US Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2025-2033

US Kitchen Appliances Market Overview:

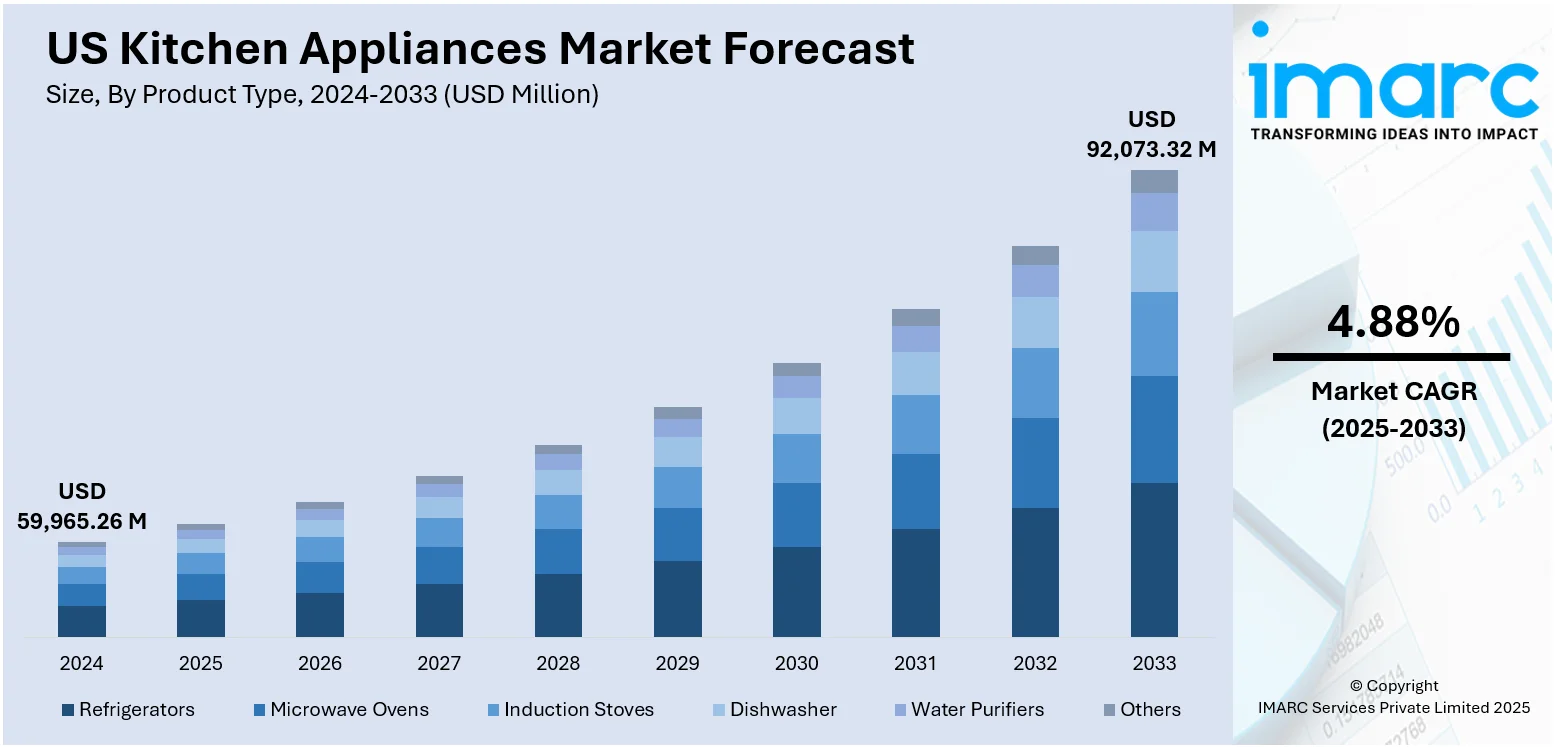

The US kitchen appliances market size reached USD 59,965.26 Million in 2024. Looking forward, the market is expected to reach USD 92,073.32 Million by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033. The market is driven by evolving consumer lifestyles, smart home integration, and rising preference for energy-efficient and multifunctional products. Innovations in design, connectivity, and convenience continue to reshape purchasing decisions. Growing urbanization and renovation trends further boost demand, contributing to the steady expansion of the US kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 59,965.26 Million |

| Market Forecast in 2033 | USD 92,073.32 Million |

| Market Growth Rate 2025-2033 | 4.88% |

US Kitchen Appliances Market Trends:

Technological Advancements and Smart Integration

One of the most significant drivers of the US kitchen appliances market is the rapid adoption of smart technologies. Consumers are increasingly seeking appliances that can connect to Wi-Fi, be controlled via smartphones, or integrate with voice assistants like Alexa and Google Assistant. Features such as remote operation, energy consumption tracking, and predictive maintenance appeal to tech-savvy households. Smart refrigerators, ovens, and dishwashers that offer automation and convenience are gaining traction. As the smart home ecosystem expands, manufacturers are investing in IoT-enabled appliances that align with evolving consumer expectations. These innovations not only enhance user experience but also drive product upgrades, contributing to steady market growth across both premium and mid-range appliance segments. For instance, in February 2024, LG introduced its 29-cubic-foot Smart InstaView MAX 4-Door French Door Refrigerator (models LF29S8365 and LH29S8365), featuring the new MyColor option and a versatile Full-Convert Drawer, designed to make a bold style statement in the kitchen. The LG STUDIO line, in Essence White, showcased a classic aesthetic with a soft matte-white finish that adds timeless elegance. Meanwhile, the 1.3-cubic-foot Smart Low-Profile Over-the-Range Microwave (MVEF1337F) combines a streamlined silhouette with enhanced interior height, making it ideal for accommodating taller items while maintaining a sleek, space-saving design.

To get more information on this market, Request Sample

Energy Efficiency and Sustainability Awareness

The growing environmental awareness and tightening energy regulations have made energy efficiency a top priority among American consumers, which is driving the US kitchen appliances market growth. Appliances certified under Energy Star or equivalent programs are in high demand due to their ability to reduce electricity bills and environmental impact. Manufacturers are responding by introducing energy-saving technologies like inverter compressors, eco-modes, and smart sensors that minimize resource usage. Additionally, sustainable manufacturing practices and the use of recyclable materials are influencing buying decisions, especially among younger consumers. Government incentives and rebates for energy-efficient appliance purchases further support this trend. The push for greener living has transformed energy efficiency from a secondary consideration into a central purchasing factor, prompting innovation and reshaping competitive dynamics in the kitchen appliances market. For instance, in April 2024, Clayton Home Building Group, a leading builder of single-family homes in the US, announced a multi-year collaboration with Samsung Electronics America, the country’s top home appliance brand. As part of this partnership, most new Clayton homes will feature a selection of Samsung kitchen appliances. The appliance packages will include modern, design-centric ranges and microwaves, along with ENERGY STAR certified dishwashers and refrigerators, many of which offer Wi-Fi connectivity for added convenience.

US Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, structure, fuel type, application, and distribution channel.

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwashers

- Water Purifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes refrigerators, microwave ovens, induction stoves, dishwashers, water purifiers, and others.

Structure Insights:

- Built-In

- Free Stand

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes built-in and free stand.

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes cooking gas, electricity, and others.

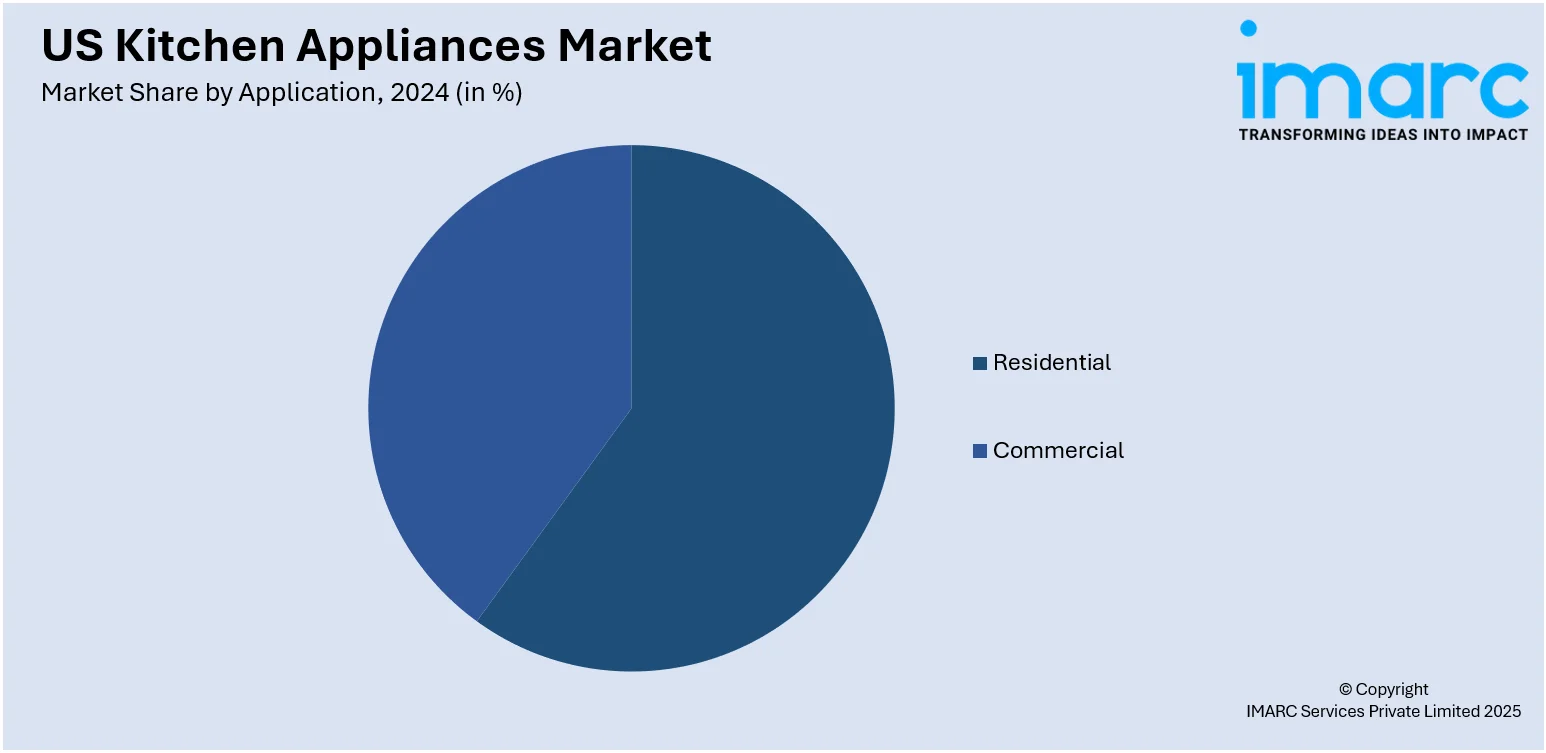

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, departmental stores, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Kitchen Appliances Market News:

- In May 2024, Thermomix, the maker of the popular all-in-one Wi-Fi-connected TM6 cooking appliance, launched the Thermomix Sensor, an advanced smart thermometer, just in time for World Baking Day on May 17. Engineered for precision, this state-of-the-art device allows users to monitor the core temperature of food with exceptional accuracy. Ideal for baking, grilling, and a wide range of cooking tasks, the Sensor is set to redefine how home cooks approach temperature control in the kitchen. By combining convenience with high-performance technology, it empowers users to cook with greater confidence, ensuring consistently perfect results with every dish.

- In October 2024, CAFÉ, a brand known for its customizable hardware that offers versatility in kitchen design, announced that collaborate with interior designers. By offering expert guidance both online and at select retail locations, the brand aims to help consumers overcome design indecision and simplify the decision-making process during kitchen planning.

US Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwashers, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the US kitchen appliances market on the basis of product type?

- What is the breakup of the US kitchen appliances market on the basis of structure?

- What is the breakup of the US kitchen appliances market on the basis of fuel type?

- What is the breakup of the US kitchen appliances market on the basis of application?

- What is the breakup of the US kitchen appliances market on the basis of distribution channel?

- What is the breakup of the US kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the US kitchen appliances market?

- What are the key driving factors and challenges in the US kitchen appliances market?

- What is the structure of the US kitchen appliances market and who are the key players?

- What is the degree of competition in the US kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)