US Healthcare Advertising Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

US Healthcare Advertising Market Size and Share:

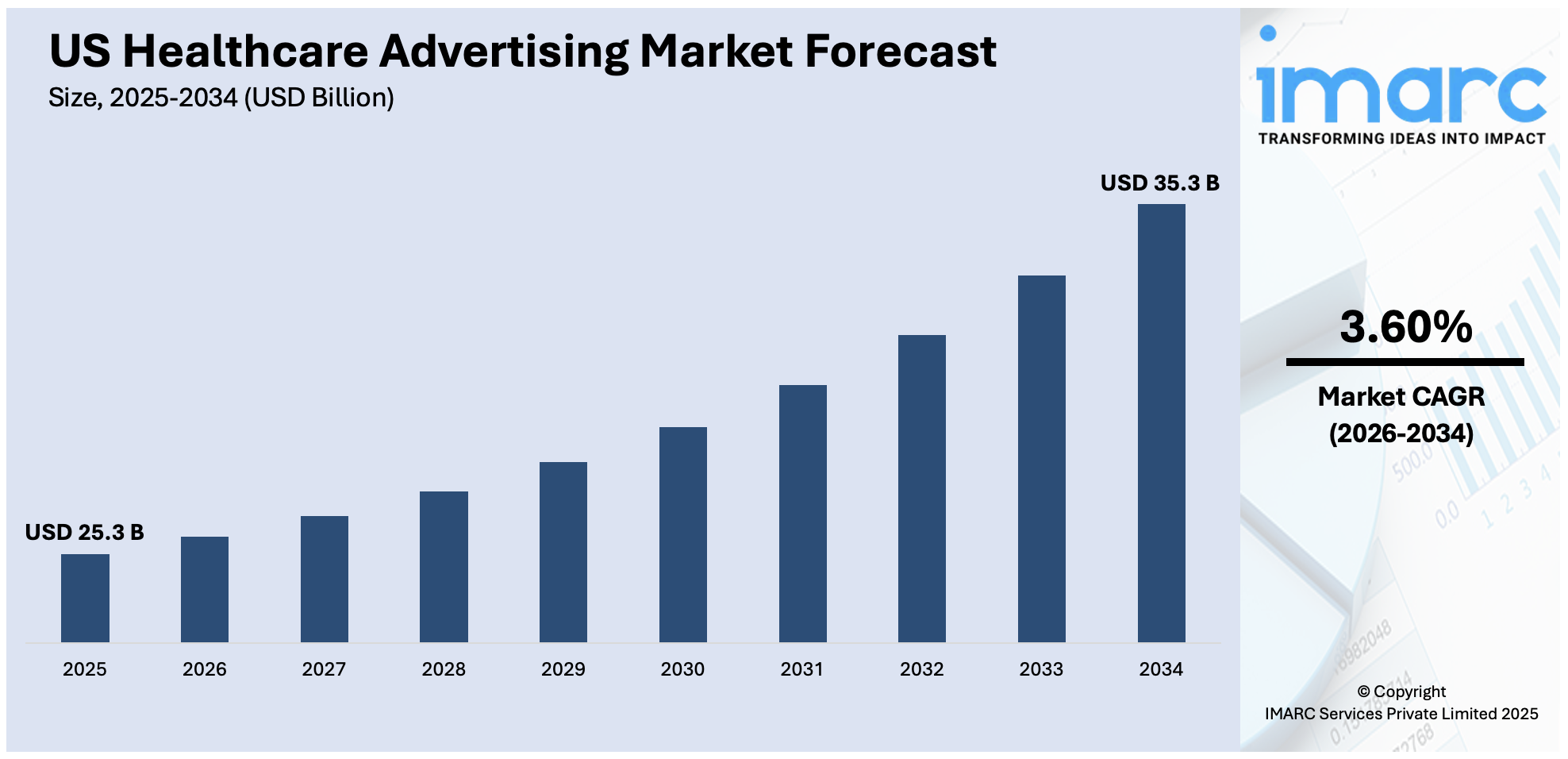

The US healthcare advertising market size was valued at USD 25.3 Billion in 2025. Looking forward, the market is projected to reach USD 35.3 Billion by 2034, exhibiting a CAGR of 3.60% during 2026-2034. The market is dominated by increasing usage of customized healthcare solutions, where digital platforms are playing an important role in targeted advertising. Moreover, increasing health awareness campaigns and rising healthcare spending are stimulating greater investments in diversified healthcare services and products. Furthermore, increased social media influence and the move toward telemedicine are significantly influencing consumer participation, further bolstering the US healthcare advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 25.3 Billion |

|

Market Forecast in 2034

|

USD 35.3 Billion |

|

Market Growth Rate 2026-2034

|

3.60% |

The market is fueled by the growing demand for custom and niche healthcare services. This, in turn, is being led by the widespread use of digital platforms for healthcare marketing. Further, the massive rise in health awareness drives is also emerging as a major growth driver for the market. In October 2024, IPG Mediabrands' MAGNA and DeepIntent released a press release highlighting the "Beyond the Prescription" study, with 1,100 patients and 1,000 physicians polled about the influence of pharma advertising. The study revealed that 63% of patients heard about new drugs via pharma ads, with 61% of Gen Z and 62% of Millennials showing this pattern. Besides, 55% of the participants learned about new health conditions from these adverts, and pharma adverts assisted 54% in controlling existing health conditions, with 61% reporting a better overall understanding of their condition. The research highlights the significance of trust and genuine patient experiences in adverts. Apart from this, the rising healthcare spending due to increased insurance coverage is leading to increased investment in varied healthcare products and services. Apart from this, the expanding power of social media influencers and celebrities in advertising health-related products is generating profitable opportunities, providing a positive outlook for US healthcare advertising market.

To get more information on this market Request Sample

In addition, the increasing emphasis on telemedicine and virtual healthcare solutions is also having a positive influence on the market. The market is also being driven by the adoption of supportive government policies to increase the availability of healthcare services and bring down medical expenses. Besides this, convenient access to healthcare information and services via mobile apps and online portals is driving the United States healthcare advertising market demand. For example, in August 2024, Pfizer launched PfizerForAll™, a digital patient platform that simplifies health care access, management of health and well-being, and connecting patients to third-party services. The platform addresses the growing consumer need for more digital management tools for health care. Among the other drivers of the market are the aging population, growth in the prevalence of chronic diseases, and growing healthcare digitalization.

US Healthcare Advertising Market Trends:

Increasing Adoption of Patient-Centered Care and Consumer Empowerment

The growing emphasis on patient-centered care and consumer empowerment is positively influencing the US Healthcare advertising market revenue. Healthcare organizations are increasingly focusing on attracting and engaging patients through advertising investment. Moreover, the escalating adoption of various innovative advertising strategies by healthcare providers, including showcasing testimonials and success stories of the patients and communicating personalized approaches, are also playing an important role in driving the US healthcare advertising market growth. Furthermore, these initiatives assist in building meaningful connections with the target audience. For instance, according to the United States Government Accountability Office, from 2016 through 2018, drug manufacturers in the US spent USD 17.8 Billion on direct-to-consumer advertising (DTCA) for 553 drugs. Moreover, nearly half of the spending was for three therapeutic categories of drugs used in the treatment of chronic medical conditions, such as arthritis, diabetes, and depression. Such massive investments in healthcare advertisements are projected to propel the growth in the United States healthcare advertising market forecast.

Rise Of Digital Platforms and Advancements in Technology

Ongoing advancements in advertising technology and the rising adoption of digital platforms are one of the most significant US healthcare advertising market trends. Growing penetration of social media and online search platforms backed by the widespread usage of smartphones is bolstering the US healthcare advertising market revenue. For instance, the number of people using social media in the US is expected to grow between 2024 and 2029 by 22 million. In addition to this, according to the survey conducted by Pew Research in 2023, nearly 8 in 10 US adults report using video-based platforms. Furthermore, the growth of telehealth services presents new opportunities for healthcare advertisers to promote virtual consultations, remote monitoring, and digital health solutions. Digital platforms serve as a key channel for advertising telehealth services, reaching consumers who prefer the convenience and accessibility of online healthcare. For instance, according to the National Center for Health Statistics, in 2021, 37% of US adults used telemedicine.

US Healthcare Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US healthcare advertising market, along with forecasts from 2026-2034. The market has been categorized based on product type.

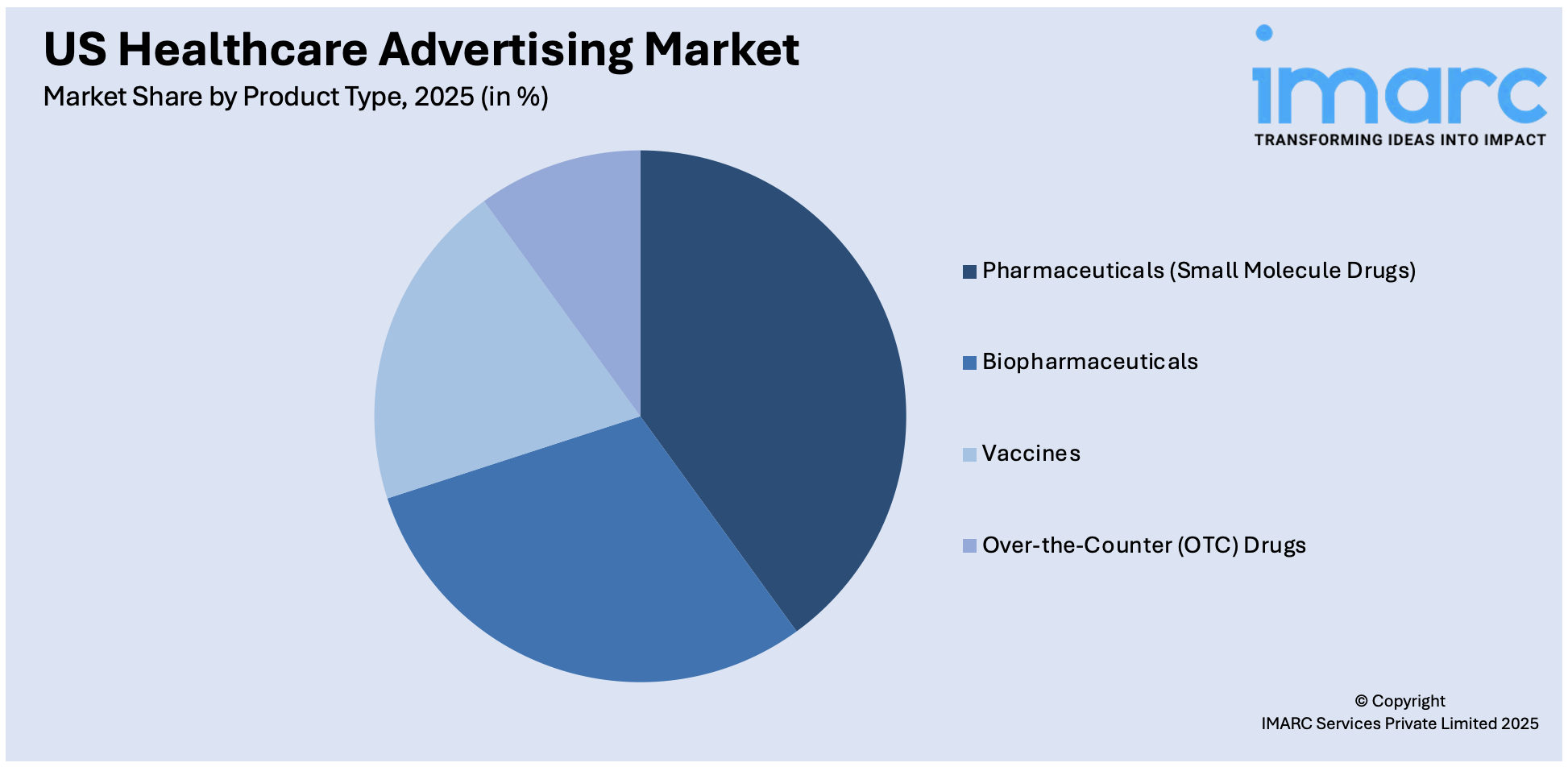

Analysis by Product Type:

Access the comprehensive market breakdown Request Sample

- Pharmaceuticals (Small Molecule Drugs)

- Biopharmaceuticals

- Vaccines

- Over-the-Counter (OTC) Drugs

Pharmaceutical (small molecule drugs) market accounts for the largest share in the market in 2025. According to the US healthcare advertising market forecast, the rising prevalence of chronic illnesses such as cardiovascular conditions, respiratory diseases, and diabetes are augmenting the demand for pharmaceuticals in the market. Moreover, the growing research and development activities in the pharmaceutical industries and growing advertising campaigns to promote the new drugs are also positively influencing the US healthcare advertising market share. In 2021, Pfizer Inc., invested USD 13,829 Million in R&D, an increase of USD 4.4 Billion as compared to 2020. Moreover, Johnson & Johnson also invested USD14.7 Billion in research and development in 2021, recording an increase of 21% as compared to 2020.

Competitive Landscape:

Key players in the US healthcare advertising market are increasingly focusing on digital platforms to reach a broader, more targeted audience. They are leveraging data analytics and AI to personalize campaigns, ensuring ads are relevant to individual healthcare needs. Partnerships with influencers and healthcare professionals are also growing, as they help boost credibility and reach among consumers. Additionally, many companies are investing in omni-channel marketing strategies, blending traditional media with social media, mobile apps, and telemedicine platforms to expand their presence. Collaborations with pharmaceutical companies to create educational content and awareness campaigns are on the rise, while compliance with regulatory standards ensures that campaigns remain ethical and transparent, further enhancing growth in this evolving market.

The report provides a comprehensive analysis of the competitive landscape in the US healthcare advertising market with detailed profiles of all major companies, including:

- Johnson & Johnson

- Pfizer

- Merck & Co.

- GlaxoSmith Kline

- Eli Lilly

- Novartis

- Sanofi

- AstraZeneca

- Roche

- Bayer Healthcare

- Bristol- Myers Squibb

Recent News and Developments:

- In September 2025, The FDA, alongside the U.S. Department of Health and Human Services, has launched a major crackdown on deceptive drug advertising. Thousands of warning letters and about 100 cease-and-desist orders target misleading ads, while new rulemaking aims to close the “adequate provision” loophole. Officials emphasize the need for transparency, ensuring patients receive clear safety information, addressing overmedicalization, and promoting responsible drug promotion over aggressive marketing that distorts clinical decision-making.

- In June 2025, The American Hospital Association (AHA) launched a TV and digital ad campaign urging Congress to protect access to hospital care nationwide. Highlighting hospitals’ 24/7 role in patient care, the campaign emphasizes the potential negative impacts of pending legislation on patients and communities. Ads will run on broadcast and cable TV in Washington, D.C., alongside digital platforms, calling on lawmakers to safeguard hospital services and ensure uninterrupted care for Americans.

- June 2025: U.S. Health Secretary announced plans for a major campaign promoting wearable devices, like heart rate and glucose monitors, to help Americans take control of their health. The initiative aims for widespread adoption within four years, supporting proactive health monitoring over medication.

- June 2025: Newsweek acquired Adprime, a healthcare-focused advertising platform, to enhance its healthcare vertical. The acquisition integrates Adprime’s data-driven media products with Newsweek’s editorial content, offering a comprehensive solution for healthcare marketers. The deal expands Newsweek’s capabilities in precision-targeted digital campaigns across web, mobile, and CTV.

- February 2025: The Coalition to Strengthen America’s Healthcare launched the "Faces of Medicaid" campaign to protect Medicaid from cuts, emphasizing its crucial role for 72 million Americans, including children, seniors, and veterans, and addressing the threat to rural healthcare access due to hospital closures.

- February 2025: Inizio Evoke launched Flex Marketing, an independent agency focused on pharmaceutical, biotech, medtech, and health tech clients. The agency offers services like strategic planning, brand development, and data-driven analytics, emphasizing flexibility, speed, and innovative customer-centric solutions at lower costs.

- December 2024: Omnicom and Interpublic announced a merger, creating the world’s largest ad agency. The combined company will generate USD 3.7 Billion in pharmaceutical and healthcare revenues, employing over 100,000 people. The merger aims for USD 750 Million in cost savings, enhancing marketing services and innovation across industries.

US Healthcare Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Pharmaceuticals (Small Molecule Drugs), Biopharmaceuticals, Vaccines and Over-The-Counter Drugs |

| Companies Covered | Johnson & Johnson Services, Inc., Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc., Eli Lilly and Company, Novartis International AG, Sanofi S.A, AstraZeneca PLC, F. Hoffmann-La Roche Ltd. (Roche), Bayer AG, Bristol- Myers Squibb (BMS). etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US healthcare advertising market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US healthcare advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US healthcare advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The US healthcare advertising market was valued at USD 25.3 Billion in 2025.

The healthcare advertising market in the US is projected to exhibit a CAGR of 3.60% during 2026-2034, reaching a value of USD 35.3 Billion by 2034.

The market is driven by the growing adoption of personalized healthcare solutions, the rise in health awareness campaigns, increased healthcare expenditure, the influence of social media, and the shift towards telemedicine. These factors, along with digital platform usage and government initiatives, are positively impacting market growth.

The pharmaceutical (small molecule drugs) segment accounts for the largest share in the healthcare advertising market in the US.

Some of the major players in the healthcare advertising market in the US include Johnson & Johnson, Pfizer, Merck & Co., GlaxoSmith Kline, Eli Lilly, Novartis, Sanofi, AstraZeneca, Roche, Bayer Healthcare, and Bristol-Myers Squibb.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)