beauty’s Beauty Systems Group announced a distribution partnership with biotech-driven brand K18, bringing its patented peptide-based repair products to professional salons and retail shelves across the U.S. and Canada and underscoring how salon-grade innovation is moving into mainstream channels. Advanced repair systems, bond-building treatments, and professional-grade styling products move from exclusive salon channels into mainstream retail and e-commerce. Higher disposable incomes, social media influence, and ingredient transparency encourage buyers to trade up for efficacy, sensory appeal, and brand credibility, driving value growth and strengthening margins across the premium haircare segment globally over the forecast period.

Digital Engagement and Personalization Technologies

Digital engagement transforms haircare purchasing through AI-driven recommendations, virtual consultations, and smart diagnostic tools. In June 2024, Unilever’s Dove brand launched a virtual AI-powered Scalp + Hair Therapist diagnostic tool that generates personalized hair and scalp profiles and recommends tailored products based on individual concerns, highlighting how major legacy brands are leveraging AI to deepen consumer engagement and personalization. Brands deploy scalp imaging, quizzes, and hair analysis technologies to tailor product regimens to individual needs. Personalization enhances consumer trust, reduces trial-and-error, and improves outcomes. Data-driven insights also enable targeted marketing, subscription models, and loyalty programs, helping brands deepen relationships, increase retention, and differentiate in competitive markets through seamless omnichannel digital ecosystems and services globally today.

Market Outlook 2026-2034:

The US hair care market demonstrates sustained momentum driven by evolving consumer preferences toward natural formulations and specialized treatments. Innovation in ingredient sourcing and product functionality addresses diverse hair types and concerns across demographic segments. The integration of sustainability principles throughout product development and packaging resonates with environmentally conscious consumers. Expansion of omnichannel retail strategies and subscription-based models strengthens brand-consumer relationships while optimizing distribution efficiency. The market is projected to generate substantial revenue growth through the forecast period, supported by premiumization trends and increasing male grooming participation. The market generated a revenue of USD 23,207.54 Million in 2025 and is projected to reach a revenue of USD 32,306.95 Million by 2034, growing at a compound annual growth rate of 3.74% from 2026-2034.

US Hair Care Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Shampoo |

45% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

40% |

Product Type Insights:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

The shampoo dominates with a market share of 45% of the total US hair care market in 2025.

Shampoo maintains its position as the foundational hair care product, driven by daily usage patterns and continuous product innovation addressing specific consumer needs. In February 2025, Living Proof reimagined its entire shampoo and conditioner franchise with a new silicone-free formulation powered by Sili-CLONE™ HairTech, designed to deliver salon-like detangling, conditioning, and sleekness while supporting healthier hair with every wash. Manufacturers introduce specialized variants targeting concerns including dandruff control, color protection, volumizing effects, and damage repair. The segment benefits from strong consumer loyalty and established purchasing habits across all demographic groups.

The premiumization trend is reshaping shampoo formulations, as consumers increasingly seek products with natural ingredients, sulfate-free formulas, and scientifically supported benefits. Brands respond by emphasizing ingredient transparency and clinical efficacy, differentiating their offerings while aligning with consumer demands for high performance, sustainability, and ethical sourcing. This shift reflects a willingness among buyers to invest in shampoos that deliver tangible results and align with their values and lifestyle choices.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

The supermarkets and hypermarkets lead with a share of 40% of the total US hair care market in 2025.

Supermarkets and hypermarkets maintain dominance through extensive product assortments, competitive pricing strategies, and convenient shopping experiences. In March 2025, Walmart expanded its premium beauty and personal care offerings, including hair care products, by adding more than 80 premium brands and 250 new items to both its online marketplace and physical store assortments, demonstrating how mass retail channels are innovating to meet evolving consumer hair care preferences. These retail formats offer consumers the ability to compare products across brands and price points while benefiting from promotional activities and loyalty programs. The channel's widespread geographic presence ensures accessibility across urban, suburban, and rural markets.

Retailers are elevating in-store experiences with dedicated beauty sections, enhanced merchandising, and expert staff support. By integrating digital tools like mobile apps and online ordering with in-store pickup, they cater to consumers’ growing preference for seamless omnichannel shopping. This approach balances convenience and technology with the tactile, hands-on product evaluation that physical stores offer, ensuring a comprehensive and satisfying shopping experience that meets modern customer expectations.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region demonstrates steady market growth driven by concentrated urban salon activity across metropolitan centers. Consumers in this region exhibit strong preferences for high-performance formulations addressing seasonal hair care challenges including cold-weather hydration and anti-static solutions. The sophisticated consumer base prioritizes clean-label ingredients and advanced conditioning treatments.

The Midwest region exhibits moderate but consistent market expansion supported by stable salon activity and growing consumer awareness of professional-grade hair care products. Value-conscious consumers increasingly adopt premium formulations for at-home care routines. The region demonstrates rising demand for bond-repair treatments and essential oil-based products among younger demographics seeking quality solutions.

The South region represents a rapidly expanding market driven by population growth and younger demographics across major metropolitan areas. Consumers prioritize texture management, moisture retention, and humidity-resistant formulations suited to regional climate conditions. The diverse population base fuels demand for specialized products addressing varied hair types including curl-focused moisturizers and edge-styling solutions.

The West region leads market growth driven by strong salon density and heightened consumer consciousness for maintaining healthy hair. The eco-conscious consumer base demonstrates significant preference for sustainably sourced, natural formulations and clean-beauty products. E-commerce platforms and direct-to-consumer brands achieve substantial traction among urban consumers seeking personalized hair care solutions.

Market Dynamics:

Growth Drivers:

Why is the US Hair Care Market Growing?

Increasing Consumer Focus on Scalp Health and Wellness

Consumer awareness regarding the fundamental role of scalp health in overall hair wellness drives significant market expansion. In April 2025, Unilever’s premium professional hair care brand CLEAR globally launched its ScalpCeuticals Pro range, a technologically advanced line of scalp-focused treatments developed with over 200 dermatologists and patented cellular-level repair innovations, signaling how major legacy brands are intensifying investment in clinically driven scalp health solutions. The conceptualization of scalp care as skincare extension prompts adoption of specialized treatments incorporating therapeutic ingredients. Concerns about hair loss, thinning, and scalp conditions motivate consumers to invest in preventive and restorative products. This wellness-oriented approach transforms purchasing behavior from basic cleansing to comprehensive hair health management, expanding average basket values and product repertoire usage.

Rising Demand for Clean-Label and Natural Formulations

Consumer preferences increasingly favor products featuring natural, organic, and sustainably sourced ingredients. In November 2025, Kenvue’s Neutrogena® and OGX® brands announced the launch of new hair growth and scalp health innovation systems that leverage decades of skincare expertise to address scalp-related concerns and strengthen hair from the root, highlighting how major consumer health companies are bringing science-led scalp solutions into mainstream haircare. The clean beauty movement drives reformulation efforts across established brands while creating opportunities for emerging players emphasizing ingredient transparency. Paraben-free, sulfate-free, and cruelty-free certifications become purchase decision criteria for health-conscious consumers. This trend supports premiumization as consumers demonstrate willingness to pay higher prices for products aligned with their values regarding ingredient safety and environmental responsibility.

Expansion of Male Grooming and Gender-Inclusive Products

The male grooming segment demonstrates accelerated growth as societal attitudes toward masculine self-care evolve. In December 2025, India’s Honasa Consumer, the parent company of Mamaearth, acquired a 95% stake in premium men’s personal care brand Reginald Men for ₹195 crore ($≈24 M), marking its strategic entry into the rapidly growing male grooming and hair-related care market and underscoring increasing corporate investment in targeted men’s solutions. Men increasingly incorporate specialized hair care products into daily routines, seeking solutions for hair loss prevention, scalp health, and styling. Brands respond with gender-neutral formulations and targeted men's product lines addressing specific concerns. This demographic expansion broadens the addressable market while introducing new consumers to premium product categories previously associated primarily with female consumers.

Market Restraints:

What Challenges the US Hair Care Market is Facing?

Price Sensitivity and Economic Uncertainty

Economic fluctuations and inflationary pressures impact consumer spending on non-essential personal care items. Price-sensitive consumers may trade down from premium products to value alternatives during periods of financial uncertainty. This dynamic challenges brands positioning in premium segments while intensifying competitive pressures in mass-market categories.

Ingredient Sensitivity and Allergic Reactions

Rising incidence of scalp sensitivity and allergic reactions to hair care ingredients constrains product adoption among affected consumers. Individuals experiencing adverse reactions become cautious about product experimentation, potentially limiting brand switching and new product trial. Negative consumer experiences damage brand reputation and customer loyalty.

Market Saturation and Brand Proliferation

The highly competitive landscape with numerous established and emerging brands creates challenges for market differentiation. Consumer confusion arising from excessive product options may impede purchase decisions and brand loyalty development. Intense competition compresses margins while escalating marketing expenditure requirements for visibility.

Competitive Landscape:

The US hair care market exhibits a highly competitive structure characterized by the presence of established multinational corporations alongside numerous regional and emerging brands. Major players leverage extensive distribution networks, substantial marketing investments, and diversified product portfolios spanning mass-market to premium segments. Innovation remains central to competitive strategy, with companies investing significantly in research and development to introduce advanced formulations addressing evolving consumer needs. Strategic acquisitions enable portfolio expansion and capability enhancement. The direct-to-consumer channel emergence creates opportunities for digitally native brands to compete effectively against established players through personalized marketing and subscription models.

Recent Developments:

-

In June 2025, Arbonne launches a science-backed, plant-powered haircare line focused on scalp health and hair vitality with five performance products including Restorative Shampoo and Scalp Elixir, emphasizing ingredient integrity and clinically informed formulation. Full collection available via Arbonne consultants and online.

US Hair Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The US hair care market size was valued at USD 23,207.54 Million in 2025.

The US hair care market is expected to grow at a compound annual growth rate of 3.74% from 2026-2034 to reach USD 32,306.95 Million by 2034.

Shampoo dominated the market with a 45% share, fueled by daily usage habits and ongoing innovations targeting specific hair concerns, reinforcing its leading position and strong consumer demand across diverse hair care needs.

Key factors driving the US hair care market include increasing consumer focus on scalp health, rising demand for clean-label natural formulations, expansion of male grooming products, and growing preference for premium personalized solutions.

Major challenges include consumer price sensitivity, allergic reactions reducing trust, market saturation hindering product differentiation, and intense competition compressing profit margins, all of which pressure brands to innovate while maintaining affordability and consumer confidence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)